Writing by | Leng Zelin

Editing by | Wang Pan

On July 4, at the Huawei Summer New Product Launch, the previously highly anticipated Wanjie M7, which had been regarded as having the same level of comfort as a million-dollar luxury car by Yu Chengdong, CEO of Huawei Terminal BG and CEO of Intelligent Automotive Solutions BU, was finally released.

According to official data, the M7, which opened for pre-sale, received more than 20,000 orders within 2 hours and broke through 40,000 orders within 4 hours. In contrast, the sales performance of ARCFOX, a partner of Huawei, has been far from satisfactory.

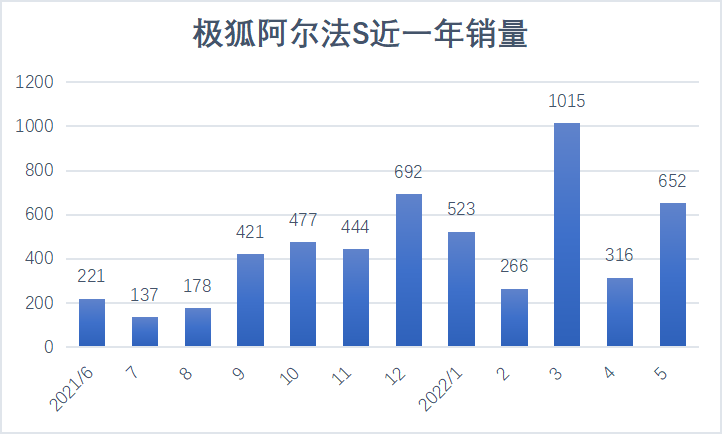

According to data from the China Automobile Circulation Association, the ARCFOX Alfa S only broke through four digits in sales in March this year. In comparison with Wanjie, one is performing excellently while the other is struggling.

Of course, this is also related to the fact that the ARCFOX Alfa S HI version has not yet been launched. From last year’s stunning debut at the Shanghai Auto Show to the actual official launch, the ARCFOX Alfa S HI version took more than a year, during which there were many “postponements”. Even if it is launched, large-scale deliveries can only be expected in September.

How many consumers can be impressed by a car that has been on sale for more than a year and still cannot be equipped with fully automated driving in the short term? At least, the order volume revealed by Wang Qiufeng, vice president of ARCFOX Automobile, last May was only “over a thousand”.

However, what is worth considering is that Huawei has shown unprecedented enthusiasm for the Wanjie.

Yu Chengdong said at the Wanjie M7 launch event, “Our two teams (Huawei and Xiaokang) have created a hundred-year miracle in the automotive industry,” referring to the one-year period in which Wanjie continuously “developed” two models, the M5 and M7.

The different performance of Wanjie and ARCFOX behind the scenes is actually the two main paths for Huawei to enter the automotive field, namely the HI mode and the Huawei Smart Selection mode.

Two steps into the same river

There has always been a division within Huawei between the “car-making faction” and the “non-car-making faction”, with Yu Chengdong being the former and almost everyone else being the latter.

Xu Zhijun, the rotating chairman of Huawei, said at the 2021 Huawei Technology Conference, “Our old Yu (Yu Chengdong) is not convinced, but he only has one vote. As the head of the consumer business, Yu Chengdong wanted to make cars from the perspective of the Consumer BG.”

Xu Zhijun is an important figure who initiated Huawei’s entry into the automotive field. As early as the 2019 Shanghai Auto Show, Xu announced Huawei’s automotive business news.At that time, Xu Zhijun shared three directions for Huawei’s entry into the automotive industry. The first is to build the MDC intelligent driving platform, including the sensor ecosystem, intelligent driving application ecosystem, and the standardization of MDC interfaces. The second is to build the intelligent cockpit platform based on Huawei’s HarmonyOS and existing intelligent terminals. The third is to build a whole vehicle control operating system based on MCU and form an intelligent electric vehicle platform.

It is not difficult to see that these three aspects correspond to Huawei’s HI mode “prototype” and the parts supplier mode, instead of the Huawei Smart Selection mode that Yu Chengdong now holds high.

Soon, Ren Zhengfei issued the first organizational change document about Huawei’s automotive business, and the Huawei Intelligent Automotive Solution BU was officially established with Wang Jun as the president. Wang Jun’s reporting object was Xu Zhijun, who was in charge of the ICT management committee.

There are two major business management committees within Huawei, namely the ICT infrastructure business management committee and the consumer business management committee, which are responsible for business strategy, operational management, and customer satisfaction.

From Huawei’s organizational structure in 2019, it can be simply understood that the former is responsible for the To B business, and the latter is responsible for the To C business. Placing the intelligent automotive solution BU under the B-end business seems to further dispel external concerns about “Huawei making cars.”

At that time, Xu Zhijun and Wang Jun were the main figures in cooperation with partners such as BAIC and Changan. Yu Chengdong, who was the CEO of the Consumer BG (later renamed Terminal BG), actively promoted another line–HUAWEI HiCar.

