Author: Zhu Yulong

Yesterday I was on a business trip and finally took a small step forward.

NIO Power Day has been held for the second year, and I think it’s still very interesting. My observations are as follows:

-

The total number of NIO Power battery swap stations has officially exceeded 1,000, and the number of charging stations has also reached 1,681 (with 9,603 charging piles), and the strategy of focusing on battery swapping as the main energy supply and charging as auxiliary in the two energy replenishment scenarios is being developed (with battery swapping accounting for 52.3%, home charging piles accounting for 24.2%, on-the-go charging accounting for 11.4%, and one-click charging accounting for 0.9%).

-

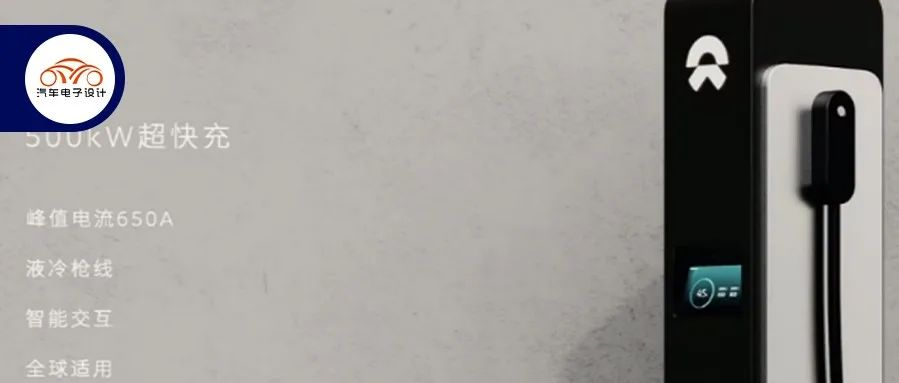

In the previous scenario, fast charging accounted for approximately 10%, but with the emergence of 500 kW ultra-fast charging, the strategy has been adjusted overall. Considering the limited power supply load, it is valuable to combine battery swapping stations and charging operations, especially with the advent of the 800V era.

-

The total number of battery allocations for the 1,011 battery swap stations is 3,821 for the long-range version and 5,140 for the standard-range version, totaling 8,961 batteries. In other words, each battery swap station has approximately 9 batteries as backups, and this number may be further adjusted with the launch of the third-generation battery swap stations.

I personally think that in the future, NIO Power will gradually accelerate from serving NIO to serving other new energy vehicles in China.

NIO Power’s Energy Supplement System Planning

NIO Power’s energy supplement system is focused on battery swapping, and currently operates 1,011 battery swap stations (including 205 high-speed battery swap stations that cover the high-speed battery swap network of the five vertical and three horizontal and four major city clusters), as well as 1,681 charging stations (with 9,603 charging piles). Over 80% of the charging volume serves non-NIO brands. By 2025, NIO will build over 4,000 battery swap stations (3,000 in China and 1,000 overseas) and aims to fully cover the high-speed battery swap network of the nine vertical, nine horizontal and 19 major city clusters. This foundation remains unchanged.

I think that as the number of users increases and the difference between electricity and oil prices widens, we should pay attention to the overall service cost of the charging and battery swapping facilities. Similar to the overall cost reduction of distributed photovoltaic power generation systems, NIO Power can make money in this business as China’s electric vehicle ownership grows rapidly and the audience for charging services expands.

# The Logic of Fast Charging

# The Logic of Fast Charging

With fast-changing stations and 500 kW super-fast charging, this is definitely a perfect match. The 500 kW fast charging pile can achieve peak current of 650A, using liquid-cooled snatch wire design, including intelligent interaction, compatible with global standards, diverse payment methods, and will be deployed by the end of 2022, which will also form a chemical reaction with 800V models like the G9.

The third-generation battery exchange station supports multiple types of batteries and is configured with 500 kW supercharging stations to achieve supercharging and battery exchange stations. With the 800V high-voltage platform battery pack and supporting battery exchange system, the complexity of this system has increased. The total number of battery ratios for 1011 battery exchange stations is: 3821 for long-range level and 5140 for standard range level, for a total of 8961. It can be seen that 75 kWh is enough for battery exchange at present, and the penetration rate of battery exchange is about 75%, with a total exchange time of about 11 minutes.

The United States Department of Energy (DOE) has a clear definition of eXtreme Fast Charging (XFC), which is that the power battery specific energy density is ≥200Wh/kg, the charging pile power is ≥400 kW, and the SOC of the vehicle battery can be charged to 80% within 10 minutes, adding more than 55 degrees of electricity or more than 322 kilometers of vehicle range (average charging rate of 6C or higher); and XFC has been identified as a key challenge to be overcome in order to widely adopt electric vehicles, and shortening the fast charging time of electric vehicles from 0 to 80% SOC to within 15 minutes by 2023.

It can be said that companies that can do well in this area still have strong technological capabilities. Currently, the main companies in China that have officially demonstrated this kind of ability include CATL (Kirin Battery), Fudi (E3 Fast Charging Battery), Hiven (2C and 4C Battery), and Giant Wave Technology (3C and 6C Battery).

The demand for this fast charging is also driving the layout of distributed energy systems, and is also supporting the interaction between electric vehicles, battery exchange stations, and power grids, digesting excess wind and solar energy from the power grid, and even transmitting electricity to the power grid during periods of peak electricity consumption, with great potential for development.Summary: With the rapid growth of electric vehicle ownership, the charging industry is addressing the challenges of charging and energy supplementation. High-power charging is shortening the charging time, meeting the demand for “plug and play” for consumers, a consensus between charging stations and vehicles. Third-party integrated and managed operation models for charging stations in residential areas are solving the installation difficulties of home charging in communities. Based on this, digitization, intelligence, and networking empower the operation of charging stations, improving the energy supplementation experience for consumers and enhancing the operational efficiency of enterprises. In terms of 800V, the core competitiveness is still competing with a complete set of solutions.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.