Author: Zhu Yulong

The field of electric drive systems has undergone some changes with the introduction of integration and power semiconductors. In the first half of 2022, the cumulative installation of new energy passenger car electric drive systems reached 2.3185 million units, which is equivalent to 71.2% of the total installed in 2021. The cumulative installation of tri-in-one electric drive systems in the first half of the year was 1.3715 million units, and the proportion of tri-in-one and multi-in-one electric drive systems reached 61%.

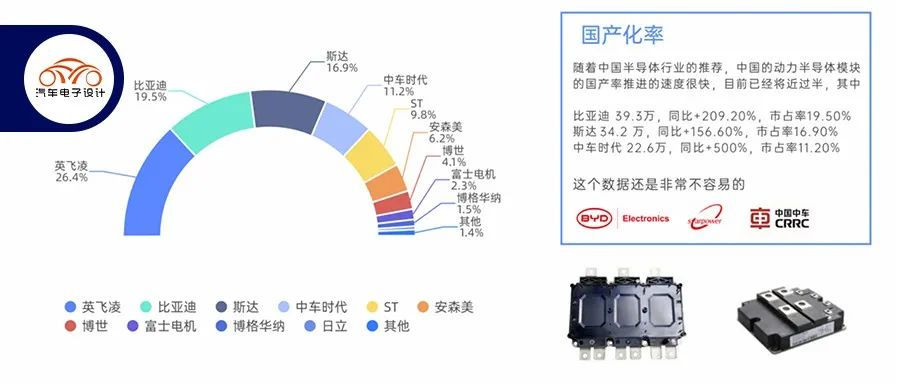

According to data from the NE Research Institute, except for more than 290,000 low-voltage MOS tubes, there are 2.01 million models of vehicles using medium and high-voltage power modules. With the recommendation of China’s semiconductor industry, the domestication rate of China’s power semiconductor modules is increasing quickly, currently almost exceeding 50%, among which:

- BYD 393,000, up 209.20% year-on-year, with a market share of 19.50%.

- STANDA 342,000, up 156.60% year-on-year, with a market share of 16.90%.

- CRRC Times Electric 226,000, up 500% year-on-year, with a market share of 11.20%.

This data is still very remarkable.

Status of various sub-modules

The electric drive system is divided into motor, power drive, and power module. Since the power module consumes a lot of research energy of the NE Research Institute, let’s take a look at it first.

Power Module

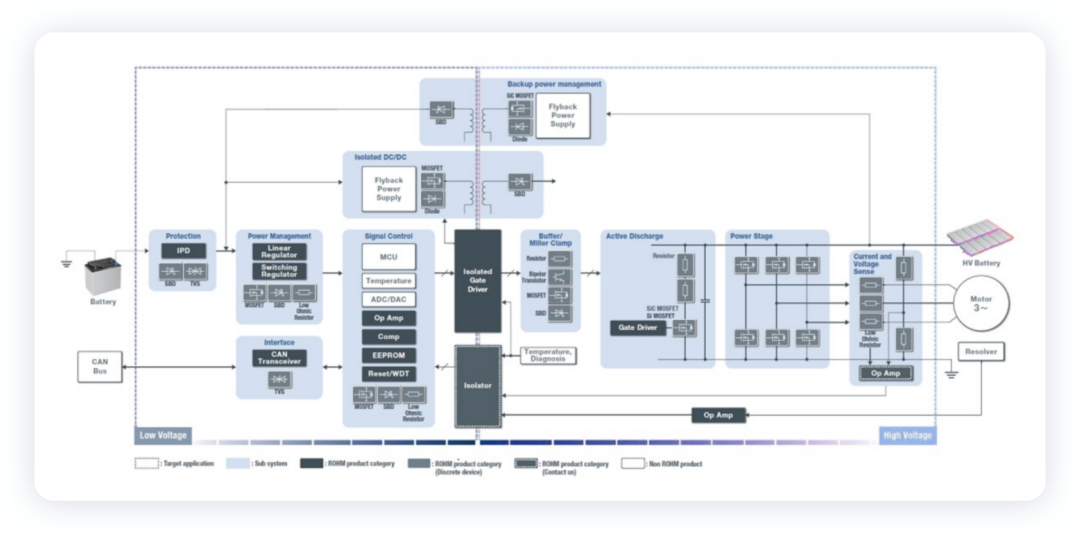

The power module is the most important core component in the inverter, responsible for converting the battery pack’s DC output into AC, accounting for more than 1/3 of the cost of electric control and directly related to its performance and cost. Apart from this, the inverter circuit mainly includes the driving part, and some systems integrate part of the VCU’s functions into it. With more and more companies entering into the development of the inverter, except for the power module, the price of all other inverter components is cheap. With China’s market share also approaching 50%, the price of the entire power module will also be very cheap.“`

