Author: Zhu Yulong

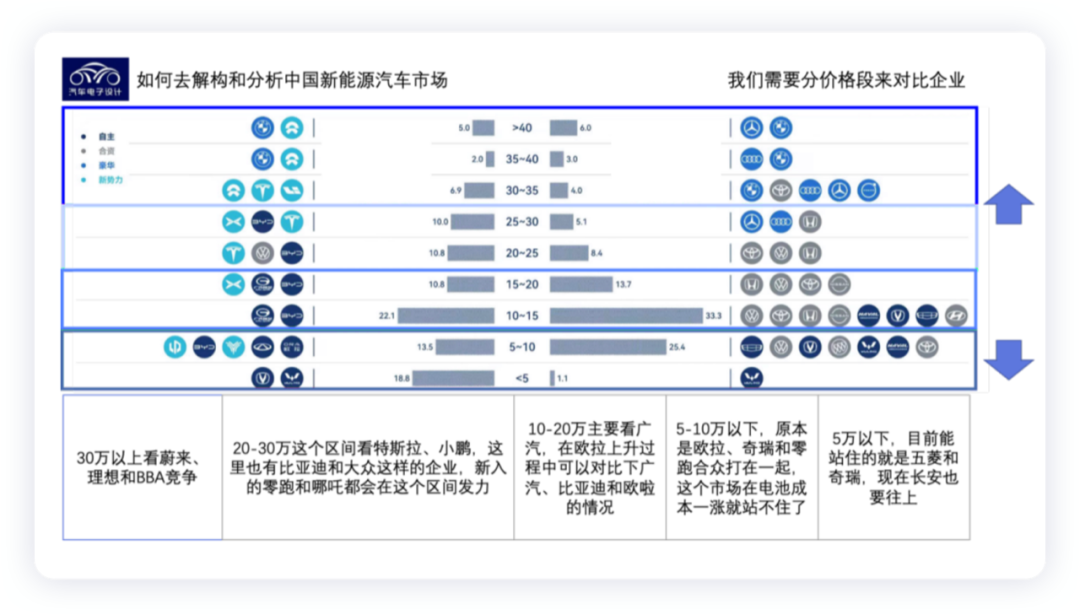

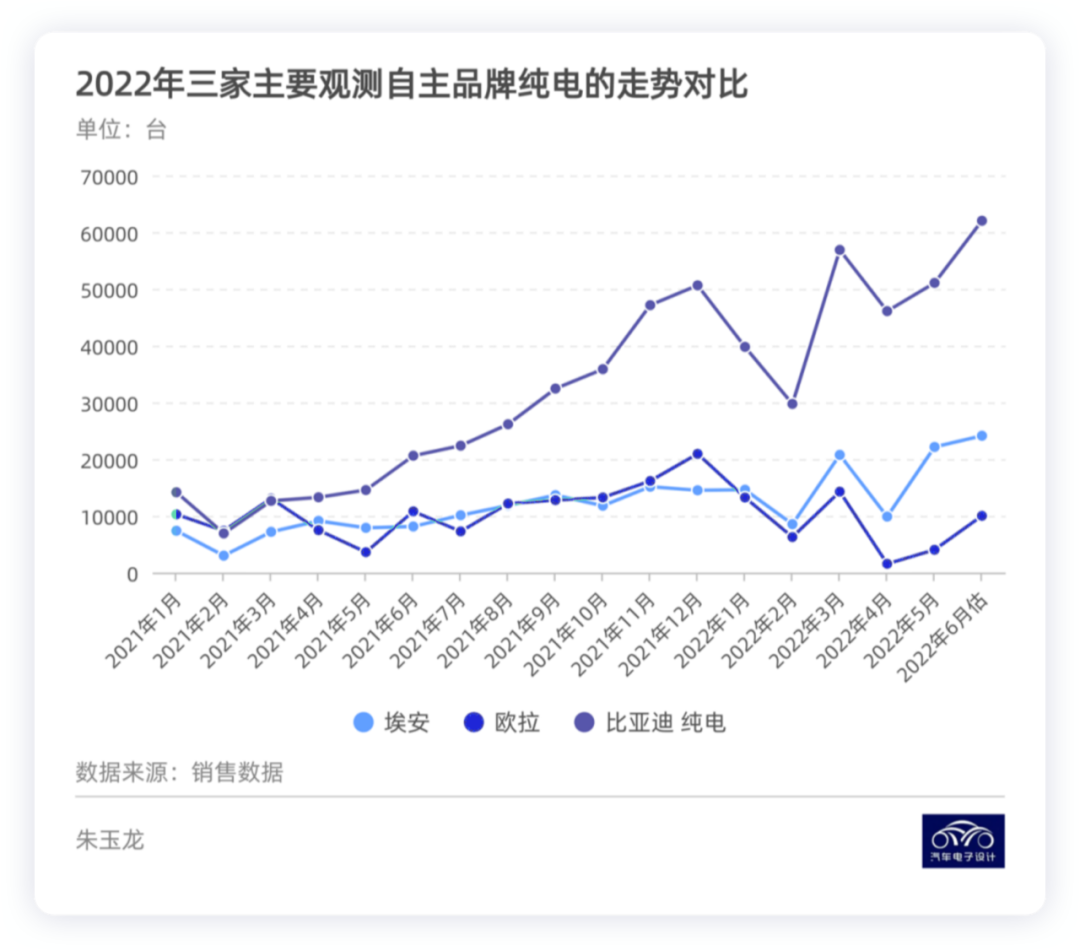

Placing these three brands together is mainly due to their price range considerations. BYD (pure electric), Aiways, and Ora’s differences in trends in pure electric parts in 2022 objectively reflect many issues. With deeper cultivation of the subdivided market, as the cost of batteries rises, everyone’s survival strategies have changed.

- BYD

Due to the existence of VW, as long as the profits from batteries and the entire vehicle are held, BYD is actually competing on price in the pure electric track, where other companies raise prices more and we raise prices less. In the entire fast LFP low-cost line, it cut a straight line.

- Aiways

The process of Aiways’ LFP hasn’t really begun yet, but actually, many problems arose between it and Ningde several years ago. On the contrary, it has nurtured a situation where three suppliers can supply, plus it could cooperate in terms of batteries. It successfully changed from Aion S to Aion Y and targeted the young small car market.

- Ora

Before, Ora was targeting a market of about 80,000 yuan in the White Cat and Black Cat era. With the transfer to Good Cat and various types of Lightning Cat and Thunder Cat, it still encountered a lot of resistance.

Let’s take a closer look at the specific analysis.

