New Energy Car Companies’ Sales Volume Broke 10,000 in June

In June, the monthly sales volume of the five main new energy car companies in China exceeded 10,000 each despite the impact of the COVID-19 epidemic on many cities in the first half of this year, which is a remarkable achievement. Currently, the five major new energy car companies in China have opened up a considerable gap with other new energy car companies. Some leading new energy car companies have also been repositioned.

From the perspective of sales volume, the top three new energy car companies have evolved from “WEY Xiaoli” to “Xiao Na Li” and even spawned the title of “New Energy Five Tigers”.

Since June, each car company has launched a new car investment period and presented their own advanced technologies and products, which has made the competition intense. Can the front-runners defend their leading position with new cars? Can the newcomers rely on new cars to achieve a comeback?

WEY Xiaoli’s second half of the year will be defined by the new car models

This year can be said to be a year of explosive new car models for NIO. Within a year, they will continuously deliver three new car models – ET7, ET5 and ES7 – which will overturn the situation of no new car deliveries in more than one year. In the just-released delivery results, the ET7 exceeded 4,000 units delivered, which also made a significant contribution to the record-high monthly delivery volume of June.

While the three new cars are being put into operation, NIO’s existing ES8, ES6 and EC6 models will also receive a comprehensive upgrade, which will improve their product strength. With the increasing sales volume of smart electric cars, product competition has become more intense. For the three models, ES8, ES6 and EC6, which were introduced a few years ago, a comprehensive upgrade is necessary to enhance their competitiveness.

As the head of China’s new energy car companies in the past, the past few months have not been easy for NIO. Changes between old and new products and brand positioning have caused NIO to lose its position as the leader in new energy car sales.

Therefore, the delivery of the three new car models in the second half of the year, especially the ET5, which has advanced product strength and cost-effectiveness, will become key to NIO’s improvement of its terminal sales volume.

Recently, the Ideal, which launched a new model, will start delivering Ideal L9 at the end of August. According to June sales data, the new model L9 did not divert too many sales of Ideal ONE. Although the L9 has been officially unveiled since March, the momentum of Ideal ONE has not weakened, and its delivery volume reached 13,024 units in June.

Recently, the Ideal, which launched a new model, will start delivering Ideal L9 at the end of August. According to June sales data, the new model L9 did not divert too many sales of Ideal ONE. Although the L9 has been officially unveiled since March, the momentum of Ideal ONE has not weakened, and its delivery volume reached 13,024 units in June.

In terms of vehicle planning, whether it is the already released Ideal ONE and L9 or the upcoming models announced for next year, Ideal has almost only invested in one model in each price range to ensure that there is no mutual conflict between its internal vehicle models and to fine-tune product details according to the demands of the target audience at the respective price points.

For Ideal, the L9, which has taken 30,000 orders just launched, is a great boost to the entire team, and the next step is the pure electric model next year. How to replicate the success in the extended range field in the pure electric field, and continue the momentum of Ideal ONE best-seller in L9 and pure electric models, may be the question Ideal is currently considering. After all, a good product can be carefully crafted, but a “best-seller” also requires a bit of coordination of timing and environment.

Compared with the previous two, the current selling price of the car models of XPeng Motors is relatively low. The three car models aimed at different demands have crowned the domestic new power sales champion in recent months. However, there is still a certain gap in terms of sales and gross profit margin compared with competitors.

Therefore, for XPeng Motors, G9, which will be officially launched in September and delivered in the fourth quarter, will be the key to the brand’s upward momentum and improving gross profit margin, as well as the highlight of the second half of the year. It not only determines whether XPeng can continue to sit firmly on the new power sales crown but also whether the first step of XPeng’s high-end branding can be successful.

To be honest, exploring the brand from the bottom up is destined to be more challenging than extending downwards. And XPeng’s smart card, which is the core selling point, happens to be the most challenging field for research and development strength and capital reserves. This will be a significant challenge for G9 and XPeng’s marketing team. Perhaps that is why, in the midst of the abundant news of new cars from NIO and Ideal, XPeng G9 is a bit low-key, and it seems that all the news is to be saved until the official launch in September.

Naza and Leapmotor are urgently in need of a Hong Kong stock market listing.In the past year, NETA and Leapmotor can be regarded as two dark horses among the new forces in the automotive industry, quietly climbing into the forefront in terms of delivery performance. We put these two automakers together because they share many similarities.

