Author | Tian Hui

Editor | Zhu Shiyun

The price hike has not affected the sales of new energy vehicles.

At the beginning of 2022, various car companies increased the price of new energy vehicles, but the increase above 10,000 yuan did not affect the actual sales volume.

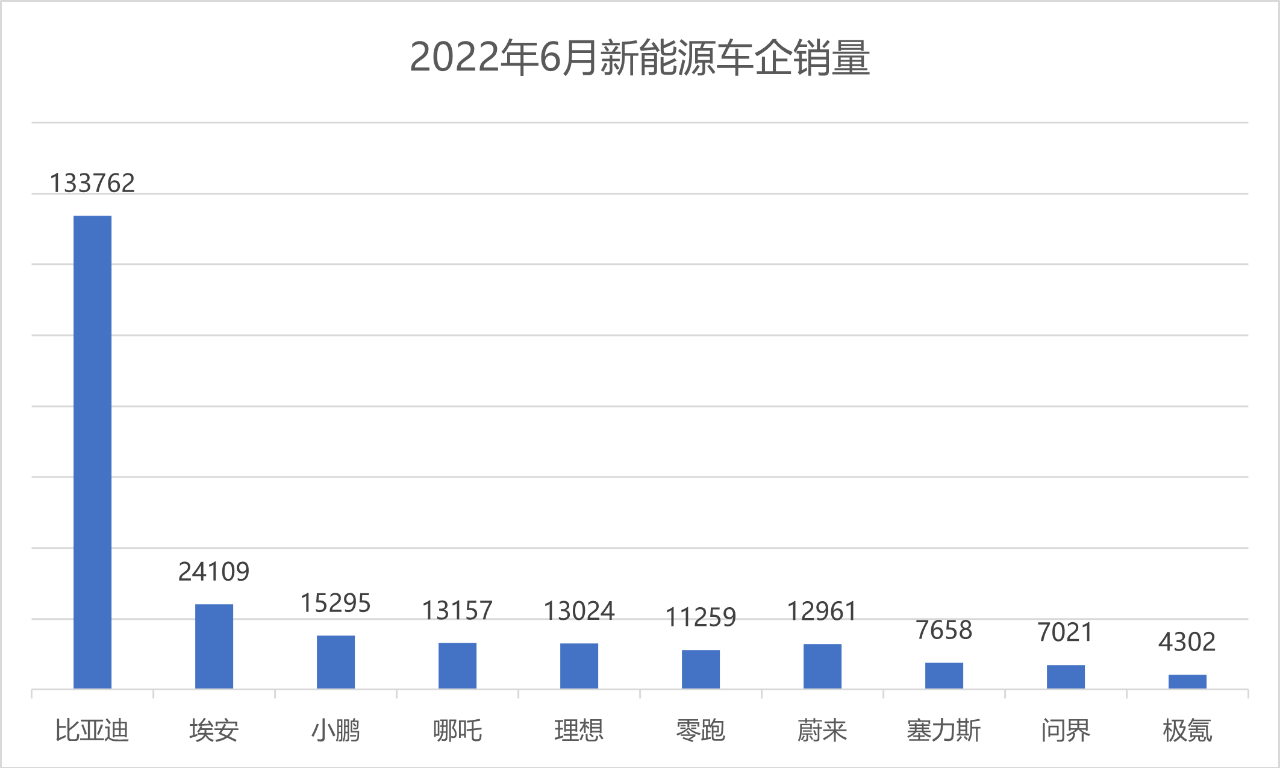

Judging from the situation of 9 car companies that first announced their new energy vehicle sales in June, the overall sales situation is very optimistic, and most car companies set a new record in sales in June.