Brand pricing

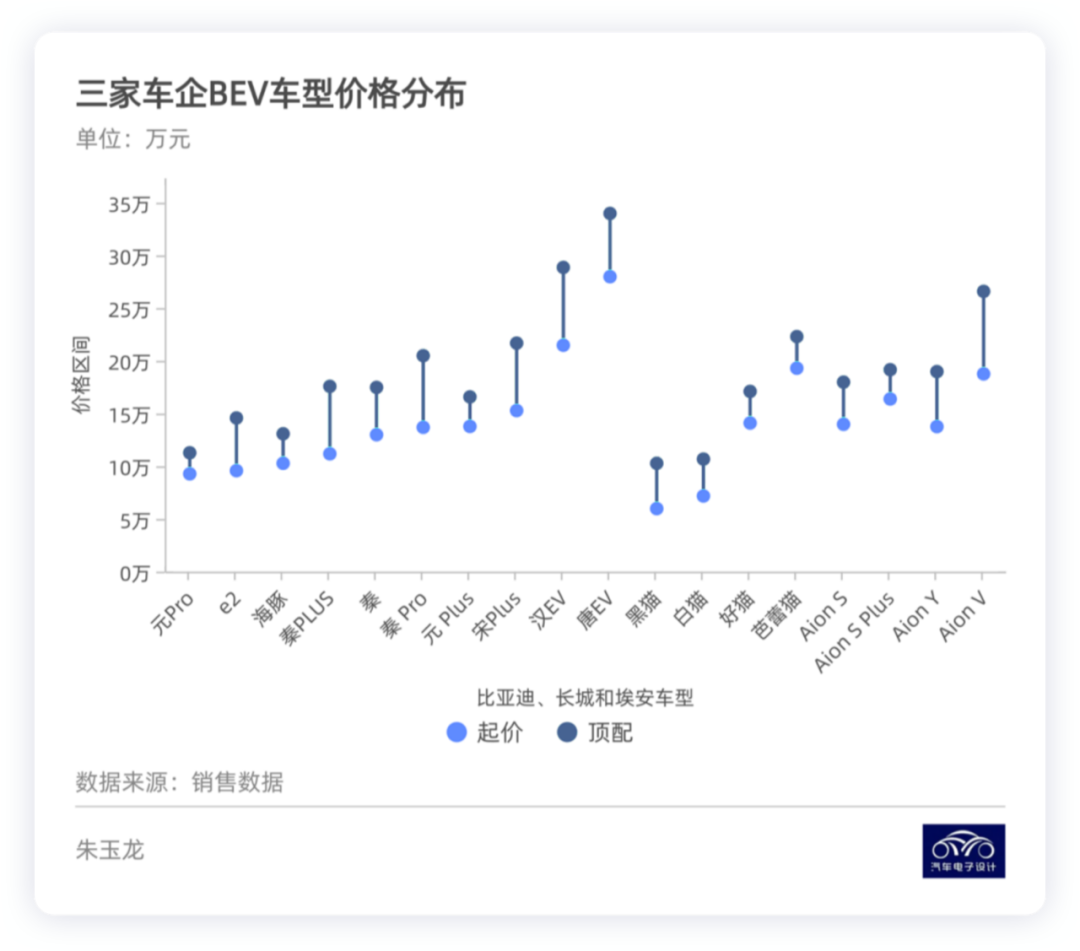

I think we should start by analyzing the price range chart:

