Weekly Index

Weekly News

Sales in June Released

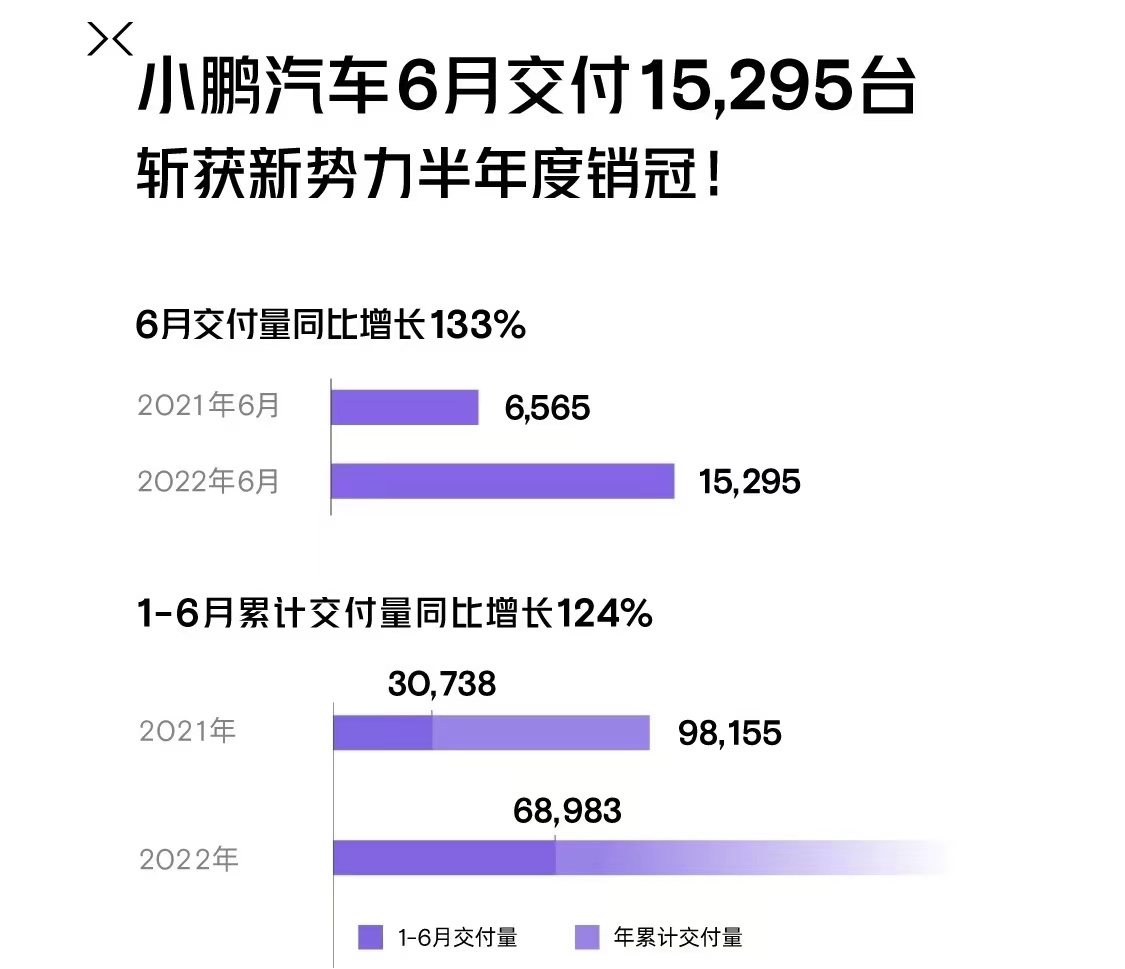

XPeng delivered 15,295 vehicles in June, with a total of 68,983 vehicles delivered in the first half of the year. Among them, P7 delivered 8,045 vehicles, P5 delivered 5,598 vehicles, and G3 delivered 1,652 vehicles. In the first half of this year, XPeng delivered a total of 68,983 vehicles, which is 2.2 times the cumulative delivery volume of the same period last year.

