Author: Shiyun Zhu

Editor: Lingfang Wang

“At first, we thought that the ’14th Five-Year Plan’ target was very ambitious. But now, we will break through one million vehicles next year,” said Zhao Aimin, Secretary of the Party Committee and Deputy General Manager of SAIC International, to the “Electric Vehicle Observer.” “To be honest, I didn’t expect it to happen so fast. But at the same time, we value the sustainability of development more when we make rapid progress.“

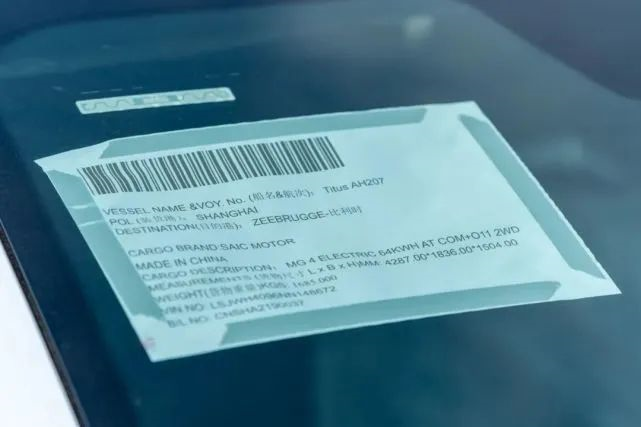

On July 20th, nearly a thousand MG MULAN vehicles departed from Shanghai Haitong Wharf, and 25 days later, they will arrive at Zeebrugge Port in Belgium and officially go on sale in Europe in the fourth quarter. MG MULAN is the world’s first car developed by SAIC based on European standards, designed according to market demands in Europe.

Unlike the previous emphasis on brand building in Europe and America, MG MULAN (hereinafter referred to as Mulan) will be the first to be sold in Europe, and will enter Australia/New Zealand, the Middle East, Mexico, South America next year, covering six key regions around the world, with an annual sales target of 150,000 vehicles.

But even before the launch of Mulan, Europe will become SAIC’s first market with a volume of 100,000 vehicles this year.

Chinese car companies have never interrupted their strategy for Europe, from the previous pickup commercial vehicles to the later new energy products, but they have always had a greater brand significance than commercial significance.

Why is SAIC dominating Europe now?

Mulan needs to “capture” Germany and the UK first

“By 2025, 1.5 million vehicles is the baseline target, which we will continuously adjust,” said Yu De, Assistant to President of SAIC, General Manager of International Business Division of SAIC, and General Manager of SAIC International, to the “Electric Vehicle Observer” in 2021.

A year later, SAIC is approaching this “small goal” at high speed.

In the first half of the year, SAIC’s overseas sales totaled more than 380,000 vehicles, an increase of nearly 50% year-on-year, and full-year sales are expected to exceed 800,000 vehicles. With the landing of the global car Mulan, SAIC’s overseas sales will break through 1 million next year.

“In Europe this year, we can achieve a sales target of 60,000 or even 70,000 vehicles in the continental region. If the UK is included, Europe will become our first overseas region market with a volume of 100,000 vehicles,” said Zhao Aimin in an interview.

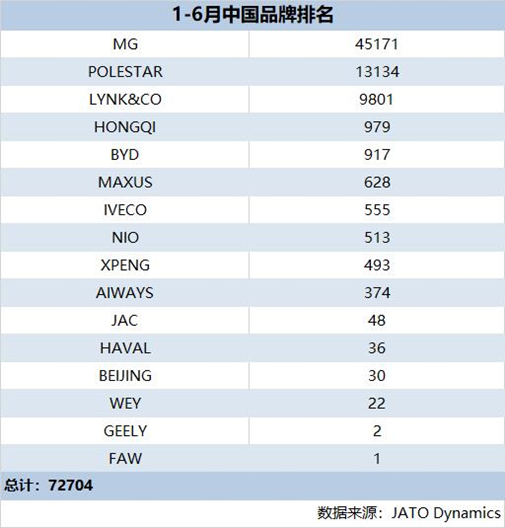

Data from JATO Dynamics shows that from January to June, MG’s sales in Europe exceeded 45,000 vehicles, followed closely by the Chinese brands Lynk & Co and Geely with sales of 13,000 and 9,801 vehicles, respectively. Other Chinese brands performed poorly, with BYD, NIO, and XPeng selling 917, 513, and 493 vehicles, respectively.

Currently, MG has entered the top ten of electric vehicle markets in Sweden, Norway, and other countries.In Germany, the MG EZS achieved a sales volume of 4,179 units in the first half of the year, surpassing Volvo (2,277), Nissan (2,005), and Citroen (3,718) in electric vehicle sales, but still lagging behind brands like Volkswagen (29,651), Tesla (18,259), Hyundai (18,805), Seat (13,333), and Kia (12,306).

“We can only barely pass with our current performance. There is indeed still a gap compared to Japanese, Korean, and German brands in the international market, but this gap is shrinking,” said Zhao Aimin. In his view, Mulan will be an important step for SAIC to reduce the gap between it and its Japanese, Korean, and German competitors in the international market. “The first step for this vehicle is to be sold in Europe, with a particular focus on breaking into right-hand drive UK and left-hand drive Germany.”

