Writing | Zheng Wen

Edited by | Zhou Changxian

In 2021, people thought that the factors affecting the market were becoming more and more controllable, and they held a cautious and optimistic attitude towards challenges such as chip shortages and epidemic fluctuations. However, unexpectedly, in the first half of 2022, first-tier cities such as Shanghai once fell into suspended animation, and the Yangtze River Delta economic circle also followed suit, and the shortage of chips did not return to supply-demand balance.

As companies in this environment experience a constantly changing internal and external environment, they are like sailboats at sea that must adapt to changes in wind direction, wind speed, and currents in order to stay on course, otherwise the consequences can be imagined.

As a “big ship” in the automotive industry, during this era of great change and uncertainty, the best approach is to send a speedboat to explore the mist. Therefore, many new brands created by traditional automotive groups, such as Zeekr, IM, Avita, Voyah, and Salon, have emerged one after another.

Recently, Zeekr announced the six-month performance of its first product, Zeekr 001: it delivered 4,302 vehicles in June, and the accumulated delivery volume exceeded 25,000. Objectively speaking, compared with new forces in the early stage of brand development, Zeekr, which has been established for more than a year, has seen a very fast growth in its accumulated delivery volume.

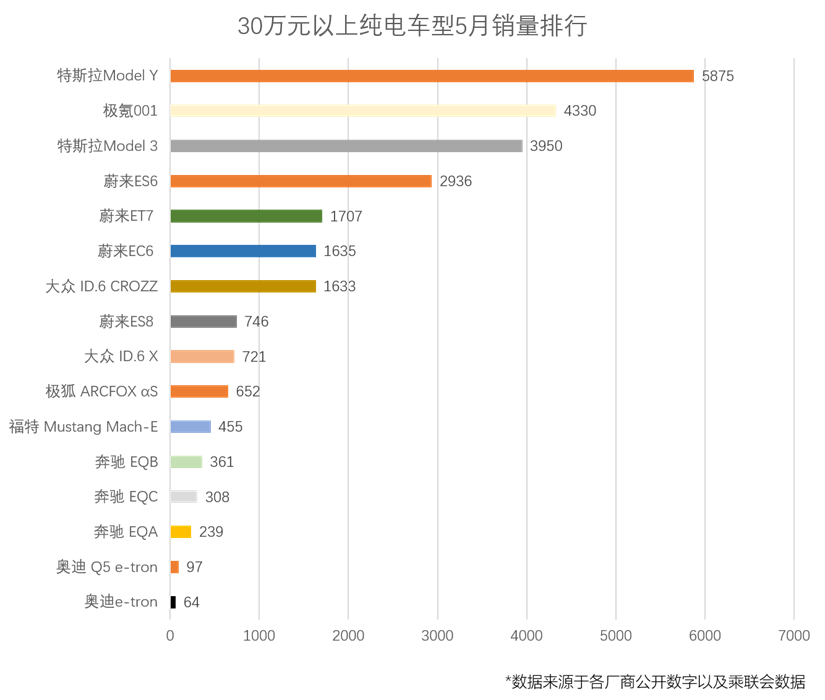

It is worth mentioning that the average order price for Zeekr 001 is 335,000 yuan, which is the highest for a single model from a Chinese brand in the luxury pure electric vehicle market (above 300,000 yuan) in May.

In January of this year, Yang Xueliang, CMO of Zeekr Intelligent Technology, stated in an interview with the media in Xiamen that “our orders are still increasing, which has indeed brought us great encouragement.”

Apparently, users are willing to trust a high-end intelligent pure electric brand from China at this price point, and are willing to wait for delivery despite various uncertainties. For Zeekr, it is a great incentive.

Why is it difficult to deliver Zeekr 001?

Zeekr 001 is the first model born on the vast SEA architecture and is a product that can only succeed and not fail.

Under the continuous evolution capability provided by the vast architecture, Zeekr 001 has been embedded with many leading hardware. It not only provides users with a longer period of product software and hardware upgrades, a better long-term usage experience, but also benefits the second-hand value of the product, all of which guarantee user benefits and value.

However, it is important to note that the global automobile industry is still under pressure from the mainly-chip supply chain. Even with Geely Group as the backer, Zeekr 001 that includes more than 2,000 types and more than 10,000 chips (of which 7 are global debuts) is also vulnerable in this supply chain crisis.# Positive Effects Emerged from Joint Efforts of Giga and Supply Chain Partners

Fortunately, despite facing numerous difficulties, positive effects have emerged from the joint efforts of Giga and its supply chain partners. For example, the air suspension configuration that many users have chosen. Through communication with Webasto, since the beginning of this year, the air suspension components of the Giga 001 have gradually switched from co-linear production to the official production line of the Webasto Hamburg and Świdnica factories in Poland. The exclusive production line is currently in operation, and the overall production and delivery of the Giga 001 will continue to improve.

All models of the Giga 001 have undergone numerous leading hardware preparations, such as the pre-burial of seven 8 million pixel cameras, which are even ahead of many new cars released this year. Of course, this has also increased supply chain pressure. The current shortage of core chips is precisely from the supporting chips of these seven cameras, which is also a core supply chain factor that affects the delivery in June.

In addition, Giga’s launch of so many global first-chip products has increased the difficulty of mass production. What does being a first-chip mean? It means the uncertainty of mass production, and it also means the huge challenge of supply chain management. Tesla, NIO, and Li Auto have all experienced delays in functions due to problems caused by the first launch. This was also an important reason for Tesla’s crazy delay in delivery in the early years.