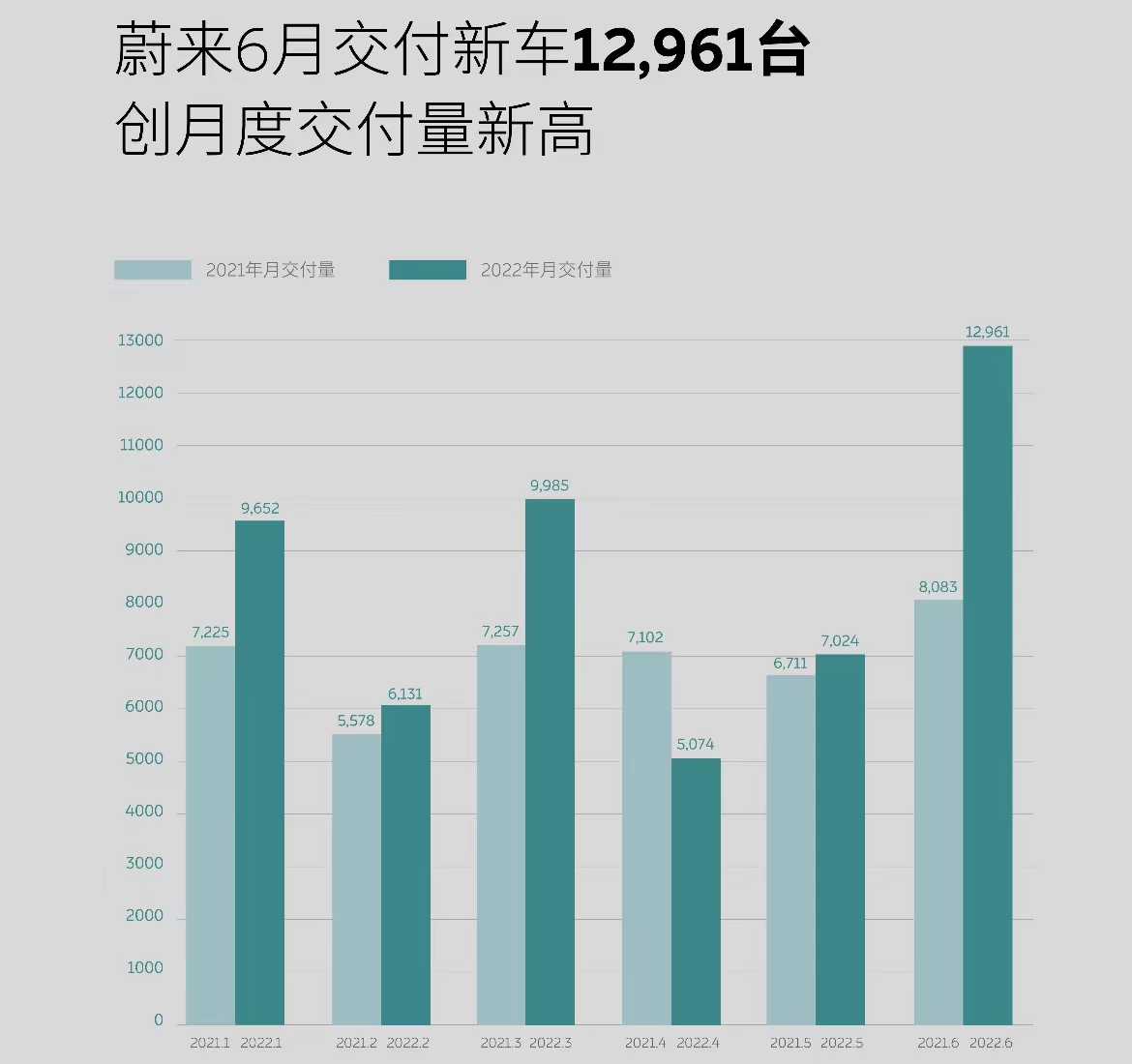

NIO delivered 12,961 vehicles in June, with monthly deliveries returning to more than 10,000 units, of which ET7 accounted for 4,349 units, ES8 for 1,684 units, ES6 for 5,100 units, and EC6 for 1,828 units. The delivery of ET7 increased significantly in June, and the delivery volume of ES6 also returned to the previous level.

NIO delivered 12,961 vehicles in June, with monthly deliveries returning to more than 10,000 units, of which ET7 accounted for 4,349 units, ES8 for 1,684 units, ES6 for 5,100 units, and EC6 for 1,828 units. The delivery of ET7 increased significantly in June, and the delivery volume of ES6 also returned to the previous level.

Li Auto delivered 13,024 vehicles in June, accumulating 60,403 deliveries in the first half of the year, breaking through ten thousand units per month in delivery volume.