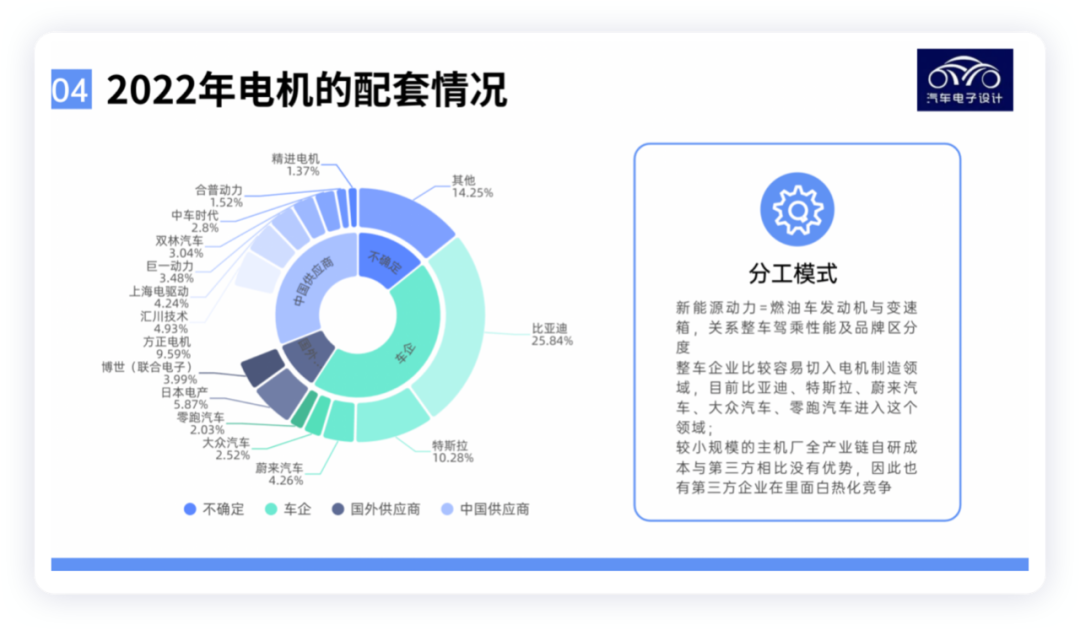

Motors

New energy power = internal combustion engine and gearbox of fuel vehicles. The relationship between them affects the overall driving performance and brand differentiation of the whole vehicle. Therefore, it is relatively easy for the vehicle manufacturers to enter the motor manufacturing field. Currently, BYD, Tesla, NIO, Volkswagen, and Leapmotor have entered this field. Smaller manufacturers have no advantage in terms of self-researched full industry chain cost compared with third-party enterprises. Therefore, third-party enterprises also compete fiercely in this field. In the first half of 2022, the market share of motors highly depends on the choices of whole vehicle manufacturers. The top three supporting companies in terms of installation capacity are Fudi Power, Tesla, and followed by Fangzheng Motor, Nidec, and HB Technologies. For high-power and high-performance motors with high reaction difference, automakers still need to build their own. This is a definite major trend and everyone hopes to seize this market.

