Text by Du Debiao

Last night, the joint venture automobile company Rui Lan Automotive, jointly funded by Geely Automobile and Lifan Technology, unveiled its first A-level Coupe SUV, Rui Lan 7, at a public online launch event, officially announcing its involvement in the “Battery Swap Track”.

According to the audience’s habitual cognition of the OEM, the manufacturer sells cars, but Rui Lan chooses to focus on its brand strategy based on battery swapping and its battery swapping technology architecture as the main point of its speech. This inevitably creates confusion about the main focus of the presentation.

However, following the spread pattern of manufacturers revealing points in batches, the next main focus will shift to Rui Lan 7, which is scheduled to be unveiled at the Chongqing Auto Show on June 25. Therefore, it is expected that the integration of battery swapping and products is a foreseeable trend. This time, Rui Lan focuses on the analysis of its battery swapping strategy, which is the first step for this new player to try to run the logic of the new energy track.

Nowadays, it is difficult to say whether there is any winning rule in the new energy market. For example, Tesla’s Autopilot system has not yet become a killer feature in China, and the success of Ideal and BYD is still dependent on internal combustion engine technology. Especially in the 130-200K price range, there are few successful pure electric products. Rui Lan has noticed that the “pure electric main market is still in a dormant state”.

Can battery swapping solve user pain points?

In fact, the first question to ask is, is charging a pain point for users? Not entirely, but definitely one of them.

To be frank, battery swapping is not a new concept, and it has been tried by companies ranging from BAIC to NIO. It solves the problem of slow charging and is comparable to fuel-efficient cars in terms of efficiency.

Rui Lan believes that users of 120K-200K pure electric cars are most constrained by this problem, and even buying pure electric cars is a passive behavior. Rui Lan hopes that after the large-scale popularization of battery swapping, users can become more active.

