Author: Jimmy

According to the data from research firm Strategy Analytics, the number of cars equipped with BlackBerry QNX software worldwide has exceeded 215 million, a growth of 20 million from the previous year.

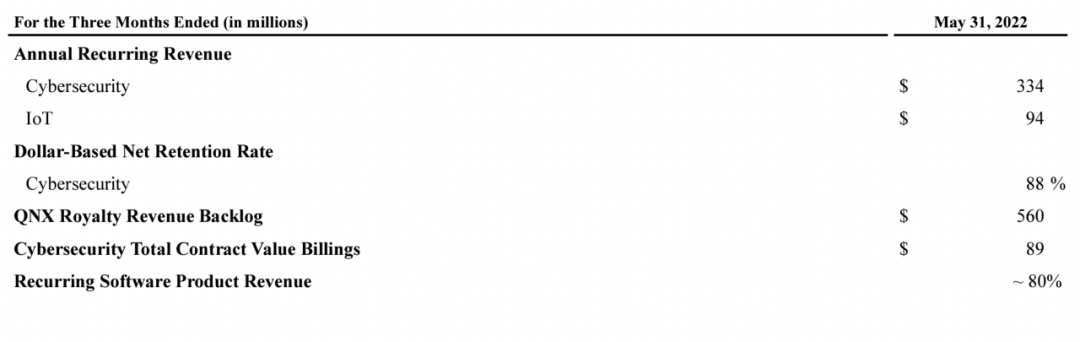

In the first quarter of the 2023 fiscal year, BlackBerry QNX’s royalty revenue backlog reached $560 million, a 14% increase, according to BlackBerry’s financial report.

BlackBerry has also recently received design orders from industry-leading companies such as Aptiv, Denso, Ford, GM, Hyundai, LG Electronics, Magna, and Volvo.

Since the beginning of its transformation, BlackBerry has firmly held the dominant position in the field of automotive operating systems. What’s more, it is not open source, and any system designed based on any QNX technology requires licensing fees. This means that if BlackBerry refuses to cooperate, you will be in a difficult position like a fishbone stuck in your throat.

The scarcity of underlying operating systems

Apart from mapping systems like Apple Carplay, car companies mainly develop two types of operating systems: customized and ROM-based. The difference between the two lies in the depth of self-customization, with ROM-based being limited in depth and not involving modifications to the kernel, but both are based on underlying operating systems.

QNX, Linux, and Android (based on Linux kernel) constitute the three major camps of underlying operating systems, and WinCE has stopped updating and gradually withdrawn from the field.

QNX was initially developed by Canadian company Quantum Software Systems in the early 1980s, later renamed QNX Software Systems. It is a real-time operating system that conforms to the Portable Operating System Interface (POSIX) Unix-like interface, primarily targeting the embedded system field. It is the world’s first ASIL-D-level automotive operating system and one of the first commercially successful microkernel operating systems.

- In 2004, QNX was sold to the US audio electronics company Harman.

- In 2010, BlackBerry announced the acquisition of QNX from Harman.QNX’s greatest advantage lies in its high security, stability, and real-time performance, which has long dominated the majority of the car OS market share. According to IHS Markit’s data, QNX’s market share is close to 100%, particularly in the smart driving OS field, such as safety-oriented instrument panels and assisted driving. However, QNX’s closed-source nature has limited its openness, application ecosystem, and requires a licensing fee for further development.

Linux and Android are undoubtedly filling in the gaps for QNX in these aspects. Linux is a time-sharing operating system based on the community’s open-source model, with no commercial licensing fees, fully customizable, and relatively low development costs. However, the complexity of the Linux kernel is high, with over 17 million lines of code in version 4.19, and continually increasing. A research result from Carnegie Mellon University showed that there are about 6,000 vulnerabilities in every one million lines of code, even with optimization. In contrast, as Victor Marques, VP of BlackBerry QNX engineering services, said at the developer conference, “There are 100,000 vulnerabilities in the best case with 100 million lines of code in high-end cars, and 1,000-5,000 of these vulnerabilities are prone to attacks. This is a significant number.”

Therefore, Linux’s security and real-time performance are destined to be inferior to QNX’s in the smart driving field. However, Linux’s openness allows many players to develop and build the ecosystem of in-car applications, particularly in the information and entertainment field. Android, developed based on the Linux kernel, dominates the global smartphone market, and benefits from its prowess in smartphones. Its most significant advantages lie in its excellent compatibility and rich application ecosystem, which can be fully leveraged in the car information and entertainment field.

According to ZoZi Analysis’ forecast, the market share of Android-like OS in the new car cabin operating system will increase from 25% in 2021 to 50% in 2026.

Developing the underlying system kernel is an extremely time-consuming and costly task. QNX has been developing for over 40 years, and no one has shaken its position in the automotive embedded system field. Furthermore, for traditional car companies with weak software development capabilities, QNX’s high security is irreplaceable in the field of smart driving, which can be seen from most car companies’ choices.

In summary, there is no alternative.

