Author: Zhu Yulong

I have several judgments on the separation of the vehicle and the electricity, Battery as a Service (BaaS), and the triple play in the battery field:

-

It’s difficult for the price of batteries to decrease further: The cost-effect from the scale effect of batteries brought about the cost reduction to stabilize in the feedback from leading companies in the automotive industry during the Battery Day of Tesla and Volkswagen in late 2020.

-

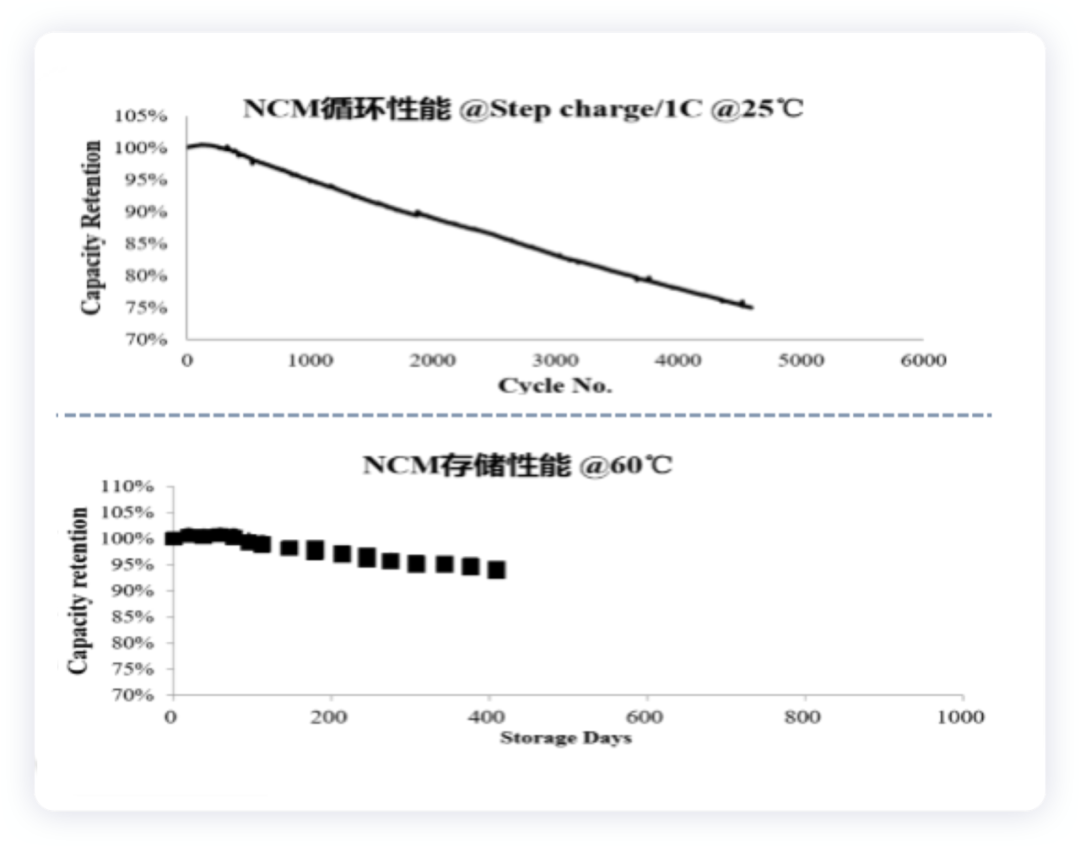

There is a lot of space for battery life: Both ternary materials and lithium iron phosphate materials have a cycle life that is far longer than their daily calendar life attenuation. With the development of technology and the introduction of software technology, we can manage the battery life from embedded BMS to the cloud, which can result in the assets of batteries.

-

Batteries are gradually moving towards platformization: The mode of vehicle to battery is turning to the platform-compatible battery.

Therefore, with the launch of the BaaS Battery-as-a-Service rental service model, car owners can experience something new through the separation of the vehicle and electricity and the rechargeable, replaceable, and upgradable battery technologies. After the subsidy is cut, electric vehicle owners can purchase cars without batteries and use batteries on-demand through rental, enjoying the right to use the batteries. I want to spend some time talking about Wuhan NIO, which may need to be serialized, as an entry point.

Note: Subsidies are a significant obstacle to the separation of car and electricity. The loophole patches that previously defrauded subsidies were for the mode of vehicle-to-battery.

What Kind of Company is Wuhan NIO?

