Special Contributor | Zhu Yulong

Editor | Qiu Kaijun

The power battery industry has completely switched to the fast lane.

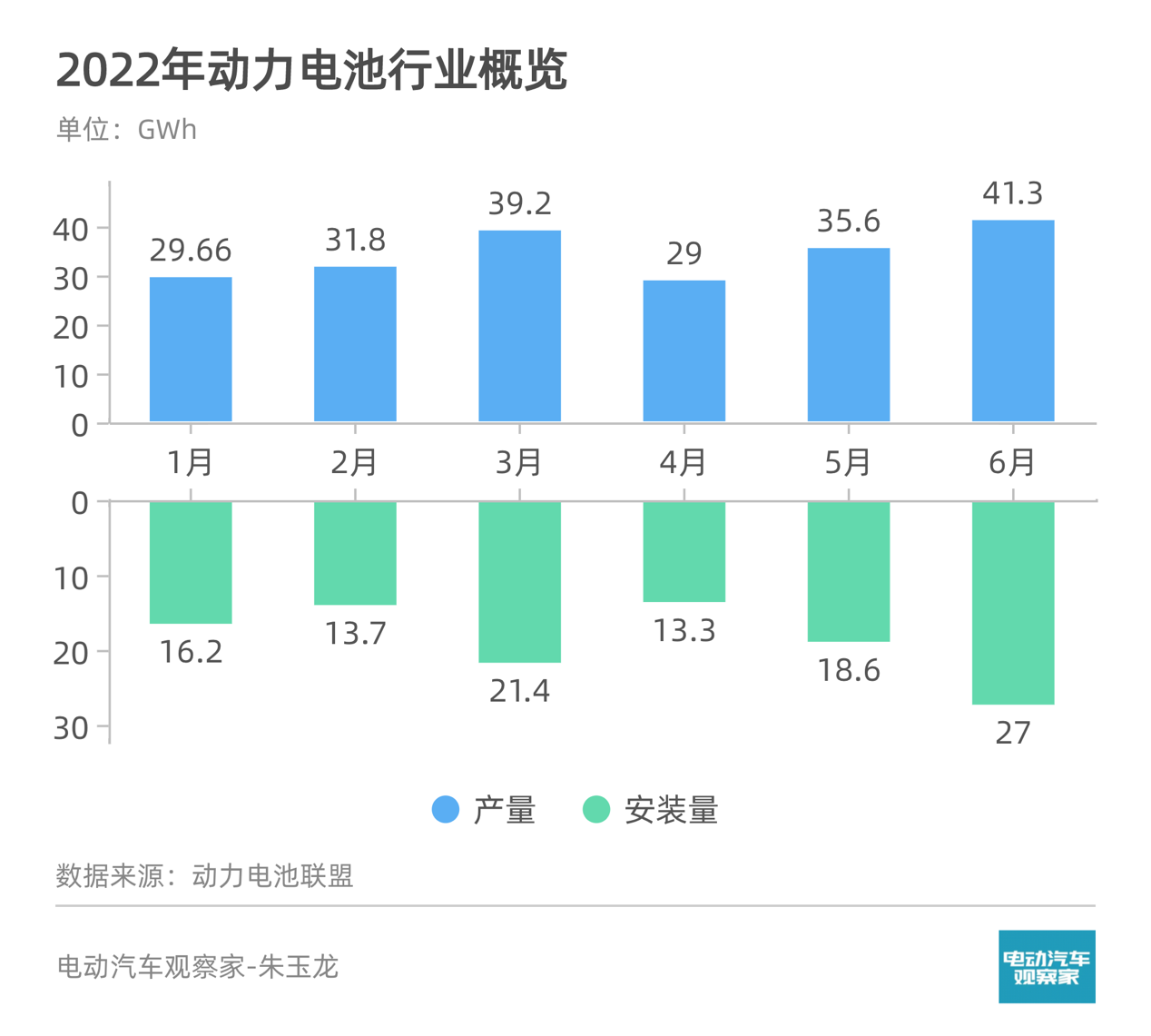

On July 11th, the China Automotive Power Battery Industry Innovation Alliance released its June data.

