Recent Developments in Chinese Electric Vehicle Batteries

Author | Leng Zelin

Editor | Wang Pan

Recently, Honeycomb Energy announced the successful development of the first batch of 20Ah sulfur-based, all-solid-state prototype battery cells in China. The energy density of these cells reaches as high as 350-400Wh/kg, exceeding the energy density of current ternary lithium batteries which is around 250Wh/kg-300Wh/kg, as well as the energy density of lithium iron phosphate batteries which is around 170Wh/kg-190Wh/kg.

The battery has undergone several experiments including puncture testing and tests in a 200-degree Celsius oven. It is expected to increase the range of electric cars to over 1000 kilometers. There is no specific production schedule available yet, but based on the production time of other solid-state batteries manufacturers, it will also be around 2025.

Undoubtedly, since separating from Great Wall Motors in 2018, Honeycomb Energy has become a “dark horse” in the lithium-ion battery industry.

According to data from the China Automotive Power Battery Industry Innovation Alliance, in the first half of this year, Honeycomb Energy’s installed capacity reached 2.58GWh, surpassing Xinwangda and ranking sixth. Although it is still a small fraction compared to Ningde Times and BYD, Ningde Times recently filed a lawsuit against Honeycomb Energy under the terms of the non-competition agreement, suggesting that Honeycomb Energy may pose a threat to this lithium-ion battery industry leader.

On the other hand, Wei brand, owned by Great Wall Motors, recently released the Latte DHT-PHEV, and all models under Wei brand have turned to the PHEV field. Wei brand’s CMO, Qiao Xinyu, revealed during the press conference that Wei brand’s future models will be equipped with DHT-PHEV system.

In the process of transformation of traditional automotive companies, companies that operate both hybrid and battery technologies are not only Great Wall Motors. The most prominent example is BYD, which began using blade batteries and introduced DM-i hybrid models last year.

On the surface, Great Wall Motors also seems to want to replicate the success of BYD, but upon closer inspection, the two companies’ strategies differ.

BYD starts with cost performance

To understand Great Wall Motors’ current strategic direction, we need to first understand BYD’s product strategy.

BYD started earlier in the new energy industry, almost at the same time as Tesla. However, while Musk can easily handle mature American industrial technology, due to the weak domestic automotive industry, BYD had to accumulate experience through combustion-engined vehicles while also laying out key components for new energy vehicles.

But it is also because of this that BYD established the strategy of laying out the entire industry chain.

In 2020, BYD established five subsidiaries named “Fudy”, including Fudy Battery, Fudy Vision, Fudy Technology, Fudy Power, and Fudy Mold. These companies officially opened the business of selling new energy core components to the public.

The biggest advantage of laying out the whole industry chain is low cost. According to 36 Kr’s statistics on BYD’s Han supply chain, its self-sufficiency rate is very high, with 37 out of 61 components being self-supplied.

In addition, BYD DM-i system and blade battery further reduce the purchasing and usage costs for consumers. Obviously, in the field of new energy, BYD’s main route is cost-effectiveness.

It’s needless to say the cost difference between lithium iron phosphate battery and ternary lithium battery, while BYD DM-i hybrid system adopts a simpler single-stage gear transmission, which has the same low-cost advantage as other traditional car companies’ hybrid systems.

An engineer who participated in the design of the BYD DM system told PhantaCity that when they developed this system, they thought that only one gear was the simplest and most economical solution. As for the complex hybrid system, the Chery e+ is the most prominent one. Although it can cover more usage scenarios with “3 Engine, 3 Gears, 9 Modes, and 11 Speeds”, the manufacturing cost, failure rate, and later tuning cost will be much higher than those of the DM-i system.

However, an undeniable fact is that except for BYD’s own product system, few models priced over 300,000 yuan use lithium iron phosphate batteries, and they are still emphasizing the usage costs.