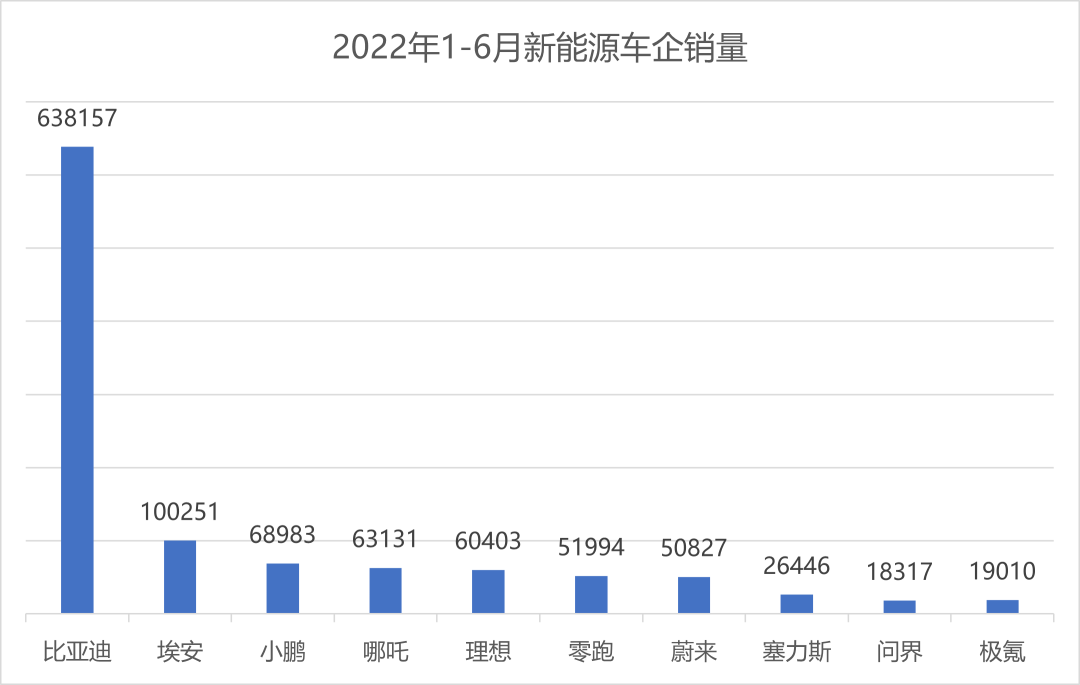

Looking at the half-year sales list and market situation, China’s new energy vehicle companies present a market landscape of one superpower many strengths and comprehensive development.

BYD, who uses two legs – pure electric and plug-in hybrid, surpassed pure electric Tesla in June and became the super leader.

The top camp has strong sales growth, with NETA and LI ranking high on the half-year sales list for the first time. “Dark Horse” AITO’s sales growth rate has increased significantly, with more than 10,000 deliveries in the first 3 months.

The growth trend of China’s new energy vehicle market in the first half of the year was not affected by price hikes, the pandemic, or production capacity restrictions. In the second half of the year, there are four controversial topics in the competition for the annual sales crown between BYD and Tesla, the changing ranking of new energy vehicle companies, and the sales scale of AITO’s brand compared to traditional automakers’ electric vehicle brands.

BYD and Tesla Competing for Annual Sales Crown

BYD has regained the position of global new energy vehicle sales champion in the first half of the year and is expected to maintain its advantage and become the annual sales champion.

It should be noted that BYD is not the first time to become the sales champion of global new energy vehicles. Before the delivery of Tesla Model 3, BYD has repeatedly obtained the position of global new energy vehicle sales champion. However, after the delivery of Tesla Model 3, Tesla surpassed BYD with the sales of Model 3 and Model Y, and dominated for many years.

However, BYD returned to the position of global new energy vehicle sales champion in the first half of the year, which is directly related to the quarter-on-quarter decline of Tesla’s sales.

In April and early May, Tesla was affected by the Shanghai pandemic and was in complete shutdown for one and a half months. Single-shift production began in mid-May. Judging from the delivery data, Tesla’s delivery volume in the second quarter decreased by 56,000 vehicles, a decrease of 20% compared with the first quarter. At the same time, Tesla’s failure to achieve large-scale production in Germany is also the reason why Tesla’s sales cannot be increased.

Tesla, which was affected by the pandemic and production capacity, allowed BYD to quickly return to the position of global new energy vehicle sales champion.

In the second half of this year, the sales competition between BYD and Tesla is more in favor of BYD.

According to the analysis of Snowball’s popular V who tracks BYD’s sales with great joy, BYD’s production in the second half of the year will be between 1.1-1.2 million units, plus 640,000 units from January to June. The optimistic estimate for passenger car sales for the whole year is between 1.7-1.8 million units, the neutral estimate is between 1.6-1.7 million units, and the pessimistic estimate is between 1.5-1.6 million units.