In June, China’s power battery production totaled 41.3GWh, breaking the record high, a year-on-year increase of 171.7%, and a month-on-month increase of 16.1%;

The installed capacity of power batteries was 27.0GWh, a year-on-year increase of 143.3%, and a month-on-month increase of 45.5%.

In the industry:

1) Currently, power batteries are in a state of high demand and high prices. In the first half of the year, BYD’s sales soared, which will lead to increases in production by domestic and joint venture enterprises in the second half of the year. The second half of the year will be a time when automobile brands need to take comprehensive actions. Due to the high oil price, the B-side market can absorb many new energy vehicles.

2) Due to the limited deliveries of overall joint ventures and foreign enterprises in the first half of the year, the driving force of these automakers on ternary batteries will be more evident in the second half of the year, so the proportion of ternary output and installation will rebound somewhat.

3) Looking at the overall demand for Q3 and Q4, it is expected that because automakers will be installing power batteries before the subsidy ends in Q4, the installation volume of power batteries will increase. Therefore, we can judge that the volume of Q3 will continue along the current trend. Such a large volume will support the continuous strengthening of upstream lithium carbonate and lithium hydroxide prices.

4) Currently, the average electric load of pure electric cars is 52.9kWh, and the battery cost is high. On the one hand, PHEV & EREV will grow opportunistically, and on the other hand, A00 models will also evolve towards smaller power loads.

