Actually, there has always been a saying online that Magna is the “Emperor of OEMs”. This is closely related to Magna’s deep and broad layout in the automotive field, which has led many automakers to directly adopt Magna’s provided vehicle solutions to start manufacturing cars.

Under the background of carbon reduction, the penetration rate of new energy vehicles is gradually increasing, and global automakers are introducing new innovations, moving forward steadily towards pure electric vehicles. As an old-fashioned automotive supplier giant, can Magna still maintain its title as the “Emperor of OEMs”?

On June 30th, I was invited to participate in the Magna “Powertrain electrification solution for future mobility” small communication meeting online. I witnessed Magna’s powertrain electrification solutions, covering hybrid and pure electric fields, and products specifically designed for automaker transformation, and also showed Magna’s strategic layout for the next few years.

The Emperor of OEMs?

What kind of company is Magna? In the words of Li Xiang, Asia-Pacific General Manager of Magna Powertrain, and Vice President of Business Development and Strategic Cooperation, Magna is a “65-year-old travel technology company“.

Currently, Magna has 160,000 employees, 340 production bases, and 89 product research and engineering centers worldwide. In addition to glass and tires, Magna’s products cover almost all automotive parts areas. Most importantly, Magna has system integration capabilities, whole vehicle engineering and manufacturing capabilities, which are three key areas that set Magna apart from other automotive parts companies.

In the global automotive parts supplier rankings by the US automotive news magazine, Magna ranked fourth in 2021 and has been the top-ranking company in North America for many years.

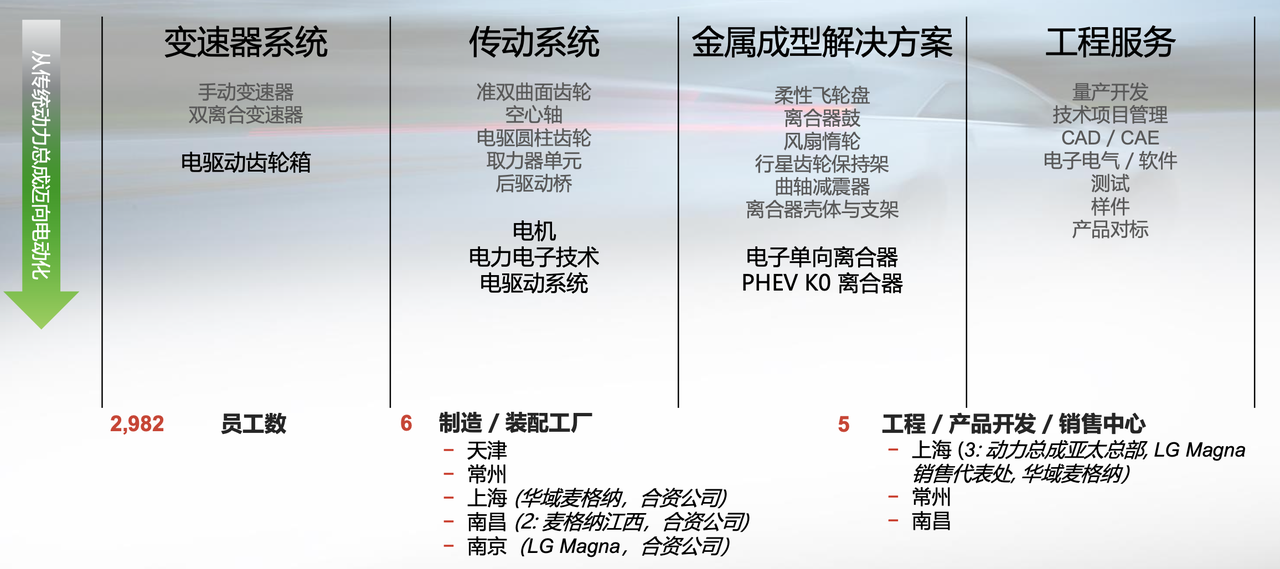

Magna Powertrain is a subsidiary of Magna and includes the Transmission Systems Division (the world’s largest independent transmission supplier), the Driveline Systems Division, the Metal Forming Division, and the Engineering Services Team. Among them, the Driveline Systems Division provides all-wheel/four-wheel drive products and a three-in-one electric drive solution.

Magna Powertrain has nearly 3,000 employees, six factories, and five engineering research and sales centers in China.

In fact, many times when we hear the word “Magna”, it is often accompanied by the names of other companies. Yes, Magna has teamed up with many other companies to form different joint ventures, trying to unleash the full potential of its abilities and those of its partners:- Magna’s joint venture transmission company with Jiangling Motors (Magna Powertrain Jiaxing Co., Ltd.) focuses on the production of manual and dual-clutch transmissions, with its base in Nanchang. In recent years, the company has expanded its business to include electric drive gearboxes, producing nearly 260,000 units for automakers.

