Author: Zheng Senhong

A new force in the carmaking industry, with a total valuation of 200 billion yuan, what does that mean?

In just four months, GAC Aion’s valuation is about to catch up with WeRide?

In March of this year, GAC Aion completed a restructuring through mixed ownership reform and raised 2.566 billion yuan. At that time, the initial valuation of GAC Aion was 39.2 billion yuan.

Four months later, GAC Aion launched a first-round financing plan of up to 15 billion yuan, corresponding to a valuation of 85 billion yuan. Some investment institutions even gave GAC Aion an overall valuation of about 200 billion yuan based on a 16-fold PE calculation.

If GAC Aion can successfully complete this financing, it will not only surpass GAC Group’s current market value of 68.9 billion yuan, but also be on par with WeRide’s current market value.

Behind the valuation carnival, is the sales data improving?

In 2021, GAC Aion’s cumulative sales exceeded 120,000 vehicles, a year-on-year increase of 119%, exceeding annual targets.

As of the first half of 2022, Aion’s cumulative sales have exceeded 100,000 vehicles.

From its infancy as an independent brand to its challenge of a sales target of 240,000 in 2022, transforming the “WeRide” pattern into “Aion-WeRide”, GAC Aion’s growth has shown new vitality beyond the new forces in the car-making industry.

With the implementation of mixed ownership reform policies and the promotion of the A round of financing, GAC Aion’s IPO ambitions are expanding step by step.

What does GAC Aion’s IPO mean?

New car-making powers are not only competing in technology, products, and ecological layout, but also in capital.

And IPO not only means being recognized by capital, but also being recognized by more consumers.

WeRide, a head player, first gathered in the US stock market to play a survival game, and then gathered in the Hong Kong stock market, completing the accumulation from 0 to 1. Now, with sufficient cash flow, they are launching challenges to higher goals.

As a catalyst, the IPO accelerates enterprise development from multiple dimensions such as financing and branding, which is also applicable to GAC Aion, which comes from the national team.

Firstly, IPO can help Aion’s brand to move up. Gu Huinan, General Manager of GAC Aion, believes that capital has a great influence. When stocks rise, it will let hundreds of millions of people know that there is such a brand, which is difficult to achieve by advertising alone.

Secondly, IPO can bring substantial financing to GAC Aion, making its arsenal more abundant, especially in the continuous investment in the three-electric system and intelligentization. Billions of yuan are often needed, which is a huge burden for any traditional host plant.

The new round of strategic financing of GAC Aian will focus on the research and industrial layout of core technologies such as new product development, next-generation batteries, electric drive, intelligent driving, intelligent cabin, energy ecology and capacity expansion. Additionally, through IPO, GAC Aian can also change its management mechanism, including the implementation of the previous mixed reform policy. GAC Aian believes that protecting employee shareholding can retain talent, greatly improve enthusiasm, and increase research and development efficiency. Regardless of the trend of brand development or the need for self-built industrial chains, IPO will be the key point for GAC Aian to upgrade and accelerate. Gu Huinan revealed that GAC Aian plans to complete the introduction of A-round strategic investors in the third quarter of this year and choose to list on A-shares or H-shares. Since 2019, national teams such as Changan, Dongfeng, and SAIC have successively cut into the new wave of intelligent electric vehicles with Avita, Voyah, Fevan, and IM. Supported by large state-owned enterprises, these new brands have benefited from previous experiences, and their starting points in terms of both vehicle production conditions and supply chain systems are much higher than those of new forces. However, from the market performance, except that Avita has not yet achieved delivery, Voyah, Fevan, and IM’s sales and brands are still in the climbing stage. Facing the strong attack of new forces, the advancing speed of these national teams is somewhat sluggish. In contrast, GAC Aian’s market scale and influence are more mature, and the first IPO action will directly affect the investment party’s judgment on the future development of the car company and subsequent capital investment. If GAC Aian’s first financing was to make talent layout, then the A-round financing and future IPO financing will be to seek product development. GAC Aian plans to exchange 30% equity for 50 billion yuan in financing and invest all 50 billion yuan in research and development. It includes various parts of the product life cycle, from power batteries to vehicle production capacity, from product offline to after-sales system. In terms of products, GAC Aian will continue to independently develop new product development, next-generation batteries, electric drive systems, intelligent driving, and intelligent cabins.# Translation

