Author: Zhu Yulong

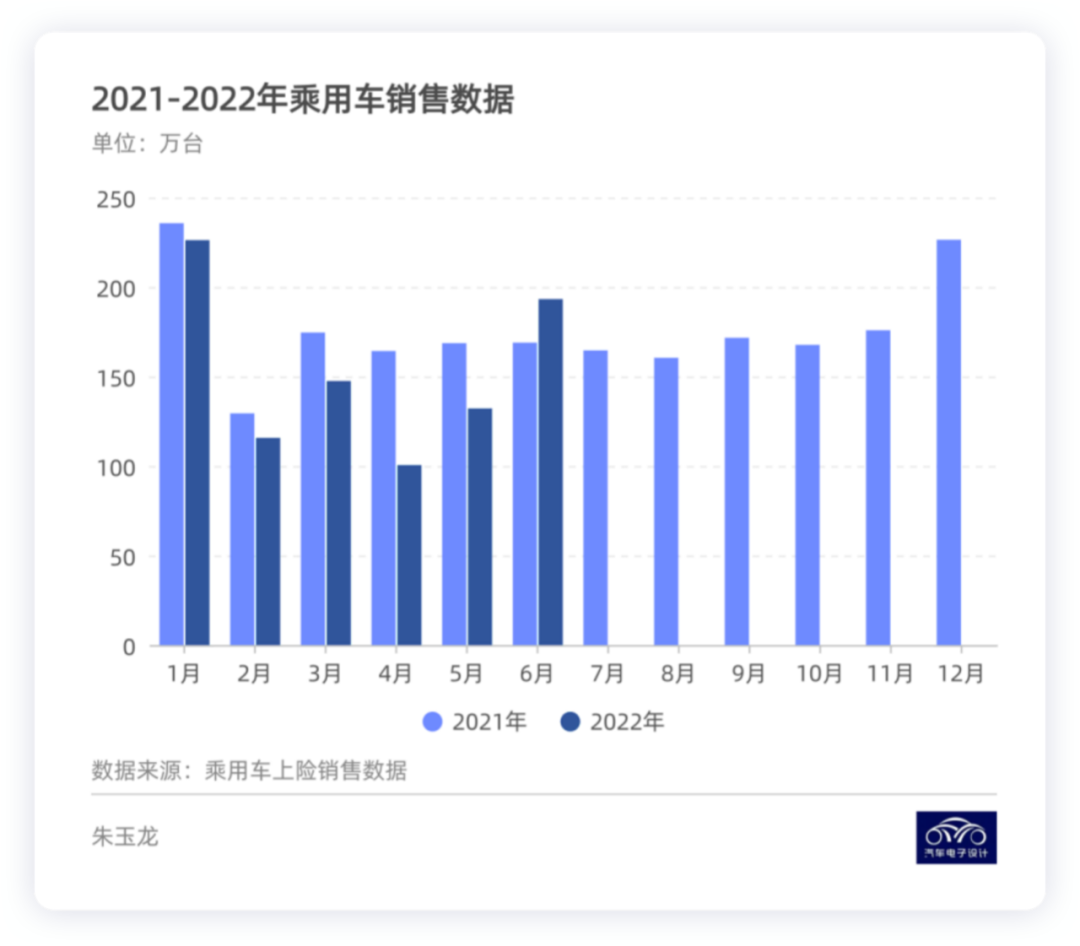

In June, there were 1.932 million units of passenger vehicle insurance data, an increase of 610,000 units from May, a year-on-year increase of 14.4% under strong measures. The total amount for the first half of the year was 9.15 million units, a year-on-year decrease of -12.1%. Next, we will analyze these data. I think the overall characteristics are as follows:

-

With the strong stimulation in June, various policies and purchase tax reductions at the local level have promoted the demand for fuel vehicles and new energy vehicles. June is the most responsive month with immediate results. As the weather gets hotter, the data for the traditional off-season of July-August may interrupt this recovery trend.