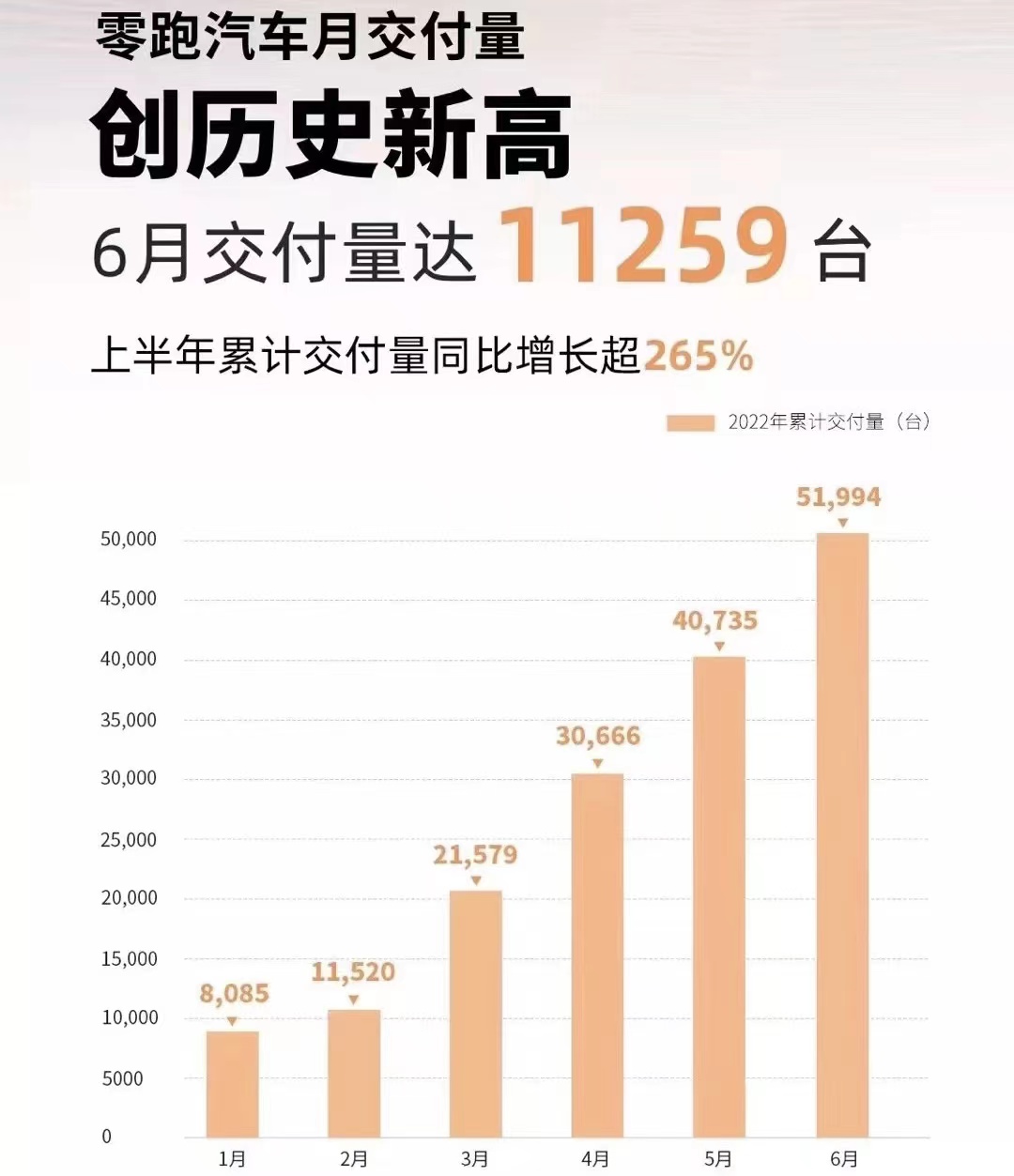

ZEEKR delivered 11,259 vehicles in June, setting a new monthly sales record. In the first half of 2022, ZEEKR delivered a total of 51,994 new cars, an increase of 265% year-on-year. With the success of the ZEEKR C11, which has brought the brand up, the ZEEKR C01 will soon be launched. The potential for the follow-up of ZEEKR is still considerable.

