Author: Zhu Yulong

A few days ago, Yanyan went to Yibin for a visit before attending the Power Battery Conference, visiting the new energy vehicle industry park in Yibin and Sichuan Times in Sanjiang New Area.

Many car companies (GAC, Geely, Changan, and BYD) attended this conference, and battery companies (CATL, LG, SDI, and Panasonic) also shared some information. Here are some of the main points I collected.

Perspectives from Car Companies

GAC

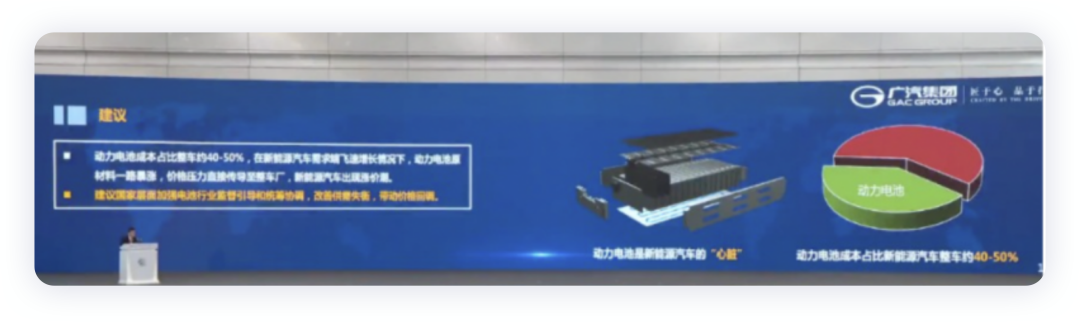

Zeng Qinghong, former president of Guangzhou Automobile Group, emphasized the need to strengthen supervision and coordination in the battery industry to achieve supply-demand balance and bring prices back to a reasonable range. “I want to thank our partner, CATL. GAC has half of its installation capacity and is matched with CATL. Power battery costs have accounted for 40% -50% of automobile costs, and I am now working for CATL.”

My understanding is that GAC’s product line currently overlaps heavily with BYD’s. With the current cost structure, it may not look good to examine Eian’s gross margin and actual procurement spending.