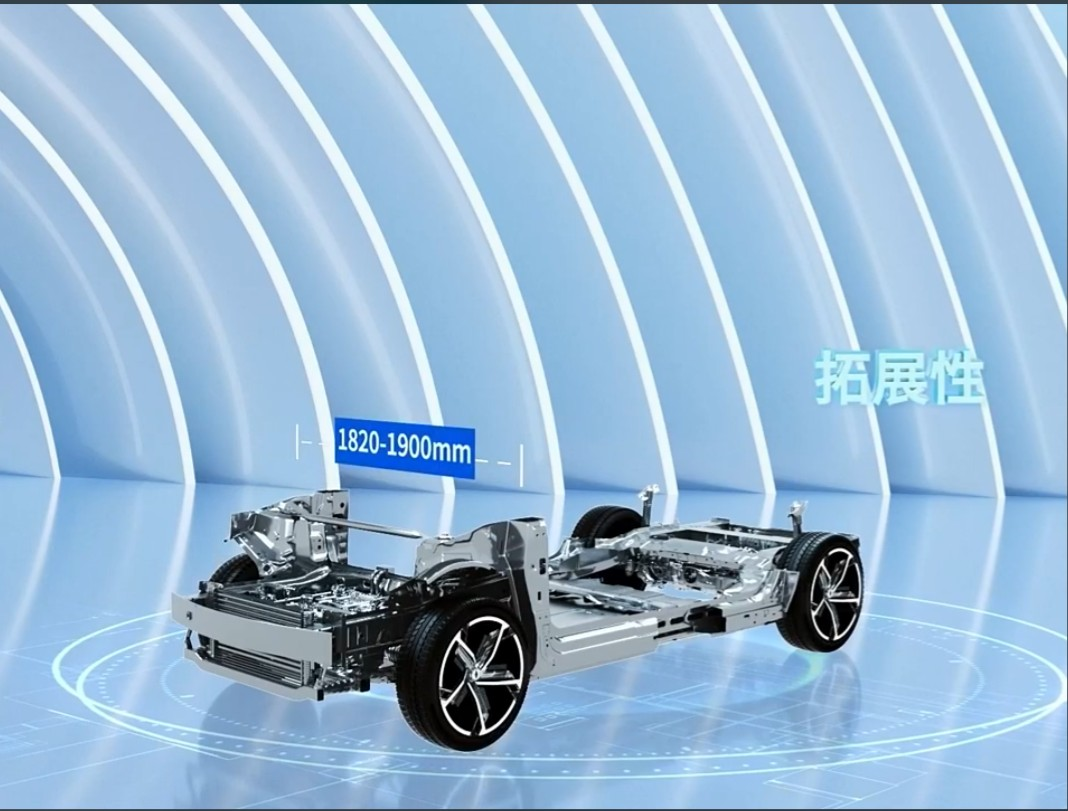

They have also proposed an efficiency-first solution. To put it figuratively, this efficiency comes from the “TNGA or MEB architecture of the battery swapping world” – the GBRC crystal architecture.

TNGA used to be able to produce vehicles from Corolla to Highlander. Now, with the crystal architecture, the fastest 60-second exchange can support different types of vehicles such as Corolla, Highlander and even MPVs. The MPV category can also be divided into B-side and C-side. For example, logistics vehicles and private cars. The capacity range for battery exchange includes 50kWh to 90kWh+.

TNGA used to be able to produce vehicles from Corolla to Highlander. Now, with the crystal architecture, the fastest 60-second exchange can support different types of vehicles such as Corolla, Highlander and even MPVs. The MPV category can also be divided into B-side and C-side. For example, logistics vehicles and private cars. The capacity range for battery exchange includes 50kWh to 90kWh+.

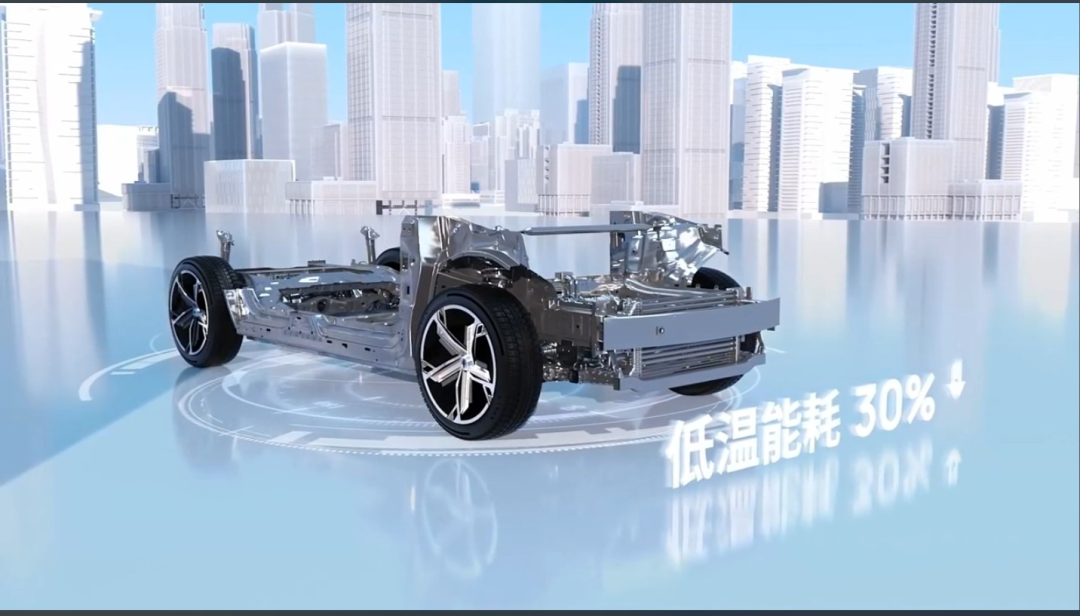

At the same time, Rui Blue mentioned the capsule battery that their models will use, with a cycle life of up to 2500 times, and capacity attenuation is less than 30%. The battery life will reach 8 years / 800,000 kilometers.

This means that the capacity of the battery exchanged by users is guaranteed. The exchange mode is a battery leasing behavior. Except for paying the leasing fee, users only need to pay the electricity fee. If the battery attenuation is fast and high, then more electricity fees need to be paid.