-

Currently, there are differences in the recovery speeds between new energy vehicles and fuel vehicles. The high oil prices this year have a significant driving effect on the demand for low fuel consumption DM-i models.

-

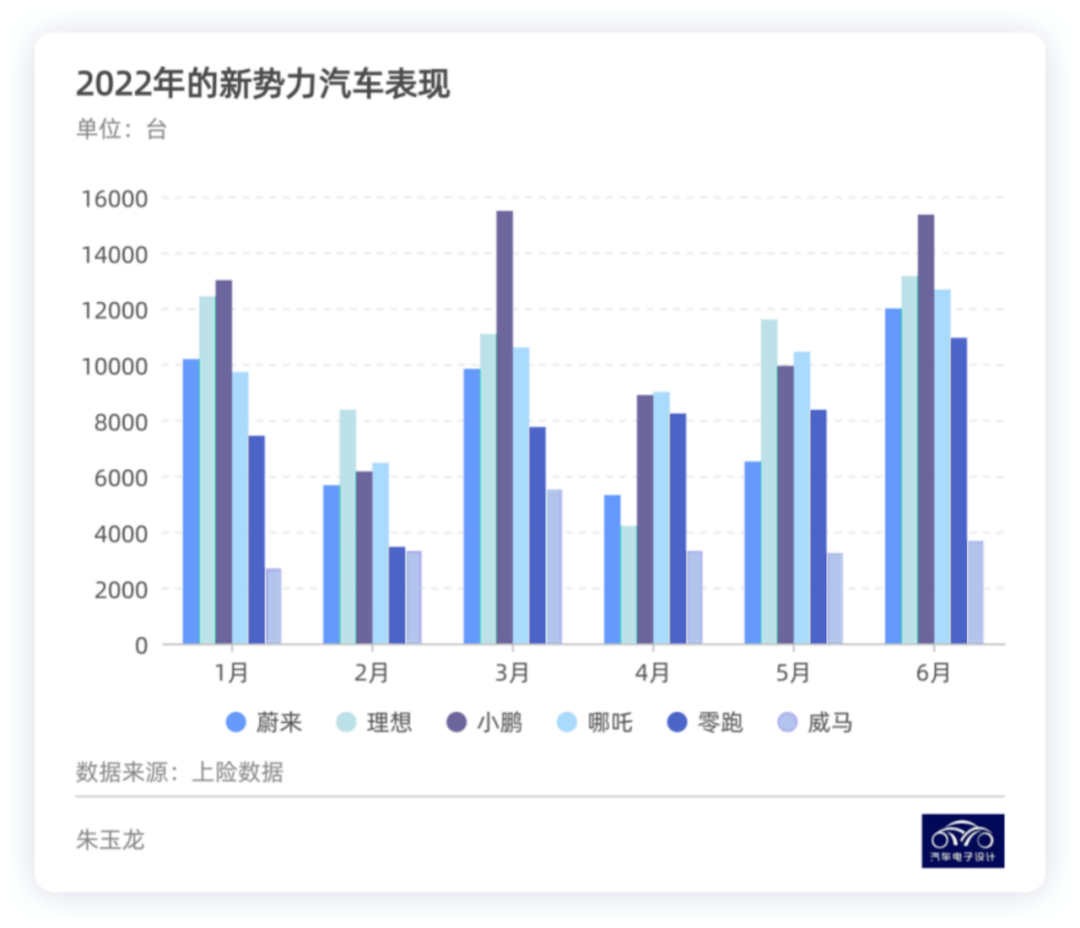

Among the new forces, there are different tiers. Here we will break it down. Looking at the growth quality, the ZERO RUN started to transform first, followed by NETA, which is now also moving towards NETA S. Wey is now in an awkward position.

Looking at the overall data in June, the good news is that after almost a year of negative year-on-year growth since August of last year, June has returned to a positive growth channel compared with the same period last year. While looking at the demand for the second half of the year, some caution is needed.

Looking at the estimated sales trend for the second half of 2022, there may be some comparability with the second half of 2020, but there are currently many complex macro factors.