According to SAIC, their profitability in the European market is also worth looking forward to.

How to Sell Cars in Germany?

Germany, France, the UK, Italy, Spain, and other countries are the core automotive sales markets in Europe, and it is not surprising to target them first. However, they are also important automobile manufacturing countries, with many historic local brands. So how can we win them over, such as Germany?

One of SAIC’s strengths comes from not only its product itself, but also its own sales and service network.

The performance and quality of SAIC’s products have been recognized. Prior to Mulan, the MG EZS gave the German market a preliminary understanding of SAIC, a Chinese automaker. Last October, after test-driving the MG EZS, ADAC (Allgemeiner Deutscher Automobil Club), the largest automobile club in Germany and Europe with over 70 million members, concluded that “the MG EZS clearly shows that Chinese manufacturers have done their homework.”

ADAC’s test also found that, apart from its relatively short range (263 kilometers under the WLTP standard), the MG ZS had no obvious weaknesses, and its price of 23,000 euros (32,000 euros minus 9,000 euros in environmental bonuses) is almost unbeatable value for money. The manufacturer can also be proud of receiving four stars in the ADAC Ecotest.”In the past, Chinese cars like the Huachen B6 appeared to crumble during collision accidents, but that era seems to have ended. The MG EZS achieved five stars in the EuroNCAP collision test, comparable to its existing competitors. With an eight-year battery life and five-year vehicle warranty, MG has established trust in its brand, surpassing most established manufacturers, except for Kia (7 years) and Hyundai (5 years). ADAC emphasized that the question remains of whether German car buyers can truly be friends with Chinese car models.

The sales network is SAIC’s way of ‘making friends’ in Germany. In France, the dealer model broke through quickly in 2021, with 100 dealerships established and sales rising rapidly. On the other hand, the completely new direct sales model in Germany posed a great challenge and was painful. Zhao Aimin mentioned that no one believes in your brand and questions why MG should be here. Our on-site promotions were very difficult, but fortunately we reached over 100 points.

The reason why SAIC adopted a direct sales model in Germany is due to the high brand loyalty and strong appeal of local brands among German consumers. As a weak brand, MG cannot take the old road of dealership representation in Germany. Zhao Aimin indicated that, in order to succeed, they must take a distinctive sales path in different markets from other competitors or traditional powerhouses.

The premise of the direct sales model is that “our own people” can carry out business activities in the local market, just as local dealers do. In order to carry out its overseas marketing strategy, SAIC Group has transferred more than 30 executives who can communicate effectively with foreigners to enrich its overseas marketing team. Each overseas company has a dispatched general manager and key personnel who can fluently communicate in different languages with locals. Thanks to the construction of its direct sales network, SAIC’s sales in Germany and France in the first half of the year were virtually equal.

Zhao Aimin emphasized that this accumulated resource is not only a result of its JV introduction to going global, but also an ability that greatly benefits the direct sales model. Due to the establishment of its direct sales network, MG’s sales in Germany this year may still exceed those in France, given the network is completely in SAIC’s hands, and it can fulfill demands with sufficient resources.

This explains why SAIC has done well in Europe from a certain level, with the German model being an example.

“Since the 13th Five-Year Plan, SAIC has been promoting a “systematic, planned, and institutionalized” international business model, establishing a global automotive industry chain integrating research and development, marketing, logistics, parts, manufacturing, finance, and used cars; setting up three R&D and innovation centers in Silicon Valley, London, and Tel Aviv; building four vehicle manufacturing plants in Thailand, Indonesia, India, and Pakistan, and over 100 parts production and R&D bases and more than 1,800 marketing service outlets; opening six self-operated international air routes including Southeast Asia, Mexico, South America West, Europe, etc.; and its products and services covering nearly 90 countries and regions worldwide, forming six regional markets with “50,000-unit scale” in Europe, Australia and New Zealand, the Americas, the Middle East, the ASEAN, and South Asia.

“Since the 13th Five-Year Plan, SAIC has been promoting a “systematic, planned, and institutionalized” international business model, establishing a global automotive industry chain integrating research and development, marketing, logistics, parts, manufacturing, finance, and used cars; setting up three R&D and innovation centers in Silicon Valley, London, and Tel Aviv; building four vehicle manufacturing plants in Thailand, Indonesia, India, and Pakistan, and over 100 parts production and R&D bases and more than 1,800 marketing service outlets; opening six self-operated international air routes including Southeast Asia, Mexico, South America West, Europe, etc.; and its products and services covering nearly 90 countries and regions worldwide, forming six regional markets with “50,000-unit scale” in Europe, Australia and New Zealand, the Americas, the Middle East, the ASEAN, and South Asia.

These figures support SAIC’s ability to dominate in the international market.

In 2020, Anji Logistics, a subsidiary of SAIC, opened a self-operated European air route, achieving a one-way trip from China to Europe in 30 days by direct shipping, which improved efficiency by 10 days compared to the stop-to-stop route. A year later, this air route ensured that SAIC had cars to sell in Europe without losing money.

