Jianghuai launches its first electric coupe, IPLATO under its brand SIHHO

Author: Zhu Shiyun

Editor: Wang Lingfang

This time it’s not Jianghuai Volkswagen Sihao, but just Jianghuai Sihao.

More than a year after being regarded as the third “Volkswagen” outside of North and South Volkswagen, Jianghuai Sihao, under the support of the Jianghuai Auto Group, has launched its first pure electric coupe, IPLATO, and is back in the public eye.

However, this time Sihao is no longer under the halo of Volkswagen, but as one of the flagship brands under the Jianghuai Auto Group, has once again joined the mainstream track of electric vehicle competition.

Naturally, this model also has hardcore technology such as the new generation of honeycomb batteries, “3-in-1” electric drive system, autonomous vehicle domain controller, intelligent sense heat pump air conditioning and other core technologies.

On July 28, IPLATO officially went on sale at a price range of RMB139,900 to RMB199,900. Jianghuai Volkswagen has high hopes for this model, as the first model of Sihao brand to achieve sales of 500,000 units during the 14th Five-Year Plan, representing Jianghuai’s second effort in the field of electrification.

Compared to Sihao’s debut in 2017, China’s new energy vehicle market is now filled with strong competitors. How will Jianghuai and Sihao return to the race?

Goal: cumulative sales of 500,000 units

“Jianghuai cannot be seen in this market (new energy passenger vehicles) after 2020. (This is because) we are going through a transition period from the Sihao brand to the Jianghuai brand, carrying out product, brand and channel switching.” Zhao Jiuzhi, Executive Deputy General Manager of Sihao’s new energy passenger car marketing company, said in an interview with Electric Vehicle Observer.

At the end of 2017, Volkswagen’s third joint venture in China, “Jianghuai Volkswagen,” was launched and launched its pure electric new energy brand, Sihao.

However, two years later, the mode of cooperation between Jianghuai and Volkswagen underwent fundamental changes. In 2020, Jianghuai Auto announced that Volkswagen would invest 1 billion euros to acquire 50% of its parent company, Anhui Jianghuai Automobile Group Holding Ltd., while increasing its stake in Jianghuai Volkswagen to 75% and gaining control of the joint venture’s management, realizing a change in the company’s management model.

According to the letter of intent for cooperation, after Volkswagen’s shareholding in Jianghuai Volkswagen increases, it will import mainstream brands from the Volkswagen Group and a series of new energy products and achieve an annual output of 350,000 to 400,000 units by 2029. “Jianghuai Volkswagen’s new factory is next to us and is currently under orderly construction.” Zhao Jiuzhi said.

However, Jianghuai Volkswagen has not only produced the Sihao brand. In accordance with Volkswagen’s production quality standard system, Jianghuai invested 200 million yuan to upgrade the production line of Sihao, which has also introduced Volkswagen’s product standards.

But when Volkswagen Anhui wants to import its mainstream brand – the Volkswagen brand, what will become of Sihao?Investors recently learned from a survey of Jianghuai that Sihao is still a brand of Anhui Volkswagen, but is provided to Jianghuai for free and indefinitely. Within the Jianghuai system, three major core brands have formed: Jianghuai Commercial Vehicles, Ruifeng MPV, and Sihao. Sihao aims to regain a foothold in the new energy market for Jianghuai. According to the plan, Sihao will break even with 100,000 units sold annually. With economies of scale, average net profit per vehicle could exceed 5,000 yuan with annual sales of 200,000 units or more. It is expected to achieve annual sales of 300,000 units in the future. To achieve this, Sihao will return to the essence of car making, participating in the fiercely competitive new energy market with safety, reliability, and cost. “During the 14th Five-Year Plan period, we will lay out four product lines, covering the 100,000-250,000 yuan price range, and achieve cumulative sales of 500,000 units,” said Zhao Jiuzhi.

According to the plan, before 2025, Sihao will launch four platforms: A0-level, compact, I-Power, and medium-large.

The A0-level platform already has products like HuaXianZi, with cumulative terminal sales of more than 170,000 units. “Targeting the need for home purchases, the lifespan of A0-level electric vehicles will be longer than that of the same class of gasoline vehicles.”

The I-Power platform is mainly a sedan platform targeting the purchasing needs of restricted cities. Next year, it will launch products with a range of 500 kilometers or even higher.

The compact and medium-large platforms will be pure electric exclusive platforms. Among them, the compact platform also targets the need for home purchases and will launch its first product in the second quarter of next year. The products on the medium-large platform will be launched at the end of 2023 or in 2024.

Zhao Jiuzhi believes that with the completion of the import into the Jianghuai system, Sihao coincides with the golden age of China’s new energy vehicle market. Products will compete in safety, reliability, and cost, which is exactly what Jianghuai and Sihao are good at.