-

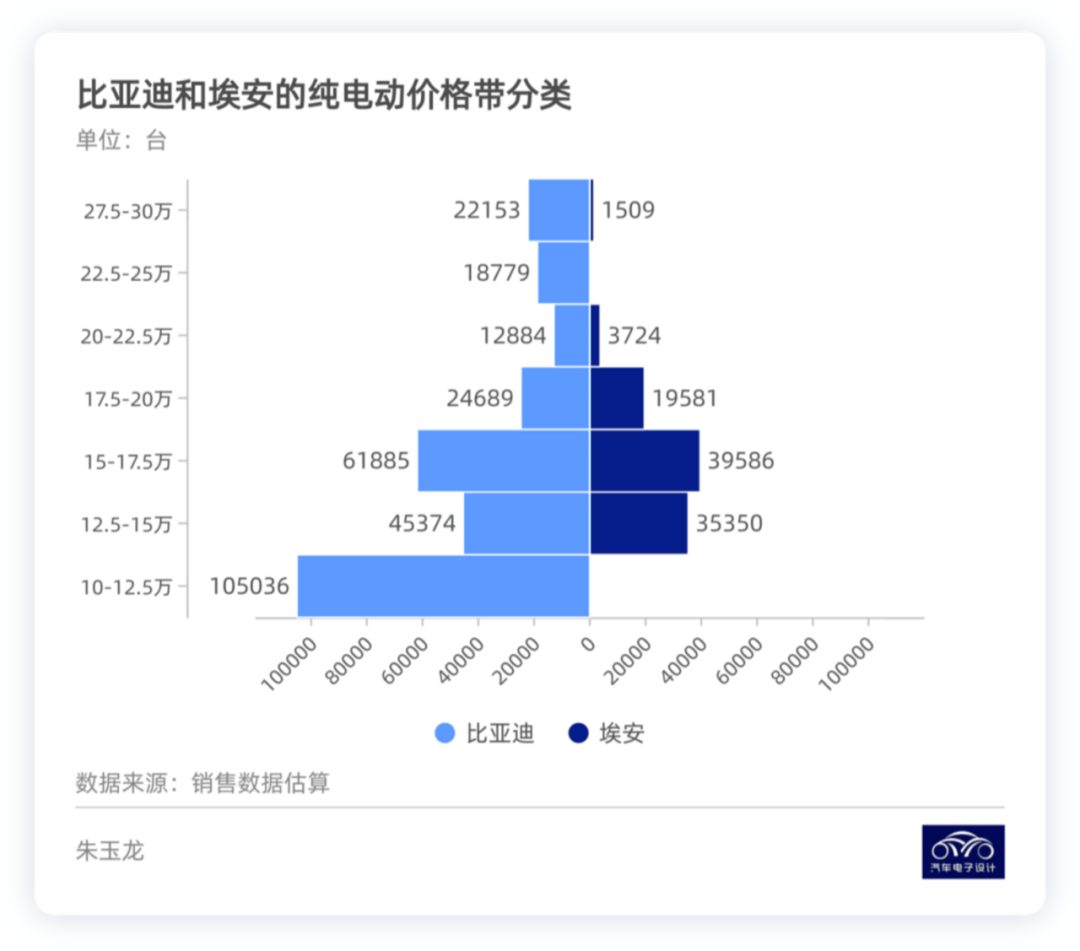

Looking at BYD, the dense array of pure electric models fills the 100,000-200,000 yuan range, and the Han EV is the starting model for all models. The subsequent Sea Lion model targets the higher cost-effective models of 200,000 yuan or more.

-

Aiways’ high-volume models are mainly divided into Aion Y and Aion S, and the price range overlaps with BYD.

-

The Ora series transitions from Black Cat and White Cat to Good Cat, and needs to have good cost control. Moreover, it overemphasizes subdivided models. In the eyes of mainstream consumers, its growth ability is not very good.