In the fourth quarter of 2020, with the spread of the epidemic worldwide, China’s foreign trade exports, still with production capacity, continued to hit record highs, and the demand for export transportation surged. The “blocking ship” incident in the Suez Canal further intensified the competition for global shipping capacity. The Baltic Freight Index soared from its lowest point of 700 US dollars to a high of more than 9,000 US dollars. For some routes, the shipping cost of a container increased to tens of thousands of US dollars. Later, there were even cases of cargo ships “dumping” containers at overseas ports and empty ships “returning” to China to transport goods to improve the turnover rate.

Against this background, the European air route not only enabled SAIC to deliver cars in France within a week – even faster than some local brands – but also guaranteed profits. “Without a self-operated air route, the transportation cost of a car could be tens of thousands of yuan more,” said Yu De, Vice President of SAIC, at last year’s communication meeting.

This kind of control is also reflected in the “local operational services” capability overseas.

In August 2020, Liu Xinyu, who had worked in SAIC Volkswagen service for many years, and his three colleagues stood in front of the Arc de Triomphe to develop the French market for SAIC. In the midst of the intensely developing epidemic, the SAIC team of three in France, including a translator, started a roadshow promotion for dealers with four cars and other work such as negotiation of bank financial services and recruitment of employees.

Ten months later, with the efforts of the SAIC France team and the dual role of the PSA and FCA alliance’s restructuring network important window, SAIC had 31 local employees and 82 dealers in France, reaching 100 dealers by the end of 2021. In comparison, Hyundai had 180 dealers in France, which took 29 years.”Establishing a team is crucial for us,” Liu Xinyu cited an example: MG EZS encountered a problem of being unable to charge at a location where three countries meet in France. Engineers from the SAIC Motors France team went to the site multiple times for repairs and eventually found that it was caused by compatibility issues between different power companies. The problem was ultimately solved by modifying the compatibility of the vehicle’s charging module.

“By providing services through a dense network, consumers can see that we are not only reviving an old brand (MG), but more importantly, we are seriously pursuing long-term and stable development.” New MG CEO in Europe, Liu Xinyu told “Electric Vehicle Observer”.

Today, this control needs to be extended to the product end.

Before Mulan, Chinese brands including SAIC were still adapting to overseas markets with the label of “Chinese cars.”

Yang Junling, SAIC Maxus Overseas Business Unit General Manager, mentioned an example: Maxus’ products are used for logistics in Europe. The team found that the local forklift pallet size was different from the size designed for Chinese products, so the project was halted and a micro-adjustment of 2 millimeters was made to achieve convenience for local use.

As a global car, besides meeting European standards in safety, environmental protection, and quality, Mulan also takes into account European market demands and preferences in terms of design, function, and performance.

“We joked before that during the epidemic when overseas styling reviews couldn’t travel to China, we would find some foreigners in the Bund area. ” Zhao Aimin said that compared with mainland China, the interiors in the European market tend to be fabric-oriented, simple, and environmentally friendly. That’s why Mulan’s interior features a European style. Higher demands for handling performance led to Mulan’s chassis tuning being tougher. The exterior designer is European, ” and later we went through multiple rounds of online and offline overseas reviews. Our styling, interior, and range are all highly respectful of local market habits, so I believe this car can sell well.”

Zhao Aimin revealed that SAIC Group’s Research Institute may establish a design center in Munich, Germany.

Why go to Europe

With the increasing uncertainty of domestic and international macroeconomic factors, many Chinese car companies that were previously actively going abroad have slowed down. However, for SAIC, the strategy of going abroad is still very firm.

“China’s automotive exports have experienced peaks and valleys, but in the 2.0 era, we value the sustainability of going abroad.” Zhao Aimin explained why they want to stay in the European market, saying that sustainability first means that the brand can integrate into the local area. And being able to stand firm in developed economies while contributing considerable sales is also an important support for the brand’s growth.Sustainability is also reflected in the aspect of sustainable market and stable profitability. “During the export era 1.0, there were more words about low quality, low price or ultra-high cost-effectiveness. However, in the future, we should focus more on the profitability of Chinese manufacturing, in addition to maintaining its cost advantage. We should also have profitability when consumers can afford it.”

Sustainability is also reflected in the ability to cope with uncertainty. Zhao Aimin said that the current complex international political and economic situation has posed great challenges to the export of complete vehicles. “In fact, we also hope to better integrate into different regions and markets, establish manufacturing centers, achieve sustainability, and reduce risks caused by politics, economy, exchange rates, etc.“

“Sales are just about selling products. However, throughout the long process from domestic production to overseas sales, whether it is the product perception and design capabilities at the front-end, or the supply chain’s guarantee and manufacturing capabilities, we need to construct and narrow the gap with others in every node of the process.” Zhao Aimin said at the end of the interview, “SAIC is not a company that can do everything on its own. We need to integrate the strength of China and make the global market bigger together, so as to have sustainability and stronger competitiveness.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.