Author: Zhu Yulong

During this period of research, it is clear that automotive technology is being reorganized globally. The focus has shifted away from previous efforts on electric vehicles and now concentrates on software and chips. Companies such as Volkswagen, General Motors, and Toyota are starting to choose strategic chip partners, operating system ecosystems, and software strategies. For example, Volkswagen’s software subsidiary, Cariad, is not only focused on software development but also hopes to rely on jointly developed chips with its partners. The development of intelligent vehicles, self-driving technology, and continuous updates require more powerful but standardized System-on-Chip (SoC) chips and central computing platforms.

Volkswagen’s Two-Step Strategy

To catch up with competitors like Tesla in critical chip technology for large projects such as Artemis or Trinity, Volkswagen hopes to participate in system planning from the very beginning. The next step is collaborative design between automakers and semiconductor manufacturers to jointly determine which system is most effective on equal terms. In the long term, from 2021 to 2027, the annual growth of automotive semiconductors will maintain a healthy 7%, and by 2030, almost 50% of automotive manufacturing costs are expected to be related to electronic products, driven by the increasing electrification of vehicles and the improvement of self-driving technology.

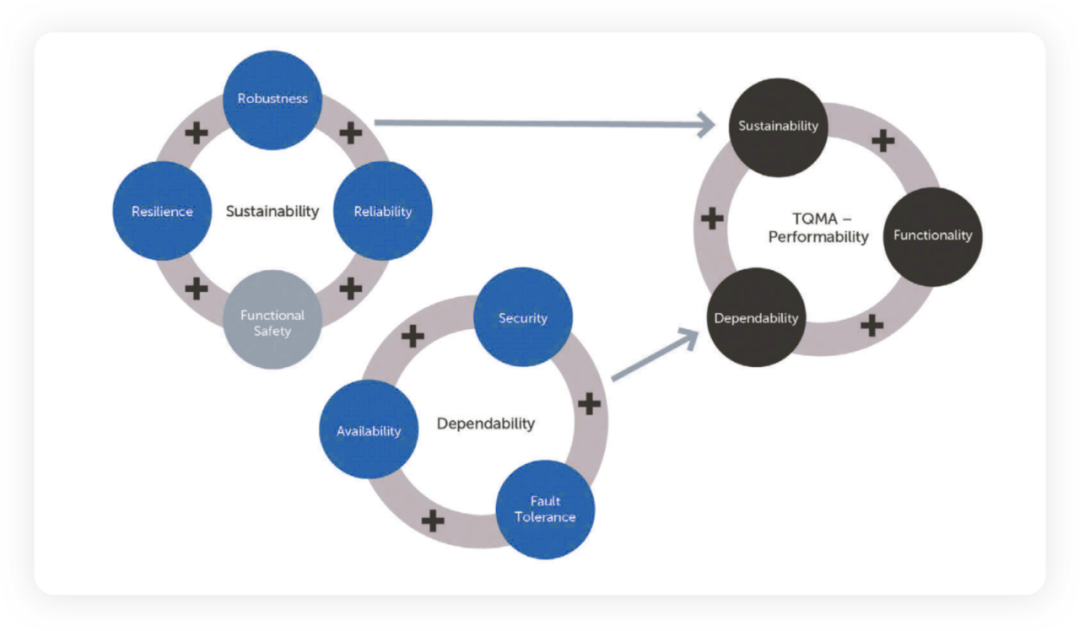

The value of automotive chips is significant and directly related to vehicle performance, so automakers are increasingly concerned with the quality and performance of automotive chips, specifically the sustainability of electronic systems, including robustness, elasticity, reliability, and functional safety. For car companies, functional safety is the most important aspect, protecting drivers from the unintended consequences of system failures, far beyond standard testing, software simulation, and electronic system modeling.

The most advanced System-on-Chip (SoC) electrical test coverage will reach 99.4%, with only 0.6% of billions of transistors untested. Automotive companies are delving deeper into their supply chains to identify and eliminate the root causes of potential hazards, some of which may be generated during the semiconductor manufacturing process.

Volkswagen has chosen Bosch and American chipset company Qualcomm as partners. The initial collaboration with Qualcomm involved using existing chip designs and gradually shifting towards developing custom chips that require high computing power and lower power consumption.

Volkswagen has chosen Bosch and American chipset company Qualcomm as partners. The initial collaboration with Qualcomm involved using existing chip designs and gradually shifting towards developing custom chips that require high computing power and lower power consumption.