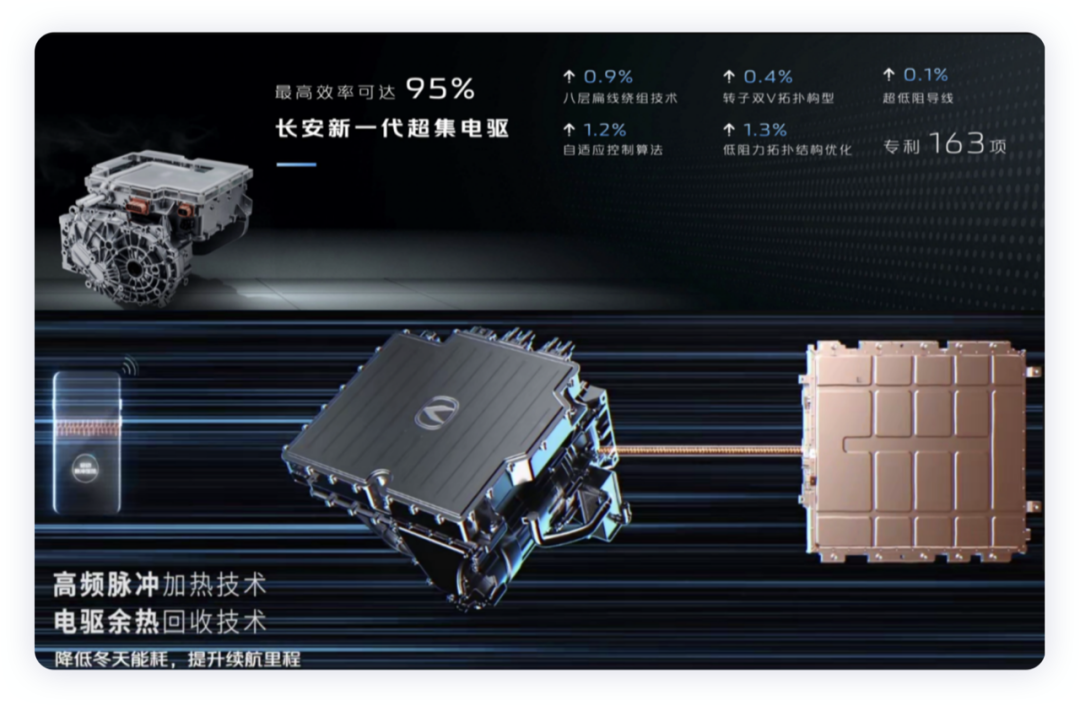

Changan

The automobile industry has upgraded from a traditional manufacturing industry to a technological and intelligent industry. China has formed the world’s most mature new energy automobile industry chain (domestic brands account for more than 70%) and constructed the world’s largest regenerative energy network. It is expected that China’s new energy vehicle sales will reach 5 million units in 2022 and more than 10 million units in 2025, and Chinese world-class brands will emerge in the next ten years. Changan has launched a new energy automobile brand, Changan Shenlan (pure electric, extended range, hydrogen fuel), which Avita and Changan Luminn have released.

Technologically speaking, the next-generation super set electric drive has increased power density by 37%; high-frequency pulse heating technology can heat up by more than 20 degrees in 5 minutes. The inverter adopts a multi-core multi-system layout, integrates more than 1,500 core components, increases power density by 70%, and reduces volume by 70%. The digital battery butler effectively avoids battery pack thermal runaway.

From the perspective of development challenges, including the shortage of battery raw materials and the rapid cost increase, core technology needs to shift from structural innovation to material innovation, and the energy supplement infrastructure needs to be strengthened.

From the perspective of development challenges, including the shortage of battery raw materials and the rapid cost increase, core technology needs to shift from structural innovation to material innovation, and the energy supplement infrastructure needs to be strengthened.