Rapid Sales Growth, Obvious Product Upside Trend

As the second-tier new domestic automakers, NETA and Leapmotor have grown rapidly in the past year. With the combination of NETA U and NETA V, NETA is now a strong contender for the sales champion on the domestic new energy vehicle sales ranking. As for Leapmotor, it has already launched four models, S01, T03, C11, and C01, and the pre-sales of C01, which started in May this year, have already exceeded 62,000 units.

Both companies mainly focus on low-end electric cars, taking the “surrounding the center from the outside” route to counterattack the sinking market. They happen to fill the gap in the blank area where the demand for electric cars at around 100,000 yuan is huge, but the products are not competitive enough. Coincidentally, after successfully taking this path, the two automakers have begun to launch higher-end models to seek upward development. Recently, NETA’s flagship sedan model, NETA S, launched a limited pre-sale, and Leapmotor’s C01 price has also reached 150,000-300,000 yuan.

Hong Kong Stock Exchange Listing, Arrow on the Bowstring

Whether it is for Leapmotor, NETA, or Wei Xiaoli, which has already completed listings on NASDAQ and the Hong Kong Stock Exchange, listing is an important target for them.

Although the monthly sales of several top new domestic automakers have exceeded 10,000 units, the huge research and development investment in the automotive industry has prevented them from achieving overall profitability. Therefore, besides financing from investors, finding a low-cost and stable financing channel is crucial for Leapmotor and NETA. These two companies have also almost announced news of listing on the Hong Kong Stock Exchange one after another.

Judging from the current sales and product matrix of Leapmotor and NETA, they indeed have the capital and confidence to be listed on the Hong Kong Stock Exchange.

EA and Jihkai, Worth Mentioning

Apart from many new forces, there were also two independent domestic automakers worth mentioning in the first half of the year: GAC Aion and Jihkai.

In terms of sales, GAC Aion achieved a sales record of 24,109 units in June, an increase of up to 182% YoY. Its cumulative sales in the first half of the year reached 100,251 units, a YoY increase of 134%. GAC Aion’s hard work is indispensable for achieving such results.

On the model matrix, GAC Aion has successively laid out AION S, AION S PLUS, AION V, and AION Y in the mainstream sub-market of 100,000 to 200,000 RMB.

In terms of core technology, GAC Aion has many killer features: as early as 2021, Aion has successively released original battery technologies, such as “silicon sponge negative electrode technology”, “magazine battery”, and “super high-speed battery technology”, respectively solving the three major pain points of endurance, safety, and charging. Recently, Aion has also released the microcrystalline superpower lithium iron phosphate battery technology, making up for the “shortcomings” of lithium iron phosphate batteries.

In terms of intelligent driving and intelligent cockpit, Aion has based on the self-developed full-stack PUSAI OS (Intelligent Cockpit) to build ADiGO SPACE (Intelligent Cockpit) and ADiGO PILOT (Intelligent Driving) two sub-systems, becoming a sharp weapon for Aion’s smart car models.

As for the performance of Zeekr, it has been relatively stable. In June 2022, sales reached 4,302 units, with cumulative sales reaching 19,010 units in the first half of the year. Since delivery began in October last year, the cumulative delivery volume of Zeekr 001 has exceeded 25,000 vehicles.

For Zeekr, its biggest confidence comes from Geely’s investment in SEA architecture. With the support of this architecture, Zeekr will launch six new models covering multiple mainstream sub markets in the next three years. It is rumored that Zeekr will also launch a new MPV model this year.

For Zeekr, to achieve the sales target of 650,000 units in 2025 and the goal of being one of the top three high-end electric vehicle markets in the world still requires substantial effort.

AITO WENJIE’s Rise

There have been many skeptics about Huawei’s high-profile behavior in the automotive industry. AITO WENJIE’s performance in the past two months may answer this skepticism.

In June, AITO WENJIE’s M5 sales exceeded 7,000 units, reaching 7,021 units, and new orders totaled 10,685 units. The biggest reason for AITO WENJIE’s strong rise in just six months is Huawei’s comprehensive endorsement: whether it is in technology or sales channel, the “money is not a problem” Huawei’s strong support has enabled AITO WENJIE to enter the mainstream of China’s intelligent electric vehicle market in the shortest time possible.

