Author: Zhu Yulong

It’s only July, but all the new forces in the automotive industry have announced their semiannual data.

Among the first few, NIO has delivered over 50,000 units, with XPeng delivering 68,983, Li Auto delivering 60,403, and NIO delivering 50,827 units. The second tier includes NIO and Leap Motor, both delivering over 50,000 units, while WM Motor and Zeekri are headed towards 20,000 units, and Guangzhou AEA is aiming for 100,000 units.

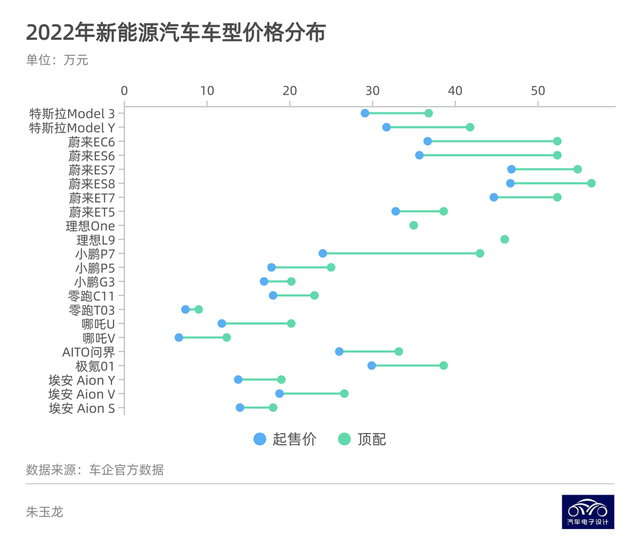

According to estimated data, we can break down the current market competition into the first and second tiers based on the market share of the main automobiles. Making some charts, which are mainly based on the price of vehicles, can help us think more clearly about the situation.

Performance of the first tier of new forces

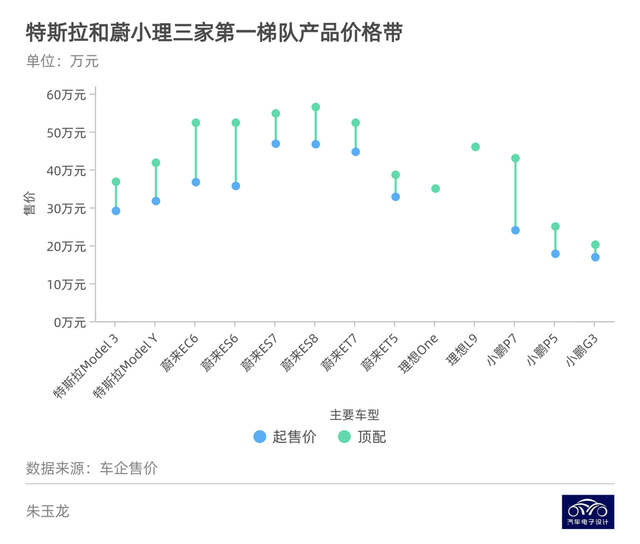

The first tier includes NIO, Li Auto, and XPeng, all of which are compared with Tesla. As for the price distribution, it can be seen in the following Figure 2. To understand the sales distribution of these cars, I think we can compare NIO and Li Auto and XPeng and Tesla.

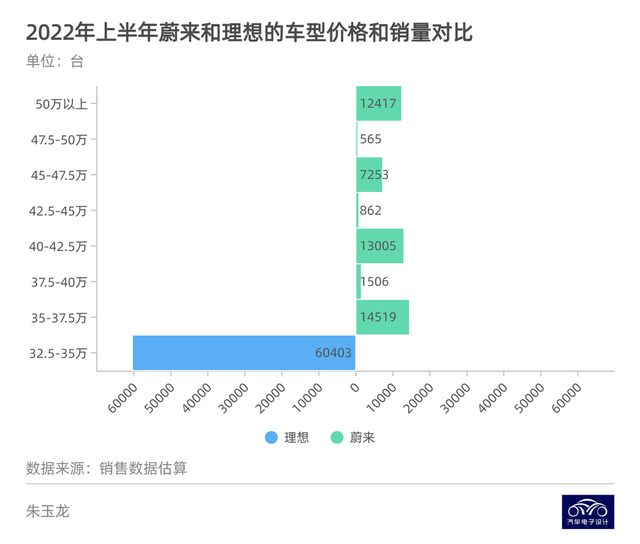

Comparison between NIO and Li Auto

NIO’s current vehicle structure mainly revolves around its three models: the ES6, ES8, and ET7, while Li Auto only has one model. The following chart shows the sales volume distribution of these three models. The main difference in price range is due to the difference in configuration and battery capacity among these NIO models.