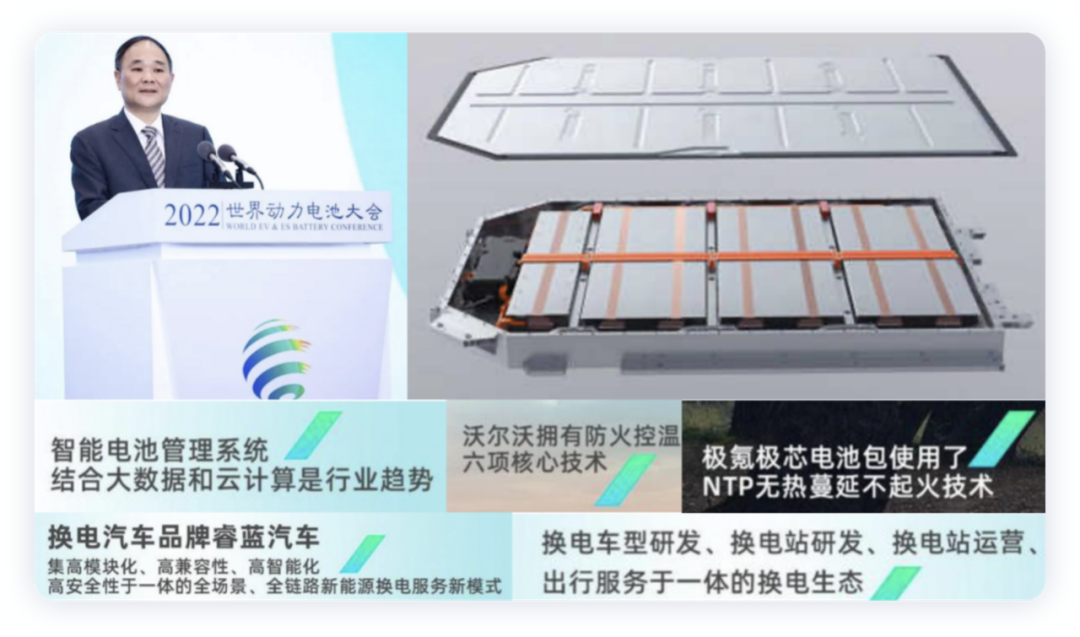

Geely

Intelligentization is what the automotive industry will strive for in the second half, and the efficient intelligent management of power batteries is gradually being realized. The power battery management system is a key control and intelligent function. The intelligent battery management system, combined with big data and cloud computing, is an industry trend. From the perspective of Geely, there are six core technologies for fire prevention and temperature control; the battery pack uses NTP non-thermal spread and non-ignition technology. Geely is developing battery packs with longer range, and they can be charged in 15 minutes.

Battery swapping business (Ruiyan Automobile) is a new model of whole-scenario, whole-chain new energy battery swapping service with high modularity, high compatibility, high intelligence, and high safety. The battery swapping station can complete battery swapping in 60 seconds, and is equipped with a three-tier fire suppression system. The company integrates power battery leasing, digital operation, and recycling of used batteries with its upstream and downstream.

BYD

The main viewpoint is still based on innovative battery technology and whole-vehicle application driven by the demand for the entire vehicle.

- Longer range – High energy density material system and high-integration battery design.

- Higher safety protection – Material design and structural integration.

- Faster charging speed – High-flux material design and efficient thermal management structure; low-temperature high-performance material, rapid and efficient heating.

- Stronger driving experience – High-rate battery design and integration with the vehicle body.