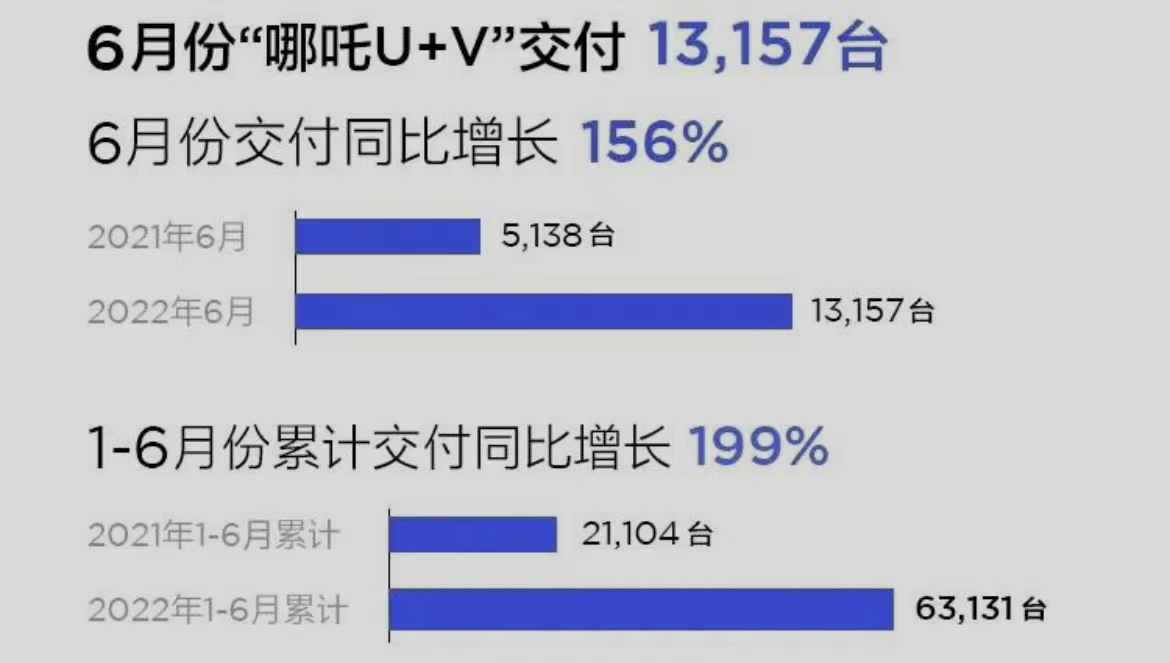

NIO’s sub-brand, NIO’s Blue Sky (NIO) delivered 13,157 vehicles in June, an increase of 156% year-on-year. This performance was significantly better than the 11,009 units delivered in May. From January to June this year, NIO accumulated 63,131 deliveries. The configuration and price of NIO S Yushu edition will be announced in July, and NIO’s upward breakthrough will also begin.

Quick Comment:

On the first day of July, new energy vehicle brands released their June delivery results. In 2022Q1, due to the epidemic situation in Shanghai, all auto companies and supply chains were more or less affected, resulting in an overall decline in delivery volume in the first quarter. With the official return to work and production in Shanghai in June, a return to normal life, as well as new energy vehicle subsidies from the government, the sales performance of several brands in June indicates that the new energy vehicle market has returned to pre-epidemic levels.For the three new forces in the first tier of the market, their sales in June all exceeded ten thousand. Speaking of the sales of XPeng, it must be mentioned that the XPeng P7 is the backbone of the sales, with very good sales data despite rumors of a redesign. Last month, XPeng delivered over 200,000 vehicles, and the P7 accounted for a considerable portion.

The low delivery period for NIO in the past few months is temporary. Once the product line is fully upgraded in Q3 and production capacity is further increased, the data will be more meaningful.

For Li Auto, they will wait until after the L9 is delivered in Q3 to see if they can impact monthly sales of 20,000, and how much of an impact the L9 will have on the delivery volume of the LI ONE.

XPeng P5 Xmart OS 3.2.0 is online

On June 30th, XPeng officially announced that it would push Xmart OS 3.2.0 to the P5.

The main content of the OTA update includes:

- Added ACC adaptive cruise enhanced version

- Added LCC lane centering assistance enhanced version

- High-speed NGP intelligent navigation assistance driving enhanced version

- Optimized VPA parking space memory parking function

- Memory parking cruise speed increased from 15 km/h to 20 km/h

- Added Mini Program Scenario Intelligent Push Service

- Added single bed mode

- Added rear seat reminder function

- Added Smart Dance Lighting function

Quick comment:

The most important content of this OTA update is undoubtedly that the XPilot basic assisted driving and NGP carried by the P5 both call on LIDAR data. Prior to this, LIDAR was only used in VPA scenes. Therefore, this OTA update can also be regarded as another milestone on the road to fully self-developed assisted driving for XPeng.

Under NGP mode, with the fusion of LIDAR data, the perception ability of the XPeng P5 for large vehicles has been improved, and it can more accurately perceive and avoid construction barriers.

Of course, the specific performance on the road still needs to be proven through testing, and we will also follow up on the performance of the new XPilot version in a timely manner. Stay tuned.

Under the parking scenario, the VPA memory parking speed limit has been increased from 15 km/h to 20 km/h. At present, the reason why the parking system is not favored by users is largely due to the slow parking speed of the system. Behind the speedup is the addition of lidar, which has improved the vehicle’s perception ability. The ultimate development trend of automatic parking function still needs to approach human driving wirelessly, otherwise it cannot be accepted by users, and its value cannot be reflected naturally.

Under the parking scenario, the VPA memory parking speed limit has been increased from 15 km/h to 20 km/h. At present, the reason why the parking system is not favored by users is largely due to the slow parking speed of the system. Behind the speedup is the addition of lidar, which has improved the vehicle’s perception ability. The ultimate development trend of automatic parking function still needs to approach human driving wirelessly, otherwise it cannot be accepted by users, and its value cannot be reflected naturally.

