Writing by | Lisa

Editing by | Zhou Changxian

Driving on the road, electric vehicles may indeed be cleaner and more environmentally friendly than gasoline or diesel-powered cars and trucks, but that doesn’t mean that electric vehicles are truly clean and environmentally friendly. The core of electric vehicles, the rechargeable lithium-ion battery, which can be repeatedly charged and discharged, requires some toxic metals that are essential to its production. The extraction and improper handling of these metals can result in environmental degradation and some social and moral issues.

For example, in South America, lithium mining involves water resource pollution and freshwater salinization. In the Democratic Republic of Congo, cobalt mining has sparked reports of child labor and environmental damage. In fact, all minerals involved in the production process of lithium-ion batteries, such as nickel, manganese, and graphite, are more or less associated with social and environmental problems.

This is just the production of lithium-ion batteries. When the life of lithium batteries is exhausted, how to deal with these waste batteries is another headache, and a little carelessness can cause long-term and irreversible harm to land and the environment.

These are real and existing problems. It’s just that in our enthusiastic anticipation of a low-carbon future, we obviously prefer to see the clean side of lithium batteries and electric vehicles, and selectively ignore the problematic side. With the increasing popularity of electric vehicles, the market demand for lithium-ion batteries is growing, and the number of discarded lithium batteries is also increasing. The elephant in the room urgently needs to be addressed.

Closed-loop Battery Recycling Supply Chain

As early as 2017, when JB Straubel was still the Chief Technical Officer of Tesla, he began to focus on battery recycling. To solve this elephant-sized problem, Straubel founded Redwood Materials, a battery recycling company.

The core business of Redwood Materials is to recycle and process lithium batteries and electronic products. This company hopes to recycle discarded batteries from electric vehicles and electronic products, extract the important raw materials required to produce lithium batteries, such as lithium, nickel, and cobalt, and then re-use these extracted raw materials to produce new batteries to achieve a closed-loop battery recycling supply chain.

Straubel believes that a mature closed-loop battery recycling supply chain can not only alleviate the pressure of raw material mining and the environmental impact of battery production and disposal, but also reduce the cost of batteries in the future, solve the dilemma of battery supply shortage, and promote the stable development of the electric vehicle industry.

Straubel believes that a mature closed-loop battery recycling supply chain can not only alleviate the pressure of raw material mining and the environmental impact of battery production and disposal, but also reduce the cost of batteries in the future, solve the dilemma of battery supply shortage, and promote the stable development of the electric vehicle industry.

However, the key to whether the closed-loop battery recycling supply chain can be established is the recycling utilization rate of battery materials.

In the past, there were mainly two ways to recycle waste battery materials in the battery recycling industry, namely pyrometallurgy and hydrometallurgy. Pyrometallurgy is to remove organic matter by high-temperature combustion, leaving a small amount of raw materials such as nickel and cobalt. The recycling process will lose a large amount of aluminum and lithium, and the environmental pollution is also very serious, which goes against the original intention of alleviating environmental pressure. Hydrometallurgy is to extract important metal elements from positive electrode materials using different reagents, including lithium. The disadvantage of this method is high cost and complicated process.

Redwood Materials innovatively combined the two methods and created a new smelting method, which uses residual battery power to drive the converter to generate high temperature, then separates battery metals using pyrometallurgical technology, and finally recovers and purifies various metal raw materials using hydrometallurgical technology. According to a set of data, through this innovative process, Redwood Materials can recover more than 95% of useful materials (such as nickel, cobalt, copper and lithium) from waste batteries, and produce anode copper foil and cathode active materials.

Initially, Redwood Materials collaborated with Panasonic, Tesla’s battery supplier. After that, other battery manufacturers such as Envision AESC, as well as automakers such as Ford and Volvo, also joined Redwood Material’s partner list, and Ford even participated in Redwood Material’s recent round of $700 million financing and invested $50 million.

In June of this year, Toyota also announced its participation in the company’s electric vehicle power battery recycling and remanufacturing project. The cooperation will start from monitoring and recycling waste batteries from Toyota Prius and other hybrid vehicles.

Redwood Materials, which is gradually moving forward, estimates that the company can process more than 6GWh of waste batteries every year, and this number is still increasing. Redwood Materials also plans to start producing anode and cathode components for batteries that can supply 100GWh of electricity per year in its American factories by 2025. By the end of 2030, Redwood Materials hopes to provide enough battery production materials for 5 million electric vehicles every year.

Small Batteries, Big Blue Ocean

Beyond its long-term environmental goals, Redwood Materials’ closed-loop battery recycling supply chain has an even more immediate significance–to help the United States reduce its dependence on rare earth minerals mined overseas. From this perspective, as a global new energy vehicle (NEV) powerhouse, China needs to accelerate the establishment and improvement of its own EV battery recycling industry.

On the one hand, according to the China Association of Automobile Manufacturers (CAAM) forecast for China’s NEV sales in 2022, NEV sales are expected to exceed 5 million units in 2022 and reach 9.75 million units by 2025. As NEV sales continue to grow, the crisis of increasingly scarce lithium battery raw materials is becoming more apparent.

