Author | Lingfang Wang

Editor | Kaijun Qiu

In May, an online bankruptcy equity auction lasting six days attracted nearly one million viewers.

The process was long and exciting; 21 buyers bid 3448 times for the equity of a company with a special type of lithium mine, and it finally sold for 2 billion yuan, nearly 600 times the starting price of 3.35 million yuan.

This auction also brought another company, Xinjiang TBEA Co., Ltd., back into people’s view. Although the parties have not yet confirmed this, public reports have shown that Xinjiang TBEA has acquired most of the debt and some of the equity of the lithium mine enterprise that was auctioned.

This is a layout at the uppermost end of the new energy vehicle industry chain for Xinjiang TBEA.

They have also established a battery positive material company, Sichuan Hengxin New Energy Technology Center.

Moreover, although Xinjiang TBEA has not yet entered into cell production, it has independently designed battery packs and commissioned processing.

Additionally, Xinjiang TBEA is trying to enter the field of customized car design and has reached cooperation with other car enterprises.

Furthermore, in the field of power battery operation for electric vehicles, listed company Xinjiang TBEA Energy Technology Co., Ltd. established a mobile energy business department, making a big push into the field of power battery and related businesses.

Finally, Xinjiang TBEA has also entered the field of battery recycling and utilization.

Therefore, Xinjiang TBEA’s layout in the new energy vehicle industry has already formed a “chain.” Combining this with Xinjiang TBEA’s existing photovoltaic, power generation, electricity sales, and energy storage, the ecological layout of “energy + transportation” is becoming increasingly apparent.

This is not the first time Xinjiang TBEA has encountered the new energy vehicle industry.

As early as 7-8 years ago, Xinjiang TBEA attempted to cut into the industry through time sharing leases, charging, batteries, and even new energy vehicles, but it was only a preliminary attempt.

In addition, in recent years, due to factors such as the subsidy reduction for photovoltaics, Xinjiang TBEA has entered into a period of adjustment. However, by the end of 2021, the financial reports of the four major listed companies showed that Xinjiang TBEA’s various business sectors had all improved.

At this time, with Xinjiang TBEA’s vitality restored, it is once again cutting into the new energy vehicle industry from the perspectives of battery swapping, mining, materials, and more.

Let’s review the rise of Xinjiang TBEA and take stock of its practices in the new energy vehicle industry. Then, we will see how it could potentially change the industry.

The Rise of Photovoltaic Giants

Corporate style often reflects the personality of the founder.

Xinjiang TBEA’s founder, Gongsan Zhu, was born in February 1958 in Donggou Town, Funing County, Jiangsu Province.

Before starting his own business, he held many different jobs.

In 1990, Gongsan Zhu resigned from his post as the factory director of Jiangsu Yancheng Light Industry Bureau’s automated complete-equipment factory and started his own business. He founded Shanghai Xiecheng Electric Appliance Complete Equipment Factory in Shanghai. In 1999, Xinjiang TBEA (Group) Holding Co., Ltd. was established in Hong Kong, and Gongsan Zhu took this as an opportunity to seek new breakthroughs.

The first project Gongsan Zhu saw potential in was power generation.

In 1996, Gongsan Zhu established the first power plant, Taicang Xinjiang TBEA Property Rich Thermal Power Co., Ltd.This power plant was later co-invested by Zhu Gongshan and Hong Kong NHK Investment Limited. The latter’s controlling shareholder is “Hong Kong Ronggao Trading Co., Ltd.,” a wholly-owned subsidiary of the Poly Group, which is also the origin of the name “Polysilicon Xin”.

At the time Zhu Gongshan started the power plant, there was a relative surplus of electricity supply, and many places could not sell electricity. His thermal power plant project was also forced to stop due to funding problems, but it survived with the help of NHK.

After receiving some breathing room, Zhu Gongshan quickly established industrial supporting power plants in Jiangsu and Zhejiang, focusing on environmental renewable energy such as waste-to-energy and biomass power plants. Within 10 years, he established more than 20 power plants. In this way, in the five major electricity groups, Xin’s Group led by Zhu Gongshan became the leader of China’s private enterprise power generation.