This is my analysis of the price ranges of different models. The main configuration differences are due to the 75kWh and 100kWh battery capacity, with different versions including sports, performance, and signature editions. Of course, we also see that as NIO’s car owner group expands, different consumer groups in different price ranges are gradually differentiated.

Here I would like to mention the report from the Grizzlies team about shorting NIO Inc. Personally, I think that this kind of Battery as a Service (BaaS) offering could be a major logic for Battery Electric Vehicles (BEV) in the future. In August 2020, NIO launched its BaaS business, where customers can choose to purchase a car without a battery and rent the battery from the BaaS supplier. Customers can select a monthly payment of 980-1480 CNY or an annual payment of 11760-17680 CNY based on the rental battery capacity.

Here I would like to mention the report from the Grizzlies team about shorting NIO Inc. Personally, I think that this kind of Battery as a Service (BaaS) offering could be a major logic for Battery Electric Vehicles (BEV) in the future. In August 2020, NIO launched its BaaS business, where customers can choose to purchase a car without a battery and rent the battery from the BaaS supplier. Customers can select a monthly payment of 980-1480 CNY or an annual payment of 11760-17680 CNY based on the rental battery capacity.

Actually, for customers, using the battery rental method can reduce the purchase price of NIO cars by at least 70,000 CNY and help improve the utilization rate of electric vehicles. This model actually lowers the starting price, which means that these rental customers can use it at a lower starting price. The cost can break even after approximately 8 years of accounting. With the trend of declining battery costs, NIO, as the entity that owns the battery and is responsible for managing it in the BaaS business, has the opportunity to recycle materials for future use. This kind of urban battery mine may be imitated by many companies after the subsidy retreats. As of September 30, 2021, the BaaS agreement serves 19,000 users, of which 18% subscribe to 100kWh of battery capacity and 82% subscribe to 70-75kWh of battery capacity.

The interesting part here is that with this battery-swapping mode, users are willing to choose small batteries and short-range models.

