Source: Annoucement from the Ministry of Industry and Information Technology

Author: Qiu Kaijun

The dual credit results for Chinese passenger vehicle companies in 2021 have been officially announced. The regulatory department has issued a significant positive credit adjustment, but the overall results are not drastically different from the previously disclosed results.

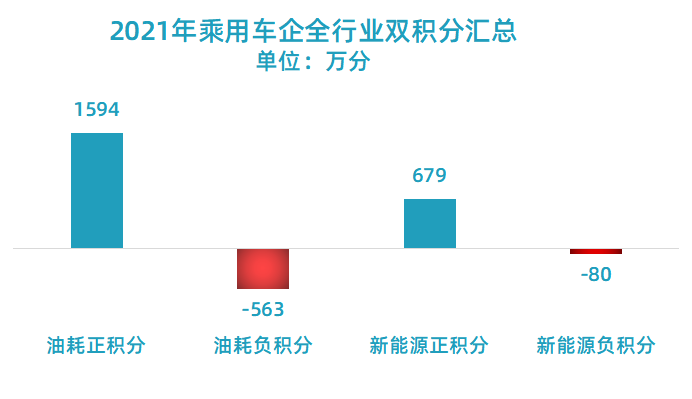

On July 5th, the Ministry of Industry and Information Technology announced the average fuel consumption and new energy vehicle credit scores for Chinese passenger vehicle companies in 2021 on their website. The dual credit scores for passenger vehicle companies were very impressive: positive credit for fuel consumption was approximately 15.94 million, while negative credit was approximately 5.63 million. Positive credit for new energy vehicle was around 6.79 million, while negative credit was approximately 0.8 million.

This is the best result achieved by the entire industry since the implementation of the dual credit policy.

This achievement seems almost unbelievable, particularly concerning the fuel consumption score. Recall that in 2020, the positive fuel consumption score was only 4.37 million, while the negative credit was as high as 11.71 million.

In just one year, how was such a large improvement achieved by the industry? Did the “students” progress rapidly or did the “teachers” relax their standards?

The core goal of the dual credit policy is to continuously reduce fuel consumption of passenger vehicles and promote the development of new energy vehicles. Will this mutually beneficial situation in 2021 really help the industry improve in these two areas?

Why was there a big leap in the positive fuel consumption credit score?

One of the core goals of the dual credit policy is to continuously reduce fuel consumption of passenger vehicles. Specifically, the 2021-2025 (referred to as “five stages” by the regulatory department) fuel consumption target is that it must reach 4L/100km by 2025, and 4.92L/100km in 2021.

This fuel consumption goal for 2025 has been repeatedly mentioned in documents such as the “Mid-to-Long Term Development Plan for the Automotive Industry,” and has thus become an important policy objective for the industry. However, when this fuel consumption goal was proposed, China was still using NEDC test cycle fuel consumption measurements.

As of 2021, the regulatory department has completed the transition of test cycles. According to the national fuel consumption standard GB27999, the overall target remains at 4L/100km, but is converted according to the comparison between the new and old test methods.

So, what is the fuel consumption level for Chinese passenger vehicle companies in 2021?