Views from battery companies

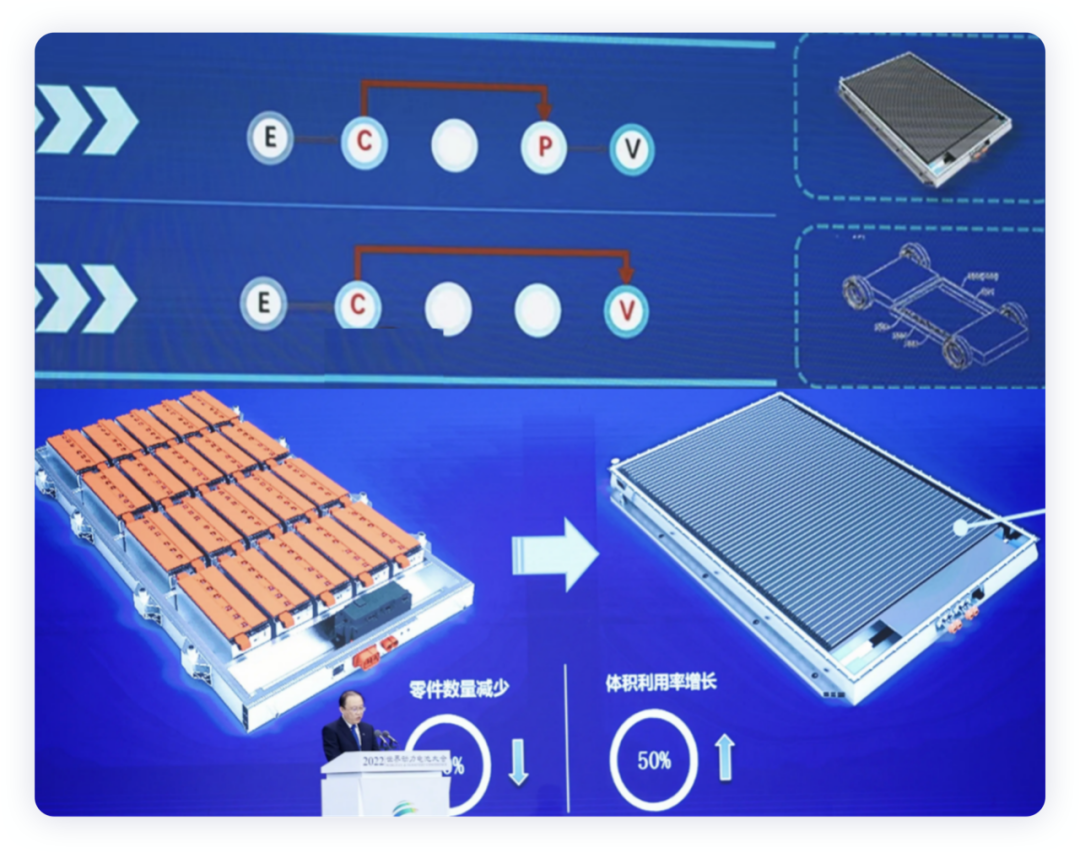

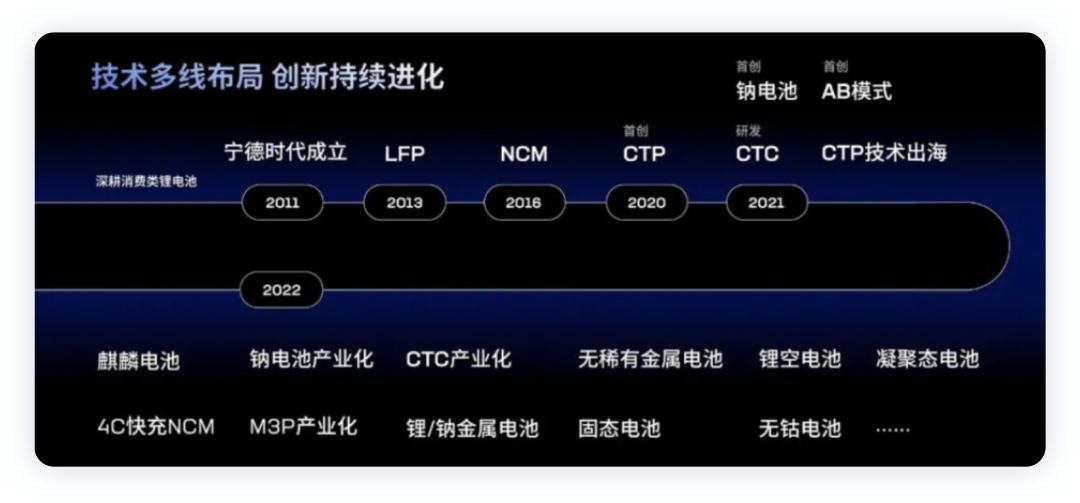

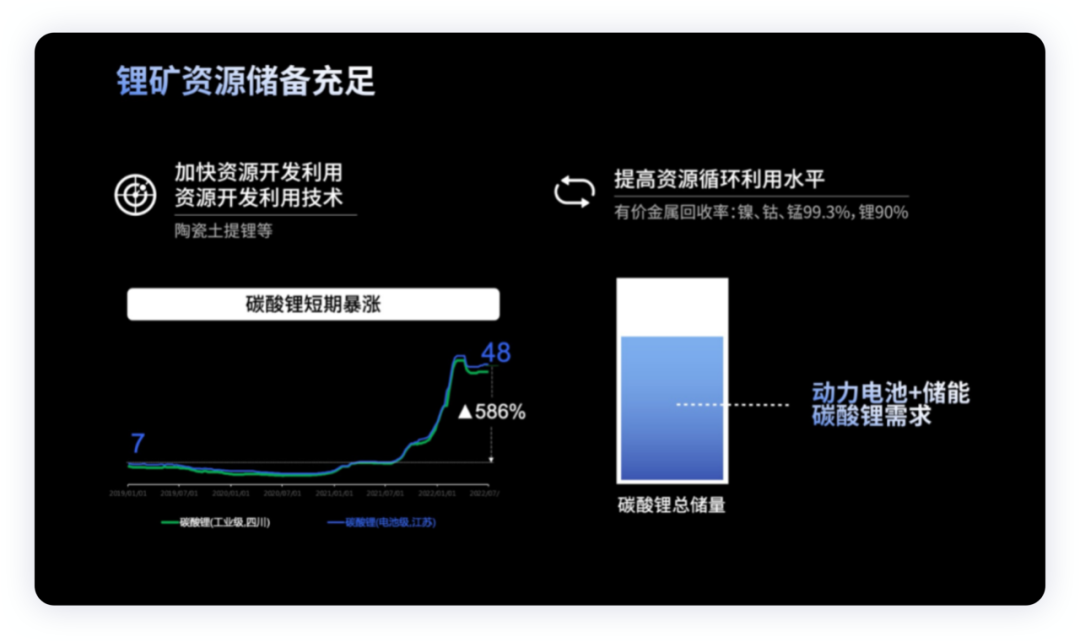

CATL

The summary of this is: I have a lot of technological innovation, I lead the market, and materials are not lacking.

In the era of TWh, I think there are still variables in the competition, this is my personal judgment. Afterwards, Ford achieved a 60GWh annual production capacity of power batteries by adding a lithium iron phosphate battery scheme and locking in the relevant raw material supply, ensuring the annual production capacity goal of 600,000 electric vehicles by 2023; the Mustang Mach-E in the North American market will add a lithium iron phosphate battery version in 2023, and the F-150 Lightning pure electric pickup in the North American market will also be equipped with a lithium iron phosphate battery version starting in 2024.

In the era of TWh, I think there are still variables in the competition, this is my personal judgment. Afterwards, Ford achieved a 60GWh annual production capacity of power batteries by adding a lithium iron phosphate battery scheme and locking in the relevant raw material supply, ensuring the annual production capacity goal of 600,000 electric vehicles by 2023; the Mustang Mach-E in the North American market will add a lithium iron phosphate battery version in 2023, and the F-150 Lightning pure electric pickup in the North American market will also be equipped with a lithium iron phosphate battery version starting in 2024.

LG

LG predicts a global production capacity target of 520GWh/year by 2025, but if its soft pack does not continue to evolve, it is actually quite troublesome, and currently, there are no other interesting things seen.