The new round of strategic financing of GAC Aian will focus on the research and industrial layout of core technologies such as new product development, next-generation batteries, electric drive, intelligent driving, intelligent cabin, energy ecology and capacity expansion. Additionally, through IPO, GAC Aian can also change its management mechanism, including the implementation of the previous mixed reform policy. GAC Aian believes that protecting employee shareholding can retain talent, greatly improve enthusiasm, and increase research and development efficiency. Regardless of the trend of brand development or the need for self-built industrial chains, IPO will be the key point for GAC Aian to upgrade and accelerate. Gu Huinan revealed that GAC Aian plans to complete the introduction of A-round strategic investors in the third quarter of this year and choose to list on A-shares or H-shares. Since 2019, national teams such as Changan, Dongfeng, and SAIC have successively cut into the new wave of intelligent electric vehicles with Avita, Voyah, Fevan, and IM. Supported by large state-owned enterprises, these new brands have benefited from previous experiences, and their starting points in terms of both vehicle production conditions and supply chain systems are much higher than those of new forces. However, from the market performance, except that Avita has not yet achieved delivery, Voyah, Fevan, and IM’s sales and brands are still in the climbing stage. Facing the strong attack of new forces, the advancing speed of these national teams is somewhat sluggish. In contrast, GAC Aian’s market scale and influence are more mature, and the first IPO action will directly affect the investment party’s judgment on the future development of the car company and subsequent capital investment. If GAC Aian’s first financing was to make talent layout, then the A-round financing and future IPO financing will be to seek product development. GAC Aian plans to exchange 30% equity for 50 billion yuan in financing and invest all 50 billion yuan in research and development. It includes various parts of the product life cycle, from power batteries to vehicle production capacity, from product offline to after-sales system. In terms of products, GAC Aian will continue to independently develop new product development, next-generation batteries, electric drive systems, intelligent driving, and intelligent cabins.# Translation

Gu Huinan believes that self-developed technology is the driving force for the rapid expansion of GAC Aion. Currently, the most important thing is to focus on technological iterations. Subsequently, continuous upgrades will be made in both the technology and product aspects, focusing on technologies such as magazine battery, silicon negative electrode film battery, ultra-fast battery, and the Starlight Electronic Electrical Architecture.

In terms of production capacity, GAC Aion’s Intelligent Ecological Factory plans to quickly increase production capacity from the original 100,000 vehicles to 200,000 vehicles in 2022, and then to 400,000 vehicles in 2023. As sales grow rapidly, expanding production capacity has also been put on the agenda.

At the same time, GAC Aion is laying out its charging network in the form of the “City of Hypercharging.” For example, it took the lead in building more than 1,000 supercharging and exchange centers in Guangzhou, achieving coverage within a 1.5km radius and less than a 3-minute wait time. This form will be replicated and promoted to the whole country, achieving full coverage of 300 cities by 2025.

In summary, the stable cash flow of GAC Aion’s future will not only help strengthen its own technological advantages, but also continuously improve its after-sales service system and even promote the development of the entire GAC Group.

However, the current GAC Aion has a considerable market share in the “online ride-hailing” market – AION S accounted for 60-70% of the B-end market in the first half of 2020-2021.

Therefore, while accelerating the IPO work, GAC Aion also needs to tell a new story about how to break into the high-end market.

What else does GAC Aion need to break into the high-end market?

As the domestic automobile industry accelerates its transformation towards the new energy era, more and more independent traditional car companies are keen to shape high-end brands and create high-end models.

Looking at the independent traditional car companies that are laying out the new energy field:

- BYD may release a new high-end brand this year;

- Chery is expected to release a high-end new energy brand in 2023;

- Geely, BAIC, and Dongfeng’s brands such as JiKe, JiHu, and LanTu are also aimed at the high-end market.

On the day of its brand independence, GAC Aion also positioned itself as a high-end smart electric vehicle.

In terms of product layout, GAC Aion currently has four models in sales: AION S, AION Y, AION V, and AION LX, covering a price range of 130,000 to 470,000 yuan, with a relatively comprehensive range of vehicle level.Due to the low-end image of “ride-hailing” left by GAC Aion in the C-end market, most consumers can only accept its mainstream products priced at around 100K-200K yuan, with AION S and AION Y, both priced at less than 200K yuan, accounting for over 82% of its sales structure in 2021, while the annual sales volume of AION LX, priced at over 280K yuan, is only over 1000 vehicles. The extreme cost-effectiveness is already Aion’s primary selling point, but to sprint above the 200K yuan price band, Aion needs high-end models with stronger product power.

