Author: Zhang Yi

What do you think when you see “SAIC” in the title? In terms of sales, it is the “pillar of China’s automobile industry”. SAIC Group is the number one Chinese auto company on the Fortune Global 500 list and has been the champion of Chinese automobile sales for 16 consecutive years. SAIC Passenger Vehicle contributes a quarter to SAIC Group’s sales.

In 2021, SAIC Passenger Vehicle achieved sales of over 800,000 units with new models such as the all-new Roewe RX5, MAX, global Roewe iMAX8, MG ONE, MG6 XPOWER, third-generation MG6 PRO, etc., with a year-on-year increase of 22%, and an export volume of 290,000 units, a year-on-year increase of 68%, once again winning the championship of Chinese brand export volume.

SAIC Passenger Vehicle sold 70,000 units in May, but is it not the best record?

According to data, SAIC Passenger sold more than 70,000 units in May, with a year-on-year increase of 32.5%. Perhaps without the COVID-19 pandemic, the momentum of SAIC passenger vehicles would be better.

Why is this? Who is the “unlucky” car company in the Shanghai epidemic? It is none other than SAIC Passenger Vehicle.

It is reported that SAIC Passenger Vehicle’s four major production bases in China are located in Shanghai Lingang, Nanjing Pukou, Zhengzhou in Henan, and Ningde in Fujian. Shanghai Lingang and Zhengzhou bases have 4 production workshops: stamping, body, painting, and final assembly as well as an engine plant, mainly producing advanced, high-quality, and reliable engines for SAIC Passenger Vehicle. Nanjing Pukou base produces models such as Roewe RX5 and MG ZS under SAIC Roewe and MG brands. Ningde base mainly produces new energy vehicles and traditional new energy vehicles for Roewe and MG brands.

Affected by the Shanghai epidemic, SAIC Passenger Vehicle was under a “production freeze” with 30% of its capacity being “frozen”, the upward trend in January and February came to a sudden stop, and from March, production and sales decreased by 15.9% and 10.1% year-on-year respectively until the decline in April directly expanded to 62% and 60.3%.

Although the Shanghai epidemic has been alleviated recently and has entered a comprehensive stage of resumption of work and production, the test is still severe. Since starting the double-shift pressure test, it has achieved 5 days of double-shift production, an increase of about 2.3 times compared to the initial resumption of work and production pressure test, and the number of new cars offline has recovered to about 80% of full production, but the challenge is still severe.

In the automobile industry, “chip shortage” has become a norm. From the perspective of the overall environment, chip supply this year is better than last year, but in new energy vehicles, chips shortage in electric control, battery management, and vehicle intelligence-related fields are severe. The lead time for ordering scarce chips is generally more than a year, while for non-scarce products it is 3 to 6 months, greatly affecting the delivery date of new cars.It is reported that SAIC Motor’s first pure electric MPV, Roewe iMAX8 EV, and Roewe Long Mao are already on sale, and even the third-generation Roewe RX5 which features the SAIC BlueCore GS61 1.5T engine + 10-speed EDU G2 Plus super electric drive with dual-core hybrid power supply will be supplied soon. As a result, SAIC’s four major factories not only supply micro car Clever 311km Yuanqiboba version and the “New Chinese style smart connected pure electric car” Roewe i6 MAX EV SUV model, but also prepare for the new car’s chip supply. The task is daunting.

Can the shortage of chips be resolved to expand domestic production and sales?

Can the limitation of SAIC Motor’s domestic development be solved by solving the difficulty of chip supply and increasing automobile production capacity?

Not necessarily. In the past year, China’s automobile industry has faced unprecedented challenges, with production and sales falling for three consecutive years since 2018 – in other words, the domestic automobile market is declining.

One of the problems that constrains the sales of independent brands is that the residual value of the secondary market is low. SAIC Motor has provided a solution to this issue, carrying out multiple measures such as the repurchase, recognition, and resale of Roewe and MG used cars, and has achieved good results.

The Roewe ei6 MAX achieved the top spot in the one-year residual value rate of plug-in hybrid compact cars, with a rate of 74.76%; the Clever achieved third place in the one-year residual value rate of pure electric micro cars, with a rate of 73.58%. The Roewe RX5 ePLUS and Roewe Ei5 respectively won the championship in the two sub-segments of plug-in hybrid compact SUV and pure electric compact cars, with one-year residual value rates of 73.71% and 71.42%. In the November 2021 three-year residual value rate ranking of Chinese automobile brands, MG ranked ninth, and MG6 plug-in hybrid ranked tenth in the three-year residual value rate of new energy vehicles.