In addition, there are also some intelligent scenario push services, such as when users purchase tickets on Taopiaopiao or Damai website on Alipay mobile phone, Little P will remind users one hour before the start, and users can click or voice confirmation to navigate directly to the destination. Single bed mode refers to when the user turns on this function, the co-pilot seat will automatically flatten, and it is convenient to use with the single bed mattress in the sleep kit.

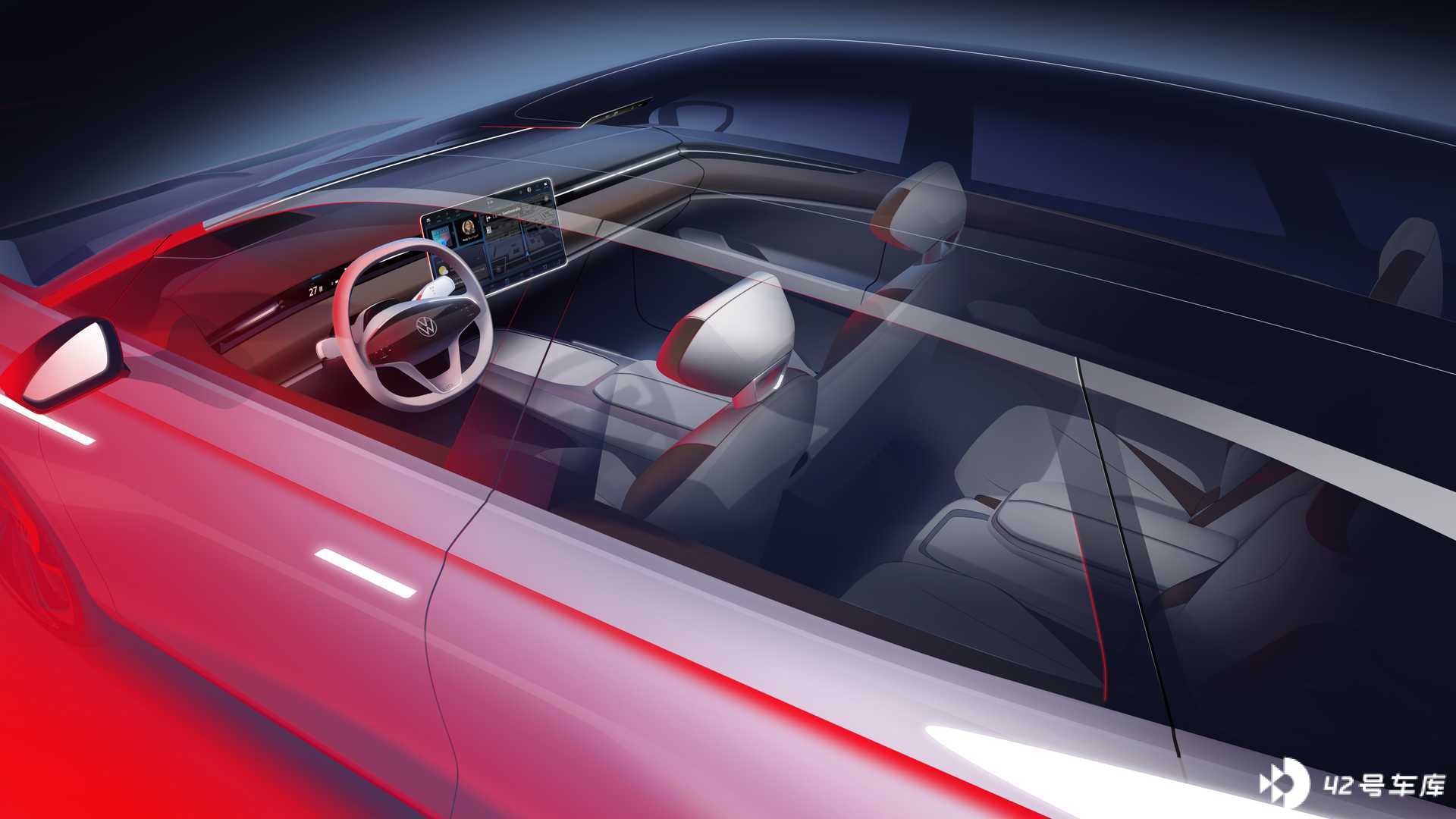

Volkswagen ID.AERO officially released

On the evening of June 27th, Volkswagen added a new member to the ID. family. ID. AERO is the first pure electric medium-sized car in the ID. family, still based on the MEB platform, and can achieve a range of 620 km under the WLTP cycle. In terms of positioning, ID. AERO may be the pure electric Passat, Magotan, just like the relationship between ID.3 and Golf.

Earlier, according to the European Patent Office’s document No. 018703388, disclosed on May 17, 2022, Volkswagen’s tested models, codenamed Aero and Aero B, or ID.Vizzion (sedan) and ID.Space Vizzion (wagon), may be launched in the market under the names of ID.7 and ID.7 Tourer.

