Jeep Brand, Once Bright in China, Officially Withdraws from the Chinese Market

Author: Da Yan

Following Chrysler, Fiat, and other brands’ withdrawal from the Chinese market, the Jeep brand, once shining in China, will also only be sold as imported cars in the future. After some strategic adjustments in the domestic market, Stellantis will only have Dongfeng Motor Corporation as a domestic platform in China.

What happened to Jeep from its peak to the bottom?

In 2016, in the first year of production in China, the Jeep brand achieved a sales volume of 179,900 units, and climbed to 220,000 units in 2017. The localization provided great vitality for GAC Fiat Chrysler and made the Jeep brand a “new noble” that was once considered to challenge second-line luxury brands in the domestic market.

However, since 2018, Jeep’s sales have continued to decline along with the cooling off of the domestic SUV market, until it hit 20,000 units in 2021. In the first six months of this year, GAC Fiat Chrysler’s cumulative sales volume was 1,857 units, and the whole company had basically reached a standstill.

The high period of the Jeep brand in China coincided with the peak of demand for SUVs in China. With its brand appeal and many fans accumulated in the hardcore SUV market, Jeep brand quickly gained popularity in China through localization.

But since then, whether it is the changes in the Chinese automobile market itself or Jeep’s adaptation strategy, Fiat Chrysler has gradually hit rock bottom in China.

Jeep is actually seen as a brand of hardcore off-road SUVs in the hearts of many fans. However, the market capacity for this type of vehicle is not very large in China. Therefore, when Jeep launched new models, it tried to move closer to the urban SUV market, even highlighting the factor of family in its market promotion.This approach helped JEEP quickly enter the mainstream SUV market in the short term, but also lost its advantage in China. Later, as homogenization of urban SUVs in China became increasingly severe, JEEP, who did not adhere to its hardcore off-road aspirations, began to face the dilemma of sluggish growth.

In contrast to JEEP’s continued decline in the domestic market, the hard-core off-road SUV, Tank 300, under the Great Wall brand is in short supply. The supply shortage during the initial launch caused Great Wall to directly separate Tank 300 from their WEY brand and become an independent brand.

At present, there is still a considerable market space in China’s off-road SUV segment, however, this is a market that JEEP can no longer return to since the homogenization of the auto market in China.

The lack of new energy development is also an important factor in JEEP’s lack of growth momentum in the Chinese market.

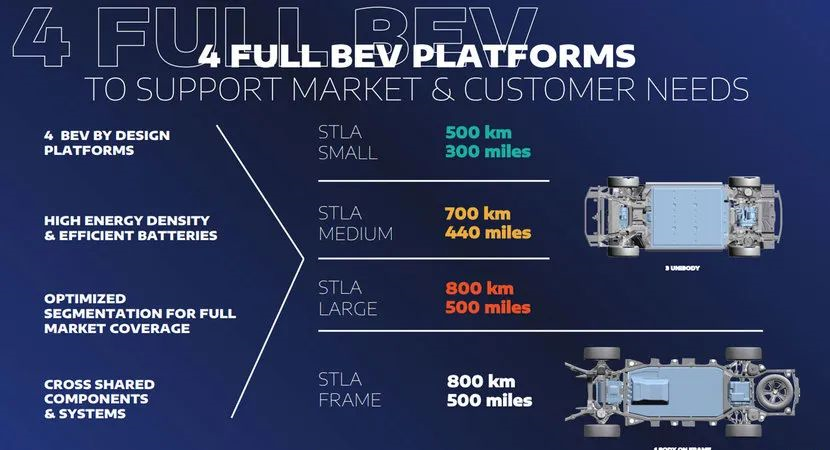

China’s auto market has bid farewell to its high-speed growth days, and new energy vehicles are one of the few segments that are still rapidly expanding. Compared with Volkswagen, General Motors, and Toyota, Stellantis’ pure electric platform has yet to launch in China. Given this situation, GAC FCA and JEEP brands are naturally out of sync with the high-speed growth market of intelligent electric vehicles.

In terms of GAC FCA, its reputation is not good in China. On the one hand, compared with Japanese cars, there is still a certain gap in quality control for American cars, which will deter consumers who are not familiar with the JEEP brand.

On the other hand, when JEEP sales began to decline, GAC FCA not only did not adjust sales strategies in time but continued to pressure dealers to stock up, ultimately leading to the collapse of the entire sales system.

How should Stellantis proceed in China?

For foreign automakers, seeking greater equity in joint ventures is a shortcut to escape difficulties and seek maximum benefits in the current situation where the proportion of foreign equity shares in joint ventures is liberalized in China. After all, for most joint ventures, input from foreign automakers is necessary from brand to technology, to system capabilities.