In August 2019, at Huawei’s developer conference, Huawei introduced a mobile phone mapping system HUAWEI HiCar solution, similar to Apple Carplay, to the industry.

At the Huawei Spring New Product Launch Conference the following year, Huawei already had over 30 HiCar ecosystem partners, and Yu Chengdong also personally demonstrated new HiCar technologies. In addition to simple mobile phone mapping, it also supports using a Huawei phone as a car key and connecting to in-car cameras.

Apple, on the other hand, did not have a car manufacturer capable of using an iPhone as a digital car key until two months later at its global developer conference with BMW.

However, Huawei’s approach always makes people feel somewhat “disconnected.” On the one hand, Xu Zhijun and Wang Jun appeared at the pre-sale launch event for the GeometryAuto Alpha T with extremefox. On the other hand, Yu Chengdong took the stage with HiCar, 5G, NFC, and other technologies at the BYD Han EV conference.Although Huawei entered the automotive industry faster than Apple, which entered the market only in 2014, due to well-known reasons, the two companies are in completely different states in their core smartphone businesses. In 2019, Huawei’s consumer business had a year-on-year growth rate of 34%, but in 2020, it quickly dropped to 3.3%.

Shortly after the Han EV press conference, Yu Chengdong admitted Huawei’s dilemma of chip shortage. This means that Apple has lost a major competitor in the high-end smartphone market, and naturally, Apple’s smartphones will sell more and more, while Huawei’s inventory of smartphones will inevitably face a declining trend. Furthermore, whether to adopt Carplay, Carlife, or HiCar for the HiCar mode based on smartphones is subject to both the automaker’s support and consumer’s preference.

Yu Chengdong is naturally eager to “break the deadlock”. Notably, in the second half of 2020, models from BYD, Roewe, and other automakers entered some of Huawei’s experience stores, not for sale, but for showcasing car connectivity scenes. It seems that this may be a foreshadowing of Yu Chengdong’s Huawei smart selection mode.

Later, Huawei HiCar became more like a doorstep for Yu Chengdong to enter the automotive industry. According to TechPlanet’s report, Huawei first cooperated with Yika Tong under Geely through HiCar. Thereafter, Huawei turned to promote its self-developed Harmony OS intelligent cockpit project.

However, having two “commanders” for one army is a taboo for Ren Zhengfei, who has a military background. Therefore, at the end of that year, Ren Zhengfei signed a second document that affects the direction of Huawei’s automotive business, which stated, “Anyone who interferes with the company and advises on car manufacturing will be transferred to a new post or find a new job.”

In fact, in addition to Huawei’s claim that avoiding conflict of interest in the European market was the reason for not entering the automotive manufacturing industry, the cold winter of new energy in 2019 and the overall environment of 2020 were also important factors. Only a few of the more than 200 new players in the market could survive, and even the top player Weidai was almost facing bankruptcy at that time. Therefore, Huawei’s cautious approach towards entering the automotive manufacturing industry may not necessarily be a bad thing.

In this organizational restructuring, Ren Zhengfei not only criticized Yu Chengdong, clarified Huawei’s direction, but also gave him some encouragement.

Transfer the business jurisdiction of the Intelligent Car Solution BU from the ICT Business Management Committee to the Consumer Business Management Committee. At the same time, restructure the Consumer BG IRB to the Intelligent Terminal and Intelligent Car Parts IRB, and adjust the investment decision and portfolio management of the Intelligent Car Parts Business from the ICT IRB to the Intelligent Terminal and Intelligent Car Parts IRB. Mr. Richard Yu was appointed as the director of the Intelligent Terminal and Intelligent Car Parts IRB.

Transfer the business jurisdiction of the Intelligent Car Solution BU from the ICT Business Management Committee to the Consumer Business Management Committee. At the same time, restructure the Consumer BG IRB to the Intelligent Terminal and Intelligent Car Parts IRB, and adjust the investment decision and portfolio management of the Intelligent Car Parts Business from the ICT IRB to the Intelligent Terminal and Intelligent Car Parts IRB. Mr. Richard Yu was appointed as the director of the Intelligent Terminal and Intelligent Car Parts IRB.

In simple terms, the plan is to consolidate the automobile business into a single unit and have Richard Yu oversee it. Obviously, in order to achieve maximum effectiveness, the two unique martial arts schools of “Kuihua Book” must combine into one.

However, the “three-year deadline” in this document also became a topic of discussion in the future.

Although the organizational restructuring has achieved a unified form for the automobile business within Huawei, there are still “two Huaweis” that appeared at the Shanghai Auto Show in 2021.

On one hand, Wang Jun and Liu Yu, the chairman of BAIC Blue Valley, announced the price of the Alpha S Huawei HI Edition; on the other hand, Richard Yu released the first product of Huawei Select in its flagship store on Nanjing East Road, the Cyrus SF5.

This has basically established the two important routes that Huawei takes in the automobile field today, so there is inevitably competition between the two in business.

