Author | Tian Hui

Editor | Qiu Kaijun

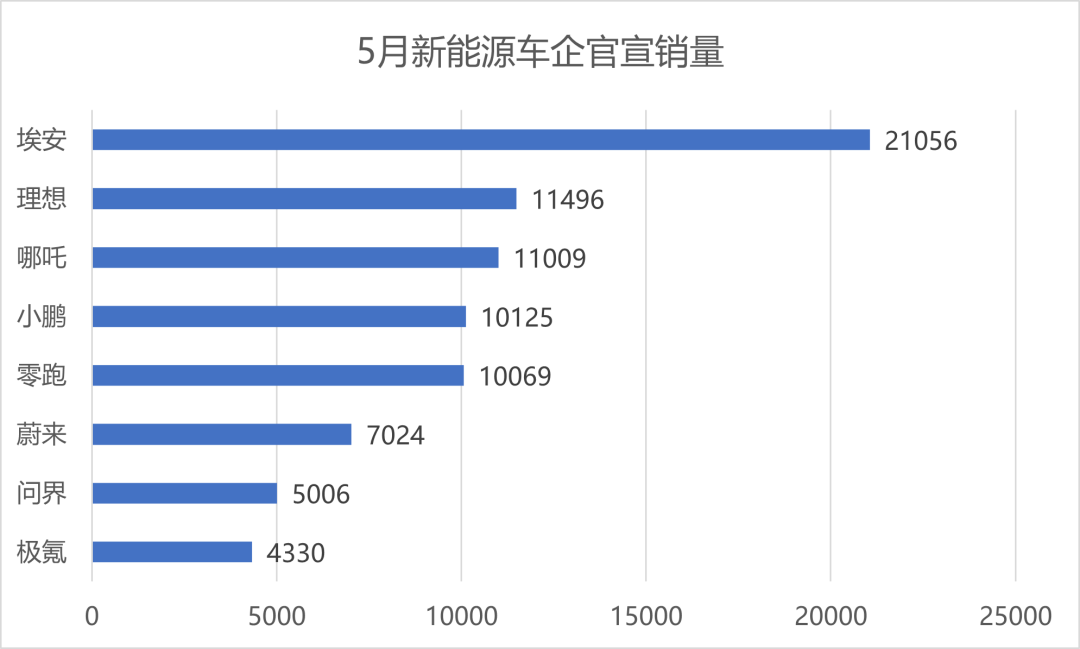

In May, the sales of various car companies steadily recovered, and more than 10,000 vehicles were sold by multiple automakers.

Compared with April, the sales of various car companies increased month-on-month, but with different ranges. The month-on-month increase in sales indicates that the impact of the epidemic has eased, and various automakers are beginning to enter the sales recovery period.

According to information obtained from NIO, XPeng, and Aiways by “Electric Vehicle Observer”, the production situation of these three automakers has gradually returned to normal, but they still face many uncertainties in the supply chain.

Looking at the absolute value of sales, automakers with factories located in the Yangtze River Delta region have a more significant increase in sales, which is related to the improvement in the epidemic.

Currently, various automakers are still in the stage of digesting Q1 orders, and some automakers have not yet fulfilled orders collected before the price increase in March.