Wuhan NIO Battery Asset Co., Ltd.-As a holder of these battery assets, NIO plays a role in providing BaaS rental services to NIO’s users.

According to public information, as of June 2022, it held a total of 6 GWh of battery assets (about 20 GWh in 2023, and about 50 GWh in 2025). According to public data in September 2021, there were 40053 batteries in total. If calculated at 1 yuan per Wh, NIO already holds assets worth tens of billions of yuan. These battery assets are dispersed throughout the country in cars that rent the service for car owners. NIO’s batteries provide NIO’s car owners with energy supply services through rental services and NIO’s battery-swapping system.

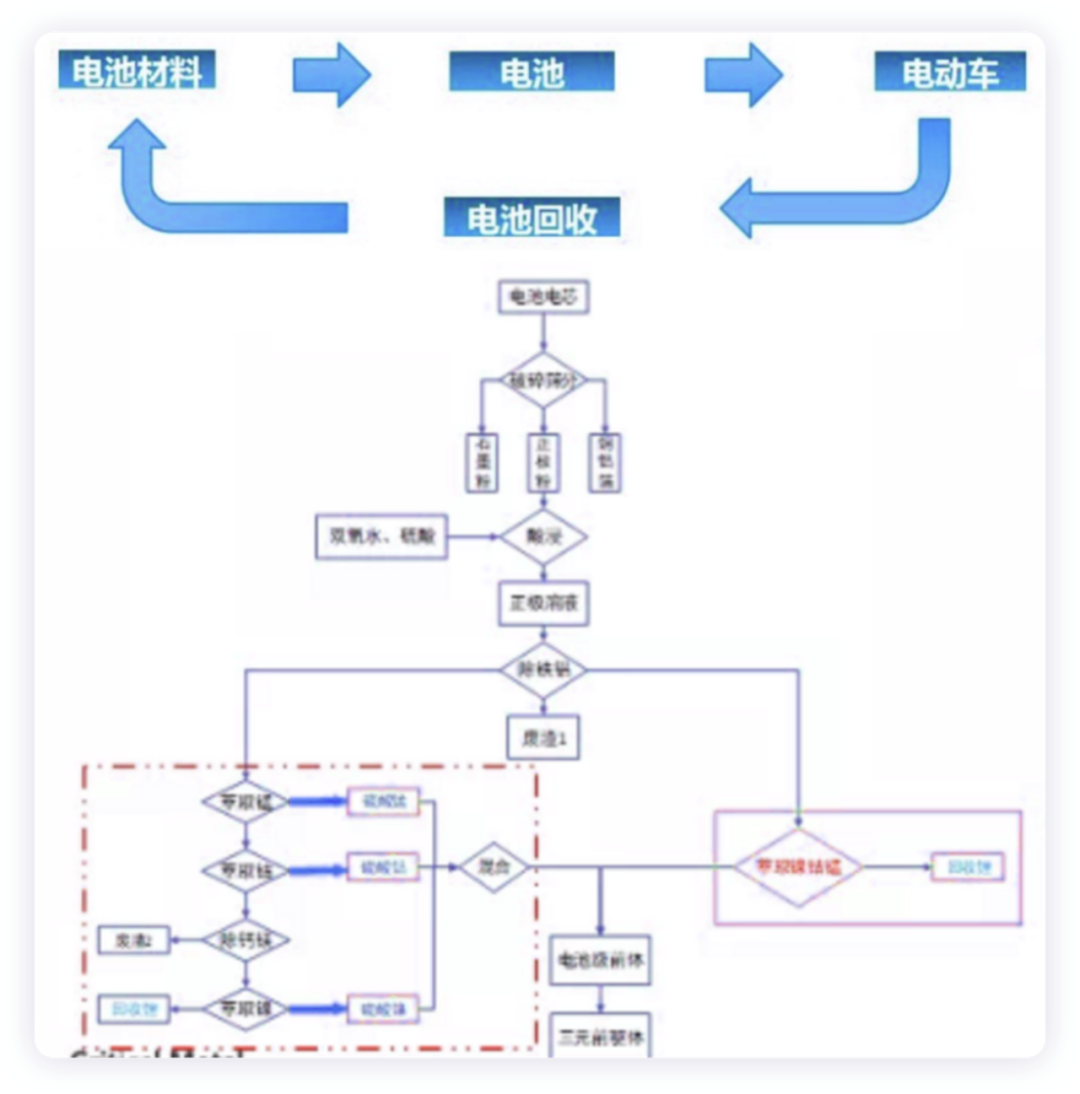

(nationwide battery-swapping stations have 8,961 batteries, including 3,821 batteries with extended range and 5,140 batteries with standard-range, which belong to NIO Power).From BaaS services, Weihan also gradually expanded into the full life-cycle management of battery assets. From the core logic, this battery asset management company manages a “mine” that contains ternary materials of nickel, cobalt, and manganese (a batch of very pure NCM523) distributed in electric vehicles across the country. Managing these assets requires data and battery technical capabilities:

- Management ability: This is actually from the battery application level, knowing how to make the battery last longer and have a higher residual value. Through IT data analysis, we can decompose users, associate users’ usage habits with battery attenuation, and manage battery assets through energy management, to enhance competitiveness.

- Battery data and asset analysis: Here we need to use IT data operations to manage user expectations. With intelligent operation and judgment, and leveraging the accumulated data from these assets, we can rent batteries like playing games.

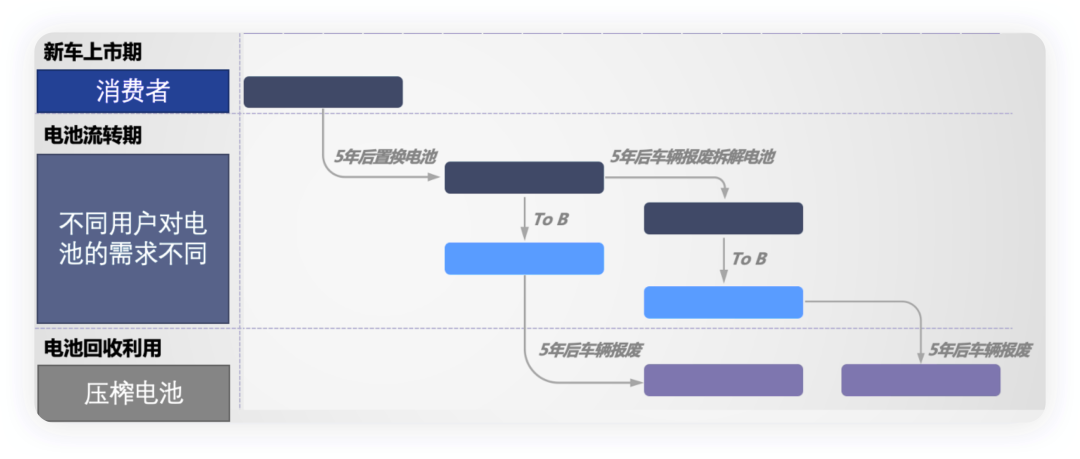

I think that users have no concept of the SOH status of batteries. We expect the batteries to be scrapped after driving 100,000 kilometers, but assuming a 500-kilometer car that cycles 400 kilometers, it actually cycles only 250 times after driving 100,000 kilometers. Consumers think the battery has reached the end of its life and will dispose of it very cheaply. But for the battery asset company, its life cycle has just begun (see Figure 3).

Another important thing is that after the battery is retired, it needs to be recycled-how to handle it at the lowest cost, whether to regenerate or recycle, and how to increase the residual value of the battery are all considerations. From the big logic of power batteries, passenger car batteries stagnated at one million from 2017 to 2020, and began to accelerate in 2021. The power battery warranty period is 8 years, which means that about one million battery levels will begin to be retired around 2025. Once the recycling rate reaches a certain level in the future, these problems will be highlighted.

Volkswagen’s AttemptsActually, Volkswagen is also making similar attempts: giving the ID series to employees and repurchasing them at a discount after two years. From a macro perspective, both the carmaker and employees think they have made a profit – Volkswagen has sold the car and the employee has used it for a year with only 10% of the car’s price. In fact, this is essentially a car rental model, with both the vehicle and battery remaining in the hands of Volkswagen. This car can be processed and utilized at different levels in the future.

In my opinion, whether the battery is used for Battery-as-a-Service (BAAS) or the electric vehicle itself is used for Vehicle-as-a-Service (VAAS), there are differences in battery cognition logic in both models. As Volkswagen establishes battery factories in Europe and China in the future, these cars will be cycled for different levels of use.

In summary, I believe that studying the service model for batteries and electric vehicles may lead to different logic in the future for using electric vehicles. They are all for use, and it’s up to the individual to take responsibility for any damage or insurance claims. This is also the logic of high-speed iteration of automotive technology, with everyone signing a three-year contract to use new cars.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.