According to the estimation of Troy teslike, a blogger who has been tracking Tesla’s sales for a long time, Tesla’s annual delivery volume is expected to be 1.6 million units in February. However, under the influence of the epidemic, this target has not been achieved. In the first half of the year, Tesla only sold 560,000 cars, and its annual sales may be below 1.5 million.

Overall, It should not be a problem for BYD to surpass Tesla in annual sales, but there will still be a certain gap between pure electric vehicle sales and Tesla.

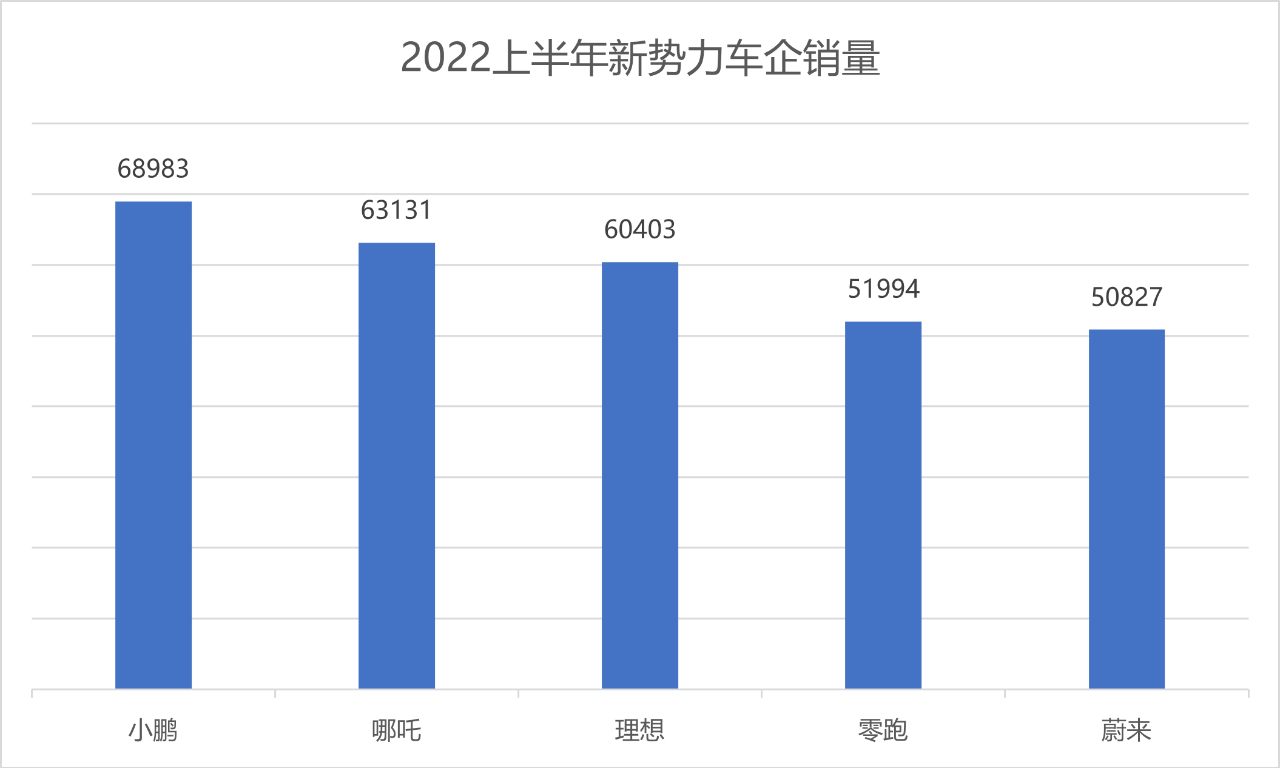

Differentiation of new forces in the auto industry

The epidemic has reshuffled the rankings of new forces in the auto industry’s sales.

XPeng Auto sold 68,983 cars in the first half of the year, with the XPeng P7 being the highest selling model, with a monthly sales of nearly 10,000 units, and it has the potential to become a popular model. However, due to the impact of the epidemic, XPeng P5’s delivery speed is relatively slow, and some consumers who purchased the battery version with LiFePO4 have been unable to pick up their cars for more than half a year.