As semiconductor supply security requires a commitment to purchase chips from semiconductor manufacturers about five years in advance, the traditional purchasing relationship with parts suppliers is gradually being phased out. Automotive companies need to establish a deep understanding of high-performance semiconductors. For now, investment does not seem to be made at the manufacturing level; instead, there is deep cooperation with current chip suppliers, with the aim of eventually constructing their own barriers at the chip level.

This originally comes from an interview conducted in 2021:

Volkswagen plans to design and develop its own high-powered chips for autonomous vehicles, along with the required software, Chief Executive Herbert Diess said. “To achieve optimal performance in light of the high demands that exist for cars, software and hardware have to come out of one hand,” Volkswagen did not plan to build semiconductors but wanted to own patents if possible, Diess said, adding that the group’s software unit Cariad would develop the expertise and expand.

Trends among other automotive companies

There are currently clear plans for some companies, including Hyundai-Kia, to develop their own chips in order to reduce reliance on chip manufacturers. From Hyundai-Kia’s perspective, the main domestic companies that they can cooperate with are Samsung Group. At present, the competition does not work in favor of Samsung; however, given the current indications of the Korean semiconductor industry in the mobile phone competition field, there is still a high probability of collaboration in the next stage around the needs of Hyundai-Kia’s entire vehicle.

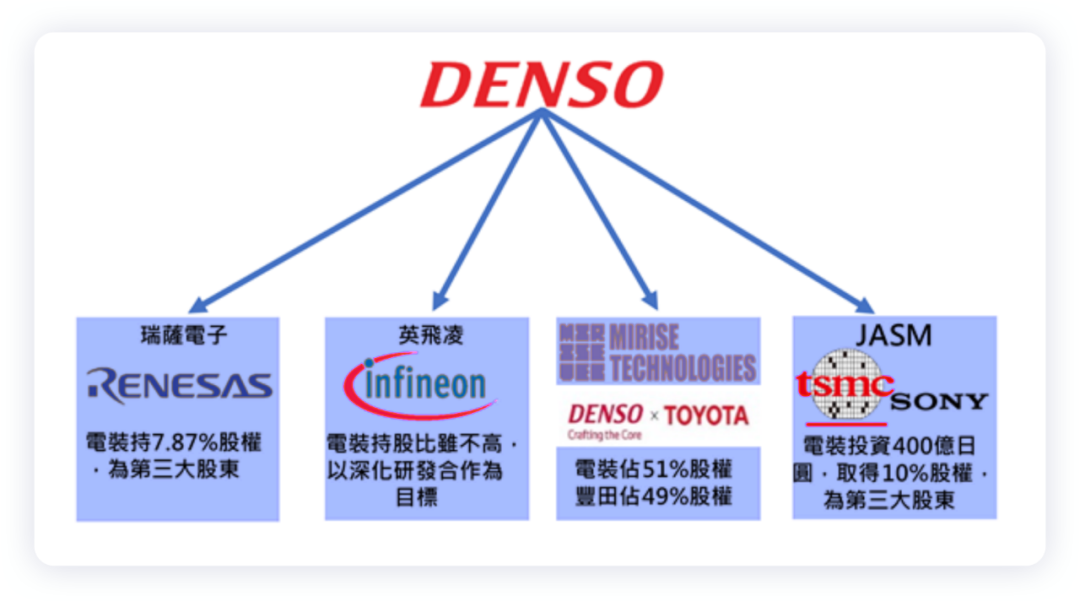

Toyota and Denso have jointly established a chip joint venture named “MIRISE” to conduct research and advanced development of next-generation vehicle semiconductors. The company is committed to three technology development areas: power electronics, sensors and SoCs (system-on-chips). In the field of power electronics, the company is conducting research and development mainly focusing on internal production (including contract manufacturing) using semiconductor material technology, as well as the manufacturing and design technology accumulated by Toyota and Denso in electrification technology. In the sensor field, the company will be committed to internal production development and cooperation with joint development partners. In the SoC field, the company will enhance its capability to determine the best SoC specifications for future mobility.