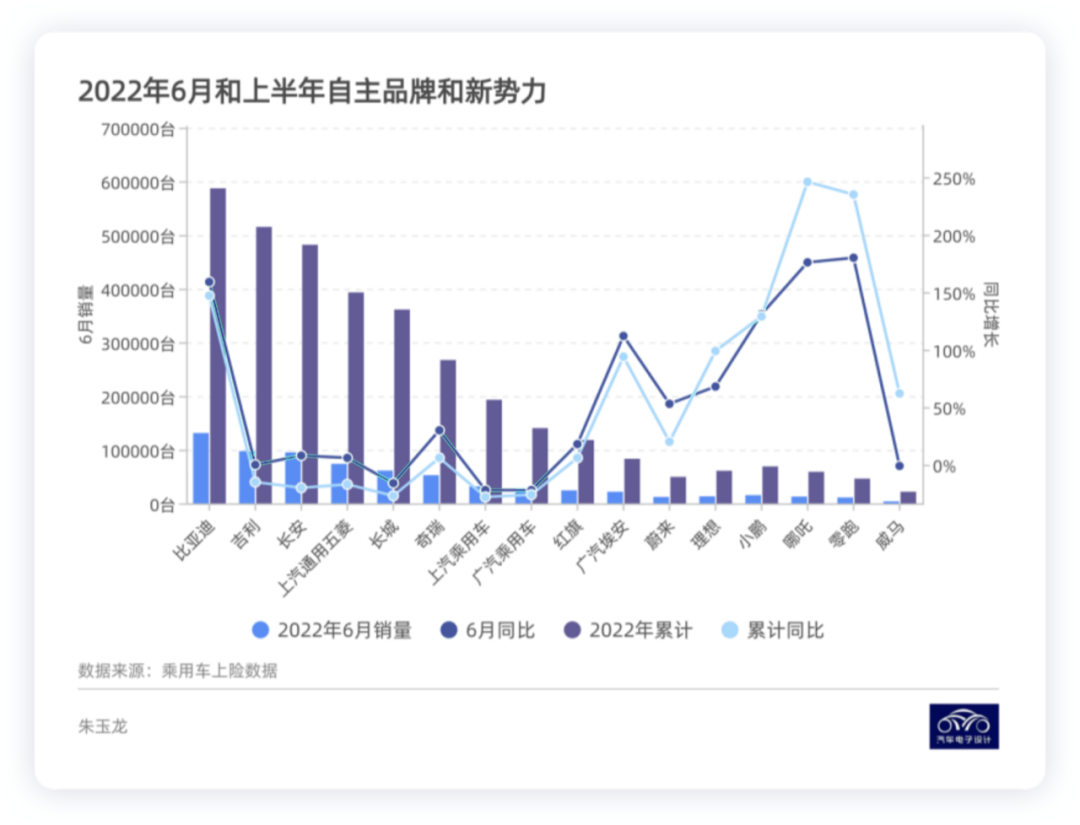

Achievements of major automakers in June and the first half of the year

Independent brands and new forces

In June, BYD took the lead, breaking through 130,000 units of insurance data for the first time (131,120). Following behind are Geely with 97,456 units, Changan with 95,232 units, SAIC-GM-Wuling with 73,662 units, Great Wall with 61,172 units, and Chery with 52,631 units. Looking at the overall structure, fuel vehicles have cumulated a lot of momentum during this tax reduction process. Guangqi Eaon, an old-fashioned company that is preparing to spin off, had sales of 21,720 units.

Among the new forces, NIO had 11,991 units, Li Auto had 13,149 units, XPeng had 15,352 units, NETA had 12,667 units, ZERO RUN had 10,940 units, and Wey completely fell behind with 3,677 units.

