Author | Lingfang Wang

Editor | Shiyun Zhu

In 2022, battery swapping technology is no longer just an “edge game” but is becoming a primary focus. Giants such as NIO and SAIC are eagerly joining the trend, and leading Chinese automaker Geely has just launched its new brand, “Geometry Automotive,” which is entirely based on battery swapping technology.

It’s worth noting that Geely is not a newcomer but an “old-timer” in battery swapping technology, dating back to the same period as BAIC and NIO. As early as April 2016, Geely established a subsidiary, Hangzhou Yiche New Energy Technology Co., Ltd. (now renamed as EYIH U-Chain Energy & Technology), which focuses on the research and development of battery swapping technology and operating battery swapping stations.

Additionally, Geely’s battery swapping technology covers both commercial and passenger vehicles, including joint ventures with Lifan and Sunshine Mingdao, which have formed a complete ecosystem covering various fields. Geely produces, sells, operates, and uses its ecosystem.

Geely now hopes to expand its ecosystem rapidly, extending the battery-swapping model from the business-to-business (B2B) side to the consumer-to-business (C2B) market. Through battery swapping vehicle development and the construction and operation of battery swapping stations, Geely is transforming itself from an automobile manufacturer to a full-fledged transportation and energy company, integrating vertically from mining resources to battery production, vehicle manufacturing, operation, energy regeneration, and recycling.

Two Sectors, Ten Leading Companies

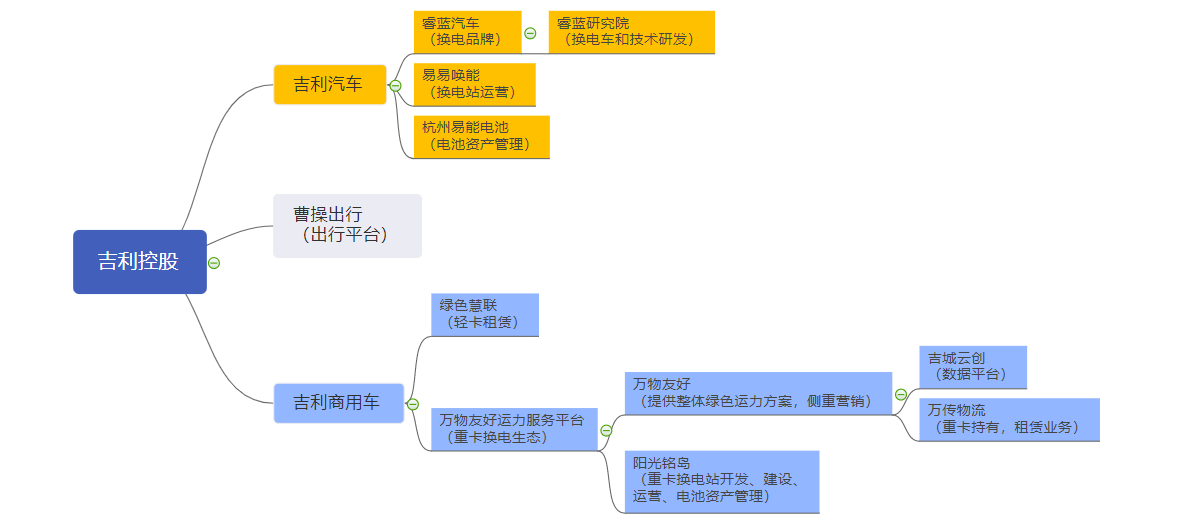

Geely’s battery swapping technology has two separate systems: one for commercial vehicles and another for passenger cars.

Geometry Automotive is Geely’s new brand for battery swapping passenger cars. EYIH U-Chain Energy & Technology operates the battery swapping stations, while Hangzhou Yincan Battery Management Technology Co., Ltd. manages the battery assets. According to Mr. Chaogao Xu, the Vice President of Sales at Geometry Automotive, the company hierarchy includes Geometry Automotive, EYIH U-Chain Energy & Technology, and Hangzhou Yincan Battery Management Technology Co., Ltd., but EYIH’s CEO and Chairman, Mr. Lou Yuanfa, oversees it all and reports to the top management. Yincan became independent and reports directly to the Geely group.

Geometry Research Institute is in charge of battery swapping technology development for both commercial and passenger vehicles.

Caocao Chuxing, an independent company from Geely, sources their battery swapping vehicles entirely from Geometry Automotive. On April 13, 2022, Geometry Automotive and Caocao Chuxing signed a long-term cooperation agreement in which Caocao Chuxing will purchase a large number of custom-made vehicles produced by Geometry Automotive for its shared mobility services in the coming years.