To illustrate, at a media communication meeting last year, Xu Yun, Vice President of Giga Intelligent Technology and Product Leader of Giga 001, revealed, “Because Giga 001 launched the 9710 chip, but this chip needs to be redesigned in July, involving bottom-level hardware changes. The ADCU (the domain controller for intelligent driving) also needs to undergo joint testing and the entire verification cycle must be re-experienced to ensure safety. So the release of the ACC function was postponed.”

Although redesigning chips is not time-consuming, the subsequent testing and validation work is very time-consuming and labor-intensive. A domain controller involves complex hardware, and if one chip needs to be returned to the factory, the testing work will start over. The stable batch production time for all chips in the ADCU of Giga 001 is in October, leaving Giga with little time.

Apart from the uncertainty that the first-chip embodies, the lack of experience in mass production is also a major challenge. On the one hand, the stability of hardware and underlying software needs to be ensured. On the other hand, the domain controller is complex, and the integration of engineering capabilities and hardware design and manufacturing requirements is also very high. The entire process is a highly complex system engineering.

Not to mention, supply chain management under special chip shortage conditions. It is reported that to ensure chip supply, An Conghui, CEO of Giga Intelligent Technology, personally watches over the status of chip supply.## Long-termism That Penetrates Through the Fog

In the automotive industry, being the first to release a product with the latest Mobileye EyeQ5 main chip, as 001 did, may provide a marketing advantage, but it also comes with the challenge of developing a highly integrated system-on-chip (SOC) that is compatible with the new camera, which is not an easy task. In the past, Mobileye provided algorithmic perception and camera selection recommendations to automakers in their cooperation. However, sources claimed that, in order to adapt to a wider range of scenarios and achieve better perception effectiveness in some extreme situations, 001 adjusted the camera’s internal parameters, which obviously affected the project progress. As the algorithms for the 1.3 million pixels camera on EyeQ4 cannot be directly applied to the 8 million pixels camera used in 001, iterative algorithmic development was necessary, which also affected the project timeline. Additionally, the working mode with cooperative suppliers is also a critical factor that affects project progress. Despite the pandemic, Jidu Auto still sent its staff to Mobileye’s headquarters in Israel to expedite the project.

All of the above details prove that delivering a successful product is not an easy task for Jidu Auto. Nevertheless, Jidu Auto persists in its pressure to deliver its product, which is user-centered and continuously evolving, for a better future in the long-run.

In the post-pandemic era, many corporate executives and managers are struggling with scarcity of industrial resources. Even the author of “The Long-Termism,” and former Honeywell CEO, David Cote, expressed his concern in an interview: “I have never seen such a situation where suppliers promise to deliver products on a certain date only to cancel a week before.”

A study from Harvard Business Review showed that 2/3 of the executives and directors considered the pressure of short-term performance has increased within the past five years. However, a report from McKinsey indicated that companies that adhere to long-term strategies have an average market value of $7 billion higher than those that only pursue short-term goals. Moreover, the average revenue growth of these companies is 47%, and the average profit growth is 36% higher than those that focus on short-term goals.

In “The Long-Termism,” David Cote argues that successful companies are not started on easy paths. Only through the continuous practice, improvement, and balanced development can a company make progress and stand out in the present and the future.

As Jidu Auto claims, “long-termism” is the firm road to success. The entire Jidu Auto team was established in 2022, and with the gradual completion of the system, resources were gradually allocated, and its plan was executed quickly. Li Shufu even took the lead as the chairman of the Jidu Auto brand company.”The two best electric cars at the (2021) Shanghai Auto Show were NIO ET7 and JIKKEAI 001, with ET7 demonstrating a mature and confident design, while 001 offers incredible price performance. Ideal Automobile founder Li Xiang had nothing but praise for his competitors.

However, the development trajectory of a brand is often nonlinear, with chaos commonly exhibited in the early stages. This results in overall uncertainty, irreproducibility, and unpredictability within the system. Last year, JIKKEAI, which was embroiled in controversy, undoubtedly had this experience.

Despite growing in controversy, JIKKEAI’s periodic performances are still impressive. ‘Last year, when we announced the price, many investors said it’s impossible,’ said Ann Conghui. Now, JIKKEAI’s gross profit is positive, as expected. With this year’s sales growth, gross profit levels are expected to be better.’

Aside from delivery issues, Ann Conghui pointed out that JIKKEAI also faced significant software improvements. Next, JIKKEAI will increase investment in intelligent technology. Currently, there are more than 2,600 software R&D personnel, accounting for 65% compared to 35% last year, and it is expected to increase to 70% by the end of the year.

In terms of energy supplementation, JIKKEAI’s smart technology subsidiary, ZEEKR Power, has made significant progress. Its self-built charging stations have been launched in 52 cities across the country, with a total of 342 stations (excluding dedicated sites), including three different types: JiChong Station, UltraCharge Station, and LightCharge Station. More new cities and stations are being accelerated for completion nationwide.

Furthermore, the layout of the charging network is still accelerating, with nearly 50 stations being launched on average from March to May of this year, showing a significant increase in speed. The one-stop installation service for intelligent home charging piles has also entered 299 households in 31 provinces across the country.

In 2022, JIKKEAI aims to sell 70,000 vehicles and will launch six models in the following three years. ‘Although there is more uncertainty due to the epidemic and supply chain, our commitment to achieving sales of 650,000 vehicles in 2025 is unwavering, and we are confident that we will be among the top three in the global high-end electric vehicle market,’ said Ann Conghui.

Undoubtedly, delivery is the immediate problem that JIKKEAI must solve, but its longer-term layout is the only way to the future.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.