Written by | Zheng Wen

Edited by | Zhou Changxian

Recently, with the outstanding live broadcast performances of several excellent teachers from New Oriental, “Eastern Selection” has become a popular online shopping choice during the “618” promotion, proving the feasibility of a win-win business model through the “selection and intelligence” mode.

In fact, in the automotive new retail industry, a similar business experiment is also in full swing. This is the Huawei Smart Selection launched by the consumer electronics giant Huawei. It is larger in scale and has already seen some success.

On June 22nd, 2018, at the 2018 Huawei Terminal Global Partner and Developer Conference with the theme of “Openness & Innovation”, Huawei unveiled a brand new smart home brand, Huawei Smart Selection, based on the principle of “brand symbiosis, traffic sharing, and consistent experience” to create an IoT collaboration ecosystem.

In the automotive field, the first car model to enter Huawei Smart Selection was the SF5 from XPeng Motors. With the efforts of these “micro blood vessels”, the sales of SF5 began to reach five figures in June 2021, and even sold 2,200 cars in October of that year.

On December 23, 2021, XPeng Motors released its high-end smart car brand AITO, in cooperation with Huawei, with the M5 being the first car model, which was officially delivered in March of this year. AITO adopts a retail model of online and offline ordering and offline experience delivery, and Huawei is fully responsible for the sales channel.

Since its delivery, the M5 has delivered more than 10,000 units in three months, and its monthly sales performance ranks second only to the Ideal ONE in the segmented market. It is worth noting that Ideal ONE took 20 months to deliver more than 10,000 units.

With the initial victory, Huawei has preliminarily proven itself. If the M5 can maintain its current sales growth momentum, it not only means that Huawei’s channel transformation is successful but also brings a new possibility to the automotive retail industry.

Seize the opportunity to prove oneself

In 2021, Huawei’s smartphone sales were 35 million units, down about 82% year-on-year compared to 189.7 million units in 2020.

After the drastic decline in smartphone business, the news that followed was not that Huawei would close its stores on a large scale but hoped to replenish its store business through new growth points.> “With more than 5,000 stores and over 50,000 Huawei terminal employees left with nothing to do, their main focus has shifted to smart cars,” according to an expert on Huawei research. “Both employees and stores need to reuse and develop their skills in the smart car industry as soon as possible.”

According to Yu Chengdong, in order to compensate for the decline in mobile business and revenue losses in stores, Huawei, which has more than 5,000 high-end experience stores, has no reason not to sell cars.

In April 2021, at the Shanghai Auto Show, Huawei announced that it would officially start selling cars. Shortly thereafter, the flagship store on Nanjing East Road in Shanghai became the first store to sell cars. The first model was the Seres SF5. In this pedestrian street with a daily traffic flow of over 600,000, Huawei’s store location is quite remarkable, attracting many customers.

At the same time, the renovation of Huawei’s high-end experience stores across the country is also underway. Huawei and channel partners use a joint venture cooperation model, with the channel partner providing funding and space, and Huawei responsible for store operations and management, with vehicle supply provided by car manufacturers. According to media reports, Huawei and the car manufacturers split 10% of the sales revenue, while the store channel partner can receive 7% to 8%.

However, going from selling phones to selling cars is not a change that can be made overnight. It is not as simple as adding a new phone category. Both store personnel and terminal sales staff need to adapt to this transformation.

“Now, it is impossible for a single phone store to maintain a balance between profit and loss. Huawei brand stores with cars can break even, but those without cars are struggling,” said Mr. Chi, who sells phones in Jiangsu and Zhejiang provinces and has over 20 Huawei stores. According to Huawei’s requirements for car dealerships, the minimum floor space must be at least 300 square meters, which means he can only sell cars in two or three stores. Therefore, if he wants to sell cars, he must expand or renovate his stores.

In early 2022, the Seres SF5 was withdrawn from Huawei stores to make way for the Weltmeister EX5. From the current stage, the EX5 is performing better in the market than the SF5.