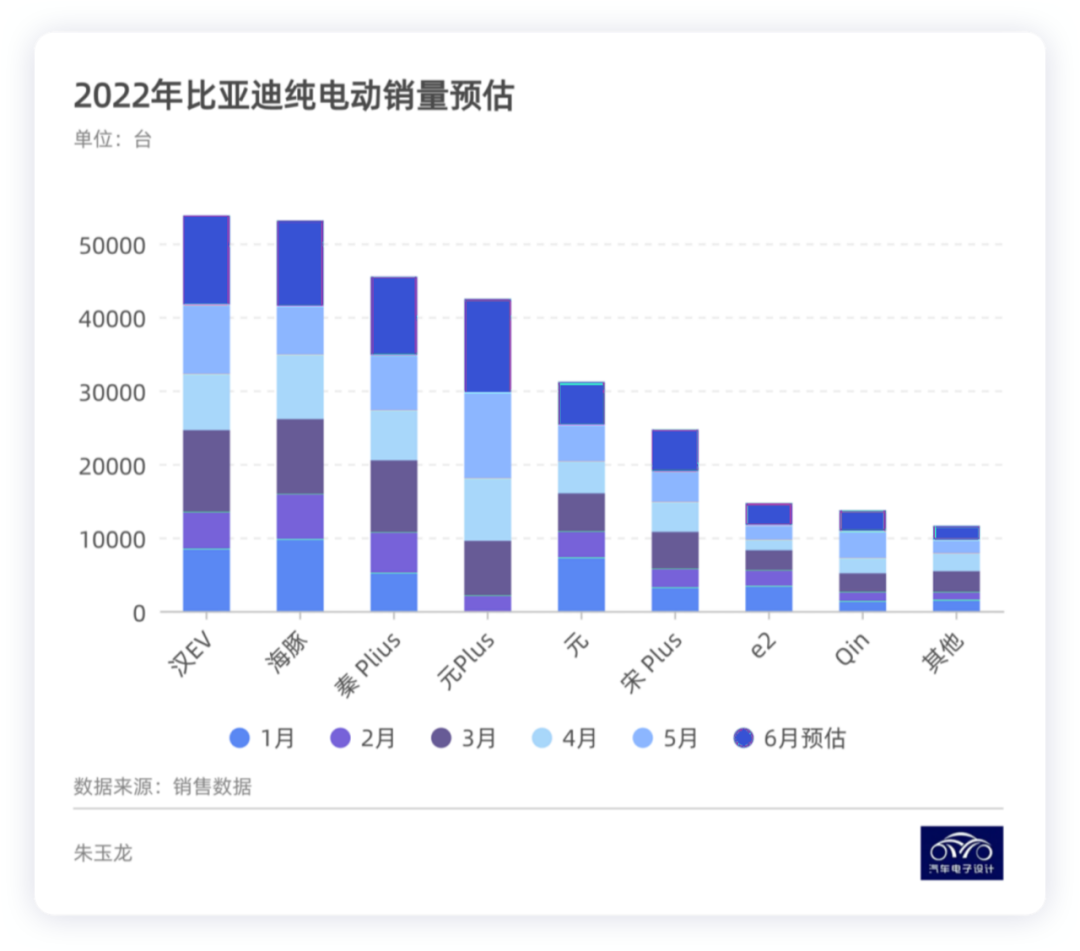

BEV distribution of BYD and AiwaysFirstly, according to the June sales volume of 69,000 units and the estimated number of insured vehicles of 65,000 to 67,000 units, the overall sales volume should be divided as follows. The sales of EVs in the first half of the year were about 290,000 units, roughly three times that of Aiways.

Based on the proportion of different price segments, we can roughly breakdown the sales as follows:

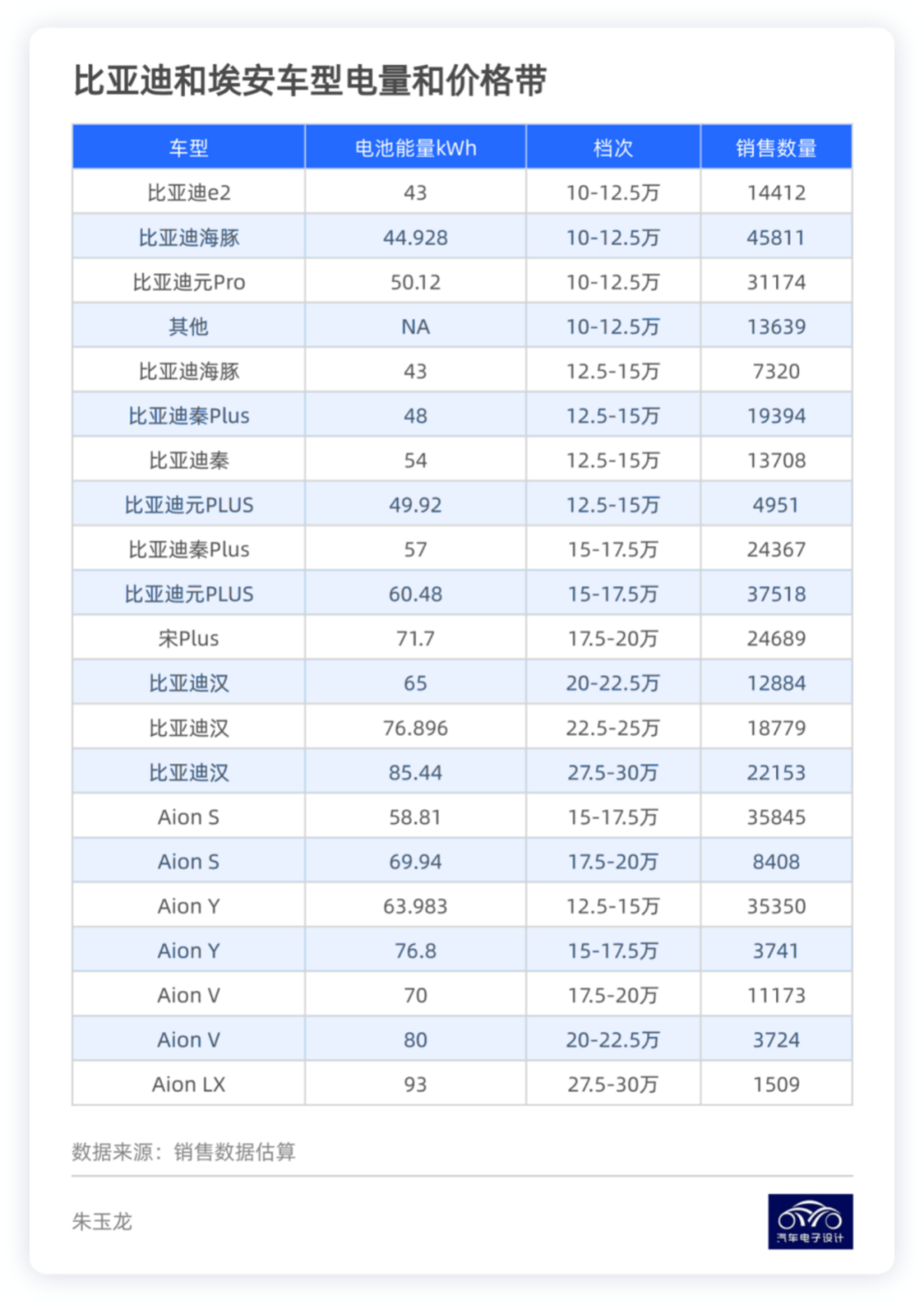

From my understanding, this wave of Aiways actually overlaps with BYD in many model prices. After BYD took the lead in introducing lithium iron phosphate, it has a significant advantage in overall cost control. Coupled with its vertically integrated approach, it has a relatively large control over the lower-priced cars with