(1) GEP 3.0 Platform: supports battery swapping, L4 level autonomous driving, and Huawei Hi solution

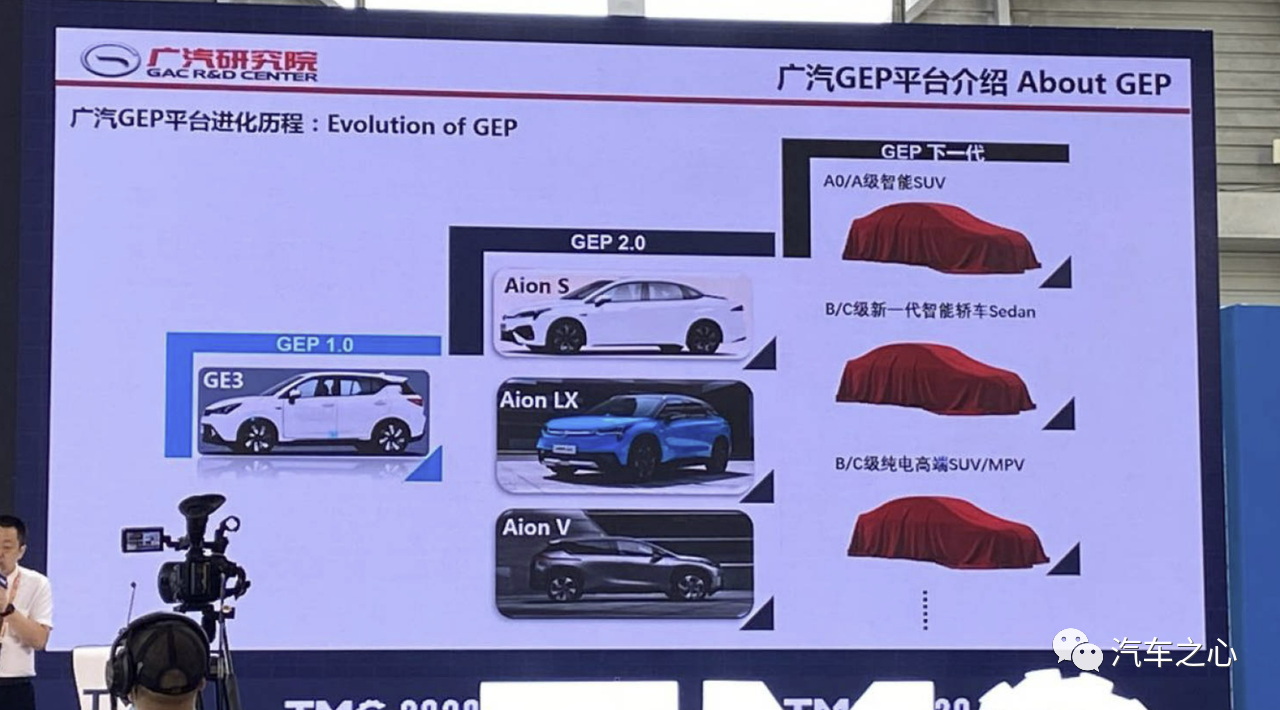

If there is still a car company that does not have an exclusive native all-electric platform now, perhaps it can be considered as lying flat in the era of all-electric vehicles. As early as 2017, GAC New Energy invested 3 billion yuan to develop the GEP exclusive all-electric platform.

At that time, when “transitioning from oil to electricity” products were everywhere, the first all-electric vehicle model GE3 based on the GEP platform was undoubtedly a unique role, and its performance and range also proved the advantages of the exclusive platform product.

From the AION series launched by GAC New Energy in 2019, all AION models were equipped with the second-generation GEP platform.

Compared to the first generation, the second-generation GEP platform has undergone comprehensive upgrades in terms of body, chassis, battery, and electrical systems. This mainly includes the highly integrated parts, weight reduction, optimization of the vehicle layout, improvement of energy consumption efficiency, and reliability.