Safety: Emphasis on Honeycomb Batteries

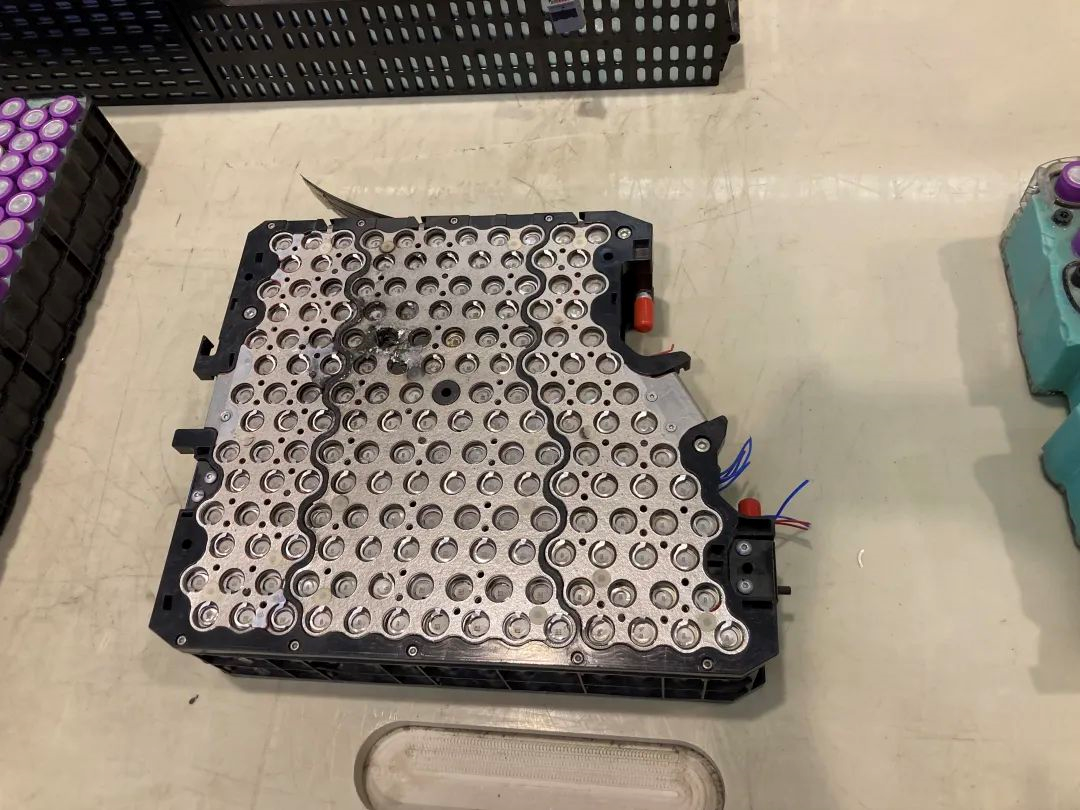

Regarding the most basic safety of electric vehicles, Sihao presents honeycomb batteries.

Jianghuai, like Tesla, is one of the few domestic manufacturers that adopts the cylindrical battery scheme. The new generation of honeycomb batteries uses 811 ternary lithium battery cores, with a 64.5 kWh I-Power electric vehicle having a range of 603 km (officially stated). It has four layers of safety protection: directional detonation of battery monomers, electrical isolation and fire suppression of battery module, active cooling, and cloud platform monitoring.

Because it is inevitable that lithium batteries will form dendrites during use, short-circuiting and ignition is only a probability problem for lithium batteries.

The head of Jianghuai’s battery division told the Electric Vehicle Observer that the honeycomb battery has a three-layer safety system.

At the level of the battery cell, once a short circuit occurs in the honeycomb battery, the cylindrical cell can explode in both directions; the conductive material between the cell and the module can also be effectively isolated to prevent a secondary short circuit causing a fire. At the whole vehicle level, the intelligent thermal control system actively takes away the heat generated by the fire. The abnormal state of the cells is also monitored in real-time on the cloud to prevent problems in advance.

“The honeycomb batteries we mass produce now are basically equivalent to Tesla’s 21700 series in terms of energy and safety. Look at the large sales of model 3, which uses the 21700 series, but the data on fires is very rare.”

Zhao Jiuzhi said that the honeycomb battery cells are currently supplied by Samsung, BYD, and Lishen. The 46 series honeycomb battery, which is equivalent to Tesla’s 4680 battery, may be available next year.

In addition to the honeycomb battery, JAC Motors has also independently developed a three-in-one electric drive, a vehicle domain controller, and a heat pump air conditioner.

As a result, the Love-Pedal can achieve a peak torque of 340N·m, and the 0-50km/h acceleration time is only 3 seconds; the heat pump air conditioner can save about 50% of waste heat in winter; in terms of the vehicle domain controller, the software system is completely self-developed by JAC Motors.

Intelligence: Possible Collaboration with Huawei

In terms of intelligence, Zhao Jiuzhi said that Southeast Motors will mainly focus on the L2 and L2+ levels in the field of intelligent driving, and will mainly strengthen the reliability of its application in the intelligent cockpit field.

The intelligent driving ability of the Love-Pedal is realized through Huawei sensors and Horizon Journey 2 chips, and its algorithm system is also provided by Horizon Journey; during the test drive, the response speed and accuracy of the Love-Pedal’s intelligent voice function were relatively high, making the voice assistant a reliable helper.

However, in the planning of JAC Motors, it is unlikely to be limited to the use of Huawei sensors alone.

Investors familiar with the matter said that JAC Motors and Huawei will collaborate in a “Smart Selection” mode to build cars. Huawei will participate deeply in product definition, core component selection, and marketing services. The joint venture car will be positioned in the price range of CNY 200,000 to CNY 350,000, and JAC Motors will invest nearly tens of billions of yuan to build a new factory. It takes 12 to 16 months for a new car to be designed, manufactured, and sold at Huawei stores across the country.And with JAC’s cooperation with Huawei, there is endless possibility for the intelligent level of Sihao in the future.

Sihao has had its moments of glory as the “third son of Volkswagen”, as well as experiencing a transformation from being unnoticed to stealthy. Some comments suggest that Sihao was an “abandoned” brand, but with the uncertain trend of electrification, examples of turning the tide against it are not uncommon.

The only certainty is the emphasis on technology and breakthroughs. Stripping away the aura of Volkswagen, Sihao needs to use its technological strength to prove itself once again and return to the competition.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.