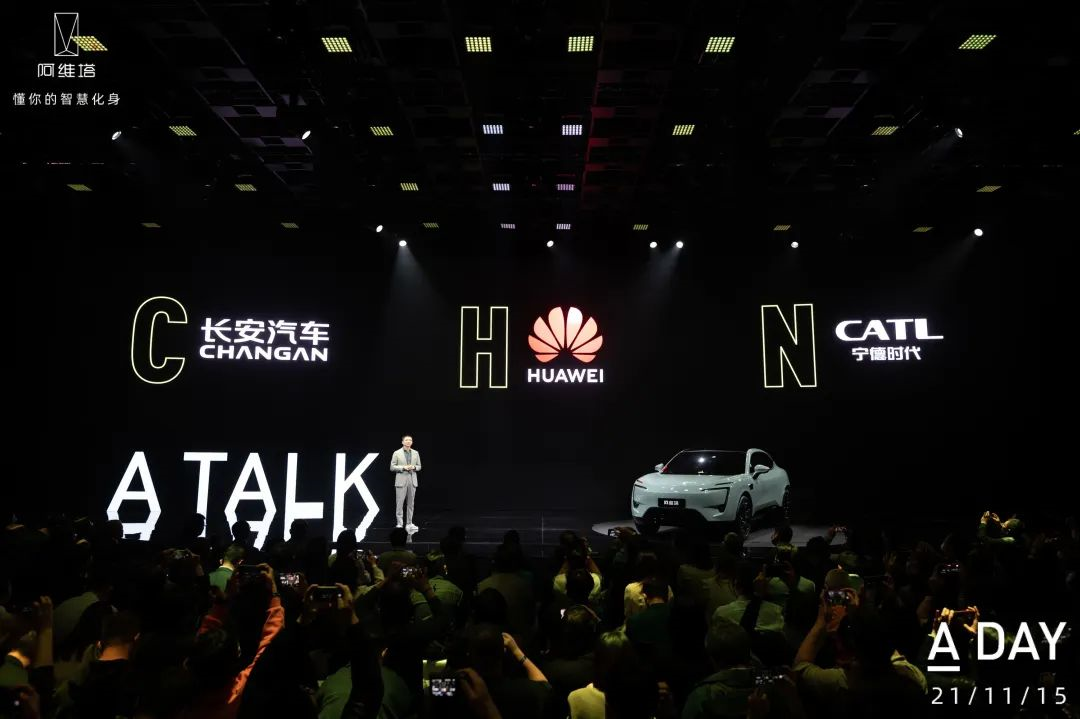

Perhaps it is because of the success of the M5, everyone is looking forward to the AITO AITO’s newly released second model, the M7, and even the new brand AVITA that Huawei is cooperating with Chang’an and Ningde is full of different expectations.

Perhaps it is because of the success of the M5, everyone is looking forward to the AITO AITO’s newly released second model, the M7, and even the new brand AVITA that Huawei is cooperating with Chang’an and Ningde is full of different expectations.

Therefore, it is more accurate to say that Huawei’s initial victory in the automotive field is the reason behind the sudden rise of the AITO AITO.

Huawei’s endorsement allows AITO AITO to stand firm in the highly competitive domestic intelligent electric vehicle market. However, Huawei’s cooperation with other automobile manufacturers has not stopped outside of the AITO brand, including AVITA, Beiqi Jiuhu, GAC, and BYD’s high-end sub-brands, which all adopt Huawei’s HI technology solutions.

Nowadays, Huawei can provide nearly all subsystem solutions related to intelligent electric vehicles for domestic automakers, and also invests its efforts into building the AITO AITO brand through the development of the Salis electric vehicles. We can’t help but wonder where Huawei’s “ambitions” lie.

Conclusion

2022 can be described as a year of intensive new model releases.

If more than a year ago, we still referred to the 200,000 to 300,000+ new energy vehicle industry as a highly competitive “red sea,” then today, all new energy vehicles can be said to be in the red sea. We can hardly find any subdivision field without competitors, whether it is low-end electric vehicles priced at around a thousand dollars or high-end models, or even pure electric MPVs that appeared in large groups in the first half of the year.

The white-hot competition in the new energy market is not only reflected in the “quantity” of new products, but “quality” is also the key to competition. The competition in the new energy market is not limited to these new forces and new vehicle manufacturers. It also includes Tesla and BYD, which have been leading in sales, traditional automakers that are poised to launch, and cross-border giants such as Huawei, Baidu, and Xiaomi. Whether they are old players who continue to play or new players who have just entered the game, what is needed to impress consumers is a “real” comparison.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.