For example, the second-generation GEP platform has a superior indicator: the axle-length ratio, that is, the ratio of the wheelbase to the body length. For example, for AION V with a wheelbase of 2830mm, although it is positioned as a compact car, the internal cabin space is comparable to that of a mid-size car, and its axle-length ratio is 61.7%, which is higher than Tesla Model 3’s 61.2%.In addition, by properly distributing the weight of the car body, the handling performance is greatly improved. Moreover, the second-generation GEP platform makes extensive use of aluminum material, and the vehicle’s lightweight data is excellent, further improving the cruising range and so on.

Thanks to the advantages of the second-generation GEP platform, AION S and AION Y have achieved superior competitiveness in all aspects and become the main sales force of GAC Aion.

However, for AION LX, which aims to enter the high-end market, it is slightly difficult to compete with NIO NT2.0 platform and XPeng E-platform, while relying on the second-generation GEP platform that focuses on the mainstream market.

Therefore, GAC Aion is also accelerating the evolution of the GEP platform to the third generation. The mass-produced models of the new generation platform will be launched in 2023, covering sedan, SUV, and MPV models.

Gu huinan previously revealed that the third-generation platform will achieve L4-level autonomous driving capabilities based on the Starling architecture. In addition, all models in the series plan to launch swappable battery versions, adopting a marketing strategy similar to NIO’s BaaS model, where batteries can be rented, bought, and sold with varying capacities.

In addition, based on the third-generation platform’s chassis architecture, GAC Aion will build a new generation of intelligent in-car digital platforms in collaboration with Huawei’s CCA architecture. Equipped with Huawei’s full-stack intelligent vehicle solution, the first models from the joint ~8 hundred million investment in research and development (with the code name AH8) is positioned as a mid-to-large-sized pure electric SUV and is scheduled to begin mass production in 2023.

If the second-generation GEP platform has allowed GAC Aion to establish a foothold in the field of pure electric vehicles, then the third-generation platform will give GAC Aion product competitiveness in the high-end market.

(2) Self-developed and self-supplied power batteries

On AION LX Plus, the highest product in GAC Aion’s product lineup, the “thousand-mile cruising range” is the primary selling point in the high-end market.

AION LX Plus is equipped with a 144.4kWh battery capacity and an energy density ratio of 205Wh/kg. It is not only one of the models with the highest energy density ratio among current mass-produced models but also is the first mass-produced pure electric vehicle with a cruising range of over 1,000 kilometers as tested under the CLTC standard.

As the core component of new energy vehicles, power batteries are mainly supplied by battery suppliers with common pure electric cruising ranges of 500 or 600 kilometers. GAC Aion believes that following the route of independent research and development not only leads technology leadership but also can achieve product differentiation and become the core competitiveness in entering the high-end market.

Therefore, GAC Aion (埃安) has successively independently developed puncture-resistant magazine battery system technology, high-specific-energy sponge silicon negative electrode sheet battery technology, and super lithium iron phosphate battery.

With the continuous introduction of advanced battery technologies, GAC Aion undoubtedly aims to further demonstrate its battery technology strength and plans to achieve a certain degree of self-sufficiency in the battery and cell fields by 2025.

Aion has already invested nearly RMB 1 billion in battery self-research and production, and will continue to invest RMB 336 million to build a power battery mass production line, which will be officially put into operation by the end of 2022. Self-developed battery technologies including sponge silicon negative electrode sheet batteries will be produced on this pilot production line.

Gu Huinan believes that regardless of whether the host factory produces batteries or not, researching batteries is an inevitable trend. The research of batteries by the whole vehicle enterprise is not essentially to replace the battery factory in battery production. If the host factory does not research batteries, there will definitely be obstacles to the combination between the host factory and the battery factory.

Although the quality and output of power batteries largely determine the quality and output of vehicles, GAC Aion is undoubtedly ahead of many automakers in this step. However, in terms of its competitiveness in the high-end market, long endurance may be difficult to become the support point for GAC Aion to break through the high-end market.

In comparison:

NIO will begin delivering 150kWh solid-state batteries in the fourth quarter, and its ET7 electric vehicle will have a range of over 1000km.

The upcoming G9 from XPeng will also have a maximum range of over 700km, which although not reaching a thousand-kilometer range, can still meet the travel needs of most users.

Obviously, AION LX Plus, which costs nearly RMB 470,000, cannot simply rely on the advantage of “thousand-kilometer range” to establish itself in the high-end market, as mainstream competitors have already gone beyond simply competing on range.