Quick Comment:Due to the burden of “family-style design”, although Volkswagen’s electric cars have more delicate and technological details in exterior design, the overall silhouette still lacks freshness. The good news is that it can be recognized as a Volkswagen at a glance.

However, although it lacks freshness, Volkswagen’s design skills still deserve praise. The proportions and lines of the body are very smooth, and there are no abrupt or strange points when viewed. The streamlined shape also brings an excellent drag coefficient of 0.228.

From the previously disclosed renderings and road test images of the B9 Passat, we can judge that there will be improvements in the car and screen parts, which is also a major pain point in the current Volkswagen ID. series and MQB EVO platform.

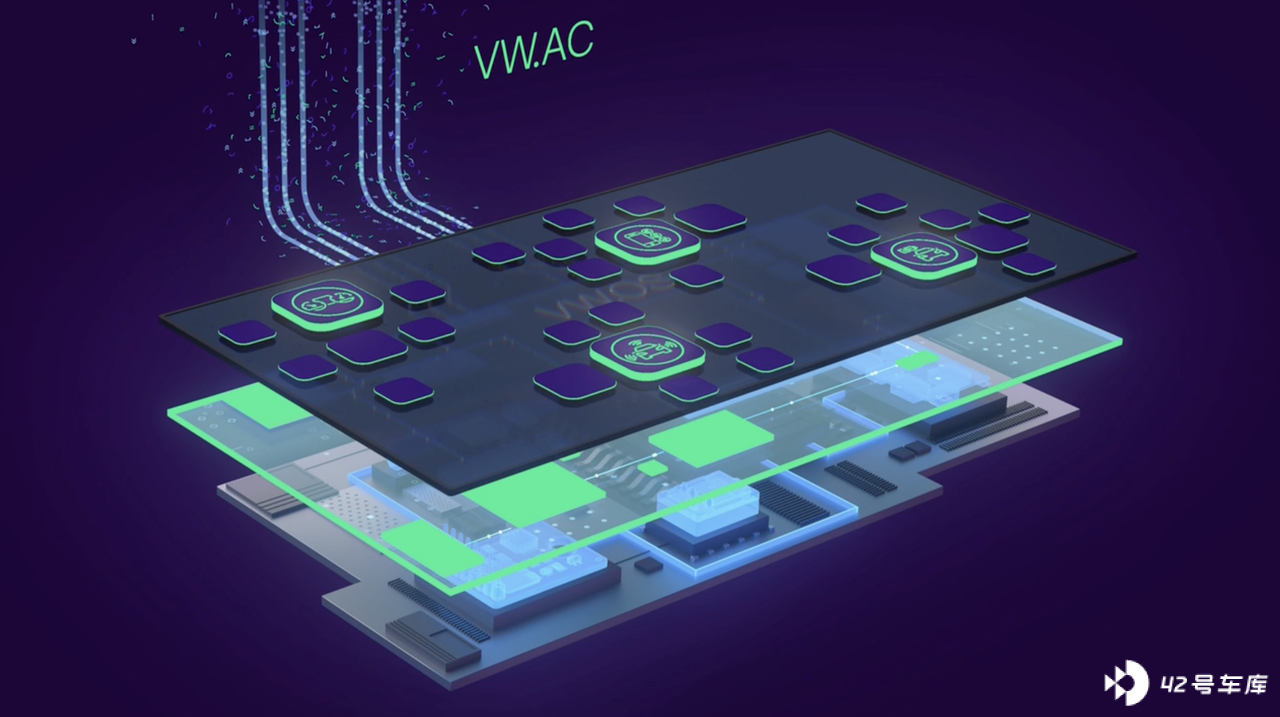

Among Volkswagen’s existing products, the car has always been a major pain point. Therefore, in Accelerate (acceleration plan) released by Volkswagen in March 2021, it declared that it will become a “software-driven mobile supplier.” On December 7th of the same year, the CEO of Volkswagen Group began to take full responsibility for the software department CARIAD.

In late April of this year, Volkswagen held the “CARIAD China Strategy Conference”, determined to solve the pain points in car experience. It remains to be seen whether the B9 Passat and ID.Vizzion to be released in the next two years can solve the existing criticisms.