Lithium Iron Phosphate Remains Strong

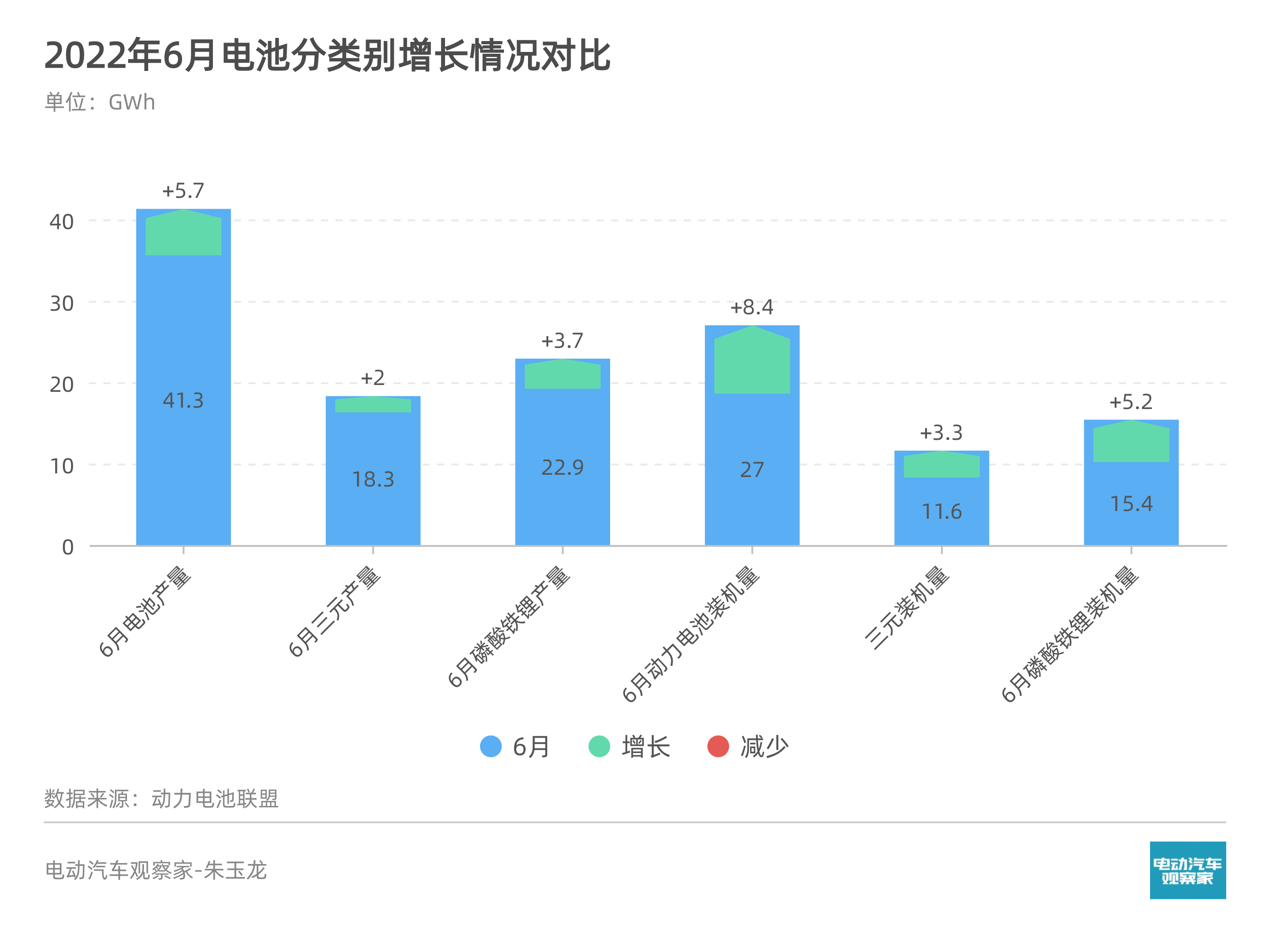

In June, the month-on-month increase in power battery types was:

- The total output increased by 5.7GWh, and the installation capacity increased even more: 8.4GWh

- Ternary output increased by 2GWh, and installation capacity increased by 3.3GWh

- The output of lithium iron phosphate increased by 3.7GWh, and the installation capacity increased by 5.2GWh

From the data, the year-on-year growth rate of lithium iron phosphate is still slightly higher, and the proportion of iron phosphate will still be stable at around 60% in the second half of 2022.

- Ternary battery production was 18.3GWh, accounting for 44.3% of the total production, with a year-on-year increase of 148.9%.- 物流配送车装车量占比最高,达到了 48.9%

- 换电重卡也是一个重要的领域,占比 6.7%

随着换电重卡的逐步普及,特别是短途运输方面,换电模式可以进一步满足用户的使用需求,并大大降低了车辆沉积率。但同时,换电重卡需要的电池规格较大,且体量大,也有一定的技术难度。因此,换电重卡领域的龙头企业将会更有市场竞争力。