Therefore, the development of SAIC Motor in China is not inferior, and what is even more surprising for SAIC Motor is the overseas market.

Is there a greater chance to “stand up” by exporting overseas?

In the “everything rolls” auto industry, SAIC Motor has found a fast solution – becoming a true global multinational automaker.

Although China became the world’s largest automobile production and sales country in 2009, it has always been in a state of being big but not strong. Therefore, export became one of the best ways for SAIC Motor to increase its sales. This can be seen from the overseas market sales proportion.According to data from the China Association of Automobile Manufacturers, the cumulative sales of passenger cars in China in 2021 were about 9.543 million units, a year-on-year increase of 23.1%. Among them, SAIC Group achieved sales of 5.464 million units throughout the year, with domestic brand sales of about 2.857 million units, and the total sales of Roewe and MG were about 800,000 units. By contrast, Japanese car brands had overseas production of 20 million units in 2018, with 60% of the domestic capacity of 15 million units used for exports, in other words, the overseas sales ratio was as high as 83%.

The breakthrough in export volume is mainly attributed to the significant increase in SAIC passenger car exports. In 2021, the annual export volume of 2.015 million units accounted for almost one-fifth of the total domestic passenger car export volume, doubling year-on-year. The proportion of SAIC’s passenger car sales throughout the year reached 36%, which is currently the highest proportion of Chinese car brands with sizeable export volumes.

In terms of geography, SAIC’s passenger car products have entered more than 80 countries and regions. In April, the brand achieved a historic record of monthly sales of 4,606 units in the European market and ranked among the top ten in single-brand sales of new energy vehicles in the UK, Sweden, Denmark, and other countries. In the Australia-New Zealand market, SAIC passenger cars set a record of monthly sales of 5,102 units again, becoming the only Chinese car brand in the top ten of Australian sales.

In May of this year, SAIC’s passenger car exports reached 45,000 units, a significant year-on-year increase of 165.6%, which hit a historic high for the same period and dominated overseas markets with an absolute advantage. This marks SAIC’s continued reign as the champion of single-brand overseas sales, and the brand performed outstandingly in multiple “high-energy” markets.

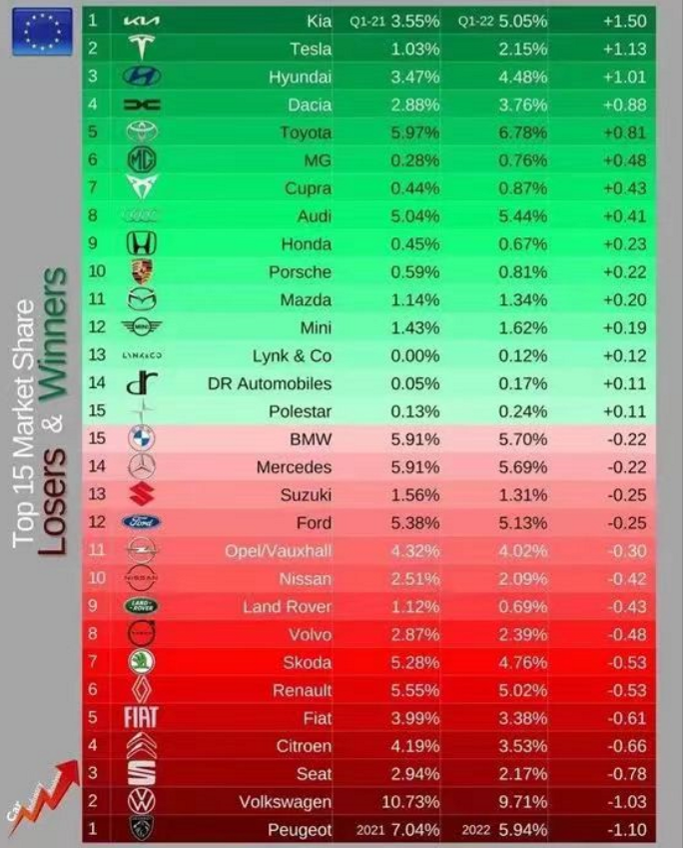

At the brand level, the latest global sales data shows that in the first quarter, MG brand made it into the top ten single-brand sales in 18 countries, including Australia, New Zealand, Saudi Arabia, and Qatar. According to the European Automobile Association’s list of the top 60 car sales in the first quarter of 2022, SAIC’s passenger car MG brand’s sales increased nearly three times compared with the same period last year, took a market share of 0.76%, and surpassed international giants such as Land Rover and Honda, ranking the 6th highest in the growth rankings on the European market, achieving the best performance of Chinese car brands in the European market.