-

Magna and LG Electronics established the joint venture company LG Magna in 2021, integrating LG’s expertise in motors, inverters, and on-board chargers, and Magna’s strengths in electrified powertrain systems and world-class manufacturing in China. The joint venture’s production base is located in Nanjing.

-

Magna’s joint venture with SAIC Huayu Automotive (Huayu Magna) has produced about 80,000 highly integrated three-in-one electric drive systems for the Volkswagen MEB platform and has also secured new business for electric drive systems from a North American automaker and another domestic automaker.

Electrification. For All.

Due to its in-depth layout in the automotive field, Magna has a keen sense of “knowing the time is right” like a duck in warm water. With increasingly strict emission regulations, continuous improvement of infrastructure, and the steady growth of consumer demand for green travel, the automotive industry is rapidly transitioning to full electrification.

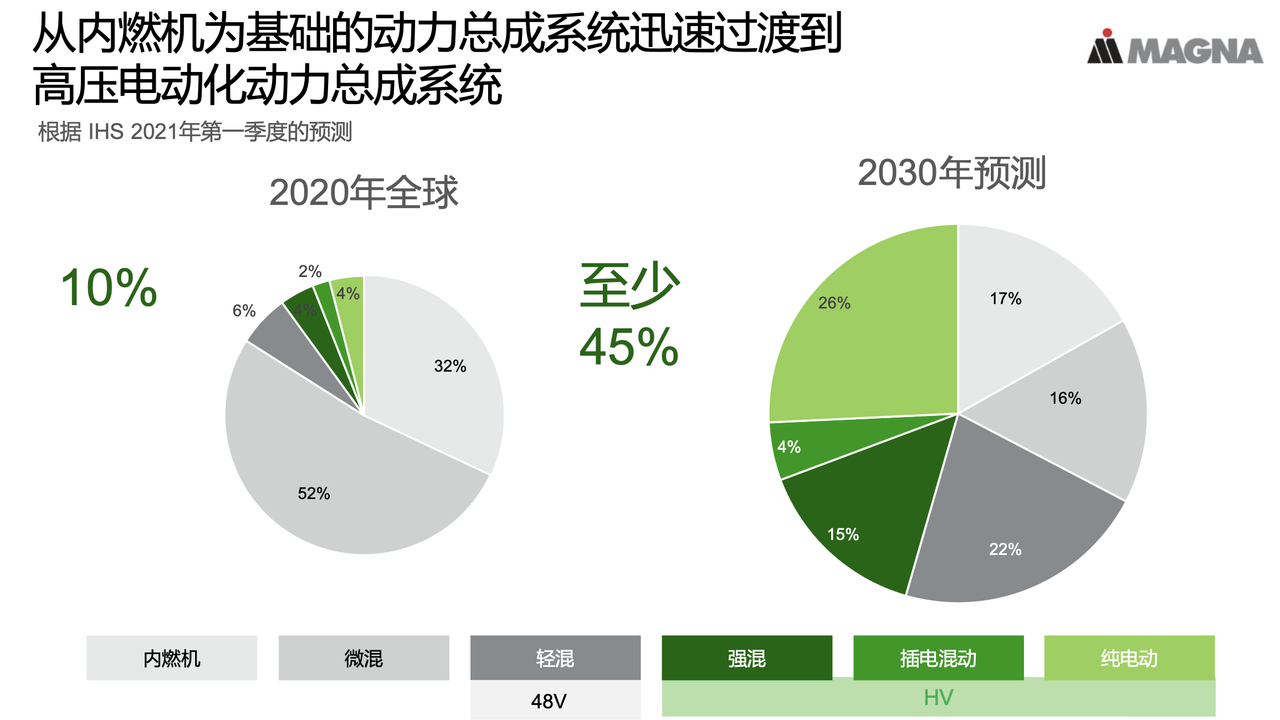

It is expected that by 2030, the market demand for high-voltage electrified powertrain systems, including mild hybrid, plug-in hybrid, and pure electric, will increase from the current 10\% to over 45\% in the future. For the more aggressive Chinese market, Li Xiang believes that it will be far ahead of other global markets in terms of both scale and the application of new technologies. This is a huge market opportunity for Magna Powertrain.