Zhu Gongshan’s second transformation—photovoltaic industry.

After 2005, the new energy industry gradually became a new trend in the global energy industry, and Zhu Gongshan began to lead the company in transformation.

In 2006, Zhu Gongshan used technology to promote the development of the energy industry, and began to enter the upstream of the photovoltaic industry, the highest barrier to entry—the polycrystalline silicon raw material industry. In the next five years, he developed into the leader of the global polycrystalline silicon and silicon wafer industry. At that time, the competition in the downstream battery and component section of the photovoltaic industry chain was already fierce, but the upstream raw materials still relied on imports. Zhu Gongshan overcame objections and decided to enter the polycrystalline silicon project, and relocated the project to Xuzhou. At the same time, he leveraged to expand its scale to thousands of tons level.

In March 2006, Zhu Gongshan invested 7 billion yuan to establish Jiangsu Zhongneng Silicon Industry Technology Development Co., Ltd. (hereinafter referred to as “Jiangsu Zhongneng”) in Xuzhou. On September 19, 2007, the first batch of 12 polycrystalline silicon products from Zhongneng Silicon Industry were successfully produced.

At that time, the 15-month production time created a construction speed record for similar projects worldwide, and also allowed Xin’s Group to hit the window of exploding demand in the European photovoltaic market, earning a full pot of money.

In 2008, the global photovoltaic industry was severely hit by the financial crisis. But Zhu Gongshan once again initiated counter-cyclic expansion, and the third phase of Zhongneng Silicon Industry project was launched.

In December 2008, the third phase of Zhongneng project was put into operation, and its overall capacity reached 18,000 tons, which accounted for half of the national polycrystalline silicon supply that year.

In June 2009, Xin’s Technology acquired 100% equity of Zhongneng Silicon Industry for HKD 26.35 billion.

Massive expansion requires massive capital. Luckily, Xinjiang Goldwind Science & Technology Co., Ltd. is one of the wealthiest enterprises in the photovoltaic industry. In November 2009, China Investment Corporation (CIC), the sovereign wealth fund of China, invested HKD 5.5 billion to acquire a 20% stake in Xinjiang Goldwind, becoming its second largest shareholder.

CIC’s investment not only improved Xinjiang Goldwind’s financial situation and reduced its debt burden, it also provided an opportunity for Zhugongshan to develop solar power stations. Xinjiang Goldwind’s first power station was a 20 MW power station in Xuzhou, Jiangsu in 2009, which was the largest in Asia at that time. In 2010, Xinjiang Goldwind was able to enter two photovoltaic projects in the United States, which are fully supplied with components produced by Xinjiang Goldwind.

In addition, in the first half of 2010, Xinjiang Goldwind was granted a RMB 10 billion credit line from the Bank of China. With abundant financial support, Xinjiang Goldwind was able to rapidly expand its production capacity.

In 2013, Xinjiang Goldwind surpassed foreign giants such as Hemlock and Wacker Chemie AG, becoming the world’s largest producer of polycrystalline silicon.

Thus, the private power giant transformed into the polycrystalline silicon industry leader.

However, the rapid rise of the Chinese photovoltaic industry in Europe and America drew the attention of local governments.

In October 2012, Europe and the United States jointly lifted their “double reverse” butcher’s knives, leaving Chinese photovoltaic companies in a difficult situation with over 300 companies closing down.

At this time, China’s photovoltaic industry ushered in a round of shuffling.

Xinjiang Goldwind once again survived the industry recession.

In 2014, to counter Europe and the United States’ “double reverse”, the National Development and Reform Commission began to introduce various subsidies to boost the development of the domestic photovoltaic industry.

With high subsidy expectations, private photovoltaic companies began operating at high debt levels, and photovoltaic power stations were built everywhere. Xinjiang Goldwind re-entered a period of rapid development.

At this time, the new energy vehicle industry was also advancing rapidly thanks to government incentives.

