Sales Figures of Chinese EV Makers in June

By Yi-Wu Zhou

Edited by Ze-Lin Leng

On the 1st of July, several Chinese EV makers released their sales figures for June. If the level in May was a return to normal, then June was generally stable and on the rise. Among them, NIO, Li Auto, XPeng, NAIKU, and Leapmotor all delivered over 10,000 vehicles, with positive growth rates.

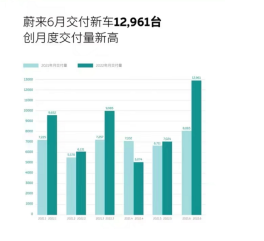

NIO

NIO delivered 12,961 vehicles in June, a year-on-year increase of 60.3%, setting a new record for monthly deliveries.

The most noteworthy achievement was that ET7 deliveries surpassed 4,000 units in June. This domestically-made model, which starts at 458,000 yuan, achieved such a high delivery volume in a single month, marking a significant milestone. Meanwhile, Li ONE, which has an equivalent price tag of 450,000 yuan, could likely deliver over 10,000 units in September. At that time, we could see China’s domestic luxury vehicles in the four-to-five-hundred-thousand-yuan range rise to prominence.

Some individual ET7 models encountered quality control issues in the past three months, but they have been largely resolved in June.

NIO released a new model, the ES7, on June 15th. This model has the same dimensions as the domestically-made BMW X5. While it is not a high-volume model, it shares the same NT2 platform as the ET5 and ET7.

The main focus for NIO in the second half of this year will be whether they can steadily deliver over 6,000 ET7 units per month and over 10,000 ET5 units by the end of the month.

Li Auto

Li Auto delivered 13,024 vehicles in June, setting a new record for 2022 and bringing total deliveries to 184,491. If all goes well, Li ONE could become the first new energy vehicle model to sell over 200,000 units among the new forces brand this year, around mid-August.

On June 21st, Li Auto unveiled the full-size SUV Li Xiang L9, and several stores had queues of people waiting to see the showcase vehicle. With a deposit of 5,000 yuan, 30,000 units were ordered in just three days, giving Li Xiang enough confidence to say that L9’s sales will certainly exceed Li ONE’s.

After the release of the L9, Li ONE orders did not decrease, indicating Li Auto’s precise product positioning ability. Even though the audience is almost identical, users can be subdivided by price. Li Xiang previously said that he was confident L9 would deliver over 10,000 units in September. Li Auto’s monthly deliveries could reach 20,000 units this September.

The most significant events for Li Auto in the second half of 2022 are L9’s production capacity and the release of new models in 2023.

XPeng

XPeng delivered 16,098 vehicles in June, setting a new monthly record, with total deliveries reaching 93,048. Of these models, the P5 became the fastest delivery model to reach 10,000 units in one month. However, the G3i has become a bottleneck for XPeng’s capacity, prompting the release of the G3i’s Super version.

XPeng also announced the upcoming launch of a new sports sedan model, the P9, in the second half of 2023. Above all, the Xpeng continuously strives to match Tesla’s price-to-performance ratio through technological innovations.

The production capacity and product prices are the main highlights of XPeng for the rest of 2022.

以上。# XPeng Auto delivered 15295 vehicles in June and 68983 vehicles in the first half of the year, a year-on-year growth of 124%, making it the new force with the highest delivery in the first half of the year.

New model G9 will be available for pre-order in August and officially launched in September. The urban NGP is progressing well.

Improved driving assistance has always been one of the core selling points of XPeng. Whether the city navigation assistance can be successfully launched in the second half of this year is also a major point to watch.

As for XPeng, it has not yet released any new models this year, while Lucid has released a mass-produced model priced at CNY 450,000, with smooth production capacity progress. NIO has also released a mass-produced model priced at CNY 328,000 and an SUV priced at CNY 468,000.

He XPeng promoted G9 as the best SUV under 500,000 CNY. Selling more than ES7 might not be a problem, but whether it can exceed L9 will be a very noteworthy point.

NIO

NIO delivered 13157 vehicles in June, with a cumulative delivery of 63131 vehicles in the first half of 2021, a year-on-year growth of 199%, significantly higher than the industry average growth rate.

In terms of sales, NIO has long been in the first echelon of new energy vehicles. The guidance price for the NIO V model is CNY 65,900-123,800, and the guidance price for the NIO U model is CNY 117,800-201,800.

NIO S, which shoulders the mission of brand image breakthrough, released the “brilliant edition” in June, and will announce the configuration and price of other models in July.

360 announced in June that it had given up the right to increase its investment in NIO, and transferred its equity contribution rights of 3.53% in NIO Auto with zero payment. Both 360 and NIO Auto have tried to downplay the impact of this incident. In any case, it is not a good thing for the company to decide to invest and then later not.

Leapmotor

Leapmotor Auto delivered 11259 vehicles in June, a record high, and cumulative delivery in the first half of the year was 51994 vehicles, a year-on-year growth of 265%, breaking the cumulative delivery of 200,000 vehicles in history.