battery capacities of less than 50 kWh. The prices of vehicles in the 70 kWh and above range are relatively higher.

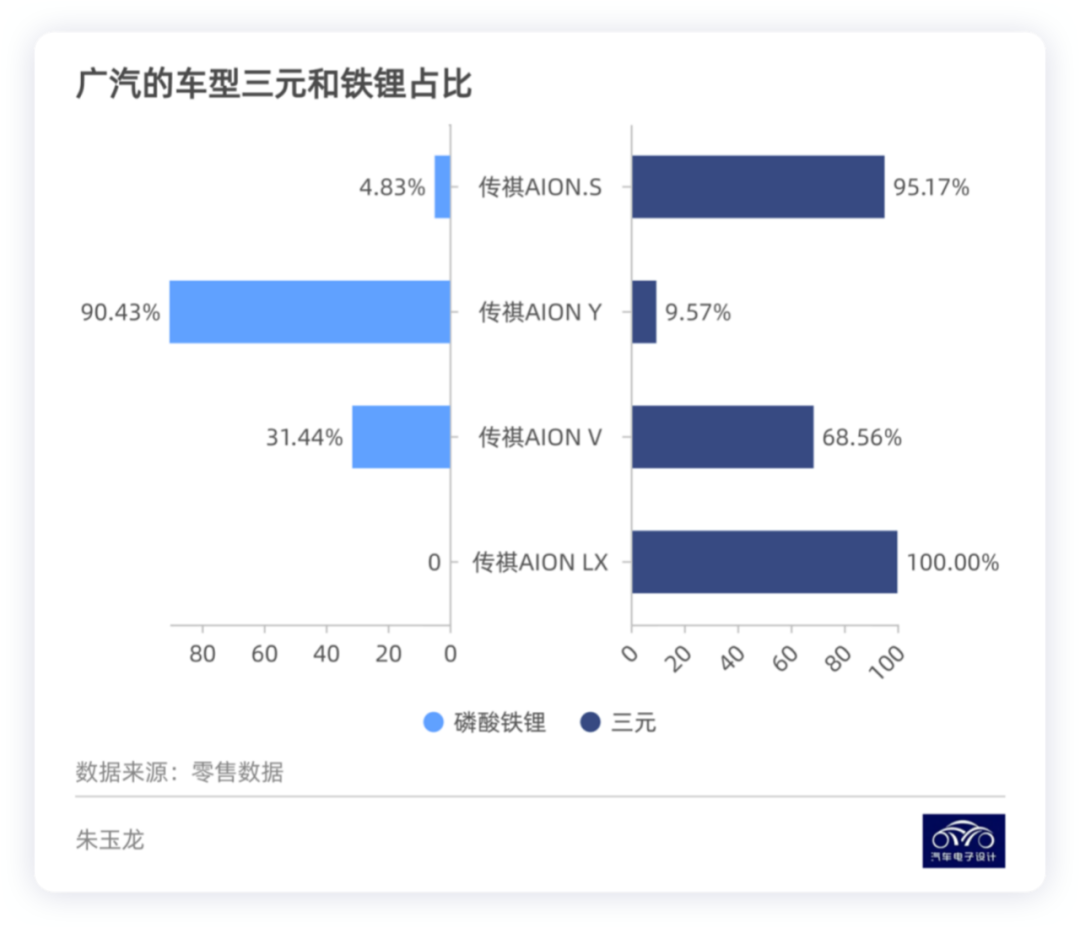

We can see that GAC has fully switched its low-priced Model Y to a 64 kWh iron phosphate battery, which is very important for GAC Aiways. Aion S will also be fully switched to a 64 kWh battery in the future.