This is also related to the material characteristics of lithium iron phosphate batteries. In the mid-to-high-end market, the “gracefulness” of new energy vehicles needs to be far greater than cost-effectiveness. In terms of range, either give consumers sufficient range (such as Ideal), or provide efficient energy supplementation schemes (such as NIO and Tesla). After all, if you spend hundreds of thousands of dollars to buy a car, you can’t compete for energy replenishment resources with online ride-hailing cars every other day.

Perhaps in PHEVs, the short board is not so obvious, but it is more easily reflected in BEVs. If we compare the range and weight of lithium iron phosphate batteries and ternary lithium batteries rudely, it is clear which one has a higher limit.

The 2020 XPeng P7 (priced at 270,900 yuan) is equipped with an 80.9 kWh ternary lithium battery pack, which has a pure electric range of 706km; while the 2022 Han EV’s Genesis version (priced at 269,800 yuan) is equipped with an 85.4 kWh lithium iron phosphate battery pack, which can travel 715km on a single charge.

At first glance, the two have similar prices, battery capacity, and range capabilities, but the difference in curb weight is about 200kg, with the former weighing 1910kg and the latter 2100kg.Lithium iron phosphate has lower energy density than ternary lithium under the negative correlation between the battery which occupies about 20-30% of the weight of the vehicle and the cruising range capability. Reliance on just stacking the number of battery cells to increase the upper limit of cruising range capability, the lithium iron phosphate is far lower than the latter, which will be more obvious when comparing Tang EV and AION LX, which is also a typical vehicle model with stacked batteries.

With about 32% more battery capacity, AION LX has increased its cruising range by about 38%, while its weight is even lower than Tang EV (of course, it is still affected by factors such as body size and materials).

In fact, from the actions of car companies in recent years, only when their models need to be further reduced in order to seize market share, will they consider using lithium iron phosphate batteries.

Therefore, BYD’s current main high-end brand-Tank, its first model D9 also uses a combination of “DM-i + blade batteries”. Whether it can obtain market favor still remains a question mark.

Wei Pai is rising and Haval is leading

If BYD is accumulating word of mouth from the bottom up in the new energy market, then Great Wall, which also holds battery and hybrid systems, is going in the opposite direction, wanting to take a top-to-bottom path.