According to Stellantis’ statement, the failure to reach an agreement on equity in the joint venture with GAC was the main reason leading to the dissolution of GAC FCA.

From the perspective of Stellantis, through the help of GAC FCA and Dongfeng Peugeot Citroen, the shortcut to maximize its own interests is to replicate the precedent of BMW Brilliance and Volkswagen JAC by obtaining 75% of the controlling rights in GAC FCA.

However, the proposal to increase the shareholding ratio was rejected by GAC Group, which forced Stellantis to focus its resources on another joint venture company in China – Dongfeng Peugeot Citroen.

After the merger of PSA and FCA into Stellantis, the adjustment of the layout in China was inevitable. Meanwhile, carrying GAC FCA and Dongfeng Peugeot Citroen, two unprofitable companies, will bring considerable pressure on Stellantis’s operations in China.

In the future, Dongfeng Peugeot Citroen will introduce the Opel brand into China in addition to the existing Peugeot and Citroen brands. Moreover, Stellantis also needs to consider building a battery factory in China and deploying a large amount of funds for the localization development required for the vehicle networking and autonomous driving.

To achieve the turnaround of Dongfeng Peugeot Citroen and focus the strategic focus of JEEP on imported car models is currently the most stable and wise choice for Stellantis.

Joint venture automobile companies that enter the era of free love

The example of GAC FCA actually verified that at present, with the lifting of the shareholding restrictions in joint venture automobile companies, foreign-funded and domestic automobile companies are moving from “arranged marriages” to “free love.”

In fact, it is difficult to imagine that if the country had not lifted the shareholding restrictions on joint venture automobile companies and stipulated that foreign-funded automobile companies were limited to two joint venture names in China, global automobile giants like Stellantis would voluntarily give up a joint venture name.

However, with the white-hot competition in the domestic automobile market, Stellantis had to make a choice and ensure its quick return to the mainstream in the Chinese market by focusing on its resources. After all, through a series of acquisitions, “Tang Weishi’s” empire can already compete with Volkswagen in Europe, challenge GM and Ford in North America, and its advantage markets are in South America.

If Stellantis, which was once insignificant in the domestic market, can further improve its market share in China, it could become a global giant that can rival Toyota and Volkswagen.

In this case, sacrificing profit bleed points is a wise move.

At present, when the independent brand’s product strength is constantly strengthening, the “takingism” pursued by joint venture car companies in the past is no longer feasible. Investing real money in the development of underlying core technologies, such as batteries and chips, and technology systems such as the Internet of Vehicles that require the introduction of local internet ecology and autonomous driving that requires large-scale local testing, all demand higher requirements for joint venture car companies. To return to the right track of the domestic auto market, Dongfeng Motor and Stellantis, as well as Dongfeng, two major shareholders, still need a large amount of investment.

Of course, JEEP, which turns to higher-profit import car business, also maintains its presence in the Chinese market. Even in the future, there is still the possibility of returning to the domestic market, even if it is produced by Dongfeng Motor.

As for GAC, it can also invest its precious funds in independent pure electric brands such as Ai An and ensure that it can keep up with the investment rhythm of Toyota and Honda in GAC Toyota and GAC Honda, two “profit cows.”

If a choice must be made between Dongfeng Motor and GAC Fiat, Dongfeng Motor’s platform may be more in line with Stellantis’ strategic interests in China. Stellantis, which does not fight a battle to the death on the JEEP brand, also has a retreat in Dongfeng Motor.

But if Stellantis cannot learn from the lessons of the series of brands that have withdrawn from China in the past and truly cultivate Dongfeng Motor’s local R&D capabilities and a set of system capabilities, the future of Dongfeng Motor in the domestic market will also be worrying.

As mentioned above, it is no longer the time for Sino-foreign joint venture automakers to achieve great success in China by just introducing a few models. However, as long as Stellantis can truly recognize the strategic significance of Dongfeng Peugeot Citroen Automobiles (DPCA) and the Chinese market, and provide strong support for DPCA’s second entrepreneurship, relying on the broad market capacity in China, the prospect is still worth looking forward to.

As mentioned above, it is no longer the time for Sino-foreign joint venture automakers to achieve great success in China by just introducing a few models. However, as long as Stellantis can truly recognize the strategic significance of Dongfeng Peugeot Citroen Automobiles (DPCA) and the Chinese market, and provide strong support for DPCA’s second entrepreneurship, relying on the broad market capacity in China, the prospect is still worth looking forward to.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.