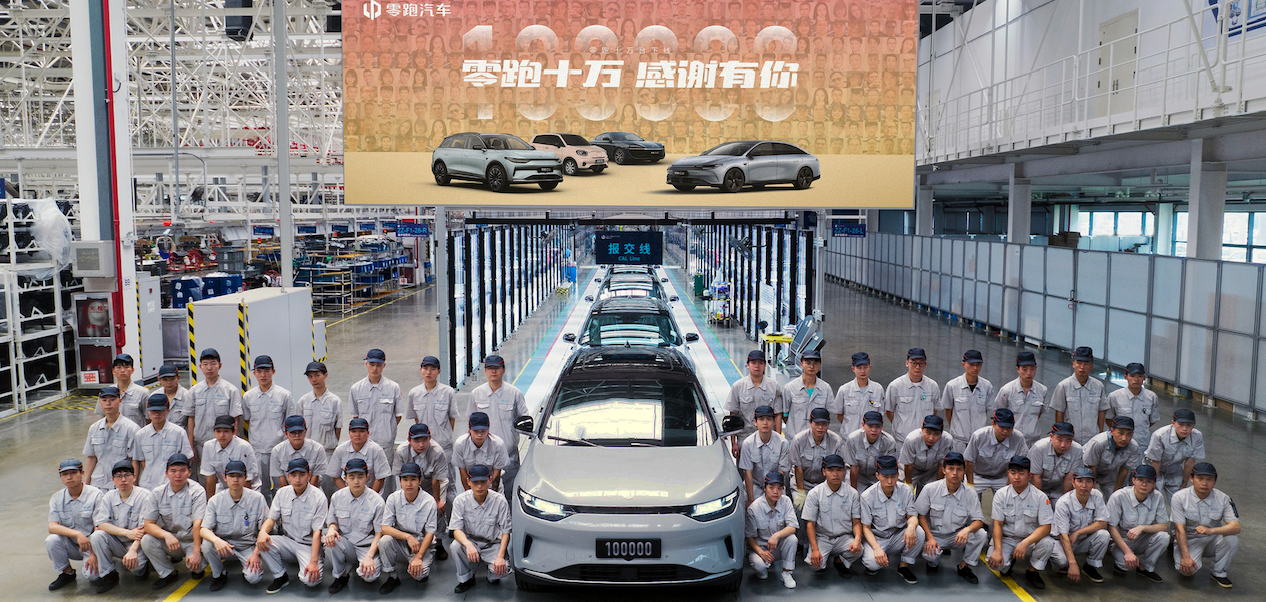

The 100,000th LI car has rolled off the production line

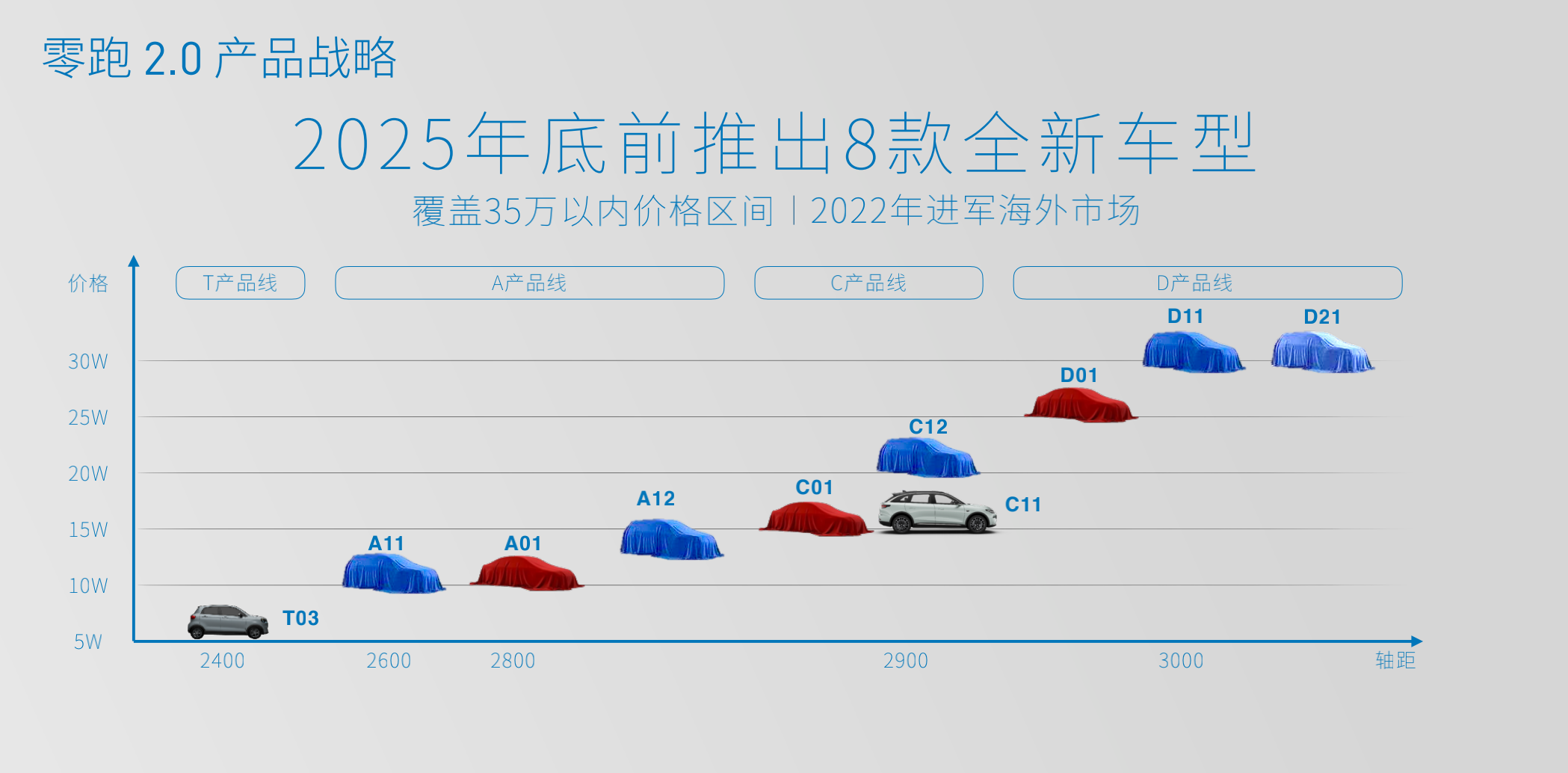

On June 28, 2022, LI welcomed the production of its 100,000th car. It took LI exactly three years, from the production of its first mass-produced car S01 on June 28, 2019 to now, to achieve this goal.Actually, many people had a negative attitude towards Leapmotor at the beginning and believed that Leapmotor, which had just launched S01, would collapse within a year. Although the market feedback for S01 was not particularly good, with the appearance of T03, it helped Leapmotor stabilize its position in the second tier of new forces.

After the launch of T03, Leapmotor has been taking the cost-effective route of low-priced small cars. Therefore, in October 2021, they launched a higher-level mid-size SUV, the Leapmotor C11, with a price range of 150,000 to 200,000 yuan, and the highest configuration with a 90 kWh battery. The launch of C11 is to upgrade Leapmotor’s overall image, making people no longer think that Leapmotor is only a company that produces elderly electric scooters.

At the same time, when C11 landed in the Ministry of Industry and Information Technology for approval, the production qualification will also be transferred to the Jinhua factory of Leapmotor for self-production. The Jinhua factory of Leapmotor covers an area of 551 mu. The base is planned to build three power battery workshops and four major craft workshops for automotive core components. The flexible production line can achieve three-platform multi-model component co-production, and the current production capacity of the factory is 50,000 units. The factory is currently expanding its production capacity, and the plan is to increase the production capacity to the planned capacity of 250,000 vehicles.

Comment:

The 100,000th car offline this time is the performance version of the Leapmotor C11, which is offline in the Jinhua factory. In Zhu Jiangming’s Leapmotor 2.0 strategy, the C01, a mid-to-large sedan, also went on the market as scheduled and will be delivered in the third quarter of this year.