Li Auto and Zero Run Auto have become dark horses among new forces in the first half of the year, surpassing Ideal Auto and NIO Auto, and ranking second and fourth in the sales rankings of new forces in the auto industry respectively. The main models of both Li Auto and Zero Run Auto are small micro pure electric vehicles. The “Li Auto One” and “Zero Run T03” models have product characteristics in the small SUV and micro electric vehicle market by relying on intelligence.

During the price increase period in the first half of the year, Li Auto and Zero Run’s car prices increased relatively less, which is also one of the main reasons for their sales growth.

Ideal Auto and NIO Auto were the two new automakers most affected by the epidemic in the first half of this year. Due to the disrupted supply chain, they were temporarily shut down, affecting the sales of both automakers.

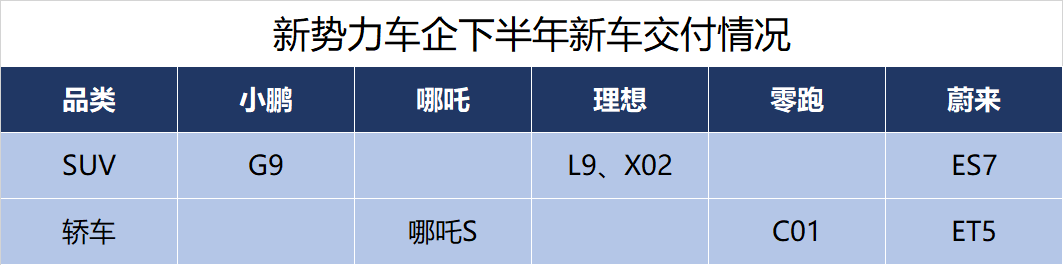

The epidemic in the first half of the year caused changes in the sales rankings of new forces in the auto industry, and Li Auto and Zero Run emerged during the epidemic, while Ideal Auto and NIO were slightly left behind. In the second half of the year, new models from various automakers will enter the delivery stage, and it is expected that the sales rankings will once again change.

In terms of product layout, NIO is the most comprehensive, with three SUVs and two sedan models, catering to pure electric vehicle consumers with prices ranging from 250,000 to 600,000 yuan.

Ideally, the new X02 model is expected to be launched in the second half of the year, which may be a smaller version of the Ideall L9, priced between the Ideall ONE and L9. However, it is still uncertain whether the car can be delivered within this year due to the impact of the pandemic.

XPeng may be the manufacturer with the most stable sales growth in the second half of the year. The selling models have formed a product system, and the XPeng P7 is more likely to become a popular model. Whether the new G9 can quickly form sales is icing on the cake for XPeng’s improvement in the second half of the year, and it does not affect the overall situation.

NIO and Leapmotor will face multiple pressures in the second half of the year, such as rising costs and traditional car companies entering the small electric vehicle market, including BYD. Although new cars like the NIO ES8 Youshi Edition and Leapmotor C01 will be launched in the second half of the year, the biggest test for NIO and Leapmotor is whether they can achieve a balance between sales volume and cost due to the limited supply of power batteries.

In terms of sales of new energy vehicle startups, XPeng is expected to become the top seller of the year among them thanks to its advantages in product quantity and price. For NIO and Leapmotor, there are more uncontrollable factors affecting sales volume, and whether they can maintain their current sales level remains to be seen.

Huawei Becomes a Golden Signboard

AITO’s cumulative sales of the questions M5 exceeded 10,000 units within 3 months after its launch, becoming the new car brand that achieved 10,000 unit sales the fastest.

On July 4th, the second AITO brand car, the questions M7, was launched. This is a 6-seater extended-range SUV model that directly competes with the Ideall ONE. Its biggest feature is the zero-gravity seats in the second row and the HarmonyOS car system that seamlessly connects with mobile phones.

Compared with Ideal ONE, which has only one configuration, the Wanjie M7 provides three configurations for consumers to choose from and introduces a two-wheel drive version, which lowers the entry-level price. This car had 20,000 orders within 4 hours after it went on sale, proving that it is a product that can sell well.

Compared with Ideal ONE, which has only one configuration, the Wanjie M7 provides three configurations for consumers to choose from and introduces a two-wheel drive version, which lowers the entry-level price. This car had 20,000 orders within 4 hours after it went on sale, proving that it is a product that can sell well.

Sales data for Wanjie M5 and M7 also indicate that Huawei has become a golden signboard in the automotive industry. The model of Huawei helping car companies make good cars without manufacturing cars itself has achieved initial results, and Huawei should continue to expand its sales to build on its success.