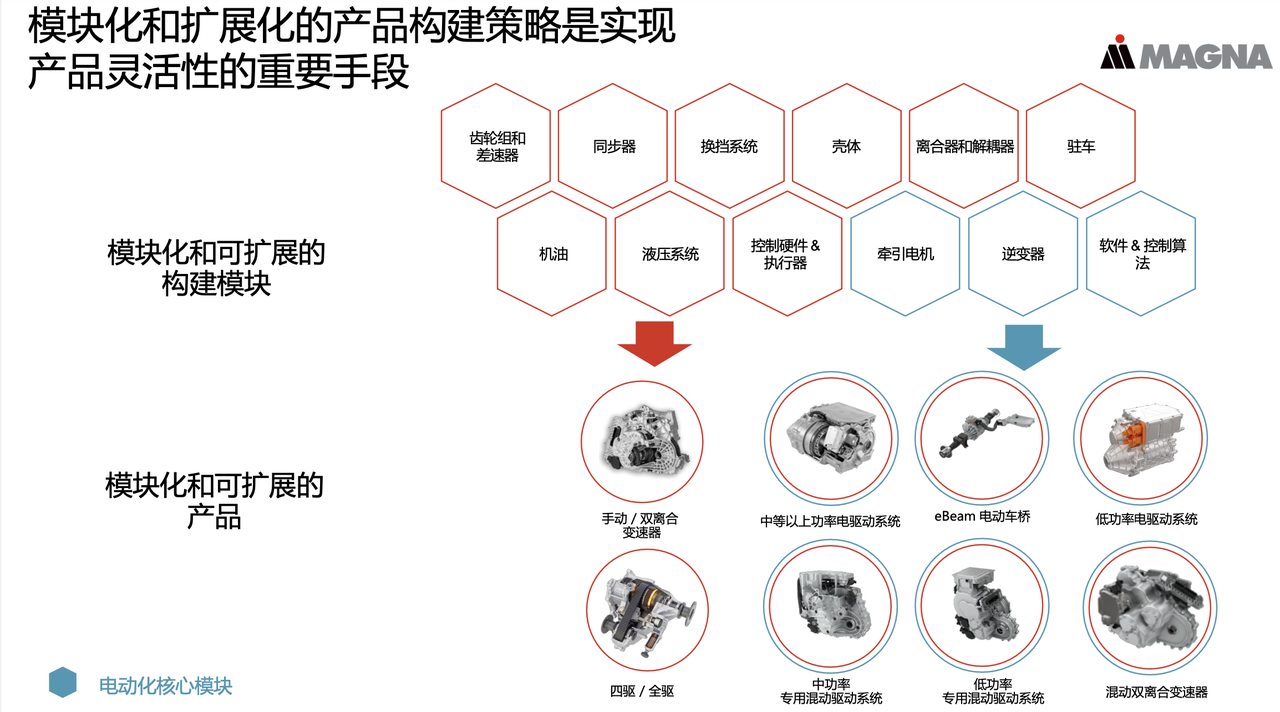

Magna is facing the market’s shift toward pure electric vehicles and has proposed the slogan “Electrification. For All.” How to seize the market opportunity? Magna’s answer is “modular and scalable building blocks.”

Magna defines its powertrain products as 12 building blocks that are standardized and reusable functional units. These units are like basic materials in building a house that can be reused, while also expanding functionality to meet the varying levels of electrification needs of the same vehicle platform.

- The red modules are traditional powertrain products, commonly used mechanical building blocks with high maturity.The blue module is the core element of electrified products, such as motors, inverters, software, and control algorithms, which can achieve scalable power and functionality over a wide range.

In the end, Magna’s modular product construction strategy has accelerated the development of powertrains, increased flexibility in custom solutions for OEMs, and optimized costs.