Looking at the overall sales for the first half of the year, BYD ranked first among independent brands.- BYD sold 587,125 units, a YoY increase of 147%

- Geely sold 515,162 units, a YoY decrease of -15%

- Changan sold 481,928 units, a YoY decrease of -20%

- SAIC-GM-Wuling sold 393,019 units, a YoY decrease of -17%

- Great Wall sold 361,241 units, a YoY decrease of -27%

- Chery sold 267,204 units, a YoY decrease of 6%

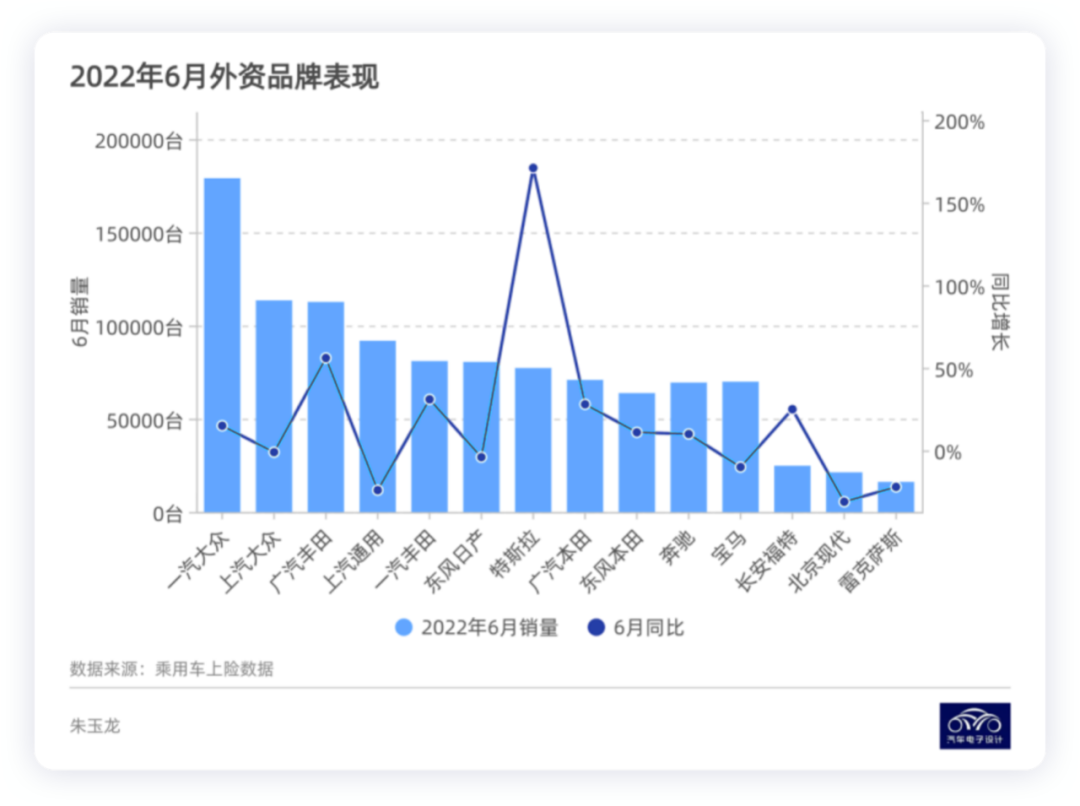

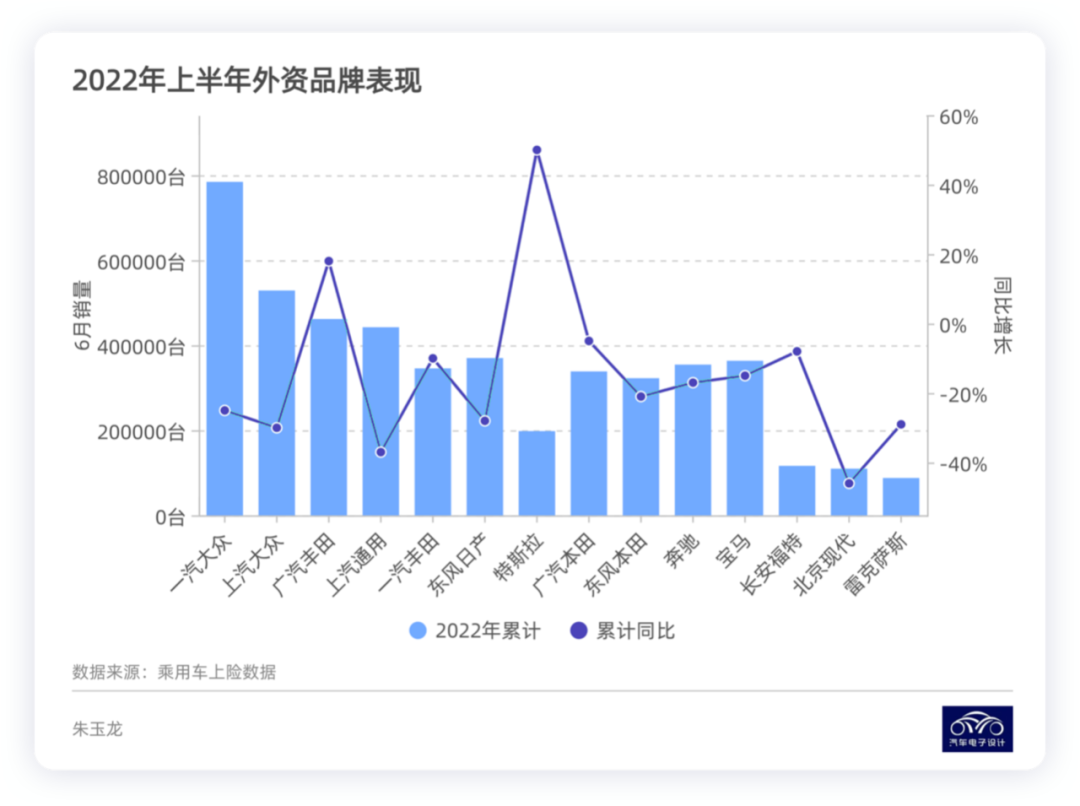

Foreign Brands

This year, the performance of foreign brands in China can be seen as a harbinger of the changes in the passenger car market.

-

FAW-Volkswagen had an obvious recovery, selling 179,093 units in June, a YoY increase of 15%; with a total of 784,423 units sold in H1, a YoY decrease of nearly -25%.

-

SAIC-Volkswagen rebounded slightly less, having sold 113,555 units in June, a YoY decrease of -1%; with a total of 528,863 units sold in H1 (less than BYD), a YoY decrease of -30%.

-

GAC Toyota surpassed SAIC-GM, selling 112,717 units in June, a YoY increase of 56%; with a total of 461,808 units sold in H1, a YoY increase of 18%.

-

SAIC-GM’s performance this month was barely satisfactory, selling 91,871 units in June, a YoY decrease of -24%, with a total of 442,503 units sold in H1, a YoY decrease of -37%, managing to barely surpass 1 million units sold this year.

-

FAW Toyota sold 80,989 units in June, a YoY increase of 31%, with a total of 345,670 units sold in H1, a YoY decrease of -10%.

-

Dongfeng Nissan sold 80,525 units in June, a YoY decrease of -4%; with a total of 369,898 units sold in H1, a YoY decrease of -28%.

-

Tesla reached a new milestone in China, having sold 77,253 units in a single month, a YoY increase of 171%; due to special factors in H1, the total sales volume was 198,209 units, a YoY increase of 50%.

Currently, the only foreign brand that seems to be relatively stable is Toyota, whose hybrid model has attracted many customers amid rising oil prices and the trend towards domestic brands. As for Tesla, it has been going strong, and if there are no special circumstances in the second half of the year, it is likely to continue rising.

At present, foreign brands maintaining a relatively strong position in China’s automotive industry are mainly extending their traditions around the Japanese and German brands, but consumer preferences are also changing in the long term.

At present, foreign brands maintaining a relatively strong position in China’s automotive industry are mainly extending their traditions around the Japanese and German brands, but consumer preferences are also changing in the long term.

New Energy Vehicles

New Power Companies

The comprehensive performance of the first half of the year is as follows:

- NIO sells 49,485 units.

