Karakush

Joy and sorrow shroud Wolfsburg.

The electric champion, revolutionary hero, Musk’s rare brother on Earth, Herbert Diess, will step down as CEO of Volkswagen Group at the end of August, three years ahead of schedule.

Diess himself was only notified of this “optimized” outcome a day ago.

The group’s largest shareholder, Porsche-Piech family, convened an extraordinary supervisory board meeting. Despite being caught off guard, 20 supervisory board members quickly reached a consensus: the little brother had to leave the scene. The whole process took only an hour.

A top worker is still a worker, not only can be forced to graduate, without any sportsmanship, no dignity, and the brutal reality is that the whole world knows you are unemployed.

More worrisome than Diess’s personal success or failure is the future and fate of Volkswagen.

Over the past four years, it has been pushed onto the electric track by a “strong leader” and has become a pioneer of reform among traditional giants. Now the outrageous impeachment shows how dissatisfied Volkswagen is from top to bottom.

After the key promoter leaves his post, to what extent can his strategic legacy continue to be executed? Will Volkswagen still have the vitality and potential to create value and face future competition? And whether the core direction of development, electric travel, will change?

Now, Volkswagen is like an envelope without an address.

The uncertainty is whether the internal attitude towards reform is ambiguous. To make matters worse, it has just proven itself to be a fortress that is difficult to implement reforms.

Wanting It All

Although specific impeachment reasons were not given, clues are everywhere. From the eight hundred “rejections” of Diess from all levels of Volkswagen, we can see its extravagant demands during the transformation.

First, it wants business growth.

Volkswagen’s global car sales in the second quarter again fell sharply, down 22.4% year-on-year; and in the first half of the year, sales fell by 22.2% year-on-year, totaling 3.8751 million units.

This year, notwithstanding the many difficulties: supply bottlenecks, European wars, and China’s COVID-19 lockdown.

However, arch-rival Toyota (including Daihatsu and Hino) sold 4.2486 million vehicles from January to May, and is still on track to achieve frictional motion by month-end, with an expected output of 850,000 vehicles in June. Toyota has surpassed Volkswagen as the world’s number one automaker for two consecutive years.The volume lost during the transition is inevitable, just like the cup size lost during the weight loss process. Although the balance sheet does not look bad through high-profit models and cost reduction, the effort to switch to electric cars has not reached expectations. The group’s electric vehicle sales in the second quarter increased by only 6% year-on-year, and both the European and Chinese main markets were disappointing. Despite the total volume of 217,100 vehicles in the first half of the year, a year-on-year increase of 27.0%, compared to Tesla’s delivery of 564,000 vehicles in the first half of the year – the small goal of “surpassing Tesla in 2025” has become very slim. For Volkswagen, it is as uncomfortable as being on the edge or falling off the long tail.

Secondly, it needs to be implemented quickly. A key investment in the transition is the software department CARIAD, which aims to create a single software platform for all its brands, including operating systems, electronic architectures, and cloud platforms. However, the development progress has been delayed, resulting in heavy models such as the Porsche electric Macan and Audi Q6 e-tron being postponed. Especially for Porsche, which is preparing to go public independently, it has not launched any new models and still only has the old model Taycan from 2019. Currently, because of a seat harness problem, it is undergoing a global recall, with an expected quantity of more than 40,000 (half of its sales volume). Its valuation has fallen from 80 billion euros in February this year to 60 billion euros.

CARIAD, led by Diess, has 5,000 engineers and developers worldwide. In the planned budget for future 5-year technology investment, 30 billion euros are planned for support. The return date is too far away, which means no return on investment for the business.

Thirdly, it needs to maintain labor peace. Volkswagen is the world’s largest private employer, with nearly 670,000 employees worldwide. The union representative includes most of the 60,000 people in Wolfsburg, as well as most of the 230,000 people in other parts of Germany. When the CEO changes the production process and technology, he must appease interest groups in some way, otherwise, like Diess, he will have conflicts with the union directly and publicly throughout his tenure. He believes that only mass layoffs can compete with more flexible opponents such as Tesla and hinted that at least 30,000 people are redundant. This has angered the union. After the dismissal was announced, the union representatives did not conduct the usual business praise but reiterated that “no colleague should lag behind” and said frankly, “The decision (to dismiss) has made this point possible.”

Finally, it needs to be courteous. Diess was accused of “not caring about colleagues’ feelings” in communicating. In addition, he praises Tesla and Musk wholeheartedly while criticizing Volkswagen’s inefficiency, which also makes the company uneasy. Some analysts believe that this is a deliberately provocative management and a desperate reform strategy. Obviously, we also have no chance to see what it’s like when provocation is pushed to the ultimate and successfully rebounds.The first and second items are crucial as they directly determine the support of the core family.