Xinjiang Goldwind, which has a wealth of experience, joined this wave of expansion, and began to explore new energy vehicle sharing and charging businesses.

Unfortunately, changes in the government’s execution of new energy vehicle subsidies were too drastic.

In 2016, the new energy vehicle subsidy scandal erupted, and many companies in the industry were fined. Although the subsidy was not completely cancelled, the payment speed became slow, and the audit conditions became more stringent. The new energy vehicle industry experienced a brief winter.

At this time, the chaotic development of the photovoltaic industry also attracted government attention. On May 31, 2018, the National Development and Reform Commission, the Ministry of Finance, and the National Energy Administration jointly issued a notice on “Issues Related to Photovoltaic Power Generation in 2018”, also known as “Photovoltaic May 31 New Policy”.

The “May 31 New Policy” directly stopped the new investment in ordinary ground solar power stations in 2018, and only arranged for a distributed photovoltaic construction scale of around 10 million kilowatts, further reducing the subsidy for photovoltaic power generation.The electricity generated by the photovoltaic power plants constructed in the early stages under capital-driven policies could not be smoothly absorbed. Photovoltaic companies, which relied on subsidies to survive, entered into a high debt operating era. Ultimately, over 600 local photovoltaic companies went bankrupt.

Meanwhile, with the support of new technologies, monocrystalline silicon rapidly expanded and occupied 90% of the market share, causing the market share of GCL’s polycrystalline silicon wafers to shrink significantly. GCL’s cash flow was tight, and the total liabilities of GCL-Poly, a subsidiary of GCL, remained high in 2017.

Like other companies in the industry, GCL also faced revenue challenges. Starting in 2018, GCL’s revenue declined for three consecutive years. Reducing debt by recycling cash was a natural choice for GCL.

Since 2018, GCL started to turn things around. In 2019, GCL New Energy sold all the shares of a 294 MW photovoltaic power plant to China Huadian. In 2020, GCL sold multiple photovoltaic power plant assets to enterprises such as China Huadian Group and XuZhou Guotou and further pushed forward the sale of other batches of power plants.

From 2019 to 2020, the photovoltaic industry gradually recovered, and with the implementation of climate agreements and policies such as “carbon neutrality and peak carbon emissions,” photovoltaic power generation continued to expand in scale. By means of its own strategic layout, GCL Group gradually overcame its difficulties. Insiders revealed that the net profit of GCL’s related businesses is currently about 1 billion yuan per month. GCL has recovered its vitality.

In the early days, GCL had ambitions for the new energy vehicle industry. In 2015 or earlier, GCL paid attention to the new energy vehicle sharing market. However, since the birth of the sharing industry, it has been unable to address issues such as high operational costs, heavy assets, and long profit cycles. Starting in 2017, Youyou Car, Togo, EZZY, MaGua Car, Zhongguan Shared Car and other sharing car companies have gone bankrupt, and the world’s largest car-sharing brand, car2go, has also withdrawn from the Chinese market due to cost issues. According to insiders, after half a year of experimenting with shareable cars, GCL turned its attention to new energy vehicles.

On July 12, 2017, the Chinese EV100, the National Renewable Energy Center, and the China Renewable Energy Power Grid Integration Research and Collaboration Group jointly held a roundtable meeting on the theme of “Collaborative Development of New Energy and Electric Vehicles.” At this meeting, GCL stated that as an energy company, it tries to connect the entire industry chain from new energy generation, energy storage, to electric vehicles.

However, it now appears that GCL’s experiments on shareable cars, new energy vehicles, and battery planning were all just testing the waters under policy guidance at that time.

After re-entering the market, GCL’s strategic planning is much clearer than its experiments of the past. Starting with its expertise in energy and considering the synergy of the industry, GCL focuses on battery layout with battery swapping as its entry point. Of course, it can also benefit from policy dividends.Since 2020, battery swapping mode has been an important part of the new infrastructure and has been written into the Government Work Report twice during the “two sessions”, causing a surge of interest. Taking advantage of this opportunity, Xinyan Power (a subsidiary of GCL Group) has entered the field.