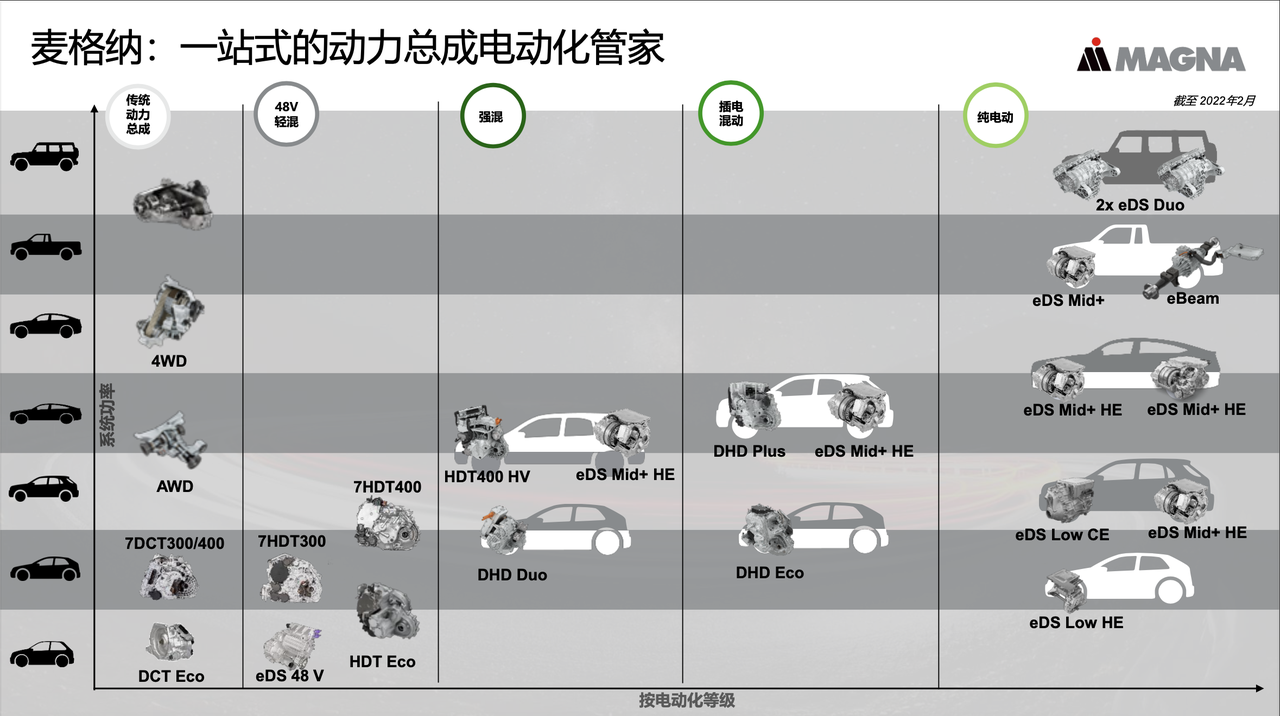

From traditional internal combustion products to 48V mild hybrid, strong hybrid, plug-in hybrid (PHEV), and pure electric vehicles, Magna’s powertrain product spectrum covers almost all types of automotive powertrains currently available on the market. Through product combinations and configurations, OEMs can receive one-stop support for sedans, SUVs, pickups, and even commercial vehicles.

Product Layout

Although the market acceptance of pure electric vehicles is increasing, Magna’s customers are B2B OEMs with a significant share of the fuel vehicle market. According to the “Roadmap 2.0 for Energy-saving and New Energy Vehicles,” at least 40% of vehicle models will still be efficient, low fuel consumption hybrid models by 2035.

Therefore, the product spectrum provided by Magna is primarily helpful for original equipment manufacturers (OEMs) to upgrade fuel vehicles quickly to hybrid vehicles.

Magna’s DHD Eco and DHD Plus use the P2.5 architecture. The two single-motor dedicated hybrid gearboxes remain compact without increasing the axial space (the lateral distance between the two front wheels) by mounting the motor directly above the intermediate shaft, which is friendly to the OEM’s engine and engine room layouts. This is why the P2.5 architecture is suitable for mass production, as demonstrated by mass-produced vehicle models applied to this P2.5 architecture this year.

Considering that some readers may not be familiar with the meaning of P2.5, they can refer to my previous post on hybrid electric motor technology: “Hybrid Technology: Which One is Better? Understand the Principles!”.

Magna has reduced the mechanical hardware of the transmission, which can effectively compensate for the increased cost of the motor. For A0 to B-level models, DHD Eco has reduced the original six gears to four gears, and for B and C-level models, it has reduced the original seven gears to five gears.Magna has developed the DHD Duo, a dual-motor product that meets the needs of plug-in hybrid and strong hybrid, and can also support extended-range electric vehicles through hardware changes. The dual motor architecture ensures smooth and efficient switching between electric, series, and parallel-parallel drive modes under different conditions and driving habits, coupled with an efficient engine, the fuel efficiency of DHD Duo can reach 33\%.

