Author: Jaz

Half of 2022 has passed, and there is no sign of the obsession with computing power coming to an end.

Media outlets have compiled a list of the top new car computing power rankings for 2022, pitting the computing power of various new cars against each other. Comparing computing power is like a crude showdown, but it’s not particularly reliable.

The top ten comprehensive computing power rankings for autonomous driving are led by 200TopS, with a maximum of 1440TopS. Excluding some interference from first-party companies, 60% chose Nvidia Orin X and 30% chose MDC 610.

To what extent does autonomous driving computing power represent the potential for intelligent driving?

The opinion of Yu Kai, founder and CEO of Horizon Robotics, is that it doesn’t matter much. On July 21st, Yu Kai commented on the rankings in a friend circle as “seeing flowers in the fog” and said that there would be a large-scale production vehicle autonomous driving evaluation next year. “By then, it will be found that there is not much relationship between autonomous driving performance and computing power between 100 TOPS and 1000 TOPS.” Yu Kai said.

The notion of “no relationship” stems from the problem of “Moore’s Law” becoming ineffective.

Moore’s Law in the semiconductor field was once regarded as an iron law, but it is gradually becoming ineffective as chip nanometers approach atomic levels. At present, the climb in the “computing power” of smart car autonomous driving chips is relatively slow. This means that relying on hardware design to improve computing power has failed, and is more favorable to software upgrades to improve autonomous driving performance.

As a result, the computing power showdown of smart cars will also come to an end.

So, what should we pay attention to in smart cars instead of computing power? Will there be a new order to replace the old world? The rise of domestic chip power represented by Horizon Robotics may provide us with some interesting ideas and stories.

“Intelligent Car Disorder” Under Moore’s Law

Moore’s Law, which dictates the trend in the semiconductor industry, is not a physical concept, but an engineering concept.

In 1965, Gordon Moore, the founder of Intel, used the lowest cost of transistors that could be integrated with 5 years of integrated circuits to draw a growth curve, proposing Moore’s Law- the number of transistors that can be accommodated on an integrated circuit board will double approximately every 18 months.

At that time, only a few thousand transistors were integrated on a chip, and now one GPU can contain billions of transistors. For example, Apple’s M1 chip, released in 2020, has already reached 56 billion transistors.

Moore’s Law has brought about a revolution in chip technology, not only lowering the manufacturing cost of chips, but also promoting the prosperity of the academic community and industry through product iterations, creating chip giants such as TSMC and Samsung.But even though brilliance has been created, Moore’s Law is inevitably coming to an end. As Yu Kai said, “Moore’s Law has reached the physical limit. The chip area has now reached a scale of 5 nanometers, 3 nanometers that is approaching the atomic scale.”

First and foremost is the cost of funding, the cost of researching advanced processes is becoming increasingly expensive, and there is a higher chance of being unable to recover the cost. Handel Jones, CEO of International Business Strategies, once stated that “the average cost of designing a 28nm chip is $40 million, while the costs for 7nm and 5nm are $217 million and $416 million, respectively.”

Data shows that the capital expenditures of the top ten global wafer foundries have exceeded $50 billion in 2021. Chips are complex in design, and advanced processes are more difficult, with higher risks in the wafer process. Once a wafer fails, millions of dollars will go up in smoke, and the original chips need to be modified and optimized.

Secondly, from the perspective of consumers, Moore’s Law drives hardware upgrades, but Andy-Wit Law reveals the rule that software consumes hardware performance.

In this law, Andy refers to Andy Grove, former CEO of Intel, and Bill refers to Bill Gates, former CEO of Microsoft. Andy gives, and Bill takes, representing the relationship where a large amount of software consumes hardware performance.

To put it in an easier way, durable electronic products have become expendable electronic products.

The failed Moore’s Law and the increasing proportion of software are all propositions that have already occurred in electronic products, including smart cars.

The amount of chips required for smart cars is two to three times that of traditional cars, with nearly 4,000 chips of various sizes. Among them, the automatic driving chip is the most critical, with the most stringent requirements for chip design and technology.

From the perspective of chip usage environment alone, automotive-grade industrial chips not only need to withstand extreme cold, heat, and dust like the car does, but their chip design lifespan has to be started at 15 years, ensuring safe driving of the car.

Therefore, the problems encountered by the chip industry are more evident in the automotive chip industry, such as the slowing down of Moore’s Law, rising material prices, and other factors, causing smart cars to suffer from “discomfort,” and the automotive chip has been facing a chip shortage for several years.