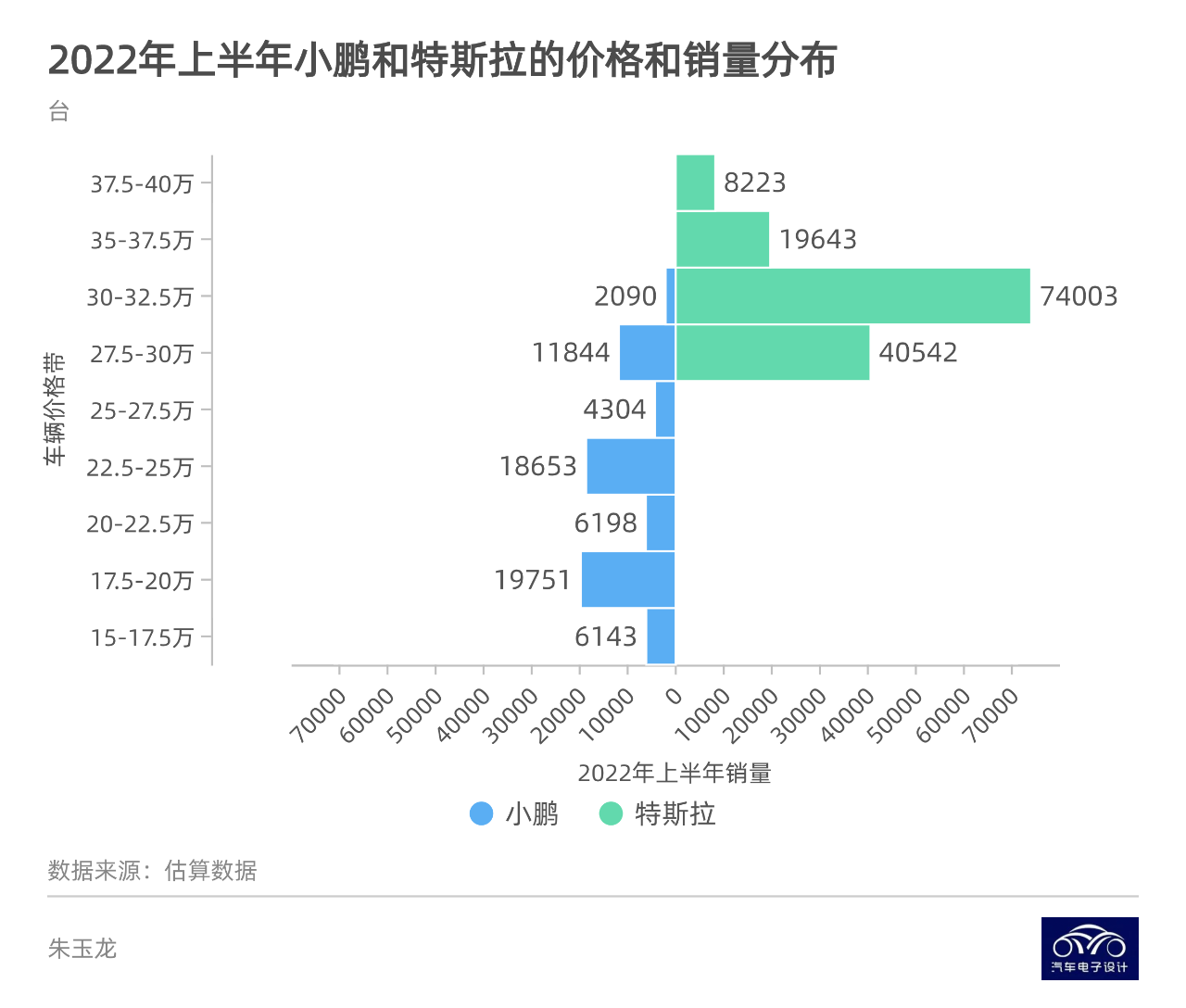

XPeng and Tesla

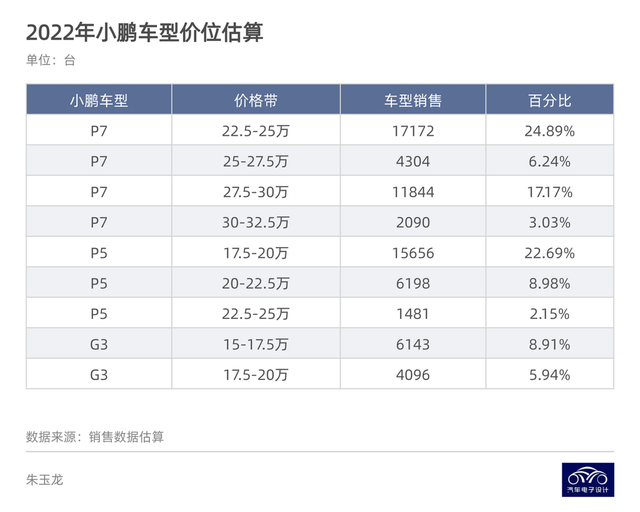

I have carefully compared XPeng and Tesla, and judging from the current situation, XPeng faces a lot of competitive pressures. On the one hand, P7 mainly competes with Tesla Model 3, while G3 and P5 compete with major domestic brands, especially those who are market-grabbing like BYD.

Now some friends have told me that there is a possibility that with the continuous high price of batteries and the continued development of automated driving and intelligence, and with G9 and P7 occupying the flagship SUV and sedan markets, it is possible to consider canceling models priced below 200,000 CNY, and move the brand upscale. This is indeed a possible strategy according to the current sales ratio (37%).