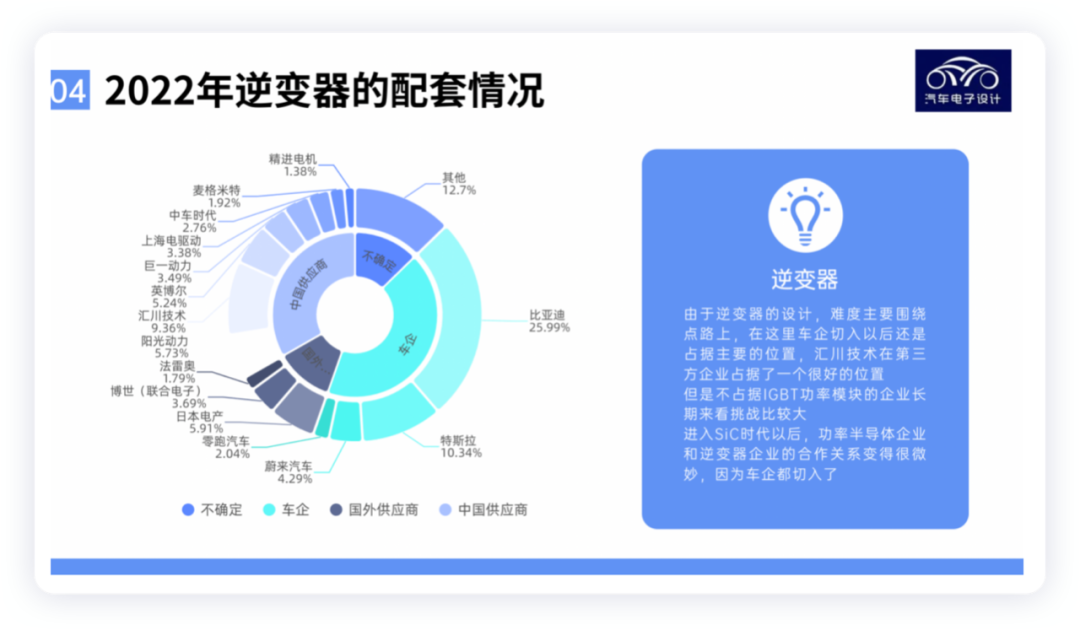

Motor Control

The top three supporting companies of motor controllers in terms of installation capacity are Fudi Power, Tesla, and HB Technologies. Companies that only make inverters can still make some money. With the improvement of the domestication rate of SiC modules, automakers may be more willing to invest in the development of SiC inverters. Due to the design of the inverter, the difficulty mainly revolves around the point-to-point connection. The automaker still holds a major position after entering this field. HB Technologies holds a good position among third-party enterprises. However, companies that do not occupy the IGBT power module have long-term challenges. After entering the SiC era, the cooperative relationship between power semiconductor and inverter enterprises becomes subtle because automakers have entered this field.

The statement of supporting relationship will not be covered again because there are basically no major changes in it.

Development Direction

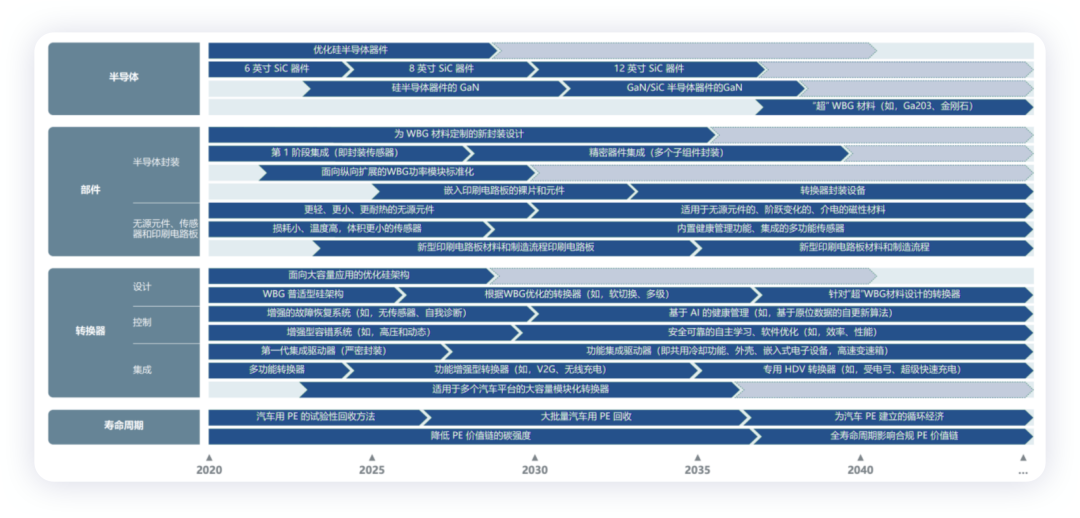

Technological development is relatively clear in these pages for everyone’s reference.

“`

Summary: I believe that technological development will still bring about significant changes. I’ve been busy lately, so I’ll stop here for now as a reference for everyone.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.