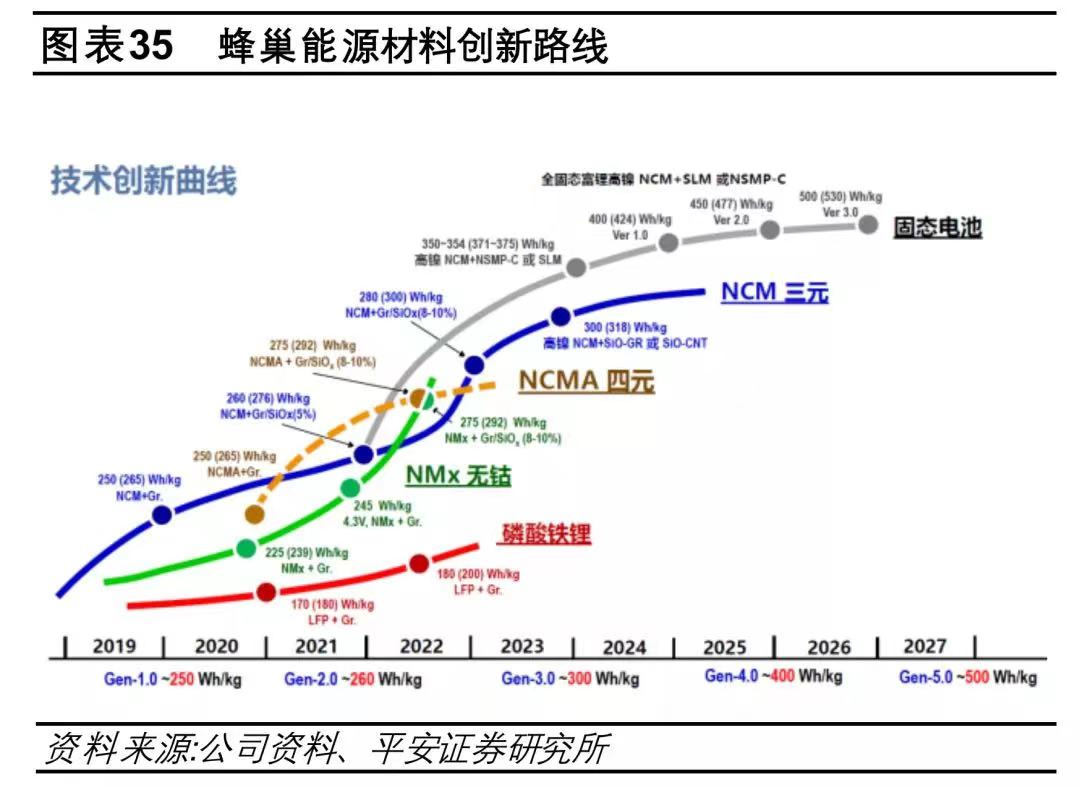

Although Honeycomb Energy has not given up on the lithium iron phosphate technology route, in the long run, it is still based on cobalt-free, quaternary, ternary, and solid-state batteries.

Since Great Wall has long since separated Honeycomb as an independent entity, Honeycomb can lay out more technical routes without consuming group resources without serving a particular host plant.

Earlier this year, Honeycomb Energy officially launched its IPO. It had already conducted five rounds of financing before this, with a total financing amount of over 20 billion yuan. In addition to the layout of multiple technical routes, its production capacity “ambitions” are also considerable.

According to the production capacity plan revealed at the end of last year, Honeycomb Energy’s planned production capacity will reach 600GWh by 2025, while NINGDE TIMES plans to have a capacity of 800GWh, CITIC Guoan Information plans to have a capacity of 500GWh, and EVE Energy plans for 450GWh. Guoxuan High-Tech only plans for half of their production capacity.

A slight calculation shows that Honeycomb Energy’s planned production capacity is more than 230 times the installation capacity of last year.

From the perspective of last year’s installation volume, Changan is still the main customer of Honeycomb Energy, providing support for its Euler brand. In addition, there are new power sources such as NIO, LINGPAO and LANTU.

From the perspective of last year’s installation volume, Changan is still the main customer of Honeycomb Energy, providing support for its Euler brand. In addition, there are new power sources such as NIO, LINGPAO and LANTU.

Starting this year, Wei brand’s models have also successively been equipped with the ternary lithium battery provided by Honeycomb Energy. The reason is also because of Changan’s Lemon DHT hybrid system mentioned earlier.

This hybrid system provides two power modes of HEV and PHEV. Previously, Changan was the first to use HEV, which means “series-parallel + small battery” and is named after the suffix DHT. On the other hand, MACH-E, LATTE, and MOCHA with the suffix DHT-PHEV belong to “series-parallel + large battery”, and therefore need to provide enough pure electric driving range.

Compared with BYD DM-i’s single-stage transmission, the difference of Lemon DHT lies in the addition of two-stage transmission, which allows the engine to enter the efficient zone earlier, with better power, lower high-speed rotation speed, and better NVH control.

However, the extra gear structure will increase both cost and failure rate and the use of the Honeycomb Energy ternary lithium battery will also increase the cost. Of course, this also comes with higher pure electric driving range. The three plug-in hybrid models of the Wei brand have a maximum pure electric driving range of 110km, 184km, and 204km respectively.

As for the HEV mode, Changan has delegated it to the Haval brand. At the end of last year, Chitu, the first model equipped with the DHT hybrid system, was officially launched. As of now, three models of Haval, and two models of H6S all use DHT hybrid systems. Next year, the second-generation Haval Big Dog will also launch DHT models.

Thus, Changan, which has been slow to move in the field of new energy, seems to have a clearer strategic path. The Haval brand is gradually turning to HEVs with small batteries, while Wei brand is differentiating itself from BYD DM-i by using PHEVs with large batteries. It is also attempting to lead Wei brand which has been lukewarm in sales to the center stage.