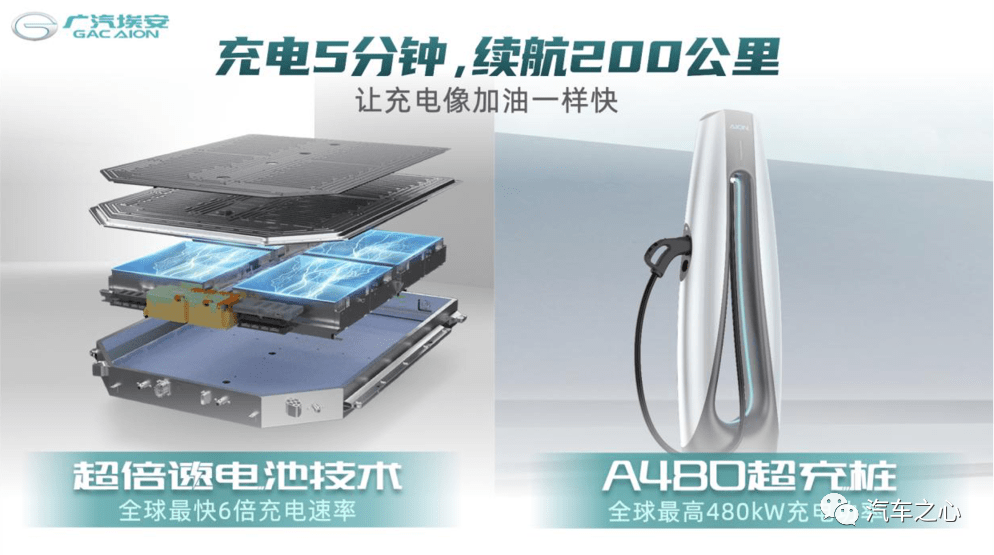

(3) Charge for 5 minutes, drive for 200km

With the increasing number of electric vehicles in China, problems such as low charging efficiency, uneven distribution of charging stations, and poor charging experience are becoming increasingly apparent.

In August last year, GAC Aion released its super-fast battery technology and A480 supercharging pile. At that time, the actual test result of “charge for 5 minutes, drive for 207km” even received certification as a world record.

Data shows that when the vehicle supports 6C charging rate and the theoretical peak charging power is above 400kW, its charging efficiency only takes 4 minutes and 30 seconds to charge from 30% to 80%.“`markdown

XPeng has also released a supercharger with a charging power of 480kW, which can achieve 5-minute charging and 200-kilometer replenishment energy efficiency, but it is still in the planning stages.

Similarly, Ideal Auto is also developing 4C-rate products, while Zeekr is 2.2C-rate, and can achieve 120 kilometers of endurance in 5 minutes under 360kW charging power.

In comparison, GAC Aion’s ultra-fast battery technology makes charging as convenient and fast as refueling, and it has already been put into use in the Guangzhou area, leading many new energy vehicle companies.

Efficient charging/swapping, long-range driving, advanced autonomous driving, and Huawei Hi solutions, at least GAC Aion has the potential to compete with mainstream high-end markets. However, how GAC Aion integrates these products into a unique label and refreshes consumers’ understanding of GAC Aion’s positioning will be a new challenge.

What Strengths Does GAC Aion Have in Smart Manufacturing?

Entering the second half of the new energy vehicle competition, seizing the trillion-level unmanned driving market has become a new track for many automakers, but how to have competitive product strength, the market has different approaches, and the most common and quickest way is cooperation to achieve mutual benefit.

By virtue of its chip, operating system, big data, and autonomous driving technologies, Huawei, which insists on being a Tier 1 supplier to automakers, has gradually won the trust of automakers and opened up multiple cooperation models.

As early as 2017, Guangzhou Automobile Group had already launched a strategic cooperation with Huawei in the field of intelligent interconnected electric vehicles, and multiple systems were also mass-produced on Guangzhou Automobile Group models. However, GAC Aion’s cooperation with Huawei this time is also different.

The two parties not only cooperate in technology but also have a joint R&D team of over 100 people who work together to define and develop products. Obviously, this cooperation is more in-depth and not simply a case of “taking for granted.”