In March 2021, Xinyan Power released its plan for the battery swapping business, announcing that it will enter the market officially. The specific business directions mainly include integrated battery swapping station solutions, battery swapping station operation and energy services, and graded utilization of batteries. According to the machine investigation reply from Xinyan Power, the company has set a goal for the “14th Five-Year Plan” and aims to build more than 6,000 battery swapping stations, serving over 500,000-600,000 new energy vehicles. The small goal for this year is set at 300 battery swapping stations, serving 30,000 vehicles.

The battery swapping is a high cost-field that requires a significant capital investment, as even each spare battery for a swapping station will use up a lot of funds. Fortunately, Xinyan Power has found the best partner. On March 31, 2021, Xinyan Power and Zhongjin Capital established a 10-billion-yuan carbon neutrality fund to quickly start the layout of mobile energy. The total initial investment amount does not exceed RMB 4.5 billion. Among them, Xinyan Power proposes to subscribe with self-owned funds of no more than RMB 2.25 billion. The remaining funds have been raised by Zhongjin Private Equity for financing intentions. In addition, Xinyan Power also raised funds publicly. In June last year, Xinyan Power announced a RMB 5 billion fixed increase plan that has been implemented with RMB 3.76 billion as of February 2022. The total funds raised are more than RMB 8 billion. According to the feasibility analysis report of the battery swapping station construction project published by Xinyan Power, RMB 3.12 billion can be used to build 407 battery swapping stations which fully covers Xinyan Power’s 2022 plans.

As for the products, Xinyan Power mainly focuses on the research and development of the battery swapping stations and the development of standard battery packs. The battery swapping station developed by Xinyan Power is called the “battery swapping port.” According to Xinyan Power, the battery swapping port has multiple core technological advantages, including hardware embedding, intelligent operation and maintenance technology, and unmanned operation. Xinyan Power’s battery swapping ports are divided into three types, which are commercial vehicle, logistics vehicle, and passenger vehicle, covering all current application scenarios for new energy vehicles.The commercial vehicle dual-channel battery swapping station is compatible with mining trucks, tractor trucks, dump trucks, and sanitation vehicles. The swapping process takes 140 seconds, and the station can provide up to 240 swaps per day per channel. The single-channel station can be configured with 5 or 7 battery packs, while the dual-channel station can be configured with 10 or 14 battery packs. The battery packs are compatible with different types of vehicles, such as mining trucks, tractor trucks, dump trucks, and sanitation vehicles.

The lateral battery swapping station for logistics vehicles developed by Xinxiang Xinchang EV Technology Co., Ltd (XXET) is the first urban distribution battery swapping product in the industry. According to XXET’s data, the whole process of five to six swaps takes 210 seconds, and the station can provide up to 408 swaps per day. The station can store up to 14 battery packs, and it uses intelligent battery control technology to realize precise two-way synchronous swapping. By equipping a liquid cooling system and optimizing the DOD control strategy, the battery lifespan can be extended by 30%, and the battery pack warranty period can exceed 400,000 kilometers.

The passenger vehicle dual-channel battery swapping station takes 80 seconds for a full swap, and the station can provide up to nearly 900 swaps per day. The station can be equipped with 8, 10, 13, or 26 battery packs to be compatible with multiple vehicle models.

Regarding the development of standard battery packs, XXET has completed the development of a standard battery pack for logistics vehicles with a lateral design, in cooperation with several automakers. The battery pack has an energy density of approximately 86 Wh/kg and provides 43 Wh/kg per cell, enabling power battery swapping between different enterprises and vehicle models. For commercial vehicles, XXET has completed the development of a battery pack with 282 Wh/kg energy density, which can currently be matched with over 10 commercial vehicle manufacturers and 4 passenger vehicle manufacturers, as well as over 2 logistics vehicle manufacturers.

In terms of product technology layout, XXET has already achieved a leading position.