Second-tier automakers

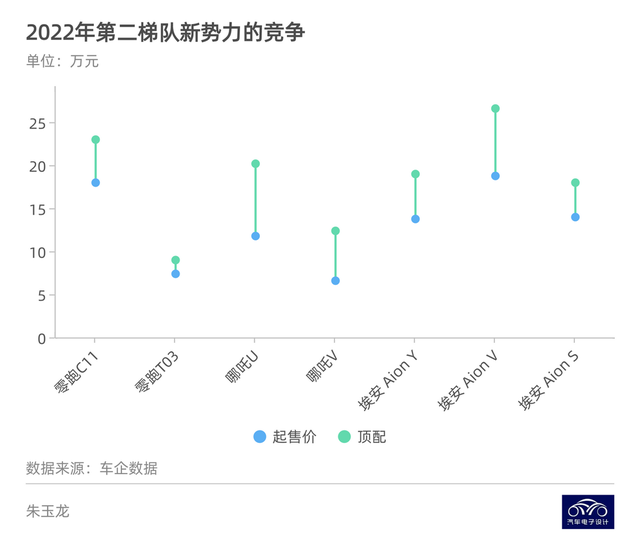

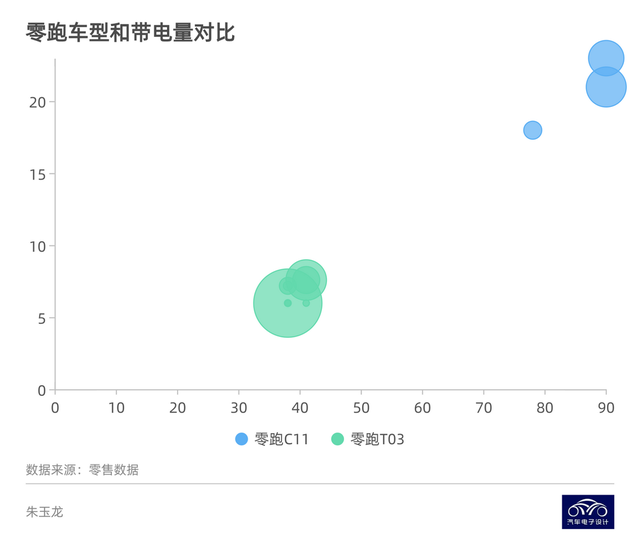

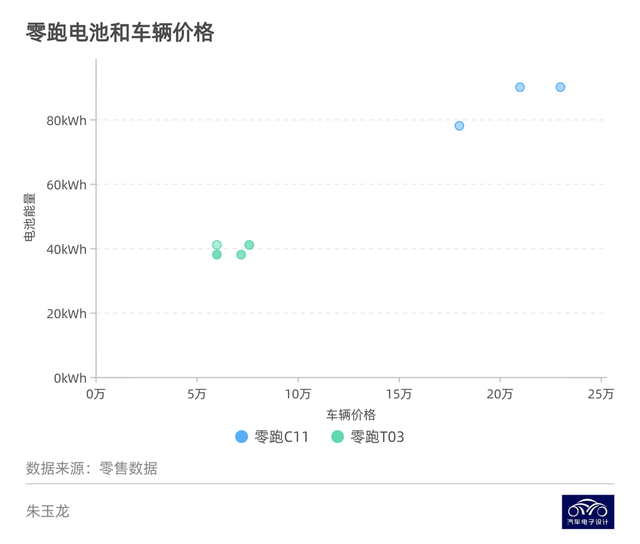

In the second tier, we mainly focus on two car companies, ZEROUNO and NIO, both of which are striving to promote their cost-effective products, the C11 and NIO S, in the mid-size sedan segment to grab market share. Meanwhile, AIWAYS is mainly focused on its Aion S, Aion Y and small SUVs for household use.

Regarding the data visualization here, I will continue to work on it when I have time, but the product distribution of ZEROUNO and HYCAN is still within their original models.

I would like to raise a question: with major new forces in the automotive industry moving upmarket, and brands such as BYD and Great Wall targeting the Model 3 directly, a lot of new models have emerged in the space of 60-80 kWh, priced at around 220,000-270,000 RMB. It is obviously unreasonable to add more batteries because of cost control considerations.

Therefore, it is very important to observe this market in the next stage to define and think about how to price and configure vehicles in this price range.

Conclusively, new energy vehicle companies have made an astonishing performance in 2022, and continue to increase cash subsidies for new energy vehicles in major cities where their businesses are cultivated. However, we can also see some problems, such as the growth of high-priced electric vehicles which is becoming narrower. Tesla abandoned its high positioning all the way down to Mass Market with a price reduction from 1 million to 220,000 RMB.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.