Toyota and Denso have jointly established a chip joint venture named “MIRISE” to conduct research and advanced development of next-generation vehicle semiconductors. The company is committed to three technology development areas: power electronics, sensors and SoCs (system-on-chips). In the field of power electronics, the company is conducting research and development mainly focusing on internal production (including contract manufacturing) using semiconductor material technology, as well as the manufacturing and design technology accumulated by Toyota and Denso in electrification technology. In the sensor field, the company will be committed to internal production development and cooperation with joint development partners. In the SoC field, the company will enhance its capability to determine the best SoC specifications for future mobility.

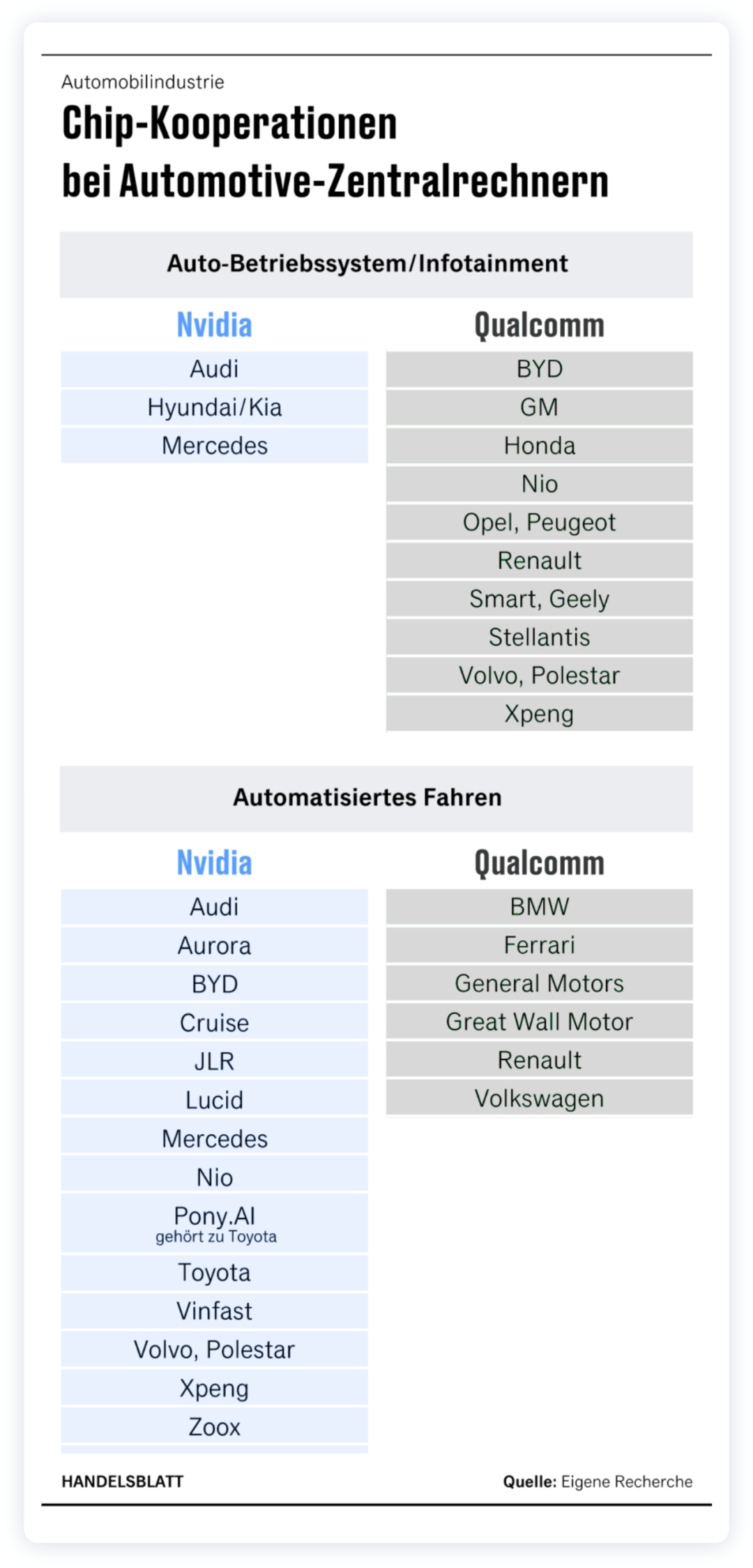

In summary: In the field of automotive chip SoCs, Qualcomm and Nvidia are ahead of the rest, but each country’s car companies and suppliers need to consider how to meet the demand for the most important SoC chips and next-generation semiconductors.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.