Starting from operating vehicles

Currently, the battery swapping mode has a stronger demand in the market for operating vehicles. Due to the higher cost of swapping compared to charging, the low operating frequency of private vehicles, and the lack of swapping models for ordinary consumers, it is difficult for swapping stations for private users to survive.

Therefore, operating vehicles are the first choice for all battery swapping operators, including XXET.

As Xinxiang Xinchang EV Technology Co., Ltd (XXET) has neither vehicles nor battery packs, how can they attract operating vehicles to use their swapping services? XXET’s approach is to either control the source of goods or control the transportation capacity.

Currently, XXET has cooperated with several enterprises including Geely, Foton, Sany, Dongfeng, Huo’s Group, Di Shang Tie, and Kuai Cheng Logistics, etc.

According to an internal source from XXET, they work with the automakers by taking on part of the swapping product R&D costs, acting as the general agent for the vehicle model, establishing a vehicle management company, and using the mode of lease and sale to connect supply and demand and expand the market scale.

Only when vehicles are widely available can battery swapping operations be profitable.

Taking Xuzhou Changshan Station of Xiehe Electromobile Harbor as an example, this is a commercial vehicle swap station with 8 charging compartments for exchanging batteries. Currently, 7 spare batteries are equipped and 1 empty compartment is used to place depleted batteries. A single battery has a capacity of 282 kWh and can be fully charged in one hour. With 24-hour uninterrupted operation, the station can provide approximately 120 battery swap services. Currently, it mainly provides battery swap services for 60 dump trucks. These dump trucks are mainly used to transport the construction waste generated by the Xuzhou Metro project, and their driving routes are relatively fixed. The demand for battery swap is relatively regular and stable every day.

Taking Xuzhou Changshan Station of Xiehe Electromobile Harbor as an example, this is a commercial vehicle swap station with 8 charging compartments for exchanging batteries. Currently, 7 spare batteries are equipped and 1 empty compartment is used to place depleted batteries. A single battery has a capacity of 282 kWh and can be fully charged in one hour. With 24-hour uninterrupted operation, the station can provide approximately 120 battery swap services. Currently, it mainly provides battery swap services for 60 dump trucks. These dump trucks are mainly used to transport the construction waste generated by the Xuzhou Metro project, and their driving routes are relatively fixed. The demand for battery swap is relatively regular and stable every day.

In the heavy truck-short haul scenario, Xiehe uses a joint operating platform that is compatible with the “trailer release” or “bulk-to-set” plan to improve operating efficiency. Taking the short haul project of a coal mine in Ordos City as an example, a vehicle and battery separation financial plan is adopted. The purchase cost of battery-swap versions is equivalent to that of fuel vehicles, which is a 47% reduction compared to the charging version.

In the Jinshaan region, focusing on the middle and lower reaches of the coal industry chain, Xiehe works with local sources of cargo, vehicle leasing companies, and vehicle operators to achieve mutual benefits through optimized transportation plans.

Regarding passenger vehicle swap stations, take the Xiehe Dongguan station as an example. This station comes with 18 batteries and can provide 400 swaps per day. Xiehe’s battery swap fee standard includes battery rental, which is 0.35 yuan/kilometer. Compared to the current conversion rate of 0.7 yuan/kilometer for 92 gasoline, it is half the price.

“In July, there will be 300 brand new battery-swap network vehicles coming online, and 1000 more will be launched within the year.” Said the person in charge of the Dongguan station of Xiehe Electromobile Harbor. “In addition to the already operating 3 stations, we plan to invest in 2 more before July to form a battery-swap network that covers the east-south-west-north-center of Dongguan city. Before June of next year, the second phase will build 15 more stations to cover all the 32 towns and streets in Dongguan city and serve over 2000 network vehicles.”

In this entry, Xiehe made overall arrangements from resources to customers. Xiehe’s advantage in power resources has also been realized.

Synergy from Lithium Mines to Energy End

Battery swap operation includes battery asset management, so focusing only on the energy side is not enough. This is where Xiehe’s participation in bidding for lithium mines comes in.