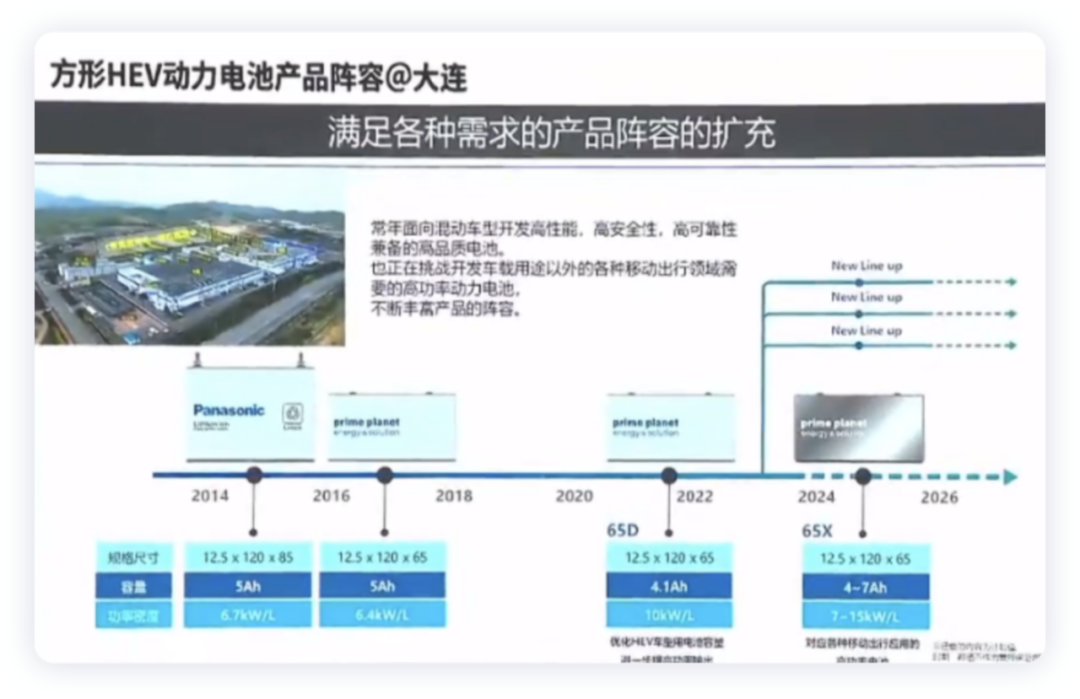

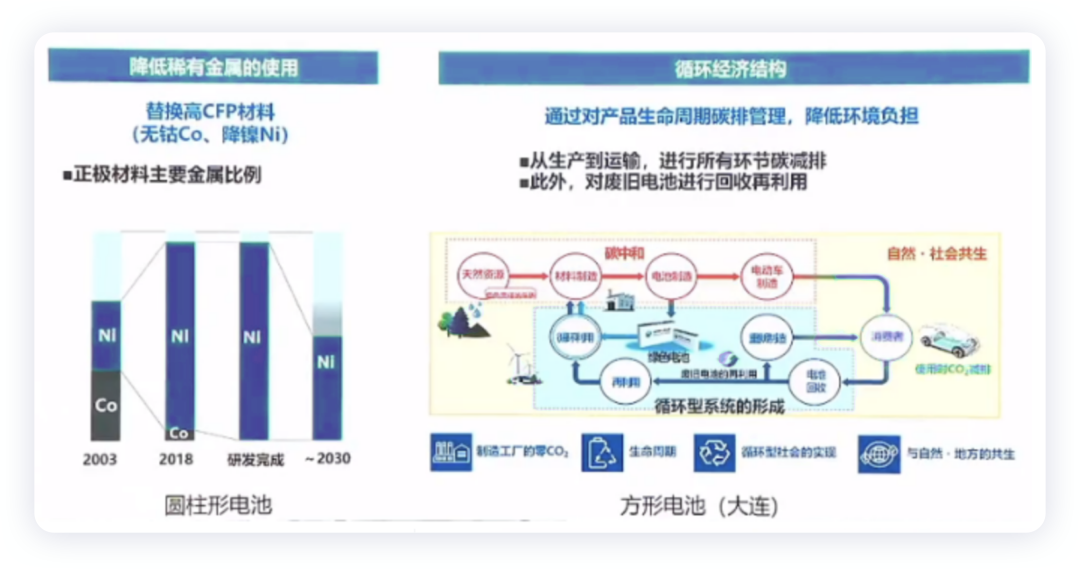

Panasonic

Panasonic has shown us two things. On the one hand, it is a square HEV power battery product based on Toyota’s demand, including high-performance, high safety, high reliability, and high-quality batteries, in various mobile travel fields beyond the development of on-board purposes.

Panasonic continues to expand the sales of the 2170 type, and at the same time, it is making early market attempts on the 4680 type. It is expected to mass-produce the 4680 in 2023, and the equipment progress is ideal at present.

SDI:

It is said that there will be some news coming at the end of July, but there is no sound in the Chinese market at present.

Conclusion: In the Sichuan region, the investment of CATL has been seen; there are also the 50GWh power and energy storage battery project of CITIC Innovation Aviation, the 60GWh power battery manufacturing base and Southwest R&D base project of BHEL, and the 50GWh power energy storage battery project of EVE Energy. Overall, due to its own mine plus green hydropower, Sichuan is a bit catching up with Changzhou in Jiangsu.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.