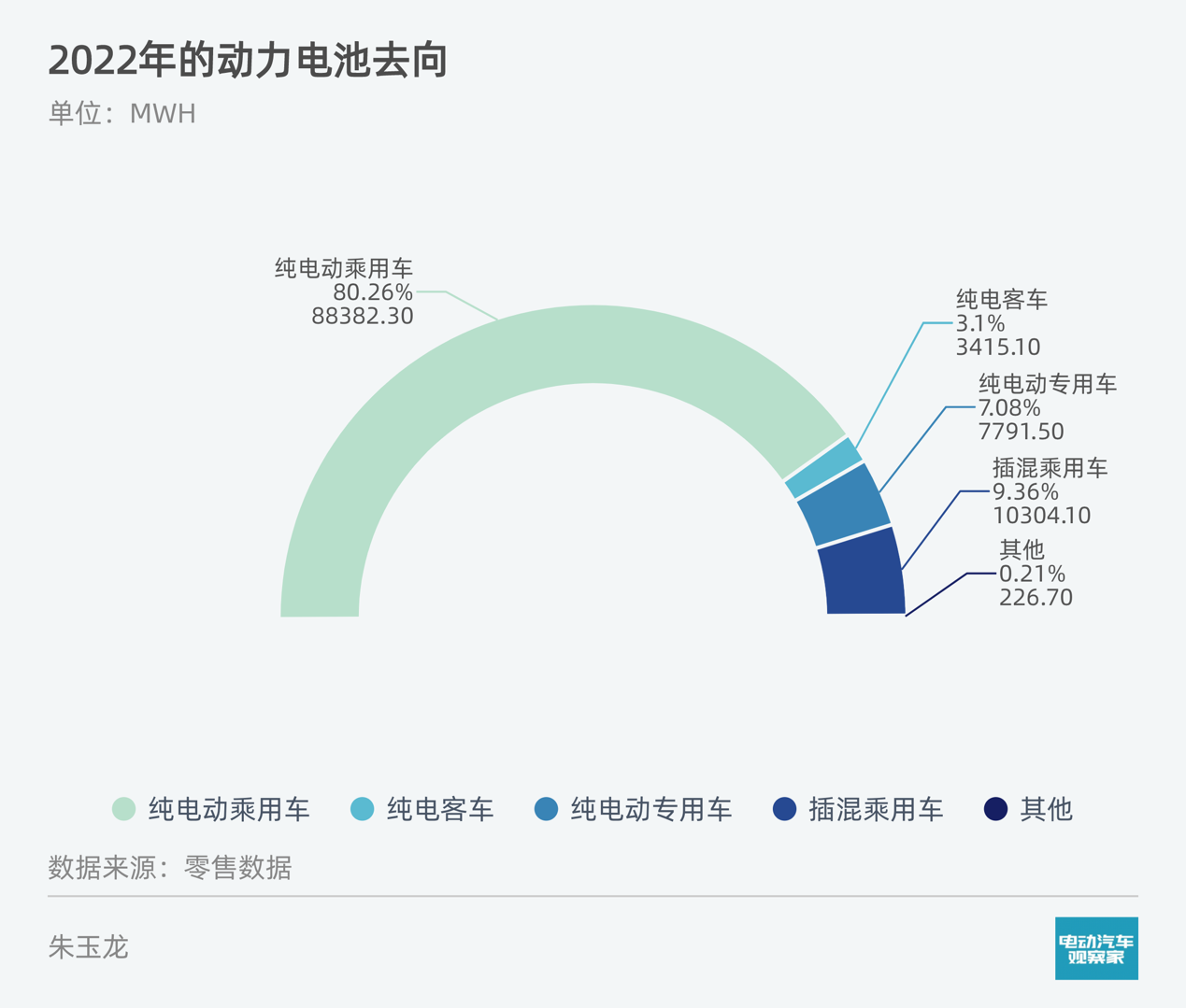

最后,在动力电池领域的产业链上,还需要更多的后市场服务的配套上线,比如二次利用,回收、再制造等。这也是动力电池企业将来需要重视的方面。- The usage of pure electric passenger cars is 88.38 GWh, exceeding 80.26% of the total;

- The usage of pure electric buses is 3.415 GWh, accounting for only 3.1%, as this sub-market has been heavily affected by the overall shrinkage of public transportation demand in cities;

- The usage of pure electric special vehicles is 7.791 GWh, accounting for 7.08%, and with the gradual introduction of battery swapping heavy-duty trucks this year, the electrification of commercial vehicles in freight transportation has been stimulated, which can effectively drive the demand for commercial vehicles;

- Plug-in hybrid electric vehicles (PHEVs) represent a significant growth, currently using 10.3 GWh and accounting for over 9.36%, with a year-on-year increase of 221.4%.

I am more optimistic about the growth of PHEVs. With the trend of battery prices changing, PHEVs can satisfy more customers while not causing a dramatic surge in demand for batteries like pure electric vehicles do.

From a global perspective, China’s power battery industry is in a high-speed development period, and the production and installation volumes have outperformed other countries.

The difference between China’s power battery production and installation volumes partly go to global markets: a portion is shipped directly through sea transportation, and another portion is exported globally through whole vehicle export.

If we were to give a score to China’s power battery industry, it would be 80 points. Especially with the never-ending emergence of new terminologies and concepts, they bring us a continuous source of imagination and expectations.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.