The commercial vehicle field is similar. The “Universal Friendly Transportation Service Platform” under Geely Commercial Vehicle is responsible for the overall construction of the commercial vehicle battery-swapping ecosystem, composed of two core sectors: Universal Friendly Transportation Technology Co., Ltd. and Sunshine Mingdao Energy Technology Co., Ltd.

Universal Friendly currently focuses on battery-swapping heavy truck marketing and market promotion; Sunshine Mingdao focuses on the industrial layout and planning of the heavy-truck energy ecosystem, battery-swapping station operation, and battery asset management, providing customized services to customers.

Universal Friendly also has two other companies, Jicheng Cloud Creation, which is responsible for data management and power dispatch, and Wan Chuan Logistics, which is the vehicle holder and involves heavy truck rental, transportation, and distribution.

In addition, the green alliance between remote commercial vehicles and CHL Logistics, mainly holds new-energy light trucks.

From the above-mentioned entities, it can be seen that the roles that should have been accomplished through collaboration are undertaken by various Geely subsidiaries.

It can be observed that in the early battery-swapping model, Geely chose to cultivate its own market and implement a full closed-loop from selling to buying.

Passenger car battery-swapping: from Maple Serenity to Ray Blue

It is an industry consensus that the battery-swapping business started with the B-side, and Geely is no exception.

Especially Ray Blue is not Geely’s first battery-swapping travel brand.

As early as March 2019, Geely established Fengsheng Automobile Technology Group Co., Ltd. On April 10, the following year, Fengsheng Automobile launched the Maple Leaf brand, positioning it for travel and battery-swapping.

The first Geely Technology Group’s new battery-swapping model, Maple Leaf 80V, was designed for the B-side, and Cao Cao Travel has been using it permanently.

Geely’s focus is still on the B-side market because, at that time, new energy vehicles were still mainly used for business operations, especially the battery-swapping models.

In 2019, the national policy plan once again emphasized concepts such as “battery-swapping” and “vehicle-electrical separation,” which had been shelved for many years, and the battery-swapping model began to revive.

Since 2020, a series of related policies promulgated by the state have frequently mentioned and encouraged the development of battery-swapping models, fully demonstrating that the battery-swapping model is receiving renewed attention.

Perhaps the spring of Geely’s passenger car battery-swapping is approaching, thanks to the policy wind and the private market’s outbreak.

It’s time to make a high-profile appearance.

In October 2021, Geely Automobile Group CEO Gan Jiayue proposed to launch a brand-new battery-swapping travel brand at the “Intelligent Geely 2025” strategy release conference.

In January of this year, Geely Automobile and Lifan Technology’s joint venture was officially established and named Ray Blue Automobile.

It is worth noting that Ray Blue Automobile is based in Chongqing, where Lifan has been working on battery-swapping for many years, and it is also its key layout area.

When it comes to battery swapping, Lifan Motors is considered a pioneer compared to Geely. As early as 2015, Lifan released its new energy strategy “i.Blue” 1.0. In 2016, Lifan launched its first centralized energy station under its subsidiary, Mifeng Energy in Chongqing.

However, according to insiders, Lifan only provided production qualifications and manufacturing bases, and the battery swapping technology of Ruilang was independently developed with no connection to Lifan.

Nevertheless, it can be seen that Lifan played a role in early-stage market education for Ruilang’s battery swapping.

According to Lou Yuanfa’s plan, Ruilang Automobile started with the B-end market, but the layout is not limited to the B-end, and it will develop in both B-end and C-end channels in the future.

Therefore, it launched three models for private users in one go- Ruilang 7, Ruilang 9, and Ruilang Maple Leaf 80V PRO.

In addition, the Maple Leaf brand under Fengsheng was also transferred to Ruilang Automobile.

Of course, to support battery swapping, standard battery packs are needed. Ruilang Automobile has introduced capsule batteries with different ranges of 300-700 km to meet different needs.

According to the latest data provided by Ruilang, they have deployed more than 30 battery swapping stations in Chongqing, all of which are directly operated stations.

In the “separation of vehicle and battery” mode, the monthly rent of Ruilang’s battery is RMB 798, and the battery swapping price is charged at RMB 1.2 per kWh (calculated as RMB 0.2 per km based on distance, and the actual battery swapping price will fluctuate depending on the differences in electricity prices in different cities).

This year, Ruilang has also set a “small target” for the layout of battery swapping stations for commercial vehicles, planning to deploy more than 200 battery swapping stations in 23 cities.