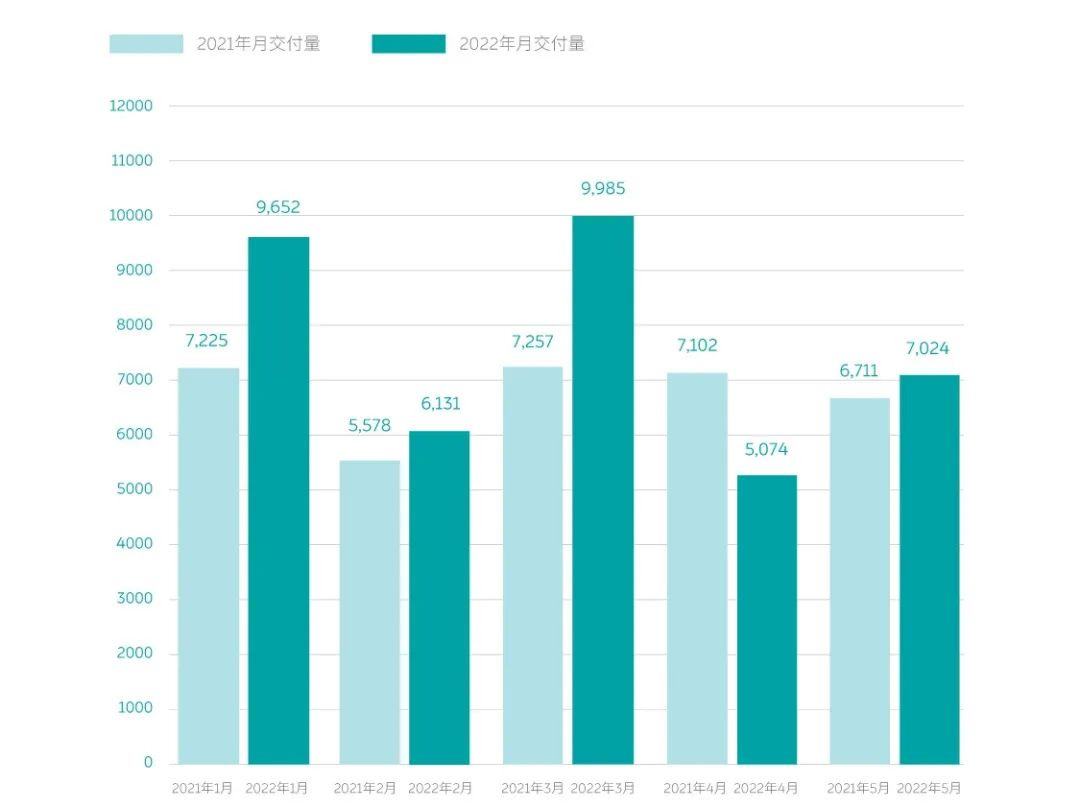

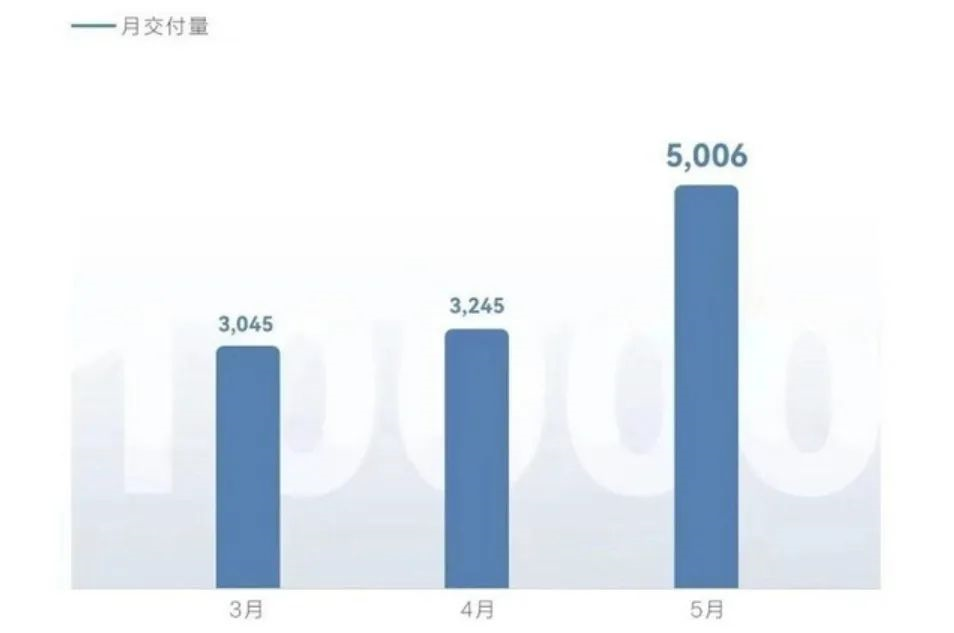

It is worth noting that NIO has had sales of less than 10,000 vehicles for five consecutive months, which is the worst-performing among new energy vehicle companies in the first tier. The performance of new brands such as WEN JIE is relatively optimistic, and the WEN JIE brand delivered more than 5,000 vehicles for the first time in May. Since the delivery started in March, the delivery volume of WEN JIE M5 has exceeded 11,000.

NIO faces multiple challenges

NIO has had sales of less than 10,000 vehicles for five consecutive months.

NIO’s delivery volume is weak, but it is not due to a lack of orders, and the main reason is the impact of the epidemic on production capacity. NIO, headquartered in Shanghai and with its production headquarters in Hefei, Anhui, is one of the automakers that have been most severely affected by this wave of the epidemic. NIO’s month-on-month growth in deliveries in May was only 38.4%, which is enough to illustrate the severity of the impact of the epidemic.

However, as a reference, IDEAL, another automaker that has set up its production base in the Yangtze River Delta region and is closer to Shanghai, saw a rapid recovery in deliveries in May, with a month-on-month increase of over 175%.

Due to the different product structures and supply chain systems of IDEAL and NIO, the comparison of month-on-month growth rates does not have practical significance, but NIO really needs to double its efforts in production and supply chain to catch up with the recovery speed of its competitors.