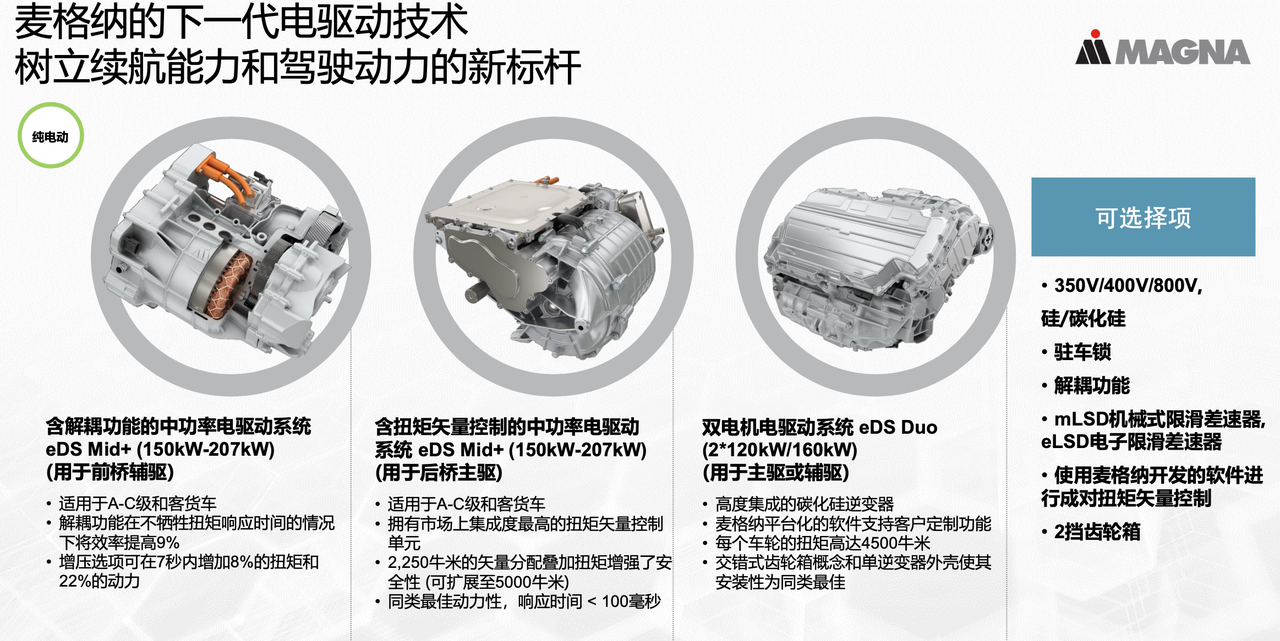

In addition to the low-power electric drive system already in mass production for the general public, Magna has targeted the next generation of electric drive technology with higher power, longer range, and higher safety. For example, in a medium-power electric drive system used as a front axle auxiliary drive, the power range covered can be from 150 to 207 kW. When used as an auxiliary drive, it can be completely disconnected from the entire power system when not needed, thereby avoiding torque losses caused by drag and the operating losses of electric motor control, thereby improving efficiency by 9\%.

When used as a rear axle main drive, Magna adds a torque distribution management device, which mainly manages the torque distribution through two real-time clutches within 100 milliseconds. With Magna’s self-developed software, it can actively identify the vehicle’s driving state and road conditions, allowing for different torque outputs from left and right wheels. Even when one side of the wheels slip, it can still ensure the driving force and direction of the vehicle, improving safety.

Magna’s dual-motor electric drive system has been launched on the market and is expected to be mass-produced in 2025. The system can provide up to 320 kW of output power and, combined with two-speed gearbox, can output up to 9,000 N·m of driving torque.

