Source: Dual Credit Policy and 2022 Revised Draft for Comments

Author: Qiu Kaijun

Editor: Zhu Shiyun

The glory days of the era of fuel-powered cars are quickly becoming a burden and safety red line for joint venture automakers.

Nearly five years after its implementation, on July 7th, the Ministry of Industry and Information Technology (MIIT) announced the “Decision on Amending the Parallel Management Measures for Corporate Average Fuel Consumption and New Energy Vehicle Credits in Passenger Car Companies (Draft for Comment)” (hereinafter referred to as the “Draft for Comment”) . The “Draft for Comment” introduced several major revisions and supplements to the dual credit policy.

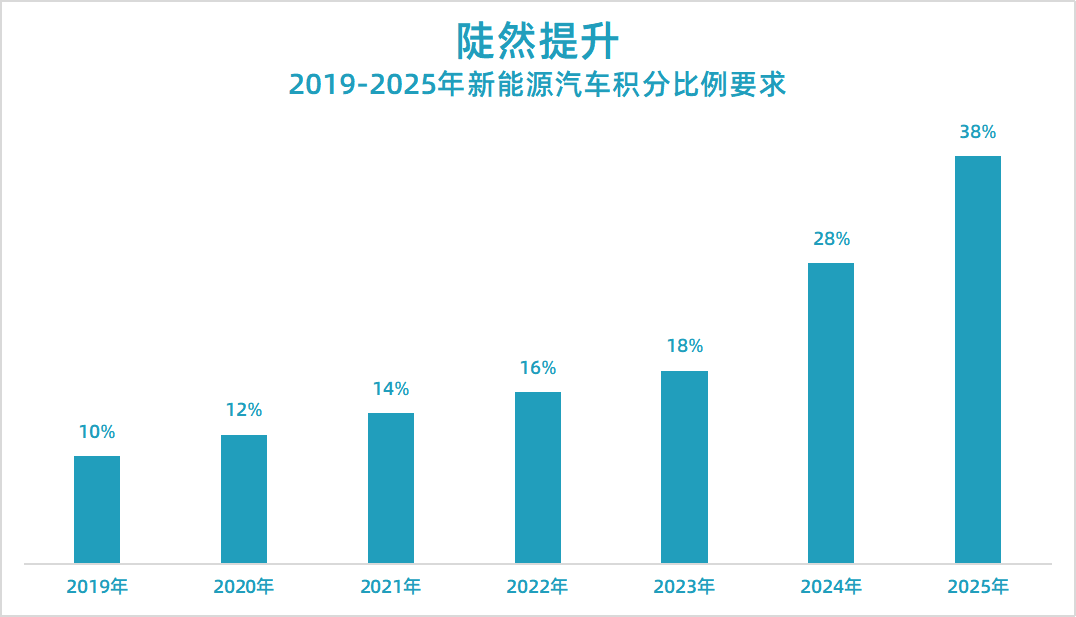

First, it clarified the required credit ratio for 2024 and 2025. In contrast to the previous increase of two percentage points per year, the credit ratio for 2024 and 2025 will increase by 10 percentage points each year, with the requirements being 28% and 38%.

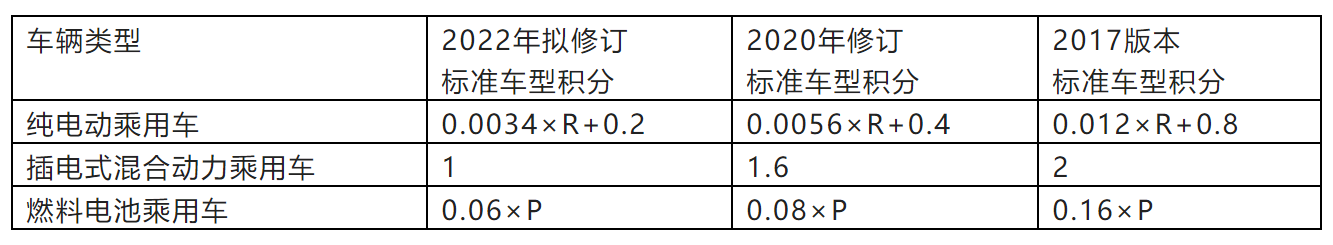

Second, the standard model scores for new energy passenger cars in the years 2024 to 2025 will be lowered by approximately 40% compared to the previous phase. For the same new energy car, if it was previously worth 1 point, in 2024 it will only be worth 0.6 points.

Third, MIIT will establish a credit pool to receive and release positive credits for new energy vehicles. Companies can store positive credits in the credit pool and trade them during times of high demand. According to “Electric Vehicle Observer,” the estimated value of positive credits for new energy vehicles in the mind of the relevant department is around 1,500 yuan.