In addition, according to DVLA data provided by New Automotive, the MG brand occupied 4.41% of the market share, ranking 7th in the sales of pure electric vehicles in the UK in the first quarter of 2022, and conquered British consumers with strong Chinese intelligent manufacturing power.

Is becoming a multinational brand a necessary path for SAIC passenger cars?No matter MG or Roewe, the brands under SAIC Motor always give people advantages different from domestic independent brands. When making product comparisons, consumers like to compare SAIC Motor with joint venture brands.

Because before 2010, the label given by Chinese people to independent brands was “counterfeit and inexpensive”. Even though MG and Roewe have SAIC Group as their backing, they cannot avoid being treated as ordinary independent brands by Chinese people. Joint venture brands value resale value, while SAIC Motor has the highest resale value among independent brands. According to the data on resale value, the top 15 plug-in hybrid new energy vehicles with one-year resale value rate under SAIC Motor’s Roewe RX5 eMAX, eMG6, MGeHS, Roewe ei6 MAX, and Roewe RX5 ePLUS account for one-third of the list, and have become the highest among Chinese automakers.

Moreover, SAIC Motor’s new energy vehicle sales in May are also impressive, achieving a record sales of 20,000 units in the first month of the year, doubling YoY.

Under the leadership of the “New Four Modernizations” environment, quality is also one of the adjustments that SAIC Motor faces. Basic product quality must be excellent, only then can it represent higher vehicle safety. Almost every model under SAIC Motor’s passenger vehicles meets the “European standards” known for their strictness in the world’s automotive system such as REACH and E-MARK.

For example, in the 2019 collision test results released by E-NCAP, two domestic independent brands, MG HS and MG ZS EV, received high Euro NCAP five-star ratings. In addition to E-NCAP, other global mainstream authoritative tests, including the European A-NCAP, are also included in SAIC Motor’s safety assessment standards.

Of course, to establish a foothold in overseas markets, in addition to having a foot in the door, there must be absolute advantages. These advantages are compared to fuel consumption in Japanese and Korean automakers and to smart technology in Chinese brands such as SAIC Motor.

As early as 2015, SAIC Motor established Banma Intelligent Driving in partnership with Internet “giant” Alibaba.In the field of intelligent driving, SAIC Motor has created a full-stack self-developed advanced intelligent driving solution – PP-CEM™ which consists of “six-fold fusion perception system” comprised of laser radar, ultrasonic radar, 5G-V2X technology, 4D imaging radar, visual camera, and high-precision map, surpassing new intelligent electric vehicles like Tesla and XPeng in perception ability. In the field of intelligent cabin, SAIC Motor and Banma Zhixing jointly launched the first heterogeneous fusion intelligent cabin system – Loshi Os, which has the ability of improvisational learning and cloud learning, becoming the first self-evolutionary system with these abilities.

Insights from EV industry

As Kofsky once said, “The earth is the cradle of humanity, but mankind cannot forever remain in the cradle.”

Same is the case with the automobile industry, where China’s automobile industry will not always be “inward-looking”, SAIC passenger car’s May sales showed an upward trend compared to the previous months, further proving that although the completion of the Roewe and MG product matrix is important, market sustainability is more important.

Currently, SAIC Motor has laid a solid foundation to become the best pioneer and leader for China’s automobile industry going global. With the support of status and quality, SAIC passenger car’s dual brand Roewe and MG, has the advantage of safety, intelligence and localization, occupying a place in important markets such as Europe, Australia, New Zealand, and South America, both domestically and internationally. The dual-line strategy is making SAIC passenger cars more likely to become the first genuine multinational automaker in China.

Therefore, when faced with the darkest moment of the auto market, SAIC passenger cars, which still have ambitions, have the results self-evident to breakthrough the bottleneck of the auto industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.