According to Huxiu’s report, “due to the fact that the MDC department, where the LiDAR team is located, and the ADS department, which provides a full solution for BAIC’s Alpha S, are two departments under Huawei’s Autonomous Driving BU. Therefore, there is competition as to which LiDAR system the Alpha S should use.”

So in the second half of last year, Huawei’s automotive business underwent a third major restructuring. Wang Jun, the former CEO of the Car BU, was appointed as the BU COO and concurrently served as the president of the Intelligent Driving Solution Product Line. Bian Honglin was appointed as the Car BU CTO and R&D Management Department Head. Richard Yu was appointed as the CEO of the Car BU and reported directly to the former two.

Perhaps due to a lack of energy, Richard Yu appeared at only one event since taking up the position of Huawei Car BU CEO, which was the HI edition launch for Alpha S in May of this year.

At the press conference, Richard Yu did not hesitate to use adjectives such as “million-level”, “high-end”, and “luxury”. He even drew sarcastic comments from the CEOs of XPeng Motors and WEY. However, he appeared much more subdued at the Alpha S press conference, showing a different attitude towards the two automakers.

Richard Yu once stated: “In the HI cooperation model, the Alpha S is the operating body, and Huawei provides assistance. The retail of this car may be sold by Huawei in part, but the main sales network and sales system are still BAIC’s, and Huawei only provides some retail stores.”# Huawei’s Auto-Driving Capability

Despite constantly promoting its robust auto-driving capability, Huawei has deliberately avoided mentioning this feature on its Smart Selection models. For example, during the M7 launch event, Yu Chengdong only stated that it is “sufficient”, but did not provide any further information.

Beijing Auto’s Arcfox is the first partner of Huawei’s Smart Selection, its solution brand HI. Changan and Guangzhou Auto were later added, and there are currently three partners.

Wang Jun, Director of the Board and President of the Smart Car Solutions Business Unit, mentioned that the HI solution’s partner list will not be expanded for the time being, as the investment in autonomous driving solutions is very significant.

Su Jing, former president of Huawei’s intelligent driving unit, also stated, “The Arcfox is our first deeply cooperative vehicle, which should have been developed for about three years, and there were many problems with the first generation. You can assume that a lot of subsequent iterations will be imported in about 24 months, and it may be difficult to do it any shorter.”

It took over a year for Arcfox Alpha S HI version to be officially released from its debut, and there were rumors of “incompatibility” from time to time.

Perhaps it was because Yu Chengdong did not invest enough time and effort in this mode, or because it was time-consuming and difficult to replicate on a large scale. However, from the Siles SF5, the Wanjie M5 to the M7, Huawei launched three vehicles in less than two years, and even changed the brand name, showing Yu Chengdong’s eagerness.

Fortunately, the sales of the Wanjie also gave Yu Chengdong a response. Selling over 7000 units in a single month showcased Huawei’s ability to build brands while revitalizing numerous offline stores. According to a dealer in a coastal city who spoke to Photon Travel, he can receive nearly 20,000 yuan in commission for selling an SF5.

However, it remains unclear whether Huawei’s launch of the Wanjie was focusing on the automobile industry or questioning its own boundaries. With over three years having passed already, how far is Huawei from becoming a car manufacturer?

In Huawei’s latest annual report, there has been a significant change in business structure: the Consumer BG has been revamped into the End Consumer BG, with the main board increasing from six to eight sections. Two first-level departments were added, namely HiSilicon and Digital Energy.

It is worth mentioning that other than the ICT infrastructure business segment, the remaining five departments are all related to automobiles. The End Consumer BG is responsible for smart selection services. Huawei Cloud provides HMS for Car, Digital Energy offers charging piles, and the Smart Car Solutions Business Unit is responsible for the HI mode. HiSilicon provides chips for Huawei MDC.

Thus, the departments related to automobile business have been given prominent positions.With Huawei’s deepening understanding of the automotive industry, its business capabilities are gradually strengthening. From initially “suffering a defeat” with the Seres SF5, to transforming it into the best-selling Wajie M5, to the heated discussion of the possible development of the M7 based on Dongfeng Fengguang ix7, which even overshadowed the recently released NIO ES7 and Ideal L9.

Huawei’s control of the automotive market becomes increasingly skilled, and the product capabilities are not inferior to those of new challengers. However, this is also the problem. If Huawei can turn a car lacking in advanced driver assistance systems software and hardware into a best-seller, even a self-made car for sale does not seem to be a difficult task.

With the intensification of competition in the new energy market, technology companies such as Xiaomi, Baidu, and traditional car manufacturers undergoing transformation, and new challengers developing fully self-developed capabilities. Huawei Intelligent Selection’s sales, which were boosted in the short term by channels, marketing, and user conversion, may be surpassed by rivals with more powerful resources.

In addition, the automatic driving capabilities of the HI mode may not necessarily surpass those of mainstream car manufacturers with higher sales volume and more collected data. At that time, Huawei Intelligent Selection and the HI mode would certainly have to take a path, and ultimately sales might be the best criterion to determine the way forward.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.