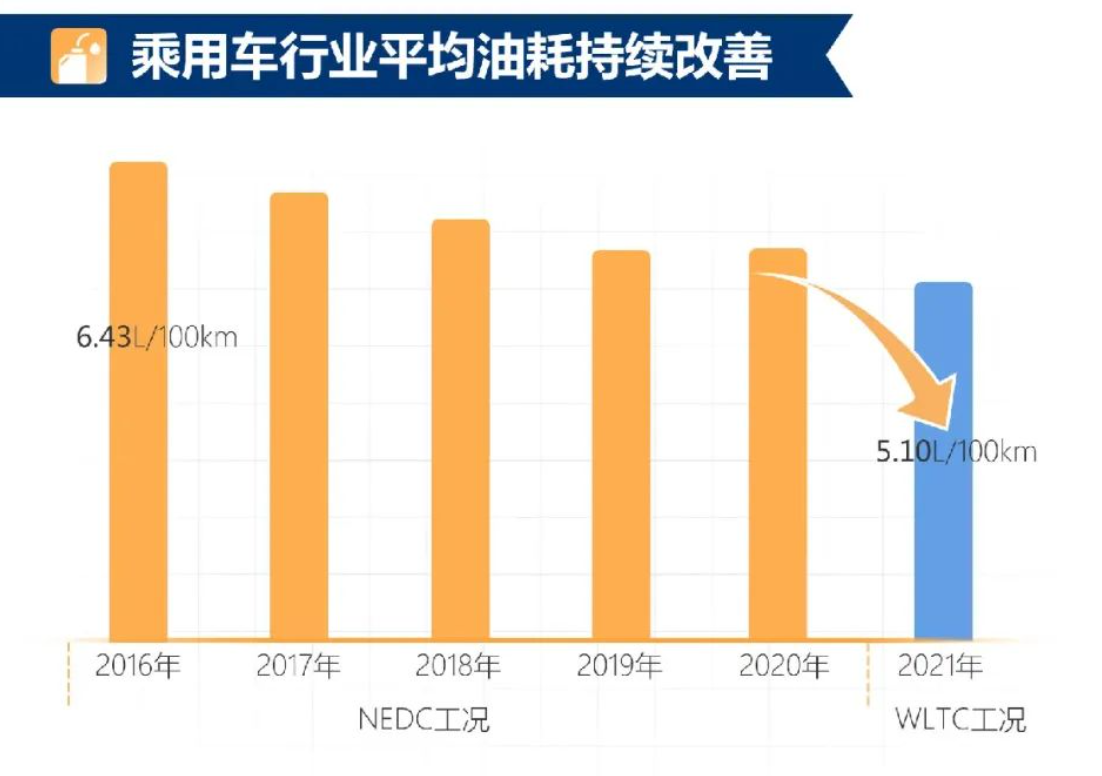

According to the dual credit announcement for 2021, the average fuel consumption (WLTC cycle) for passenger vehicles produced or imported by 129 Chinese passenger vehicle companies was 5.10L/100km.According to the GB27999 instructions, the fuel consumption of WLTC cycle test is 10.57% higher than that of the NEDC cycle test. Therefore, the 2021 average fuel consumption of a passenger car company in NDEC is about 4.61L/100km, which not only perfectly achieves the national target of 2021, but also significantly improves by 1L compared to the actual value of 5.61L/100km in 2020!

However, in reality, this is impossible. Behind this leap is the calculation method of double integral related to fuel consumption and various “incentives”.

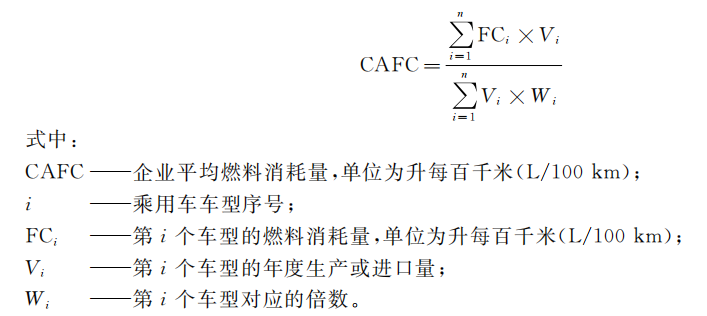

Overall, this calculation method is based on the total fuel consumption as the numerator, divided by the total number of vehicles as the denominator. However, according to the policy, there are different adjustments on the numerator and denominator.

Regarding the denominator, the most important thing is that “new energy vehicles” and “low fuel consumption vehicles” can be counted twice. For example, for pure electric and hybrid models, one vehicle is counted as two in 2021, and low fuel consumption vehicles with fuel consumption less than 3.2L/100km, one vehicle is counted as 1.4.

The larger the denominator, the smaller the result and the lower the fuel consumption. In 2021, the China Association of Automobile Manufacturers (CAAM) counted the production of 3.36 million new energy passenger vehicles in China, which lowered the fuel consumption calculation value.

Regarding the numerator, from 2021, vehicles using energy-saving technologies or devices outside the cycle can deduct a certain amount of fuel consumption. For example, regenerative braking systems can reduce at least 0.08L/100km. The energy-saving effect of efficient air conditioning is determined based on test results. These deductions can also be accumulated.

These deductions for energy-saving technologies outside the cycle have greatly improved the fuel consumption calculation results for car companies in 2021, helping to “reduce” the calculated value.

Thanks to the help of new energy vehicles and energy-saving technologies outside the cycle, the actual fuel consumption of the industry in 2021 has significantly decreased according to the calculation method.

However, in reality, whether the fuel consumption has actually decreased or not still needs more fine-grained calculation.

Doubts About Compliance

The explanation above clarifies why the “actual value” of fuel consumption has significantly decreased, but it still does not explain why there are a large number of positive integrals.

The production of positive integrals is due to the “actual value” needing to exceed the compliance target. In addition to looking at the actual value, it is also necessary to examine whether the compliance target is set strictly enough.

According to the Annual Report on the Implementation of Parallel Management of Corporate Average Fuel Consumption and New Energy Vehicle Credits (2022) released by the Ministry of Industry and Information Technology (MIIT), “the industry’s average fuel consumption in 2021 is about 5.1 L/100km (WLTC), with a year-on-year decline of more than 15% after equivalent conversion (uniformly converted into NEDC conditions), exceeding the 2021 target of 5.98 L/100km fuel consumption.”

According to the Annual Report on the Implementation of Parallel Management of Corporate Average Fuel Consumption and New Energy Vehicle Credits (2022) released by the Ministry of Industry and Information Technology (MIIT), “the industry’s average fuel consumption in 2021 is about 5.1 L/100km (WLTC), with a year-on-year decline of more than 15% after equivalent conversion (uniformly converted into NEDC conditions), exceeding the 2021 target of 5.98 L/100km fuel consumption.”