The third item is often under the spotlight because the union is always very aggressive and has direct game-playing ability.

Out of the 20 seats on Volkswagen’s supervisory board, nine are held by union representatives, nine by shareholder representatives and two by the state of Lower Saxony where Volkswagen resides. The state government is often seen as forming a loose alliance with the union due to pressure from the people, so the union has the ability to influence more than half the votes.

However, in reality, the state government has not shown independent will in its voting history and often sides with the two major families. So as long as the family shareholders are well managed, the conflict with the union can be reduced to a reconcilable one.

For example, at the end-of-year supervisory board meeting last year, a four-hour discussion was held over whether Diess should stay or leave, with the union strongly opposed. However, in the end, with the support of the two major families, the state government held firm under pressure and Diess remained in office, although with reduced power.

Within six months, however, the attitudes of the two major families fundamentally reversed and played a decisive role in his dismissal. Some friends believe that Volkswagen still lacks patience for long-term returns. But in the eyes of shareholders, perhaps they do not see the potential for redemption in Diess.

This judgement is also reflected in the capital market.

Monday was the first trading day after the announcement. Volkswagen’s stock price was unaffected and even rose slightly by 2 Euros, while off-exchange trading on the New York stock market fell only 1.37%.

If this had happened a year ago, such a dismissal would have triggered a crash. Diess’s investments in electrification and digitization, fresh speeches, and public exchanges with Musk have all given investors hope for Volkswagen’s rapid transformation.

Last year, Volkswagen’s stock price reached a historic peak, the highest since Porsche’s century-long short squeeze in 2008. Investors described Diess as “the best thing to happen to Volkswagen in nearly 50 years.” However, this year, Volkswagen’s stock price has fallen 36% from its peak in one year; and off-exchange trading on the New York market has fallen 54%.

The decline laid the groundwork for the final goodbye. Diess broke a lot of eggs, but didn’t even make an omelette. Shareholders and investors who are witnessing the loss of their wealth in investment want a scapegoat.

As for the fourth item, it can be said to be irrelevant. A leader who is not hated but useless will also be kicked out. This negative feedback is only an emotional byproduct: mature establishment dislikes revolution.

The rise and fall of Diess provides an ideal top management for Volkswagen to the outside world.# Ceiling is a Dual Focused Undertaking of Systematic Transformation and Sustainable Job Security, Both Need to be Strong, While Maintaining Dignity with Big Shots/Brokers/Managers in Multilateral Power Relations.

The bottom line is simply to ensure visible feedback by effectively promoting transformational actions while maintaining a sound fundamentals. Meeting the bottom line, regardless of how bad your temper is or how big the reform action is, power can come to rescue; failure to do so, however, will render the labor union and management style problematic.

A previous example is Wendelin Wiedeking. During his tenure, Volkswagen adopted a dictatorial management style, and managers feared the CEO who never accepted failure, but he received resolute support from the supervisory board and was even able to oust Professor Piëch. This is because he led Volkswagen to become the world’s largest carmaker in the tens of millions.

What Does the Empire Really Need?

Volkswagen from the grassroots demands transformation.

This is the fundamental reason why Diess was able to take over in 2018.

Throughout the 21st century, Diess was the fourth consecutive leader to graduate from the Group’s CEO position ahead of time, especially since the frequent changes of leadership after the emission scandal were due to Volkswagen’s subjective initiative for change.

But for Volkswagen, revolution cannot be a permanent state.

No organization can sustain a revolution for a long time.

Diess’ reform, like all major revolutions in history, permeates the negation of tradition. Just like the French Revolution in 1789, which began a new era; or the Russian Revolution in 1917, Trotsky said that all previous events should be thrown into the garbage can of history.

He insisted on building a single computer operating system within Volkswagen to achieve the highest efficiency and scale, refused brand customization requests, while brand managers complained that the across-the-board strategy did not work. In the end, three software platform projects, CARIAD E1.0, E1.2 and E2.0, were produced in parallel, which seems to achieve a phased transition. However, in the ideal state, E1.2 will be delivered as early as 2023, and E2.0 as early as 2025, and eventually it will belong to E2.0.

In the world of the Internet, multiple parallel lines do not present major problems. However, for traditional enterprises, the use of redundant resources to gain time advantages, while cutting costs and downsizing as a cost, is a huge problem. In order to avoid the labor union, Diess chose the Zwickau plant in East Germany as the mother factory of ID.3; this exacerbated the gap with the Wolfsburg labor union, which believed that it was excluded from the electrification process.Cost-cutting through layoffs is a topic that every CEO faces. In 2016, Volkswagen announced plans to cut 30,000 employees, affecting 23,000 people in Germany and 7,000 in South America, resulting in a saving of 3.7 billion euros. However, the implementation always starts from overseas first, and the domestic market is dealt with in stages. Volkswagen promised not to have mandatory layoffs in Germany until 2025, mainly by implementing early retirement.