The chip shortage is reflected in two different levels. On the one hand, low-level automotive-specific chips cannot be found due to the skyrocketing prices of upstream raw materials. He XPeng, founder of XPeng Motors, once posted a “Chip Wanted” video on Weibo. On the other hand, the upgrade of high-level autonomous driving chips is slow, with most of the cooperative project packages taken by Nvidia Orin X.

The former is due to the skyrocketing prices of upstream raw materials for chips, while the latter is a concrete manifestation of Moore’s Law failure – slow iteration, and the computing power of autonomous driving chips gradually tends to the same level of competition.

Under this context, Chinese local chip manufacturers have taken the post-Moore’s Law era as the starting point and focused more on software and algorithm levels besides chip design, achieving an “unexpected rise” in the automotive chip industry.

Under this context, Chinese local chip manufacturers have taken the post-Moore’s Law era as the starting point and focused more on software and algorithm levels besides chip design, achieving an “unexpected rise” in the automotive chip industry.

For example, let’s start with defining the actual concept of computing power.

Currently, the dominant performance standard for autonomous driving on the market is actually the computing power standard led by Nvidia. However, whether the level of autonomous driving depends on computing power is still an unanswered question. Some investors have previously expressed that there is no clearer standard than computing power at present, so they had no choice but to use it.

Chinese local chip manufacturers are now solving this problem and taking back the “definition power” for defining the performance of autonomous driving.

Huawei MDC has come up with “dense computing power”, which has half of the computing power value on paper compared to “sparse computing power”, but in reality, its computing power is equivalent and has a better cost performance.

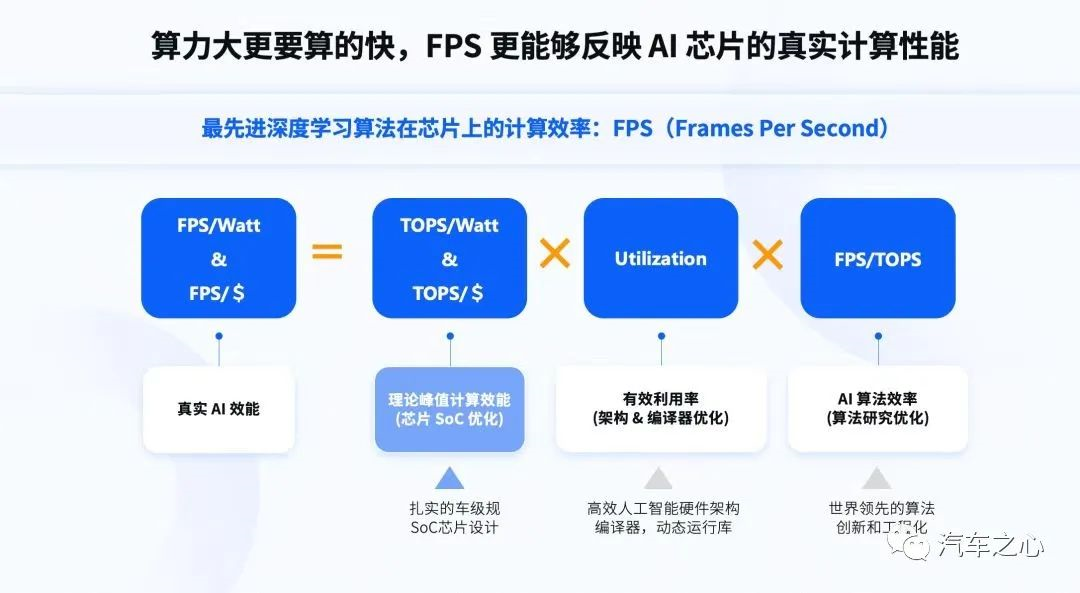

Similarly, Horizon Robotics proposed “FPS”, with the speed at which images are processed per unit as the standard for measuring the true performance of autonomous driving chips.

In the collapse of Moore’s Law, a new order for autonomous driving chips seems to be overturning the old world’s dominants.

The establishment of a new order: what is the New Moore’s Law?

Rewriting the rules of computing power for smart cars is not an overnight task.

In 2016, Horizon Robotics threw a “New Moore’s Law” stone into the pond in China, but at that time, the stone was just a stone, not a bomb.

At that time, Horizon Robotics realized that the core of intelligent driving was not the integration density of transistors, but the amount of data processed. According to Yu Kai’s speech at the China Automotive Blue Book forum in July this year: “The most important thing is how many cameras and pixels a chip can process at a unit cost.”