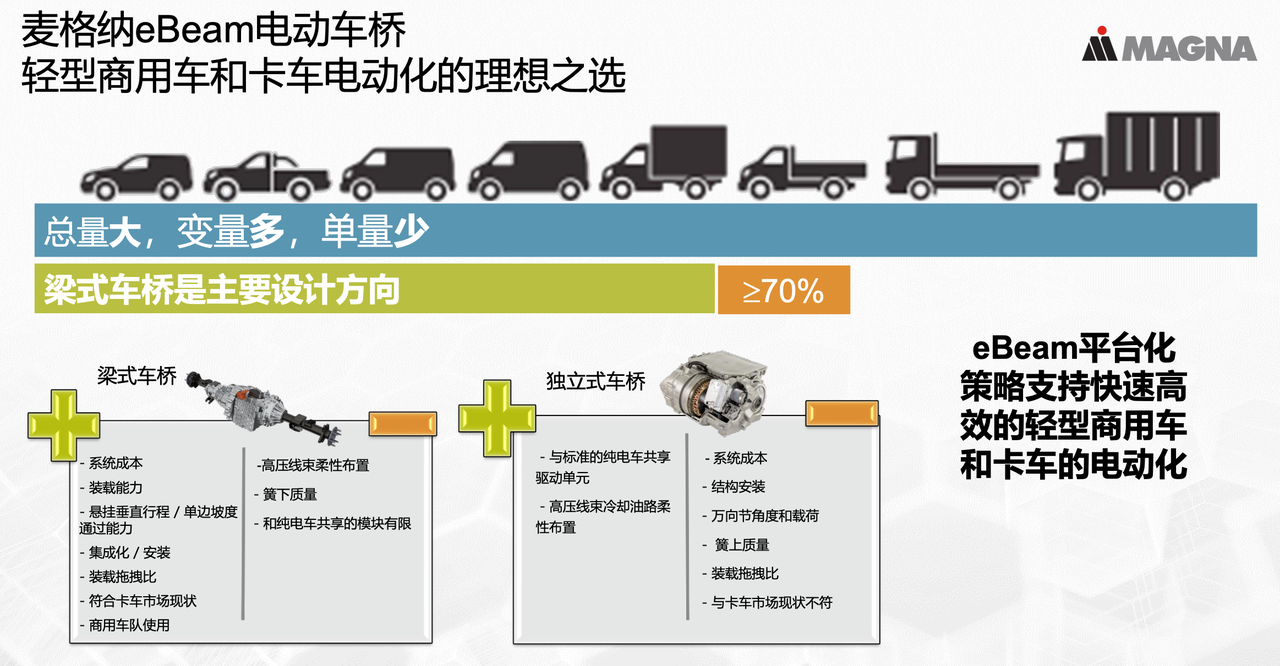

In the process of rapidly advancing electrification, the trend of electrification of commercial vehicles is also gradually emerging. Magna believes that the use of commercial vehicles in China has these characteristics: the total amount is very large, the variables are also many, and the single quantity of a single model is very small. Due to the requirements of carrying capacity, the chassis and axle used by most commercial vehicles are different from those of passenger cars and are beam-type axles.

Magna has transformed its electrification product strategy from a highly integrated and efficient electric drive system to the eBeam electric vehicle axle solution. The eBeam also utilizes a platform development strategy, which can quickly complete the transformation to electrification without changing the vehicle’s existing structure, and does not affect the vehicle’s carrying capacity.In traditional light-duty trucks, the beam axle design has been proven significantly sturdy over the years. In the early stage of eBeam project, Magna conducted a complete functional test comparison between the beam axle and the independent suspension design. It was found that the beam axle is more competitive in terms of system cost, load capacity, off-road capability, and installation. Therefore, it was decided to develop electric vehicles based on the beam axle.

At present, Magna’s eBeam electric axle uses a 400V silicon IGBT power module inverter, while an integrated inverter with 800V silicon carbide power module is under development.

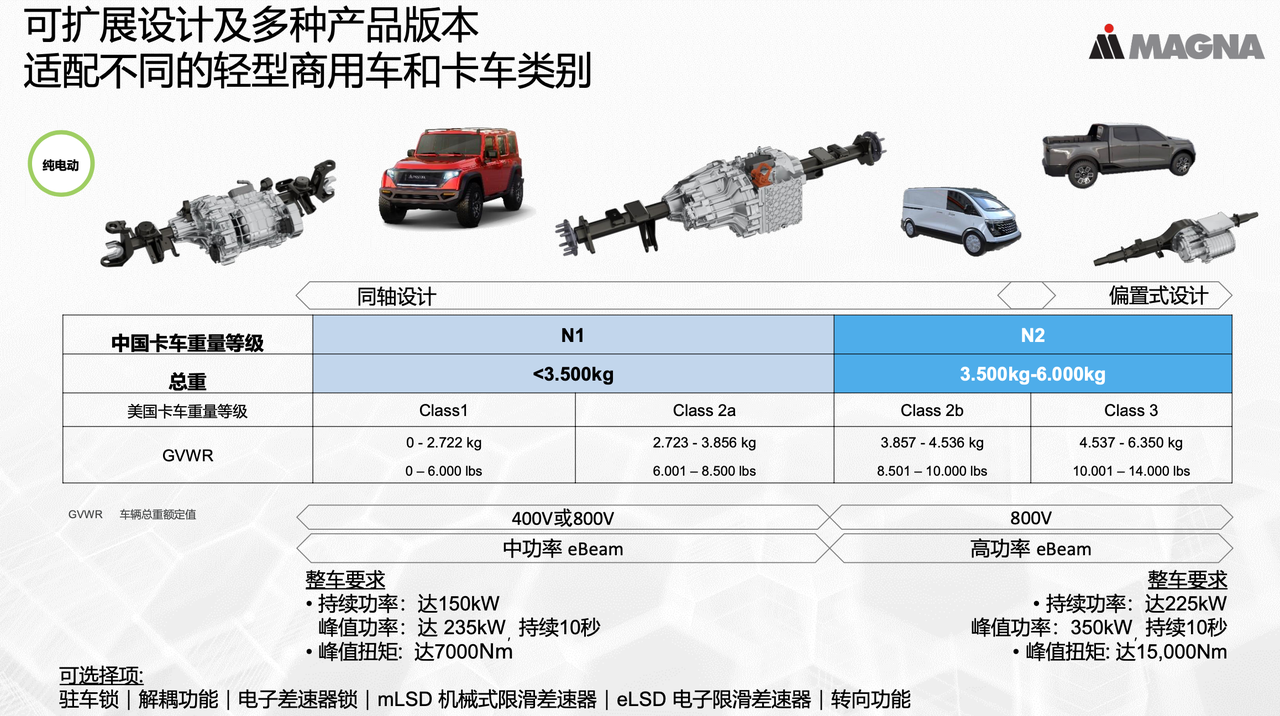

In order to expand the application of eBeam to any pick-up, SUV or light commercial vehicle platform, Magna has also adopted different ways to meet OEM requirements. For ordinary light commercial vehicles, the motor is co-axially mounted, ensuring the same compact packaging as traditional beam axles, without any modification to the vehicle’s size, space, bearing, or brake installation. For models with higher loading and traction requirements, such as medium trucks, eBeam can be designed with an off-axis motor, which ensures stronger structural rigidity and higher load capacity. In addition, by adding steering function, eBeam can be applied to the front axle to improve the vehicle’s steering and turning ability.