Car OS of Major Automakers: The More Things Change, The More They Stay the SameThe vast majority of enterprises choose to “modify” on the basis of the underlying operating system to meet personalized needs, that is, the two major systems of custom and ROM mentioned above.

Considering that the whole car OS needs to have both security and scalability as well as a rich application ecology, most car companies choose to build a complete car OS in the form of QNX + Linux/Android according to different domain requirements.

Foreign traditional car companies generally use QNX + Linux as the underlying system, such as Mercedes-Benz’s MBUX, BMW’s iDrive, Audi’s MMI, Toyota’s G-Book, etc. Due to the good Android ecosystem in China, domestic brands and new car makers tend to build in-car systems based on Android, such as BYD DiLink, Geely GKUI, NIO OS of NIO, Xmart OS of XPeng, etc.

The above in-car systems are all ROM-type operating systems, which means that they do not change the underlying basic architecture such as the kernel and virtual machine but only customize upper-layer applications and car services according to demand. This is also the way most car companies choose to compete in the car OS field.

However, the ROM-type operating system still depends on the underlying operating system fundamentally, which is like renovating a bare flat, and the layout of the house remains the same.

Customized systems become new possibilities

Customized systems represented by Huawei HarmonyOS, AliOS, Volkswagen VW.OS, and Tesla Version provide better ideas.

In 2020, Huawei released the HarmonyOS car system: HarmonyOS Cockpit Operating System HOS, Intelligent Driving Operating System AOS, and Intelligent Vehicle Control Operating System VOS.

Among them, HOS and AOS operating systems have a large number of partners in development; VOS can support chip suppliers including NXP.

The aforementioned three major systems are controlled and managed by the cross-domain integrated software framework Vehicle Stack. It is worth noting that the car OS based on HarmonyOS developed by Huawei is the first open-source operating system with dual certification of Security (CC EAL5+) & Safety (ASIL-D). It has multiple kernels such as Linux and Lite microkernel, and with Huawei’s Kirin chips and distributed capabilities, the HarmonyOS car OS can achieve seamless connection between mobile phones and cars and silky smooth operation experience.### AliOS for Smart Car: Huawei and Banma Are Leading the Charge

AliOS, developed by Alibaba and based on the Linux kernel, boasts independent intellectual property rights and is primarily used in smart cockpits. It is connected to Alibaba’s ecosystem via cloud service modules. Alibaba has successively open-sourced AliOS Things and AliOS Lite, step-by-step realizing intelligent car operation systems, intelligent cockpit operation systems, and intelligent whole-vehicle operation systems.

In 2015, the Internet of Vehicles Automotive Fund, jointly initiated by Alibaba and SAIC, invested in the establishment of Banma Network. Based on AliOS, Banma Intelligent Travel, an intelligent network-connected car platform, has been created. Currently, it has cooperated with more than ten automotive brands including SAIC, FAW, and North and South Volkswagen, with more than 40 car models and over one million intelligent cars.

Customized systems can take into account both automotive security and scalability considerations, as proven by Tesla’s Version. With the powerful technical strength of Huawei and Alibaba, they undoubtedly play a leading role in China’s vehicle-mounted system industry. This is of great significance in the current emphasis on localization and control.

Final Thoughts

China is a major global market for intelligent electric vehicles, which is also a huge market for vehicle-mounted systems. According to Guangyan Institute’s report, by 2025, the global market size of general automotive operating systems (functional software, narrow operating systems, middleware) will reach 37 billion US dollars, with a compound annual growth rate of 13.1%. China’s vehicle-mounted OS market size is expected to exceed 39.53 billion yuan.

However, China’s vehicle-mounted OS industry is still heavily influenced by foreign technology, and the kernel, middleware and other links are at risk of bottlenecking. Therefore, industry insiders have called for the rapid strengthening of open-source cooperation in the industry chain, and in recent years, the national level has also continuously launched relevant industry policies, which shows the emphasis of the government and the industry on it.

The State Council’s “Notice on the Development Plan of New Energy Vehicle Industry (2021-2035)” clearly stated that by 2025, new energy vehicle operation system technology will achieve major breakthroughs, and safety levels will be comprehensively improved; highly automated driving cars will achieve commercial applications in designated areas and specific scenarios; and by 2035, highly automated driving cars will achieve large-scale applications.

As the only domestic vehicle-mounted OS manufacturer that can deeply customize system kernels and meet the highest international safety certification standards (ISO 26262 ASI-D product certification), Huawei and Banma Intelligent Travel’s appearance undoubtedly breaks through the “soft power” pain points in China’s automotive industry.

Although the entire vehicle-mounted OS is still in the early stages of development and showing a situation of many vendors competing for market share, combining the technical advantages of Huawei and Alibaba to empower major automakers, and cooperating closely with China’s chip industry, a system and software application ecosystem suitable for the Chinese automotive market can be created to deepen the connection and stickiness of the upstream and downstream of the industry chain.In the chaos, finding a clear and stable path of development is the key to establishing a foothold in emerging fields. With the continuous advancement of the new four modernizations of the automobile industry, the competition in the car OS field has just begun.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.