Looking further, the autonomous driving chip of smart cars relies more on precise observation, rapid transmission, and agile reaction, rather than the instantaneous data processing volume.

Therefore, in the post-Moore’s Law era, when the hardware level of chip design and technology is close to saturation, Horizon Robotics found more “incremental space” from the software level of the operating system, compiler, and so on.

Horizon Robotics called this combination of software and hardware the “New Moore’s Law” and adopted FPS as the standard for measuring the true performance of autonomous driving chips.

FPS originally referred to the image concept, and when applied to the field of autonomous driving, it represents the speed at which images are processed per unit. The higher the FPS value, the higher the performance of autonomous driving. There is a calculation formula behind this, real AI performance (FPS) = theoretical peak computing performance x effective utilization rate x AI algorithm efficiency.

From this perspective, the new Moore’s Law does not completely deny Moore’s Law, but takes a purely algorithmic approach and turns it into a more comprehensive consideration. It integrates chip SoC, architecture, and software research into the standard for evaluating chip performance, thereby speeding up the upgrade of the smart car industry.# New Moore’s Law–How This Stone Turns into A Bomb

To understand how this stone turns into a bomb, we must start with the product, like the Horizon Journey 5.

Journey 5 is the latest generation of vehicle-grade automatic driving chips from Horizon. In terms of performance, it is one of the few products in China that can compete with Nvidia Orin X.

Journey 5 has a single chip computing power of 128Tops, which is only half of Orin X’s 256Tops. How is this a comparison?

Just as the actual endurance is to new energy vehicles, FPS is the actual performance for chips. It is reported that Journey 5’s FPS reaches 1531.

Although Orin X has not disclosed FPS data yet, according to tests, Journey 5 is six times that of Xavier and 3.3 times that of Orin X when processing millions of pixels per input frame.

The specialized architecture and software increments play a key role. Nvidia’s chip business battleground is not in auto, and auto only accounts for a small fraction of its chip business volume. Its core chip architecture is Ampere, mainly for commercial servers.

Therefore, the computing power of Orin X developed based on Ampere is high, but there is a lot of excess computing power that is not used for automatic driving, which leads to wasted computing power. The Horizon journey series chip, however, is based on the Bayesian BPU computing architecture designed for higher-level automatic driving to improve the efficiency of data parallel computing on a proprietary platform.

Previously, an engineer had used the analogy of shared floor area and net floor area to refer to the chip design. He believed that the standard for chip design should be based on the actual computing power in operation.

If chips designed by Nvidia and other leading companies have a large shared floor area but small net floor area, then chips like Horizon and Huawei MDC that have dedicated development platforms have a smaller shared floor area and higher net floor area. Thus, the actual computing power levels can also be higher.

In addition, the combination of hardware and software provides incremental space for FPS on the basis of constant hardware architecture. Last year, the FPS of Journey 5 chip was 1283, but in July of this year, Horizon upgraded its software architecture to increase the FPS to 1531.

This includes automatic optimization of the Horizon compiler. According to information learned by Autohome from Horizon, the compiler was optimized to handle 24 frames per second, an increase from the previous 9 frames per second, increasing the utilization rate of computing resources from over 30% to 85%.

This means that even if Moore’s Law is completely out of effect, there is still room for continuous improvement in actual computing power. Against the backdrop of the New Moore’s Law, the new rules of specialized architecture + hardware and software combination seem to be gaining recognition and acceptance from China’s intelligent automobile industry.

At present, Horizon Journey 5 has officially announced cooperation with four car companies, including Red Flag, BYD, Ziyooja, and SAIC. Yu Kai also stated that Horizon will maintain a speed of announcing one mass production vehicle per month in order to promote the mass production process of Journey 5. “The first mass-produced model will be available as early as October,” Yu Kai once publicly introduced.

At present, Horizon Journey 5 has officially announced cooperation with four car companies, including Red Flag, BYD, Ziyooja, and SAIC. Yu Kai also stated that Horizon will maintain a speed of announcing one mass production vehicle per month in order to promote the mass production process of Journey 5. “The first mass-produced model will be available as early as October,” Yu Kai once publicly introduced.

The Consciousness of Chip Manufacturers: From Self-Opening to Industry Opening

The intelligent automotive chip is ushering in a major reshuffle.