According to Rui Blue’s estimate, with high compatibility, the daily service capacity can reach 300-600 units or more. It is expected that by the end of this year, Rui Blue’s ecological partners will complete the construction of more than 300 battery exchange stations.

However, whether this spark can ignite the prairie fire does not only depend on the 60-second ultra-high-speed and strong compatibility. Although it is powerful in solving efficiency problems, new energy products are now an “integrated” category, and a powerful label alone is not enough to help it flourish.

Therefore, even though Rui Blue claims that its technical team has been deeply involved in the formulation of national and industry battery exchange standards, and has published more than 30 relevant standards, as well as obtaining more than a thousand technical patents in the fields of “battery exchange architecture, battery exchange station, and battery exchange vehicles” to build an expert image, in order to use the battery exchange as a tipping point to dominate the continent, it still needs to integrate more skills and attributes, just like the dense configuration table when the Ideal L9 was released – it tells us, and also tells Rui Blue, that manufacturers sell products after all, and domestic consumers like to have it all.

What about the product performance?

Rui Blue is naturally aware of this, and its intelligent card starts from battery exchange technology.

For example, relying on the big data platform to support the whole scenario smart battery exchange, the battery exchange appointment and reminder can be understood as the name suggests, but the imagination comes from cross-regional battery exchange, using the cloud platform as a dispatcher, allowing pure electric vehicle models to truly achieve “cross-border”.Meanwhile, “AVBS Technology” stands for Autonomous Valet Battery Swap, which we can perceive as a testing ground for autonomous driving. The scenario may be driving to a designated or non-designated location, and the vehicle will start working like a robotic vacuum cleaner in your home. However, the difference is that its route may not be predetermined, as you may not always swap batteries in the same place, lowering the difficulty level of the game. But overall, it is suitable for AI technology training and growth.

The most critical aspect is the product, or strictly speaking, the product that will be unveiled at the Chongqing Auto Show – the Roewe R7. It has a zero to one hundred acceleration capability of 4.9 seconds, 550-750 kilometers of driving range, and, besides letting you record a companion-style virtual secretary based on your voice, it also supports full-scenario voice, multimodal interaction, and super ID, etc.

As for autonomous driving, in addition to the AVBS mentioned earlier, it can also achieve navigation assist driving, HPP path memory parking, and assist driving on congested roads.

Changing Product Concepts

In this short half-hour online launch event, we cannot expect them to reveal all the highlights in limited time. The above-mentioned limited product highlights are compelling, but, as Roewe indicated this time, perhaps the concept of the product has changed in today’s new energy market. Strictly speaking, the product is a car, but broadly speaking, it includes battery swapping, services, sustainable upgrades, etc.

From product pricing, overall strength, follow-up services, etc., Roewe still has many uncertainties to uncover.

In terms of battery swapping, from pilot cities to other cities and even first-tier cities, the location and layout of battery swapping stations are the implementation level. There are even more complicated tasks that need to be examined and implemented, and it is necessary to combine product attacks to impress users, which is a complementary combination.

At this launch event, Roewe’s battery swapping strategy was grandiose and eye-catching, but it is only the prelude. However, even though this brand has only taken the first critical steps, they share a commonality with Nio and other first-batch new car brands in terms of timing. At least in the area of battery swapping, Roewe has already taken a few steps ahead of many brands.P.S: Looking at the involvement of Geely, one of the joint venture partners behind Rui Blue, it can be seen that traditional car companies are not merely focusing on their products when it comes to new energy. Instead, they are trying to create a new form and attempting to meet market demands through scalable support, even aiming to change user habits. This is the development of market potential.

Geely has taken a multi-dimensional layout in the field of new energy, such as Geometry, JiKe, and so on. In addition, they recently launched a new energy pickup brand RADAR, which initially appears to not put all eggs in one basket. This strategy is not conservative. On the contrary, with the assistance of market opportunities, who knows, newer giants like Ningde Times could emerge in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.