Of course, the AH8 code is only the first model of this cooperation between the two parties, and in the future, the two parties will launch a series of products based on creating high-end brands and use both sides’ resources to promote the brand.

This may mean that the car models that GAC Aion cooperates with Huawei on may be a single brand, or even a brand independent of GAC Aion.

However, external cooperation with Huawei is only one of GAC Aion’s routes. The direction of GAC Aion is a dual-track parallel of cooperation and self-research.

“`Gu Huinan stated that Guangqi Aion Automotive is committed to independent research and development and industrialization, whether it is EV or ICV technology. Guangqi Aion now has nearly 6,000 people in its independent research and development team. In addition to adopting the Huawei Full Stack Intelligent Automotive Solution, Guangqi Aion will also launch the Xingling architecture in 2023. This architecture can provide multi-dimensional functions for Guangqi Aion’s series of products, including intelligent cockpit, intelligent driving assistance, and intelligent scene rapid development and iteration, realizing hardware plug-and-play, software common use and updates.

With the support of the Qualcomm 8155/8295 chip, Xingling-based models can achieve high integration of intelligent cockpits, allowing vehicles to carry better imaging systems, such as AR-HUD, 3D intelligent interactive virtual images, and so on.

The biggest highlight of the Xingling architecture lies in its autonomous driving controller, which uses the Huawei Ascend 610 chip, supporting 200-400 TOPS computing power expansion, and 2.4GPix/s ISP image processing capabilities, with a performance equal to that of similar chips on the market being twice as high.

From AION S to AION LX, the most intuitive change in the Aion series of products is intelligentization, such as in the iteratively upgradable Aion ADiGO PILOT autonomous driving level, achieving full-scene autonomous driving coverage of high-speed and urban road conditions.

The high-end version of Guangqi Aion AION LX Plus will be equipped with three second-generation intelligent variable-focus lidars, with a total of up to 35 intelligent perception hardware, and will be delivered from August of this year, with a high computing power intelligent driving computing platform of 200 TOPS.

After installing a set of mainstream software and hardware systems, the high-end version of AION LX Plus supports the ADiGo 4.0 intelligent driving assistance system, which in addition to the intelligent navigation assistance function on the highway, can also accomplish direct driving through intersections, autonomous lane changing and overtaking, left and right turns at traffic lights, U-turns, and roundabout passage on city roads.

“`markdown

Meanwhile, the parking performance of the ADiGo 3.0 driving assistance system is no less than that of mainstream competitors, whether it is autonomous parking or remote parking. AION V Plus demonstrates sufficient practical value.

Apart from the C-end market, GAC Aion had previously formed a strategic partnership with Didi Chuxing’s autonomous driving company.

The two parties will develop autonomous driving vehicles from the basic dimensions of wire-control chassis, autonomous driving sensors, and system integration.

GAC Aion will provide the autonomous driving platform and vehicle design and manufacturing, while Didi will leverage its R&D strengths in autonomous driving software and hardware technology.

Therefore, facing the two different scenarios of To B and To C, GAC Aion has developed two different solutions:

- To C: This year, the company will realize city navigation driving assistance, gradually implement L3 autonomous driving next year, and achieve L4 autonomous driving in 2025.

- To B: Firstly, combined with ROEWE, we gradually promote the application of L4 autonomous driving, and begin large-scale application in 2025. Secondly, we will provide L4 autonomous driving branded vehicles to more partners in the To B market.

Although GAC Aion began as a pure electric platform and expanded through independent plant construction and full-stack self-research, it has become a unique player in traditional automotive companies’ electrification transformation based on the B-end market. Nevertheless, with the research and development ecosystem developed in EV and ICV, GAC Aion is also trying to move upwards towards the high-end market.

“Serving as a high-end intelligent electric car brand,” “Becoming a world leader,” “Occupying the top position in the new car-making forces.” From Zhenghong Zeng to Xingya Feng to Huinan Gu, these high-profile actions can be regarded as GAC Aion “telling stories” to the capital market.

With three battery technology upgrades, three platform iterations, and sales leading among the new forces of manufacturing, it’s not just a story anymore. GAC Aion has indeed become a participant favored in the capital market because of its R&D innovation and market-dominating products.

At a market valuation of 200 billion RMB, it not only signifies GAC Aion’s phase achievement in this wind-swept track but also a milestone in the transformation of traditional automakers into new energy vehicles.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.