- Ideal Automobile sells 60,824 units.

- XPeng Automobile sells 68,824 units.

- Neta sells 58,889 units.

- Leapmotor sells 46,177 units.

- WM Motor sells 21,738 units.

Originally, these companies were all planned to be around 200,000, and if they followed the original plan in the second half of the year, they would have to make up for the shortfall between 90,000 and 120,000 each month. Currently, the main issue is whether the order pool can meet the production plan for the second half of the year.

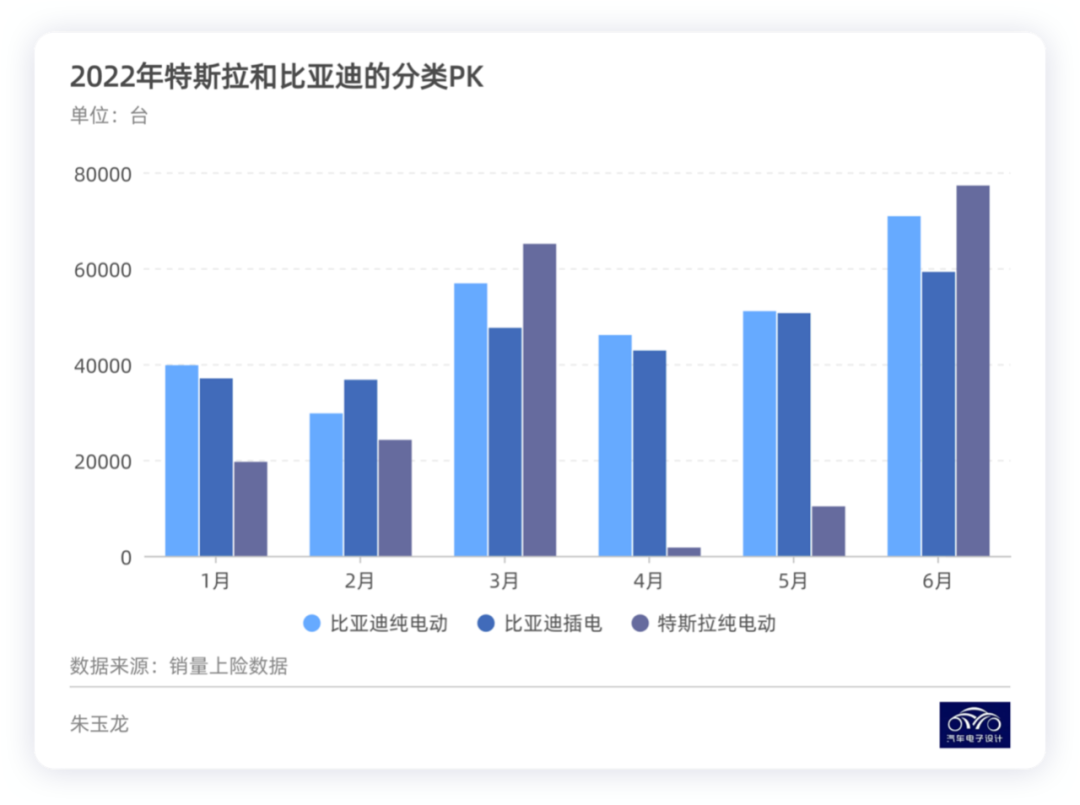

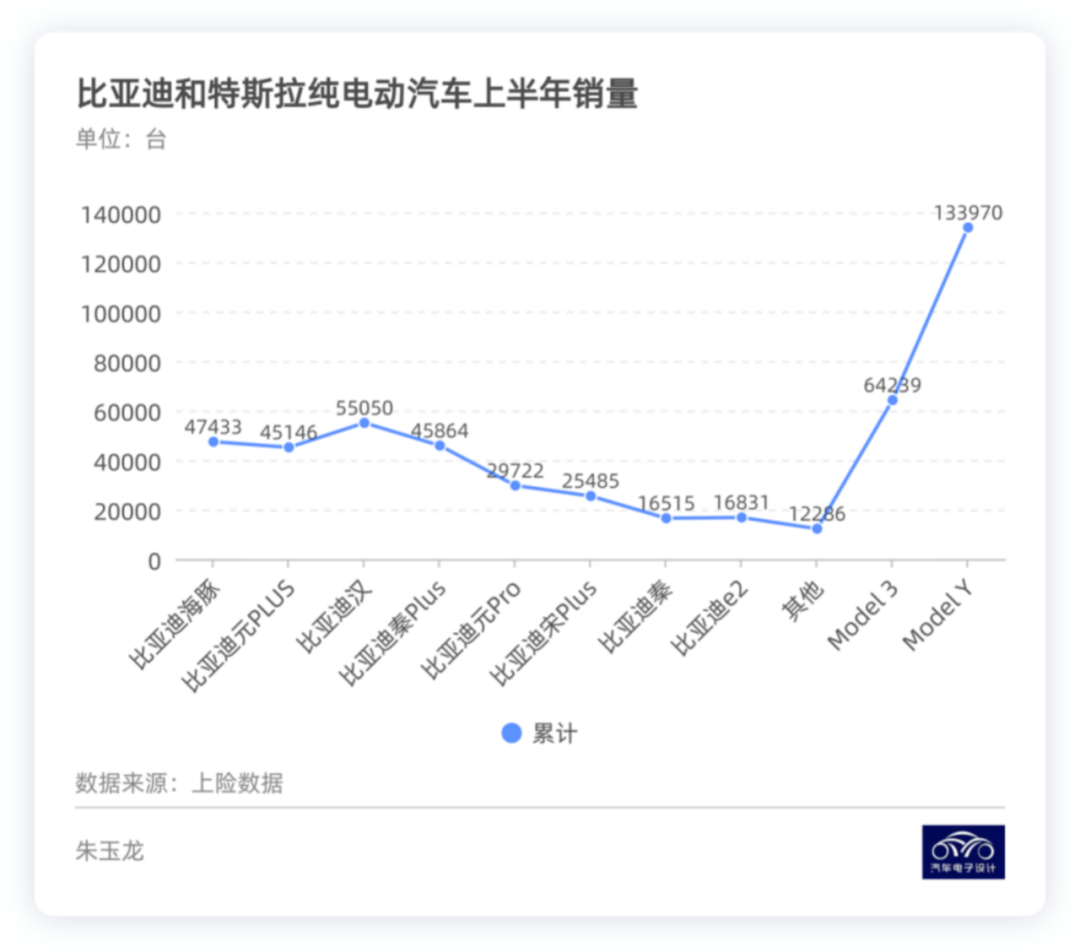