This major revision to the dual credit policy clearly addresses two major problems during its implementation:

First, the development of new energy vehicles has exceeded expectations, and the original credit ratio requirements are now too low, resulting in a large number of positive credits for new energy vehicles.

Second, the resulting decrease in the value of positive credits for new energy vehicles will not bring sufficient returns to leading new energy passenger car companies.

If the dual credit policy is revised according to the “Draft for Comment,” leading new energy vehicle companies such as BYD, Tesla, NIO Inc., and GAC Aion will not only dominate the competition for market share in the new energy vehicle market, but also gain substantial profits from positive credits.

However, automakers whose sales structure is still heavily dependent on fuel-powered cars will face severe challenges, either paying hundreds of millions or even tens of billions of yuan in credit costs each year, or quickly launching new energy products and rapidly increasing their share of internal sales.

Steep Increase in New Energy Vehicle Credits

This policy adjustment has a huge change that was not mentioned in the “Draft for Comment,” but was surprising like thunder in the preparation explanation attached to it.

The preparation explanation for the “Draft for Comment” stated:

“Set the credit assessment ratio for new energy vehicles for the years 2024 to 2025 as 28% and 38%.“

This credit assessment ratio requirement is probably beyond everyone’s expectations.Since the dual credit system was introduced in 2017, the proportion of new energy vehicle credits has been required to increase at a rate of 2 percentage points per year, with the specific proportions for 2019, 2020, 2021, 2022, and 2023 being 10%, 12%, 14%, 16%, and 18%, respectively.

However, according to the “draft opinion”, the proportion requirements for the three years of 2023, 2024, and 2025 have been increased by 10 percentage points, far exceeding expectations. Nevertheless, such an increase is reasonable.

The initial expectation of the dual credit system was that new energy vehicles would gradually penetrate the market and account for 20% of the proportion by 2025, thus requiring a gradual increase in credit proportion requirements. However, the popularity of new energy vehicles is not linear, but rather experienced a rapid growth after passing the early adopter stage.

The sales of new energy vehicles in 2021 increased by nearly 1.6 times compared with 2020. The proportion of new energy passenger cars in the overall market has reached 15.5%.

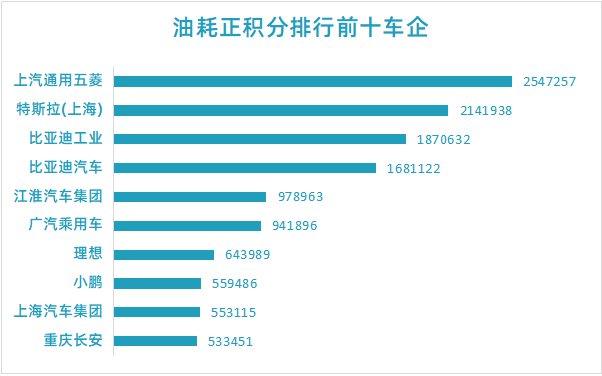

The surge in new energy vehicles resulted in a huge positive credit explosion for passenger vehicle companies in 2021. Not only the whole industry has a positive credit record of up to 6.79 million points for new energy vehicles, but also there has been a historical high of 15.94 million points for positive fuel consumption credits.

Due to the excessive output of positive credits, the price trend for new energy positive credits on the credit trading market in 2021 is expected to be low, possibly approaching the “bargain price” of 2019, i.e., around RMB 100.

Moreover, the development momentum of new energy vehicles is not decreasing and is likely to maintain a high growth rate in the coming years. Therefore, an upward adjustment of the proportion requirement for new energy vehicle credits is necessary, not only to better reflect reality but also to suppress the supply of positive credits for new energy vehicles.

The increase in the proportion of new energy vehicle credits to 28% and 38% in 2024 and 2025, respectively, means that the entire industry will need 7 million and 9.5 million credits, assuming that the total passenger car sales in China reach 25 million. According to the current average of 2.5 points per new energy passenger car, it only requires the production of 2.8 million and 3.8 million new energy passenger cars in 2024 and 2025, respectively.“`markdown

Due to the fact that there were already 3.33 million new energy passenger vehicles in China in 2021, if the current point-based calculation method is still used for new energy passenger vehicles, the point requirements for 2024 and 2025 will have no constraints at all.

Therefore, other measures need to be taken to avoid a large production of positive points.

Continuing Reduction of Standard Vehicle Points

Another major measure is to update the calculation method for new energy vehicles and reduce the score that a single vehicle can earn.

According to the “Opinion Draft”, the overall framework of the new energy passenger vehicle point calculation method is the same as the previous version, but the accounting factors have been changed.