The application of eBeam can cover N1 commercial vehicles with a maximum load capacity of 3.5 tons to N2 commercial vehicles with a load capacity of 12 tons. For China, the current eBeam market positioning mainly focuses on the light commercial vehicle and truck market under 6 tons. To balance off-road performance, improve vehicle passability and driving pleasure, eBeam offers many possibilities, such as parking lock, decoupling function, and steering function, to meet the trend of SUV passenger cars, and easily satisfy the customized needs of whole vehicle manufacturers. Magna is currently working closely with major vehicle manufacturers and plans to mass-produce the product by 2025.

For the pick-up market, Magna has successfully installed eBeam on the rear axle of the EtelligentForce prototype, with an output power of 320 kW and a torque of 7,200 N·m. The hairpin-wound motor is provided by LG and Magna’s joint venture. To upgrade the prototype to a pure electric four-wheel drive system, Magna’s mid-power electric drive system is installed on the front axle, with a power output of 170 kW in combination with the disconnection and decoupling function. This configuration enables the prototype to achieve a towing force of up to 14,500 pounds and an acceleration of 5.9 seconds per 100 kilometers.

After the later stage of the communication meeting, we asked some questions about products, technology and industry to the executives of Magna Powertrain China (Li Xiang, Director General Manager of Magna Powertrain Asia Pacific and Vice President of Business Development and Strategic Cooperation; Chen Xiao, Product Management Director of Magna Powertrain China; Han Shixiong, Senior Engineering Director of Business Development Center of Magna Powertrain China). The following is an excerpt:

After the later stage of the communication meeting, we asked some questions about products, technology and industry to the executives of Magna Powertrain China (Li Xiang, Director General Manager of Magna Powertrain Asia Pacific and Vice President of Business Development and Strategic Cooperation; Chen Xiao, Product Management Director of Magna Powertrain China; Han Shixiong, Senior Engineering Director of Business Development Center of Magna Powertrain China). The following is an excerpt:

Does Magna have a layout in software?

Han:

Magna believes that their software on existing gasoline engines is already very strong. For example, all of the software on power management and gear shifting for the dual-clutch is independently developed by Magna. Software is very critical to electric drive products.

For example, as mentioned earlier, in cloud and algorithm research, if a car detects slippery or icy road conditions in front of it during driving, all of this information will be transmitted to the central control system, and the vehicle will start vector control system to distribute torque to the appropriate wheels, thus avoiding serious slippage of the vehicle, which effectively improves safety. All of these calculations do not require driver control and will be realized in the cloud. This involves a large amount of software development and algorithm research, and Magna has invested a lot of manpower and material resources in this preliminary stage. Magna is also confident that software is a very important part.

Magna and BMW’s Mild Hybrid Transverse Gearbox

Chen:

Magna is also the only supplier of BMW’s transverse gearbox.

Our mild hybrid gearbox is a transverse P2.5 architecture that does not increase the axial distance. Its installation size is completely the same as our original DHD gearbox, so OEM does not need to make major changes to the engine layout, which is very convenient and friendly to the layout.

The motor used in this system is 4.7 kW, and the size and efficiency of the entire motor are very high. As we all know, the current application of 48V technology on the market is mainly P0 architecture, which mainly controls engine start-stop. Its contribution to fuel saving is relatively limited. The design of P2.5 can not only help the engine start-stop, but also directly drive the vehicle in low-speed, high fuel consumption scenarios because it is directly connected to the gearbox. Its fuel-saving efficiency can reach 15%~17%. The fuel-saving economy is very high, and the cost input and the final achieved fuel-saving effect are very good. This is also one of the reasons why BMW chooses this technology to gradually replace pure gasoline models.

This technology has also been widely recognized by customers. In addition to BMW, another European customer will start mass production this year. BMW has a large engine torque of 400, and the other customer uses HDT 300. Although the torque range is different, the architecture and product design are exactly the same. I believe that more and more customers will pay attention to this point, and recognize the performance of our products in terms of economy, performance, and cost. We have great confidence in this product.### How does Magna view the latest electrified hybrid system electromechanical coupling unit from Chinese brands?

Chen:

We have seen many automakers researching in the field of hybrid powertrains, which is also driven by the dual-credit policy and the national emission reduction requirements. One of the major challenges in electrification is cost, and achieving the best balance between cost and efficiency.