In early March, Weltmeister EX5 began nationwide deliveries, with 2,875 units delivered in the first month, exceeding the sales of several other models, such as the Zeekr 001 and LanTu FREE. In April, the sales volume of the first full month was 3,245 units, steadily increasing. In May, Weltmeister announced a delivery of 5,006 units, with the more accurate insurance data showing 4,405 units sold.Although there is still a considerable gap between the sales goal of “300,000 units per year” declared by Yu Chengdong, it can be considered a success for a new brand to sell 120,000 to 200,000 units in the first year, as Yu Chengdong himself admitted. In fact, selling 120,000 to 200,000 units means a monthly sales volume of at least tens of thousands.

Currently, Weltmeister has 619 experience centers across the country, offering test drives, vehicle sales, and related product sales. Except for Huawei flagship stores, all others are Huawei Smart Life stores or authorized experience stores. In addition, Weltmeister has also deployed 120 AITO authorized user centers, providing new car delivery, maintenance, and repair functions.

Undoubtedly, after joining Huawei’s sales network, Weltmeister’s store quantity and quality have significant advantages over all traditional car companies and new car builders. For reference, Volkswagen, which has been in China for nearly 40 years, has more than 2,000 stores in China, and Toyota has fewer than 700 stores. However, the 4S stores of traditional car companies are generally far from the city center and have not penetrated into the daily lives of potential consumers.

Although new car builders have changed their business philosophies and spared no effort to build high-end showrooms in prime locations, store expansion still requires time. NIO, the company that is most willing to invest in this area, has 381 NIO Centers and NIO Spaces, while XPeng and Li Auto have around 200.

Under Huawei’s channel convenience, according to the plan, AITO will have a total of 1,000 experience centers and about 300 user centers in 2022. The expansion speed is amazing.

Is the rapid success of Weltmeister M5 accidental or inevitable?

It is no secret that the current performance of Weltmeister M5 is inseparable from Huawei’s brand effect, as well as Yu Chengdong’s “big mouth” that led to frequent black-and-red hotspots, making it impossible to keep a low profile.

Not long ago, at the Guangdong-Hong Kong-Macao Auto Show, Yu Chengdong boasted, “Weltmeister beats million-dollar luxury cars” and “The pure gasoline car era will end quickly. Buying a gasoline car now is like buying a feature phone in the era of smartphones”; at the delivery ceremony, Yu Chengdong said that he was not worried about the production capacity or popularity of Weltmeister M5, but worried that owners would not be able to get them.

Every sentence carries a controversial point and spreads like a virus. Of course, this is not enough. Looking at the product level, the extended-range hybrid car Weltmeister M5 is also quite competitive.

Weltmeister M5 is priced at 259,800-331,800 yuan, has a WLTC cycle mileage of over 1100 kilometers, and has outstanding performance in power, comfort, safety configuration, and auxiliary configuration, with the advantage of the car’s infotainment system. This product is both “practical” and outstanding.In terms of product strategy, Wanjie M5 has chosen the model created by the verified and ideal ONE at the time when pure electric vehicles have not yet reached the stage of popularization and maturity in the market, giving consumers a buffer zone through the range extender route.

As we all know, range extenders were once defined as a low-end technology that “could not be put on the table” in the industry. Former CEO of Volkswagen Group (China) Feng Sihan once fiercely stated that range-extended electric vehicles are a good solution for motorcycles, but a nonsense, worst solution for the entire automotive industry and energy-saving emission reduction of the earth.

However, the ideal ONE, priced at 328,000 yuan and with a range of more than 800 km, won the first place in the domestic mid- to large-size SUV market sales with its controversial technology route. Based on precisely controlling the pain points of segmented market users, it has indeed embarked on a range-extended electric technology route that is not subject to the current state of charging infrastructure construction.

Now, with the full support of Huawei, Wanjie’s first model, the M5, has achieved some results using the same approach. So, has Wanjie M5 firmly taken the fast lane? Not really.