“The 2021 fuel consumption target of 5.98 L/100km seems too loose. In 2020, the actual value was only 5.61 L/100km. How could 2021 be more lenient than 2020?”

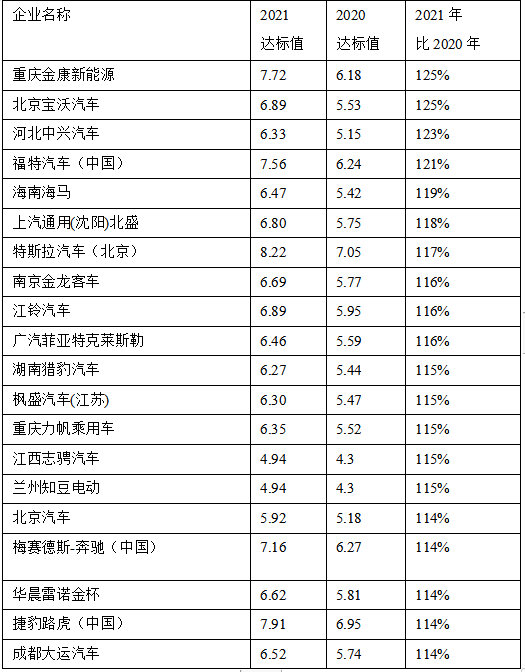

The same impression can also be obtained by examining the compliance values of companies. Compared with the dual credit results in 2020 and 2021, for the 114 companies that can be compared, the compliance value increased on average by 10%, which means it became 10% more lenient. This is opposite to common sense. The compliance value for fuel consumption should be getting stricter.

The conversion of test conditions can explain part of the adjustment. As mentioned earlier, fuel consumption tests will become 10.57% stricter from NEDC to WLTC.

Another possibility is that the vehicle’s curb weight produced by car companies in 2021 has increased significantly, resulting in an increase of the compliance value. However, according to the dual credit announcement, the average curb weight of the entire industry has only increased by 23 kg, which has negligible effect on the fuel consumption target value.

Therefore, after offsetting the impact of switching the leniency of the compliance value with the announcement (about 10% each), it can be seen that the fuel consumption compliance value of car companies in 2021 is basically the same as that of 2020 and has not become stricter.

“In the case of a significant decrease in actual values and basically unchanged compliance values, the production of fuel consumption positive credits has reached a very high number in 2021.”

As for the positive credits for new energy, although the requirement for the credit proportion in 2021 is 14%, which is increased by 2 percentage points from 2020, and the credit calculation method is stricter, with the basic original models receiving half the credit, “the number of new energy passenger cars in 2021 is nearly 1.6 times that of 2020, resulting in an increase of about 50% in positive credits.” It is also understandable.

Depreciation of New Energy CreditsThe production of positive points for fuel consumption and new energy is now in a surplus, which is not good news for new energy vehicle companies because the value of new energy vehicle credits has decreased. According to the dual credit policy, companies that fail to meet the standards need to clear negative credits by purchasing positive credits for new energy in the industry to offset the negative credits for fuel consumption and new energy.

With the current surplus of positive credits and relatively few negative credits, the price of credits will be suppressed. According to a calculation by Shui Xu, a special contributor to Electric Vehicle Observer, the transaction price for new energy vehicle credits has fluctuated from 825 yuan per point in 2018 to a minimum of 100 yuan per point and is expected to reach about 2,100 yuan per point in 2021. Based on the supply and demand of 2021 credits, the trading price for 2021 credits in 2022 may be similar to 2019, with only a few hundred yuan per point.

According to the implementation report of the dual credit policy by the Ministry of Industry and Information Technology, the supply of credits in 2022 is expected to be relatively sufficient. However, the report believes that as the fuel consumption standards and credit assessment requirements become increasingly stringent and the decline in traditional vehicle fuel consumption slows down, the supply and demand situation for annual credits may change in the future.

This means that the trading price for credits in 2022 will not be high, but prices may rise in later years, including 2023.

For the 2021 results of the dual credit policy, people who have long observed the automotive industry point out that the policy took too many factors into consideration, including the continuous investment of the automotive industry and the concerns of foreign capital, which compromised the effectiveness of the policy.

Li Jinyong, Executive Vice Chairman of the China National Federation of Industry and Commerce Automobile Dealers Association, has been following and researching the dual credit policy. He believes that on the one hand, fuel consumption must be reduced every year and cannot be reversed, and real fuel consumption reduction must be promoted in earnest; on the other hand, the dual credit policy was originally intended to take over the national subsidies for new energy vehicles, to increase the cost of fuel vehicles and lower the cost of new energy to promote their development. However, the results of the dual credit policy have not achieved its original goals.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.