Establishing a small circulation around batteries

Xiehe has made it clear that it has entered the field of positive electrode materials for batteries.

On September 27, 2021, Xiehe Energy Science and Technology announced that its holding subsidiary, Suzhou Xiehe Hengneng Energy Technology Co., Ltd., and Sichuan Hengxin Dahai Enterprise Management Center (Limited Partnership), and Beijing Oriental Taitai Import and Export Trade Co., Ltd., signed a “Partnership agreement” on September 23 to jointly establish the Sichuan Hengxin New Energy Technology Center (Limited Partnership).For the participation in the establishment of a partnership enterprise, Xinjiang TBEA Co., Ltd. (TBEA) said that this is an important measure to intervene in new energy upstream materials such as battery materials and lithium mines.

Lp of Xinchendahai was taken over by New Hope Group, the second largest shareholder of Snownovo Mining Company, an important lithium mine enterprise in western Sichuan, which has the detailed exploration and prospecting rights of Dechenba Lithium Mine.

In addition, in 2018, the Sichuan Industry Fund also invested in Sichuan Nengtoudingsheng Lithium Industry Co., Ltd.

According to the China Securities Journal, the actual controller of TBEA is still the largest shareholder of Millennial Lithium Corp, a Canadian lithium mining company. Million Surge Holdings Limited, a subsidiary of Zhu Gongshan Family Trust, holds a 12.27% stake in Millennial.

In addition to mineral resources, TBEA is also laying out in the positive pole material field.

On May 13, 2019, TBEA Group signed an investment agreement with Xuzhou Economic and Technological Development Zone on the project of 100,000 tons of lithium battery positive pole materials and lithium energy storage systems. The project mainly produces lithium battery positive pole materials and lithium energy storage systems represented by lithium iron phosphate.

On April 12th of this year, Xinjiang TBNE Co., Ltd. was established. The company is 100% controlled by TBEA, mainly engaged in battery manufacturing, new material technology promotion services, mineral resource reserve estimation and other businesses.

According to people familiar with TBEA, TBEA will also have relevant layout in the negative electrode material and battery recycling fields.

So far, except for cell production, the basic construction of battery production and use cycle has been established.

Synergy between Energy End and Battery Swap

In the energy end, combining clean energy business with battery swap station to integrate green electricity production, storage, movement, and consumption, TBEA can complete the integration of “source-grid-load-storage”.

First, TBEA has more than 20 retail electricity licenses nationwide, which directly reduces the cost of electricity procurement through large-scale procurement of electricity supply for mobile energy swap stations.

Secondly, the clean energy and mobile energy businesses are jointly developed, and TBEA can avoid redundant investment.

Nowadays, whether it is wind power or photovoltaic, renewable energy generation business needs to be equipped with energy storage stations, which is a compulsory policy of the state. The swap station itself reserves about 20% of the standby batteries, which is the energy storage facility. If TBEA wants to produce clean energy and build a mobile energy swap station in the same place, it can avoid redundant investment.Assuming energy storage facilities are installed in clean energy production, there is no need to add standby power sources in the charging and swapping stations, which can also save investment. Additionally, cooperation with existing teams is possible during project development, construction, and operation, and building charging stations relying on existing power plants can reduce input costs such as power access and rent.

Thirdly, the cascade utilization of energy storage batteries or power batteries can achieve low-cost construction of energy storage stations. Mobile energy requires a large number of power batteries, which can be used in energy storage stations after retiring in 3-5 years.

For general power companies to develop energy storage stations, they need to buy batteries. However, for Xinte Energy, battery procurement costs are close to zero, achieving high synergy between clean energy and mobile energy businesses.

Fourthly, energy production and consumption can be connected. Xinte Energy simultaneously develops clean energy and mobile energy businesses, which is equivalent to combining energy production and consumption, enabling self-use and achieving a virtuous cycle.

More Flexible Implementation Model

Compared with other swap modes, Xinte Energy’s approach is more flexible and diverse.