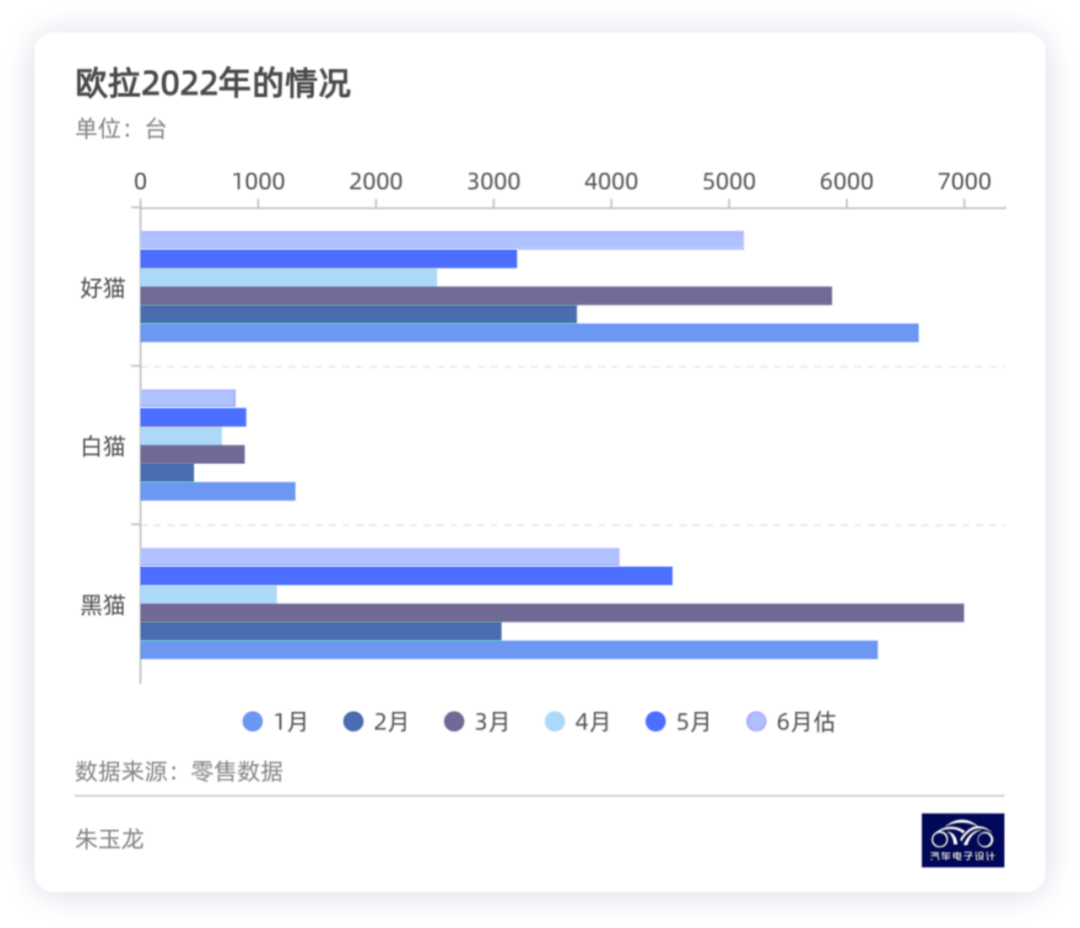

Euler

I took a closer look at Euler’s data and found that after withdrawing from the Black and White Cat terminals, they failed to capture the overall market demand relying solely on the Good Cat strategy. The subsequent Cherry Cat upgrade strategy resulted in slower decision-making for female consumers. This wave of Smart EVs further separated the market, making it difficult to achieve high growth in 2022 with such a detailed approach.