Obviously, Leapmotor has found confidence on its existing products and has also learned its own way: to continue to take the cost-effective route. The price of C11 has more than doubled from T03, directly to 160,000-200,000 yuan, but it is still the largest mid-size SUV that you can buy with the biggest battery.

C01 obviously also continues this method. Users can buy a super large cup with the price of a medium cup. Based on products, the Leapmotor brand has achieved rapid upward breakthroughs, but the road above 300,000 yuan is not easy. Leapmotor’s products can serve as a stepping stone for brand improvement, but if they want to go well and steadily, Leapmotor still needs to continue to work hard.

Deepening cooperation, Horizon receives strategic investment from FAW Group.On June 27th, Horizon announced that it had received strategic investment from FAW Group. Since 2020, Horizon has successively reached strategic cooperation with FAW-Volkswagen and FAW Intelligent Network Development Institute. In May 2022, Horizon obtained the application of FAW Red Flag’s new car project, and will work with industry partners based on the Journey 5 chip to jointly help FAW Red Flag create a high-level autonomous driving solution.

Since its establishment, Horizon has received strategic capital from many automotive capital including SAIC Group, GAC Capital, Great Wall Motors, Dongfeng Asset, BYD, as well as many upstream and downstream enterprises in the industry chain, such as Intel, SK, Hynix, CATL, Weir, and Sunway Optics.

Comment:

Horizon is the first domestic technology company to complete the mass production of front-loading ADAS chips. Currently, Horizon is rapidly advancing the mass production of Journey 5 on-board chips. As of today, Journey 5 has obtained designated cooperation from mainstream car companies such as BYD, ZYJ, and FAW Red Flag. In addition, Horizon has reached strategic cooperation with autonomous driving companies such as QZ Navigation, Hongjing Intelligent Driving, and Juefei Technology.

As of the end of 2021, the shipment volume of the Journey chip produced by Horizon has exceeded 1 million. Currently, Horizon has signed over 20 front-loading mass production designated projects for more than 70 models with various car companies, making it the largest mass-produced China’s vehicle regulation-level AI chip enterprise.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.