Every time Diess starts from scratch, it turns into a difficult journey.

What Volkswagen wants is actually a combination of revolution and restoration. Their core desire for reform is to reshape Volkswagen’s competitiveness and public image through technology, making it a great German manufacturing company again, returning to the ranks of top-notch corporations like before 2015.

Unlike those emerging companies, Volkswagen lacks a single-tech belief in the future, even until now. Most traditional car companies are also like this.

A “One of Our Own” Pattern

In September, Porsche CEO Oliver Blume will succeed Herbert Diess as the CEO of the Volkswagen Group.

Compared with Diess, Blume is a typical “one of our own.” He was born near Wolfsburg and spent his entire career at Volkswagen.

However, being “one of our own” does not solve any problems from an outsider’s perspective.

Matthias Müller was also a “one of our own.” His background is similar to Blume’s, and he spent his entire career at Volkswagen, even serving as the CEO of Porsche. After Dieselgate, he was considered the best candidate to pull Volkswagen out of the mire. However, less than three years later, he was ousted. In fact, during his tenure, Volkswagen did not have any practical problems but lacked strategic depth.

Only useful people are “one of our own.”

The first change that Blume brings is to ease internal tension. He believes that team spirit, fairness, and enthusiasm are decisive factors for success, and his emphasis will be on customers, brands, and products. “For me, people always come first.”

From this standpoint, he will be the kind of moderate party advocating evolution rather than revolution. His technology beliefs are the same.

For example, in terms of electrification, Blume believes that synthetic fuels are a better choice. It is a clean synthetic fuel that, although not economical by itself and some experts believe that it can never be cheaper than pure electricity, it generates energy in the same way as gasoline or diesel, so internal combustion engines can continue to be used and their service life can be extended.This will reduce the pressure of traditional car companies’ immediate transformation into electric vehicles. The Porsche he leads invested $75 million in Santiago, Chile in April to develop industrial-grade electronic fuel.

The dual tracks of electric and fuel are also more in line with the interests of the union, and the survival of internal combustion engines can maintain relatively higher job opportunities.

Analysts do not believe that Obomu will redefine Volkswagen’s electric vehicle strategy. However, the originally aggressive timetable, which was expected to reduce its fuel lineup by 60% by 2030, may not be so absolute.

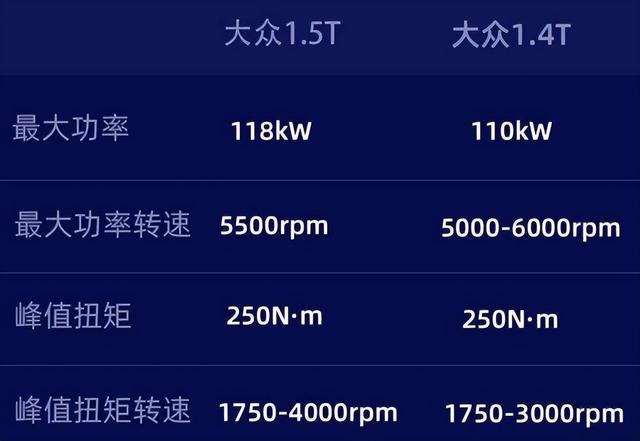

For example, in mid-July, Volkswagen launched the latest generation of fuel engines, TSI Evo2, in Europe. It’s hard to imagine a company that wants to quickly eliminate fuel vehicles is still releasing the “most advanced engine in ten years”. One of the innovations for the future is that it can also be used with fuels containing renewable energy sources, in addition to efficiency and energy consumption.

In the software field, Obomu also does not insist on the Dis-style full-stack self-development. He has negotiated with Cook on CarPlay entering the Porsche intelligent cockpit. Maybe it is not ruled out to introduce software suppliers in the field of autonomous driving. This will greatly accelerate the launch speed of Volkswagen’s intelligent models, and ironically, it is likely to make the product more user-friendly than originally planned.

Obomu will be a more pragmatic leader. There is no shortage of leaders who balance reform and historical baggage in the auto industry, such as Jim Farley of Ford, Conny Konschuh of Mercedes-Benz, Mary Barra of General Motors, and Carlos Tavares of Stellantis. However, all of them are slower than Volkswagen’s Dis in certain aspects.

Last year, Volkswagen was once considered the most suitable traditional car company to compete with Tesla.

Volkswagen’s journey on the fast lane has ended. Perhaps the fast lane is simply not suitable for them.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.