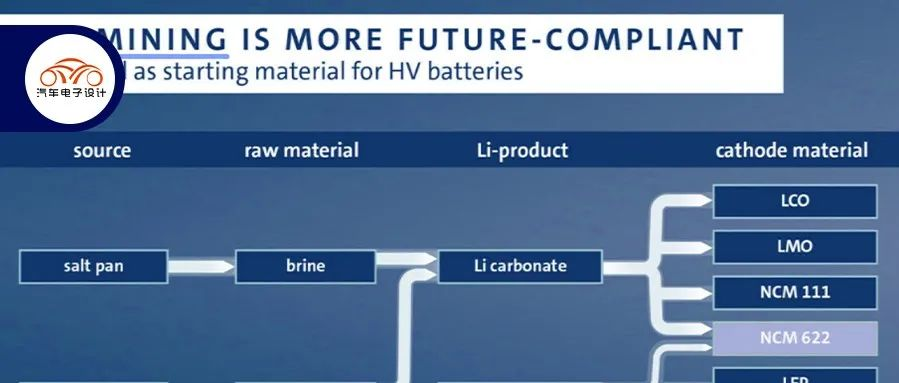

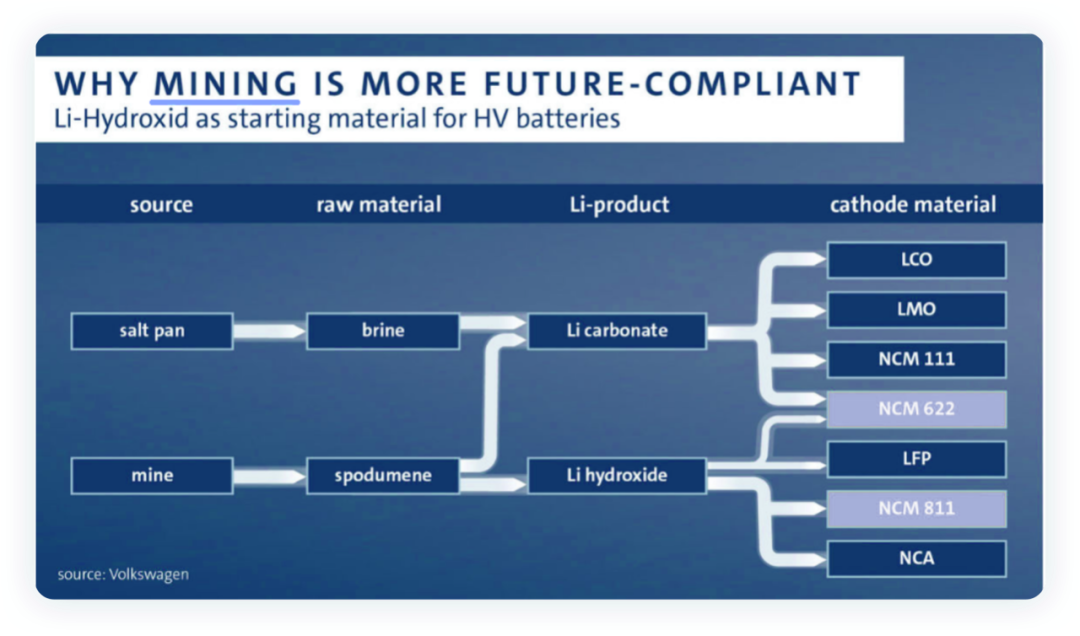

Future ProjectionsI think in order to compete with BYD in the 100,000 to 175,000 RMB market, the first step is to switch to using lithium iron phosphate batteries. The main issue is that for a market where 40-60 kWh is assumed to be the dominant size, the difference in battery prices will be directly reflected in the car prices. If automakers cannot control this price, it will be difficult to compete with BYD in the long run. BYD itself is not looking to make money in this price range, so the question is how can other companies make a profit?

Therefore, the estimated growth of the overall electric vehicle market needs to be directly linked to battery prices, by going back to the 2019 battery price system.

Secondly, in the 175,000 to 250,000 RMB price range, the battery assembly generally consists of 70-80 kWh, and according to current predictions, they are shifting towards mass-production of blade-type iron-lithium batteries. With the rise in price of the Model 3, this price range mainly competes on cost performance for Chinese consumers.

In conclusion: The time it takes for classification statistics and diagram drawing is quite long. This week’s two illustrated insights are written up to this point. I think that currently, electric vehicles under 200,000 RMB are entirely dependent on battery prices. However, the subsidy phase-out in 2023 may cause some looseness in battery prices and raw materials. For companies who want to increase their production volume, controlling battery prices will become key.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.