According to public data, since the start of delivery, Wanjie M5 has terminal sales in 203 cities nationwide.

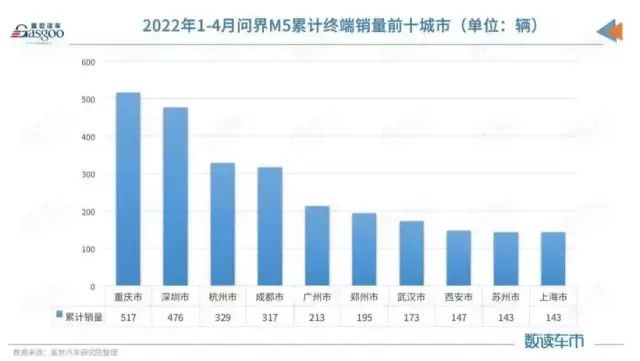

In March and April of this year, the top ten cities for cumulative terminal sales of Wanjie M5 were Chongqing, Shenzhen, Hangzhou, Chengdu, Guangzhou, Zhengzhou, Wuhan, Xi’an, Suzhou, and Shanghai, with sales of 517 units, 476 units, 329 units, 317 units, 213 units, 195 units, 173 units, 147 units, 143 units, and 143 units respectively.

It is worth noting that the cities with the highest sales, Chongqing and Shenzhen, are where Xiaokang and Huawei are headquartered, respectively. This somewhat indicates that the Wanjie brand has not really taken off nationwide.

There is also a hidden worry. For both partners, there are still psychological barriers. Has the market really accepted this new brand or has it flown to the sky in the era of “electrification and intelligence” with wild development gimmicks?

In fact, the story of a flash in the pan was very common in the automotive industry a few years ago, but looking back, it already feels like the bustling of the last century.

In those years, the SUV market was booming, and everyone wanted to get a piece of the pie. A brand called Hanteng was born in 2014 and quickly radiated tremendous energy in Chongqing thanks to the SUV outbreak period. In the first year, the sales volume reached 85,000 units, and the following year increased by 164% to 223,000 units. The monthly sales of the single model S3 exceeded 10,000 units, and at its peak, monthly sales exceeded 20,000 units.As the sales of Hanteng started to decline, in November 2016, the enterprise behind the brand, Yinxiang Group, launched a new brand named Bisu, and invited a group of celebrities such as Fan Weiqi, Deng Ziqi, and Wang Zijian to join. However, Bisu failed to regain its popularity, and it is well-known that everything was reset to zero by 2020.

This is only a small part of the automobile industry, and there is a long list of “flash in the pan” brands. They are like sparrows gathering together for food on a threshing ground, quickly flocking together and then dispersing.

Zhang Zhengping, the Chairman of Xiaokang Group, said, “The high level of attention paid to the IM5 is an incentive and affirmation for the cooperation between Xiaokang and Huawei.”

Return to Huawei, before everything is truly clear, dare it to gamble on all opportunities in one brand? The answer must be no.

At present, some brands have already begun to lay out Huawei’s sales channels amidst the uncertain results. In recent days, there has been news that Huawei’s Smart Selection cars have been rolled out to the industry in a large scale, and have signed business cooperation agreements with automakers such as Chery, JAC Motors, and Jihoo Auto. Among them, Chery has at least two cooperative models.

Although the response of Huawei’s internal staff to this news is that there is currently no information to disclose, and the response given by relevant host factories is that the specific situation is unclear, the stock prices of relevant host factories have risen sharply nonetheless.

In the environment of the overall decline of the mobile phone business, Huawei is not the only one targeting the opportunity in automotive retail. Lu Weibing, Senior Vice President of Xiaomi, once said, “The Xiaomi stores that can be found in every county are also preparing for selling cars in the future.”

To some extent, this is a self-redemption that runs in both directions. As the first crab-eater, if Huawei Smart Selection cars can continue their previous success in the automotive retail industry, it will have greater inspiration and demonstration significance for the industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.