Tesla and BYD

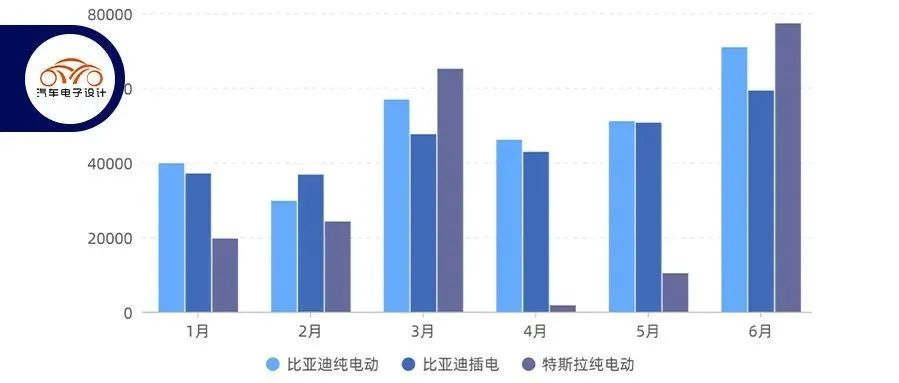

BYD’s pure electric sales in the first half of the year were 294,332 units, while plug-in hybrid sales were 274,043 units. Tesla’s pure electric sales in the first half of the year were 198,209 units. Compared with BYD, the quarter-end figure was much less due to exports. In the first half of 2022, Tesla’s Shanghai Super Factory produced nearly 300,000 vehicles, with nearly 100,000 delivered overseas. In fact, the two companies are currently competing in terms of pure electric vehicle sales in China.