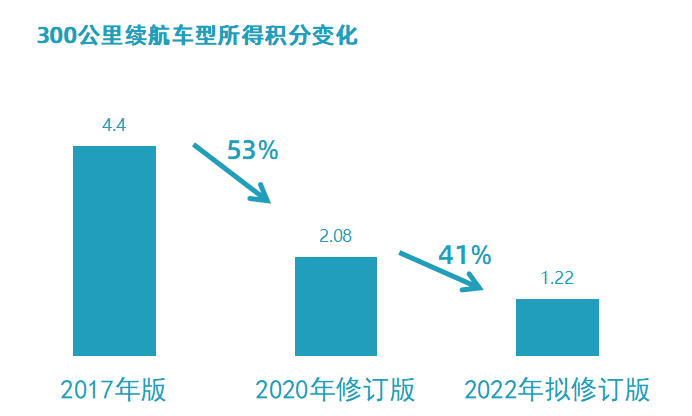

The guidelines for the preparation of the “Opinion Draft” explicitly states that “from 2024 to 2025, the standard vehicle model score for new energy passenger vehicles will be lowered by about 40% compared to the previous stage (which is basically the same as the 32% to 52% decrease from 2021 to 2023)”.

Taking a vehicle with a range of 300 kilometers, battery energy density and energy consumption coefficient both equal to 1, as an example, after three adjustments to the point calculation formula, its score is:

In 2021, the average range of China’s pure electric passenger vehicles was 395 kilometers, and it is expected to remain stable in the coming years. Adding plug-in hybrid vehicles, we preliminarily estimate that one new energy passenger vehicle can earn 1.4 points on average in both 2024 and 2025.

Based on the point ratios mentioned earlier in 2024 and 2025, the entire industry will need 7 million points and 9.5 million points, respectively.

Based on the calculation that one new energy passenger vehicle can earn 1.4 points on average, 5 million new energy passenger vehicles and 6.79 million new energy passenger vehicles need to be produced in 2024 and 2025, respectively.

Based on the base of 3.33 million new energy passenger vehicles in 2021, it is still easy to achieve the overall estimation targets for 2024 and 2025, with an annual growth rate of less than 15% to achieve the 2024 target, and an annual growth rate of less than 20% for the 2025 target.

Points Can be “Saved” to Adjust Supply and Demand

Policies are always trying to catch up with changes, especially the growth rate of new energy vehicles, which was lower than expected in 2019 and exceeded expectations in 2021.

“`For the proportion of anchored new energy vehicle credits, sometimes it is too high and sometimes it is too low, resulting in a shortage or oversupply of new energy vehicle credits.

In the 2021 credit market, there has been an oversupply of credits. The industry estimated that about 2 million new energy vehicle credits need to be purchased, but the total supply is about 6 million, three times the demand. Therefore, the expected price of positive credits in 2021 is only a few hundred yuan, compared with the over 2,000 yuan in 2020.

This is undoubtedly detrimental to the return on investment of leading new energy passenger car companies, damaging their enthusiasm.

To cope with this situation, the draft opinion has considered industry suggestions and proposed the establishment of a credit pool system.

The credit pool system is like a bank where you can store credits when you don’t need them and withdraw them when you do.

However, storing and withdrawing are not arbitrary.

According to the draft opinion, “banks” will be opened when the ratio of available new energy vehicle positive credits for trading to compensable negative credits exceeds 2:1 (called the supply and demand ratio) in a given year. Car companies can store credits in the “bank”. When the supply and demand ratio falls below 1.5:1, the “bank” is also opened and car companies can withdraw credits to sell to their peers.

In addition, there are limits to storage and withdrawal.

The proportion of storage cannot exceed 40% of a car company’s positive credits for the year.

As for how much credits can be withdrawn, it depends on the “bank”. The “bank” can only release some of the credits. When the released credits plus the credits available for trading reach a supply and demand ratio of 1.5:1, no more credits can be released. The proportion that a car company can withdraw is also the percentage of the total released credits they own.

For example, if the “bank” releases 20% of the credits that year and a car company stores 10,000 credits in the “bank”, they can only withdraw 2,000 credits for trading.

If the car company fails to trade the withdrawn credits in the given year, they can store it back in the “bank”.

Although storing credits in the “bank” does not generate interest, it can maintain their value. There are proportion requirements for carrying over previously owned credits, but storing them in the “bank” will maintain the total amount for up to five years.

This policy design will help smooth out the supply and demand fluctuations of credits and maintain the prices of new energy vehicle positive credits.

For example, car companies can store credits in a year of oversupply and sell them for a better price when there is a shortage.

Interestingly, the policy makers have a price expectation for new energy vehicle credits.

Policy makers believe that when the supply and demand ratio is 1.5:1, the price of credits is similar to their value.