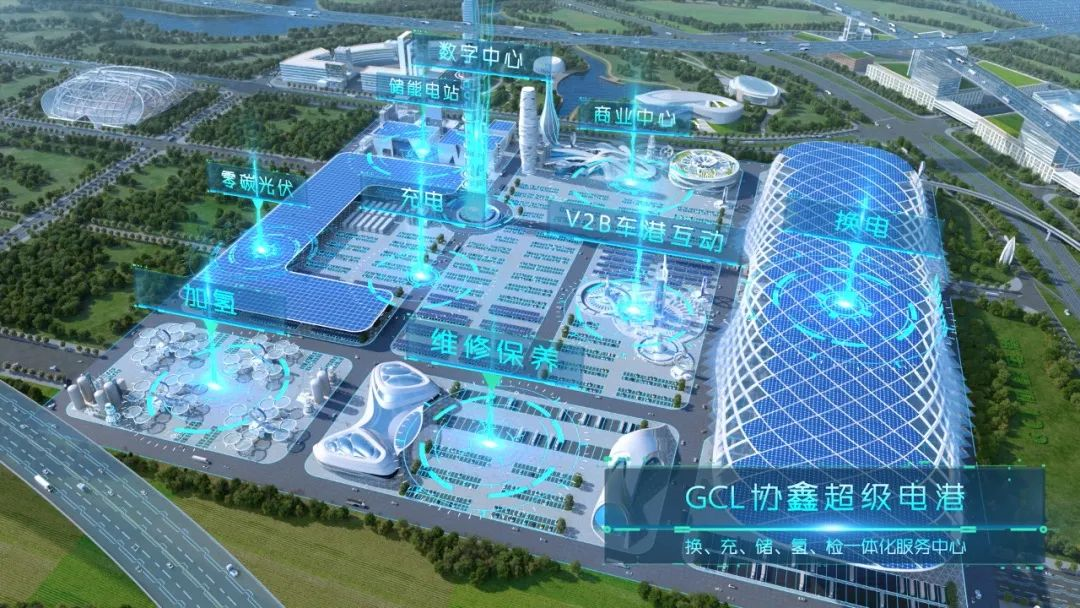

Xinte Energy has introduced the concept of a “Super Port,” which, in brief, is a comprehensive commercial center that integrates automotive sales, insurance, beauty, after-sales service, logistics, transfer hub, digital management platform, and other functions centered around the charging station. In addition to various supplementary energy forms such as hydrogenation, charging, and swapping for vehicles, Super Port also provides integrated services such as catering, accommodation, and entertainment.

The Super Port offers four advantages:

Firstly, it does not have to be located in the city center, which can reduce land costs.

Secondly, by making the region a commercial district centered on cars, it will spontaneously generate traffic flow related to cars, with more targeted audiences.

Thirdly, due to centralized power supply, Xinte Energy can use and obtain low-cost electricity.

Fourthly, the charging ports in the region do not have to be equipped with charging capabilities since they can be centrally transported to the Super Port for charging, which solves the problem of power capacity expansion and lowers electricity costs.

Of course, the challenge is to find a good location for the “Super Port” and to ensure that related supporting capabilities can be smoothly built.

In addition to lithium batteries, Xinte Energy is also expanding into the field of hydrogen energy. In July 2021, Xinte Energy’s listed subsidiary, Xinte Energy New Energy, announced the establishment of a hydrogen energy business department, marking Xinte Energy’s official entry into the hydrogen energy industry.

Xinte Energy may have further plans around hydrogen energy, but they have not yet been revealed.However, AXEVIN’s deployment in batteries and battery swapping has already begun, by establishing mineral mining and cathode/anode materials, thereby mastering the core of battery cost; self-produced and sold energy can also help minimize the cost of battery swapping. At the same time, AXEVIN keeps a lock on battery rental revenue and subsequent utilization, including energy storage and disassembly for backend profits.

This is why AXEVIN plans to invest heavily in battery operation to create sustainable usage scenarios.

Clearly, AXEVIN is embarking on a new layout and challenge, striving to create a new future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.