At the press conference, Joe Xinyu, CMO of Wei brand, also revealed Wei’s product plans for the next stage. In addition to the MACH-E, LATTE, and MOCHA-crossover SUVs, a larger six-seater SUV will also be launched at the end of the year. Two MPVs will be marketed towards business and family users, respectively. One retro car model will be announced, as well as a compact model that Changan has not entered for many years.

All of these models will be equipped with advanced intelligent driving assistance systems, in addition to having a long-lasting DHT-PHEV hybrid system.

If BYD’s comprehensive industrial chain layout highlights its cost-effective advantage, then perhaps Changan’s Hozon Zhixin (Beginner Intelligence) will cooperate with Wei brand to become a trump card in the mid-to-high-end hybrid market.

The pains of transformation still exist.In the first half of this year, Great Wall Motors sold 519,000 units, a year-on-year decrease of 16.12%. In contrast, BYD’s sales in the first half of the year reached 646,000 units, a whopping increase of 162.03%. It’s worth noting that BYD stopped selling gasoline vehicles this year, so all the data is for new energy vehicles, while Great Wall’s new energy sales in the first half of the year were about 63,600 units, of which Euler brand accounted for 59,100 units.

Of course, the year-on-year decline in sales should be objectively viewed, as the sales of Great Wall models priced above ¥200,000 have increased from 10% in 2021 to 14% today, which could also be seen as the “birth pangs” of transformation.

The main reason for the decline in Great Wall’s sales is still the decline of its first-generation “legendary car” in the new energy era. Starting from the second half of last year, as the Song PLUS DM-i became popular, the sales of BYD’s Song series began to rise steadily, directly chasing the Haval H6, which has long dominated sales.

In February of this year, the BYD Song won the monthly sales championship with 24,532 units sold, and it seems that the status of Haval H6 is declining as gasoline prices rise, and the transformation of its new energy models is imminent.

Among the hybrid models of the Haval brand mentioned earlier, we can see the hybrid version of the H6S derivative models, but there is no sign of the H6. As a gasoline SUV with a main selling price range of ¥100,000-¥150,000, perhaps due to its important position in the Great Wall product line, Great Wall is very cautious about the transformation of this model.

Because in this market, any price fluctuations will cause a significant change in sales. However, Great Wall’s DHT is not a hybrid system that focuses on low cost, and the HEV mode does not have the advantage of a green license plate.

The answer given by Great Wall on how to make a choice is to take the two tracks of hybrid and plug-in hybrid simultaneously.

Earlier this year, the media exposed the road test spy photos of the Haval H6 DHT-PHEV, and this month, the Ministry of Industry and Information Technology revealed the application information for the Haval H6 DHT model.

Regardless of which model, the addition of the hybrid system is likely to increase the cost of Haval H6, leading to a decrease in its competitiveness. At the same time, according to media reports, the H6 DHT-PHEV also adopts a large battery strategy, with a pure electric range of up to 210km. Looking back at the failure of the Wei brand, the battle between Haval’s left and right hands is obviously an important factor. Therefore, whether the plug-in hybrid version of Haval will also affect the products of the Wei brand is a “play it safe” issue for Great Wall.

On the other hand, although Foton didn’t start with Great Wall, it gained greater flexibility. However, from another perspective, BYD took the lead in offering its blade battery to its own product line, reversing the brand’s reputation with the advantage of higher competitiveness than its peers, and winning consumer recognition.And the rise of the Hive has nothing to do with Great Wall, which also means that Great Wall may not necessarily gain more first-mover advantage in terms of power battery performance. So what does Great Wall rely on to enhance its product capability, the niche market or the segmented brand marketing? Obviously neither of them.

If Wei Pai is influenced by Haval, then who will consume the production capacity of up to 600GWh?

Even in today’s thriving new energy market, Great Wall needs to bear a lot of “growing pains” if it wants to create another BYD.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.