“Shuffle” needs to be seen from two aspects. On the one hand, the scale of the intelligent automotive chip market will become unprecedentedly large. According to CICC’s estimate, by 2025, the penetration rate of high-level automatic driving will reach 65.5%, and the demand for intelligent driving chips will be nearly 14 million pieces.

On the other hand, players on the table are changing positions.

A stereotype that needs to be rethought is that for the chip industry, Mobileye and NVIDIA are old players, but for the intelligent automotive industry, these old players are still “newbies” who have just entered the vehicle-level chip race track.

Therefore, this will not give Chinese local chip manufacturers an advantage in terms of first-mover advantage, and at the same time, Chinese chip manufacturers are closer to whole vehicle enterprises, industrial chains, and end consumers, and have more home court advantages.

The strength of domestic players is also not to be underestimated. In addition to Horizon launching Journey 5 after Journey 2 and Journey 3, Hei Zhi Ma, established in 2016, is also becoming more mature. The Huashan No. 2 A1000 series chip with large computing power for automatic driving has started to cooperate with Jianghuai Automobile Group and is already on the production model of Sihao brand.

Huawei’s MDC, with its strong ICT capabilities, is also deeply cultivating the automatic driving platform.

Huawei’s MDC computing power is also impressive, with its MDC810 dense computing power reaching 400 Tops.

Automotive Heart has done statistics on MDC, and it is reported that Huawei MDC computing platform has known public cooperation with more than 8 on-board car models.

If Horizon’s new Moore’s Law solves the problem of computational wastage, when domestic power players come together, the problem of ecosystem deficiency can be solved.

Automotive Heart pointed out in an article that chip players represented by Horizon are embracing collaborative car companies in a more open form.

In the past, the Mobileye black box model might have dominated, but with the increasing demand for hardware and software cooperation by OEMs, the automotive chip industry is forming a “circle of friends” style ecological environment.

The ecology model led by Horizon is to move from self-opening to industry opening.# 2021 Horzion launched Together OS, an open-source real-time operating system that supports middleware, functional software, and application software from different underlying operating systems.

For example, Horizon Journey 5 can support Linux, Hongmeng, Android, and Ali OS.

Yu Kai revealed that the reason why it only took seven months from reaching a cooperation with Li ONE to mass production was that they adopted this type of model, and a team was stationed in the middle to provide services.

Furthermore, Horizon also provides BPU authorization mode to the public, offering Horizon BPU software support packages, reference designs, and various technical support to meet the R&D capability of strong automakers for R&D innovation.

In terms of industry openness, Horizon delivers in the “white box” mode, allowing automakers to master the key technology of the mesh circle friends mode.

In this mode, automakers, Tier1, and Tier2 are all in the same circle. Horizon’s cooperation with automakers provides flexible autonomous driving solutions and strengthens the cooperation with Tier1.

Last month, Horizon and Continental Group established a joint venture company called Continental Chip Intelligence Driving. The combination of the Tier1+Tier2 structure can be seen as a redistribution of technical advantages and market resources. The effect is also very obvious. According to Autohome, Continental Chip Intelligence Driving has received an order from a domestic new car-making force, which is likely to be the highly anticipated Xiaomi Auto.

Systems that emphasize openness and symbiosis have caused rejection and reactions from closed players, and Mobileye’s market share is shrinking.

This is like the “Wintel” alliance created by Microsoft and Intel in the past, combining hardware and software to promote the operation of the Windows system on PCs based on Intel CPUs, with strong money-making ability. There was even a rumor that “selling a PC for 100 yuan, Intel earns 70 yuan, and Microsoft earns 30 yuan.”

Close cooperation made Wintel monopolize the PC market, but in the face of the impact of tablets and smartphones, the closure of Wintel also showed, and it collapsed.

Today, the openness, symbiosis, and deep cooperation of the chip industry leave us with a question: if the automotive chip industry forms more “Wintel” deep combinations based on the concept of cooperation and openness, will it rewrite the history of China’s automotive chip in the post-Moore era?The answer is yes. In the post-Moore’s Law era, the combination of software and hardware in automobile chips will become increasingly important. The involvement of OEMs and Tier 1 suppliers in this area may inject vitality into automobile chips from a user-oriented perspective. From this perspective, Horizon has already made a good start.

Automakers need to go to Mars, autonomous driving engineers need to reach the moon, and chip makers are climbing Mount Everest. In the era of fierce competition in China’s autonomous driving industry, taking the best from various sources and tackling high-level challenges may turn “difficult but correct” things into “simple and correct” ones.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.