In terms of sales, Leapmotor and NIO have similar situations, both are in the first echelon of new energy vehicles, and their year-on-year growth rates are faster than that of NIO. However, due to insufficient delivery of high-priced models, their value may not be high enough.

Leapmotor has two models priced at around CNY 200,000, C11 and C01, both of which have done well in terms of cost performance.

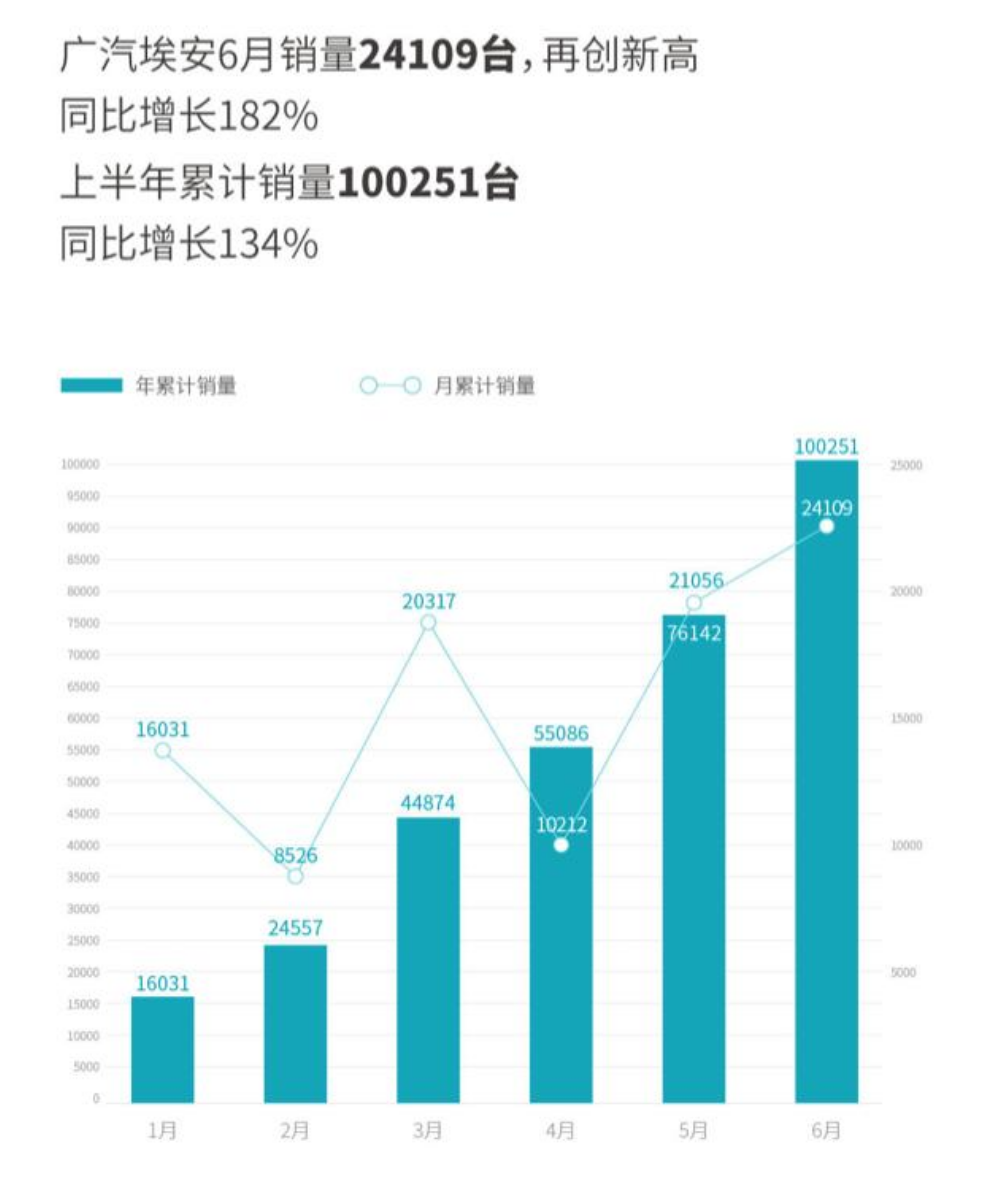

Aiways

In June, Aiways sold 24,109 vehicles, a year-on-year increase of 182%, with cumulative sales in the first half of the year exceeding 100,000 vehicles.

Aiways’ best-selling models are AION S and AION Y, with monthly sales levels stabilizing at the 8,000-10,000 level.

Aiways also faces the challenge of insufficient brand power, with its high-end model AION LX previously maintaining monthly sales at around 500 vehicles. The low sales of the Aiways LX with a range exceeding 1,000 kilometers indirectly confirms Photon Motor’s judgment that “the direction of the development of new energy vehicles is not higher range, but better energy supplementation”.

Geek+

Geek+ delivered 4,302 vehicles in June, with delivery exceeding 4,000 vehicles for two consecutive months.

In terms of the sales of a single model, delivering 4,000 new energy vehicles priced at 300,000 RMB in a single month is still a good achievement. However, as other new forces continue to release new models and new factories are put into operation, Geek+’s current speed is still relatively slow.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.