In terms of production capacity preparation, the Phoenix Factory newly built by Siles has been put into production. Together with the old factory, AITO has two factories for production, with a production capacity of 300,000 units.

However, one of the factors that may affect AITO’s production capacity is the cost of raw materials. Recently, Huawei’s Automotive BU CEO Yu Chengdong stated that even if the Wanjie M7 is launched, it would be “very good” if the Wanjie brand’s sales could exceed 80,000 units in 2022 due to chip price issues.

In the first half of this year, AITO Wanjie sold a total of 18,000 vehicles, which is still 60,000 units away from Yu Chengdong’s goal of 80,000 units. In the second half of the year, Huawei needs to sell 10,000 vehicles per month to achieve the goal.

Sales Differentiation of Traditional Car Companies’ Electric Brands

Sales volume of traditional car companies’ electric brands such as E’an, SMART Elf, Zeekr, and Ora may differentiate in the second half of the year.

In the first half of this year, E’an’s sales exceeded 100,000 units, becoming one of the leading electric vehicle brands of traditional car companies. Currently, E’an’s factory is already at full production capacity. Based on the sales volume of 24,000 units in June, E’an’s brand sales in the second half of the year are expected to be about 150,000 units, with annual sales around 250,000 units.

If the production efficiency can be further optimized and the factory’s capacity enhanced, there is a possibility for E’an to reach the annual sales goal of 300,000 units, but the difficulty is high.

The Zeekr brand incubated by Geely has a sales volume of about 4,300 units per month, which is extremely incompatible with the supply capacity of the factory with a capacity of 300,000 units, due to the increase in single-car costs caused by the price increase of power batteries. The manufacturer intends to control the production volume.

Since there are still a large number of pre-price increase orders that have not been delivered, and the cost of power batteries has not significantly decreased, the increase in sales of Zeekr brand in the future will be a test of the Zeekr’s operational capabilities.

SMART, another brand under the Geely system, announced shortly after the launch of its first model, Jingling 1, that its 2022 production quota had been sold out, which shows the popularity of the car but also shows the insufficient preparation of production capacity.# Geely, with multiple brands including Geometry, Lynk & Co, and SMART, aims to achieve a sales scale of 200,000 vehicles per year. However, whether individual brands can quickly increase sales volume to a profitable level remains a challenge.

The Euler brand is in a downturn. On the one hand, the Black Cat and White Cat models are temporarily suspended due to the rising cost of batteries, and on the other hand, the new models Ballet Cat, Punk Cat, and Lightning Cat are delayed in launch. Only one good cat model is being sold by Euler, and its sales are starting to decline. Its sales in the first half of the year are expected to be lower than those of other new forces in the industry.

After several new models are launched in the second half of the year, the sales positioning of Euler’s brand is more inclined towards the unique features of products for female customers. Whether it can achieve a breakthrough in sales volume is uncertain.

Starting from 2022, the new energy vehicle brands of traditional car companies have started to show differentiation in sales volume. Excellent brands, such as Aiways, have formed a sales scale. Those with insufficient development momentum, like Euler, have encountered difficulties with their products.

However, overall, with the overall growth of the new energy vehicle market, the pure electric vehicle brands launched by various traditional car companies are expected to continue to grow in sales volume.

Plug-in hybrid cars may become the new favorite in the market in the second half of the year.

When the Geely Dorsett L Thor Plug-in Hybrid Electric Vehicle was launched, it set a goal of delivering 10,000 vehicles in the first month. The BYD DM-i model, which is also a plug-in hybrid, has already reached a monthly sales volume of 65,000 units.

Ideal, WM Motor, and Voyah, among other automotive companies, have launched plug-in hybrid vehicles that have also been accepted by consumers, with monthly sales of more than 20,000 units.

In the second half of the year, as more plug-in hybrid vehicles are launched, the long-silent plug-in vehicle market is expected to become the new favorite in the market.

Currently, automakers such as BYD, Geely, Great Wall, Chery, and Changan have all planned to lay out the plug-in hybrid market, while joint-venture brands are slightly behind. If the market share of new energy vehicles continues to increase, the plug-in hybrid cars will undoubtedly be the biggest growth point. Domestic independent brands that enter the market early may have the opportunity to take the lead over joint venture brands and occupy the market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.