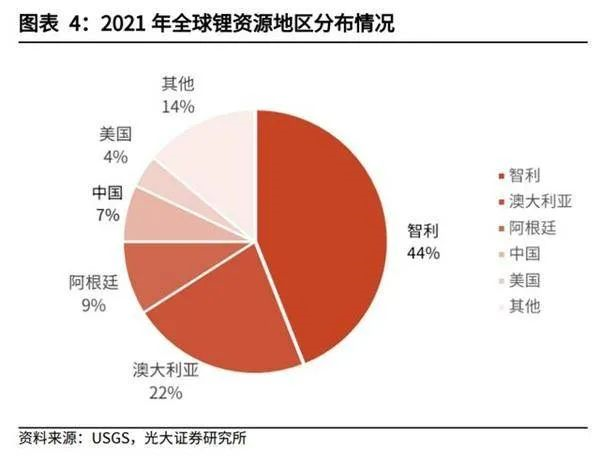

Statistics show that China has only 7% of the world’s lithium resources, 4% of its nickel resources, and 1% of its cobalt resources, with limited reserves. For these metals needed to produce lithium batteries, China still depends heavily on overseas mining.

On the other hand, in 2015, China’s NEV sales began to grow rapidly, reaching a penetration rate of over 1% for the first time. If we calculate based on the average life span of 5-8 years of power batteries, the first wave of power battery retirement is imminent. Therefore, if we can efficiently recycle lithium batteries and achieve the circular use of lithium, nickel, and cobalt resources, we may be able to reduce our dependence on overseas supplies, reduce battery costs, and accelerate the popularization of NEVs.

With this opportunity, more and more industry players are beginning to lay out in the battery recycling field.

Founded in 2001, Shenzhen Green Eco-manufacturer has now become a leading player in China’s battery recycling industry. Similar to Redwood Materials’ closed-loop battery recycling supply chain, Green Eco-manufacturer has proposed a concept of “mining city mines + developing new energy materials,” dedicated to creating a “battery recycling-material remanufacturing-battery pack remanufacturing-reuse-cascade utilization” full lifecycle value chain system.According to the first quarterly report released by the company in 2022, the company’s core product, power battery, using ternary precursors, shipped over 91,000 tons, making the precursor business second in the global ranking. The company will also comprehensively launch the technical transformation and equipment upgrading of the existing two major nickel-cobalt-manganese raw material chemical systems.

In terms of cooperation, CATL has established cooperative relationships with more than 200 globally-renowned vehicle and battery manufacturers. Among them, CATL signed a memorandum of understanding for the directional recycle of 10,000 tons of nickel products with Yawei Lithium Energy and signed strategic supply cooperation framework agreements with Xiamen Tungsten and ECOPROBM Company from Korea for high-nickel precursors for power batteries.

The world’s largest battery manufacturer, Contemporary Amperex Technology Co. Limited (CATL) has laid out the battery recycling industry by acquiring the peer BP Sciences and investing in the BP integrated battery material industry park project. According to the company, the recovery rates of lithium, nickel and cobalt from BP Science’s battery recycling business can reach 91% and 99% respectively. In the long run, resources can be obtained through battery recycling without the need to mine new ores.

However, is battery recycling really that successful?

The reality is that many enterprises with the intention of laying out the battery recycling industry are likely to stumble at the first step: where to collect discarded batteries?

Linda Gaines, the chief scientist of ReCell, the advanced battery recycling research and development center of the U.S. Department of Energy’s Office of Vehicle Technologies, once stated that the most basic problem now is that there are not enough battery materials available for recycling. Compared with the number of batteries put into use, the number of discarded batteries recycled is negligible.

Industry insiders in the domestic power battery sector have expressed similar views. It is reported that official channels only recycle less than 30% of retired power batteries.

So where do the remaining batteries go? They flow to numerous “small workshops” and “black workshops”. These “small workshops” and “black workshops”, which ignore safety and environmental pollution risks, disturb market order invisibly and squeeze the survival space of regular enterprises. This is one of the difficult points.

Secondly, enterprises will also face technical challenges. Despite the fact that most battery recycling enterprises claim that their battery material recovery rates have exceeded 90%, what is the cost behind this? A paper published in the Engineering magazine last year mentioned that different battery sizes and the extensive design, chemical processes, structure and production techniques involved will result in different costs. The connection methods between individual batteries are also different and may contain different amounts of important metal components. In addition, the chemical composition and ratio of lithium batteries are continuously being upgraded.

To recycle batteries with diverse characteristics, battery recycling companies need various technologies, which require a large upfront investment and are difficult to scale up. Therefore, although CATL’s net profit doubled in 2021, the performance of power battery recycling only accounted for 0.78% of total revenue. Even seemingly successful companies like Redwood Materials still rely on financing to survive.

To recycle batteries with diverse characteristics, battery recycling companies need various technologies, which require a large upfront investment and are difficult to scale up. Therefore, although CATL’s net profit doubled in 2021, the performance of power battery recycling only accounted for 0.78% of total revenue. Even seemingly successful companies like Redwood Materials still rely on financing to survive.

Fortunately, the government has already paid attention to the industry’s difficulties and is taking action to address them. For example, recently, a member of the National Committee of the Chinese People’s Political Consultative Conference, Ling Zhenguo, proposed suggestions including strict market access mechanisms, and utilizing digital networks to strengthen battery life-cycle traceability management.

Currently, although battery recycling is still in its early stages of development, we can see that the relevant government departments and industry enterprises are working together. We believe that in the near future, we will see that the reuse of batteries can truly help humanity move towards a low-carbon world.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.