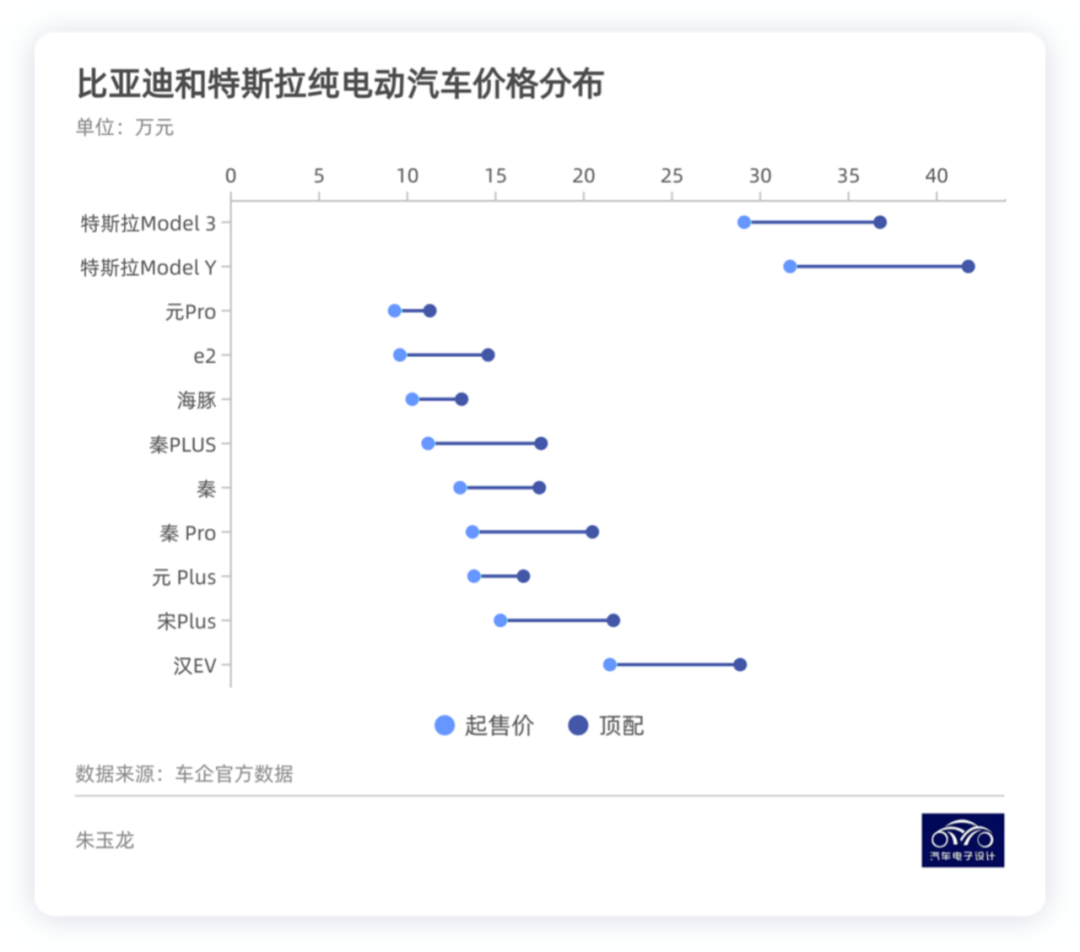

I think it’s meaningless to compare BYD and Tesla in terms of quantity. Take a look at the price distribution and you’ll know why.

If we compare the number of vehicles, everyone can judge for themselves.

In my opinion, in the continuous competition of electric vehicles, we need to pay attention to the competition among different price ranges and different models.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.