Commercial vehicle battery swapping: Focused on transportation capacity

If Geely’s establishment of a battery swapping ecosystem for passenger cars is still aimed at expanding the private electric vehicle market, then commercial vehicles are focused on transportation services, reducing energy consumption, and lowering costs to improve efficiency for logistics companies.

Unlike private vehicles, the main scenario for commercial vehicles is operation, so automakers that can help logistics companies reduce costs are most popular.

To this end, Geely’s expansion in the field of commercial vehicles is to fund and hold batteries and battery swapping stations, providing battery swapping services to customers who purchase or lease battery swapping heavy trucks.

In the view of Song Jie, the Deputy General Manager of Geely’s commercial vehicle subsidiary, Yangguang Mingdao Energy Technology Co., Ltd., commercial vehicles for the operations market are very suitable for battery swapping. After all, operational vehicles earn profits through high-efficiency and high-strength operations.

According to Song Jie, the development of Geely’s commercial vehicle battery swapping business can be traced back to 2018.With the establishment of the two companies, Wanhua Youjia and Yangguang Mingdao in 2020, a joint venture named “Wanhua Youjia Green Energy Service Platform” was formed, paving the way for the interconnection of Geely’s commercial vehicle battery swap services.

The platform primarily boasts of the following abilities: firstly, it has a complete product line of battery-swapping heavy-duty trucks and swapping stations, possessing the capability of offering integral design, manufacturing, and delivery services for the vehicles and swapping stations; secondly, it has the capacity to offer customers prompt and satisfactory swap solutions by providing them with the whole set of engineering construction and operating services for the swapping stations; thirdly, it adopts a vehicle-electricity separation mode and has battery assets that do not add to the purchase cost for customers; fourthly, it builds a combinable offline recyclable energy source, providing green power services.

Regarding battery asset management, Song Jie mentioned that the company currently relies mainly on its own funds to hold electric batteries; in the future, it hopes to collaborate with social capital to establish electric battery asset management companies to maximize the value utilization of electric batteries.

Besides, Geely also cooperates with companies like Xinjiang Goldwind Science & Technology Co., Ltd., and Sungrow Power Supply Co., Ltd. to constantly increase the use of green energy.

Currently, Geely has already established almost 50 battery swap stations.

Song Jie cited the example of the Yune Intelligent charging station for heavy trucks. This station uses integrated wind, light, energy, and storage technology to provide wind and photovoltaic energy. Fifty battery swapped heavy trucks are being used for the Yanghuopan Coal Mine of Yune Group. The station swaps the battery between 100-150 times every day, swapping between 12,000 degrees to 20,000 degrees of electricity daily. Based on a calculation of 100,000 kilometers per vehicle, the annual emissions of carbon dioxide can be reduced by 5,250 tons per heavy-duty truck.

Geely’s commercial vehicle battery swap ecosystem is still expanding.

Development Strategy: Open Cooperation

It can be seen that, whether ride-sharing cars or commercial vehicles, Geely has almost single-handedly created a closed ecosystem of battery swapping. The advantage is that Geely has formed a battery swapping ecosystem faster by relying on itself. The disadvantage is that each main subject varies in their interests, and some tensions even exist within the (ecosystem).

For instance, the interests of the battery-swapping station, battery asset holder, and vehicle owner are not the same; relying only on Geely’s services makes it challenging to earn profits. Therefore, opening up to the outside world is an inevitable choice.

Currently, Geely is actively seeking external cooperation and is not following the closed path. Chen Gaoxu revealed that new players are already discussing a partnership with Geely and hoping to employ Geely’s battery swapping technology and services.

Regarding commercial vehicles, the company is also seeking breakthroughs in external cooperation. Yangguang Mingdao has already established a partnership with CATL on battery asset holding, full-battery lifecycle management, tire utilization, and battery recycling.

Additionally, Geely has established a deep cooperation partnership with Xinyang-based Xinte Energy on battery swapping station operations, standard battery packs, and swapping technology, even though overlaps exist between the two in these areas.In Song Jie’s view, both Xinxiang and Geely have their own advantageous fields, which can complement each other and jointly expand the battery swapping ecosystem.

Indeed, the battery swapping model is still in the early exploratory stage and has a huge potential for market increment. Therefore, cooperation among enterprises is greater than competition, and the goal is to quickly expand and educate the market, and rapidly expand the cake. It is during the period of stock market competition that competition is greater than cooperation.

By sorting out Geely’s battery swapping layout, we may boldly speculate that Geely is attempting to establish a new energy battery swapping and energy supplement system in each city through the layout of passenger and commercial vehicles, and transform Geely from a car sales enterprise to a provider of transportation and energy services. Perhaps in the future, energy and travel services will be Geely’s biggest source of profit.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.