Based on the supply and demand situation of credits in recent years, it can be speculated that the expected value of credits in policymakers’ minds is around 1,500 yuan. If the credit pool policy takes effect, new energy passenger car companies can calculate their return on investment based on this from 2023 to 2025.

Joint venture car companies will be severely impacted.It is not difficult for the entire industry to achieve the new points requirements by 2024 and 2025, but for car companies that are not actively engaged in new energy vehicles, it could be a disaster.

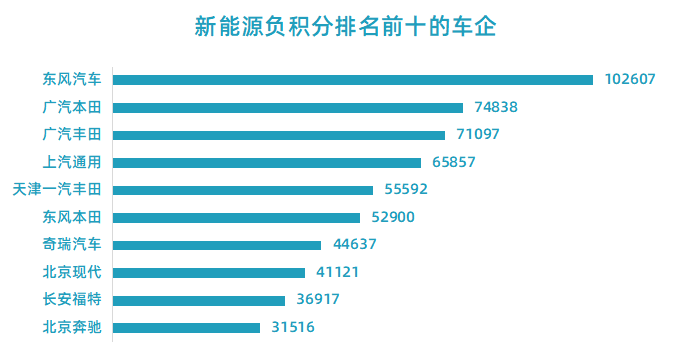

First and foremost are the joint venture car companies, which have been lying on the abundant market share and profits of traditional fuel vehicles without making sufficient investment in new energy vehicles. As a result, they are being overtaken by independent brands and new car-making forces, and will face a survival crisis in subsequent dual points compliance.

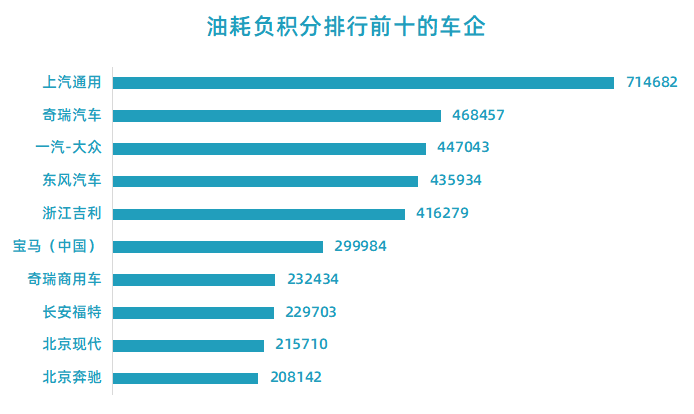

Looking at the situation of dual points in 2021, among the car companies with the highest negative points in new energy, all except Dongfeng and Chery are joint venture car companies. Moreover, Chery Automobile has a large output of positive points from its subsidiary Chery New Energy.

The distribution of car companies with negative points on fuel consumption is also similar.

In particular, in 2021, the proportion of new energy vehicle points requirement is 14%, and by 2024 and 2025, the negative points of these joint venture car companies in new energy will increase even more dramatically. Even Toyota and Honda, which are performing well in fuel consumption with their push for small displacement and hybrid vehicles, will face huge compliance costs because they are not selling enough new energy vehicles.

Among joint venture car companies, only BMW and Volkswagen are slightly better off, both of which are actively promoting new energy vehicle products.

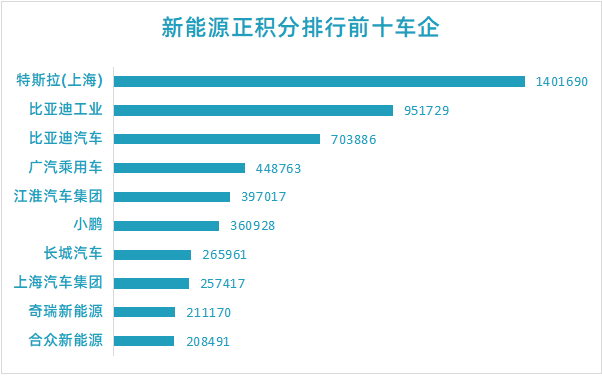

The winners are of course the car companies leading in new energy vehicles, including BYD, Tesla, new car-making forces, and some independent brands.

For example, BYD had nearly 1.66 million new energy positive points in 2021. Assuming that the company could also have this many positive points in 2023-2025 and that the price of new energy positive points is around 1,500 yuan as expected by the regulatory authorities, BYD could earn 2.49 billion yuan per year through points trading. Tesla’s size is similar.

By 2024 and 2025, joint venture car companies will be unable to keep up on the new energy vehicle playing field, and will be mostly eliminated, further weakening their advantages in the traditional fuel vehicle field.With the help of new energy vehicles, independent brands and new car-making forces will gain a comprehensive lead in various technological fields.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.