Many automakers are aligned with our product development direction in the overall direction. It may still be premature to call it mainstream, until the vehicle type and market acceptance reach a certain level. However, I believe that mainstream will emerge as one of the solutions, as everyone is still in the process of research, including optimization of motors, matching the efficiency of motors for different vehicle types, cooling methods, and creating better effects with multiple gears and matching engines. This is also a process, including the upgrade and modification of engines by automakers specifically for dedicated engines. We have also seen a lot of such news. I believe that there will still be some processes to go through, and hybrid powertrains will still hold an important market position in the next 10 to 15 years.

Regarding coupling or DHT technology solutions, what advantages does Magna have? It mainly depends on two points. The first is based on years of experience in the research and design of transmissions and drivetrains. We can flexibly apply our innovative clutch technology to hybrid transmissions. The second is that we have invested heavily in motor and electronic control, and we have global leading cooperation, including joint ventures with LG, which can provide electrification products that have been mass-produced or in pre-research phase, and have better performance in modular design.

Finally, different motors can be used, and different gear ratios can be used to meet customers’ diverse demands for different vehicle types, achieving more flexible configurations in meeting requirements, balancing cost and performance. This is a solution that distinguishes Magna as a supplier from other automakers or suppliers.

How do you view the decoupling of the vehicle from the driver’s operation?

Han:

Regarding decoupling, there are different decoupling methods in the design of electric drive system. Some are decoupled on the half-axle, and some are decoupled on the differential. The decoupling devices used by Magna involve some components. We have strengthened the design of these components to ensure that the wear resistance caused by decoupling is considered a major safety point in our design.After being installed in the vehicle, many of the decoupling features mentioned earlier are achieved through the software control of the vehicle. Of course, from the components to the entire electric drive system, including all the software and even the cooperation with the automaker on the entire vehicle, we have conducted a lot of tests and developed these test plans in collaboration with different automakers to ensure the safety of this decoupling device. To summarize, from the components to the electric drive system to the entire vehicle, from hardware to software to the entire control system, we have a very rigorous and comprehensive verification process to ensure the safety of this decoupling device.

We are currently working closely with a global OEM in preparation for the production process. It is expected that the first mass-produced electric drive with decoupling will be available at the end of this year or early next year. Some automakers also need to install a decoupling device in their existing electric drive system. Based on these customers’ requirements, our design is very simple, with only minor modifications to the existing auxiliary drive, which can be directly embedded into the existing design to help customers accelerate the industrialization process. In fact, some automakers have already requested a sample and conducted tests on their vehicles.

Regarding torque distribution with vector allocation, we have already produced this product for traditional cars and implemented it in two car models for some time. Some automakers also want to use this product to replace the differential in the existing electric rear-wheel drive. We are in talks with some automakers about this. Our design is also moving towards modularity, making minimal changes to the existing platform, reducing development costs and accelerating the industrialization speed. In this winter’s test, we successfully installed this torque vector distributor in two test car models with great success.

Is joint venture development becoming a trend?

Li:

This is a very good question and also involves our core strategy in the China region, including the joint venture and cooperation strategy.

I think joint ventures and cooperation should currently be the mainstream for us in the field of electric drives. There are several advantages to this approach:

First, it allows us to quickly obtain new technology and provide support for the entire value chain of the electric drive system, including the most critical core elements such as the electric motor inverter and software algorithms.

Second, our joint venture partners can help us quickly enter a market, and after entering the market, we can achieve success in both the market and customer aspects. For example, through our joint venture with Jiangling Motors Corporation, we focus on the market for light and medium commercial vehicles, while our cooperation with Magna in the electric drive system focuses on the Chinese electric drive market.Lastly, it is important to mention that one of the core competitive advantages of Magna’s powertrain is our global industrial layout. Taking LG Magna as an example, the latest development is the establishment of a new factory in Mexico through the joint venture, which will provide core motor and inverter components for the North American market. From this, we can see that joint ventures can quickly make progress in terms of technology, market, and industrial chain layout.

So, should we adopt cooperation or independent operation? Both have their pros and cons. However, in joint ventures, we must adhere to the principle that a joint venture company can absorb the advantages of the parent companies’ DNA and operate relatively independently, while providing it with more technical and market support. This way, joint ventures can enter into a good operating mode. This is my personal view on joint ventures.

Final Words

Just from this media communication meeting, we can see that Magna has already won a lot of “customer” names that cannot be disclosed yet. Even the existing results are very impressive, such as the MEB 80,000 three-in-one electric drive of LG Magna.

Although this is not enough to be considered a defending champion, based on the market demand, Magna’s rapidly extended product and technology branches have allowed me to see a hybrid and pure electric field layout that is being woven into a net, and this will be the ultimate weapon for defending the championship.

Magna has also accurately found the Chinese market, this globally acclaimed new energy vehicle market, and has simultaneously tilted a large amount of resources to the country.

Therefore, do you think the title of “OEM Emperor” can still continue?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.