In addition to the impact of the epidemic, NIO is currently in a window period of product replacement and faces significant changes in service levels and competition environment.On the product front, NIO’s ES6, ES8, and EC6 models have been on sale for over two years, and their overall competitiveness has declined. The new car, ET7, is currently in the stage of climbing production capacity, and while the old models are losing competitiveness, the delivery of the new ones has not yet begun in bulk. This puts NIO in a brief window of opportunity in terms of product delivery.

In terms of service level, NIO’s service level for owners has not noticeably declined, however, competition from rivals has increased – NIO’s services have become a standard offering for many high-end brands, so NIO’s services are no longer unique and their appeal to consumers has declined.

According to NIO’s plan, the ET7 will enter a stage of rapid production capacity climbing starting in June, while the ET5 will begin deliveries in September. At the same time, NIO’s new car, the ES7, based on the NT2.0 platform, is expected to be released in June, with deliveries throughout the year.

Overall, NIO faces multiple challenges in the second half of the year, with increased pressure on production, supply, delivery, product innovation, and service innovation.

WEY brand shows its strength

“WEY M7 is designed to surpass the million-dollar luxury car experience.” This was what Yu Chengdong, CEO of Huawei’s car business unit, said during his speech at the Guangdong-Hong Kong-Macau Greater Bay Area Auto Show. The WEY M7 is WEY’s second model and is expected to be released at the end of June.

WEY’s first car, the M5, sold better than the first models of XPeng and Li Auto during the same period.

On June 1st, WEY released its monthly delivery volume for the first time, and was the first brand to do so that day.

Since delivery began in March, the delivery volume of the M5 has gradually increased, reaching 5,006 in May and a total of 11,296 delivered. This shows the advantage of the Huawei brand in empowering traditional automakers.

Compared with the delivery data of XPeng’s first model, WEY’s delivery volume is significantly higher, with XPeng’s delivery numbers for the first three months being less than 1,500/month.

WEY’s brand has benefited from the overall rise in sales of new energy vehicles in the market, as well as from the Huawei brand’s empowerment and channel advantages brought by Huawei’s Consumer Business Group.

Unlike XPeng, which started from scratch to build experience stores, the WEY M5 was sold in 500 Huawei mobile phone stores as soon as it launched. In 2022, Huawei plans to further expand its channel to 1,000 stores.

Yu Chengdong stated in an interview that the WEY brand is currently mainly constrained by the chip and other supply chain aspects and unable to reach the planned sales target of 300,000 vehicles annually. His interview explains that Huawei’s plan is to establish WEY’s channel development according to the 300,000-unit target.“`

Therefore, with the launch of the heavily anticipated WEY M7, it is projected to outsell the WEY M5 within Huawei’s planned annual sales of 300,000 vehicles. The monthly delivery figures released by WEY demonstrate the satisfaction and confidence of Huawei’s automotive operation team regarding their current sales status and expected sales increase. This debut of WEY has made quite an impact on the automotive industry. Huawei is the first smart device manufacturer to enter the automotive industry, and with the entry of new players such as Jidu and Xiaomi, the competition in the automotive industry may enter a new era.

NIO and Leading Ideal remain stable amid competition

NIO and Leading Ideal’s sales have already stabilized at the top of the new energy vehicle industry.

Since the beginning of this year, both NIO and Leading Ideal have had monthly delivery figures surpassing 10,000, especially in April. NIO took the top spot in monthly sales among new energy vehicle companies.

After stabilizing their sales, NIO and Leading Ideal have begun to exert their efforts on new vehicles.

NIO will begin pre-sales of a new car, the NIO S, on June 6th. Leading Ideal began pre-sales of their new car, the Leading Ideal C01, on May 10th and has reached a respectable level of pre-orders, with over 45,000 pre-orders for the Leading Ideal C01 as of May 27th.

Leading Ideal’s C01 uses CTC battery technology, which is a technology that merges the cover of the power battery with the chassis to effectively improve the energy density of the power battery.

The new NIO S will be equipped with advanced driving assistance systems provided by Huawei, and is expected to show outstanding performance in assisted driving.

It is evident that, after stabilizing their sales, NIO and Leading Ideal have begun to make progress. As both companies enter a crucial stage in terms of capital, they are expected to achieve their IPO goals later this year.

Price increases may be offset by rising oil prices

In early March, the new energy vehicle industry experienced a wave of price increases, with almost all companies raising their vehicle prices. At that time, there was a negative expectation for the mid-to-long-term (over three months) sales of new energy vehicles.

But since May, with the skyrocketing of oil prices and the retail price of 92-octane gasoline surpassing 9 yuan, this is beneficial to the new energy vehicle market.

“`

Higher gasoline prices may offset the negative expectations caused by the rise in prices of new energy vehicles. The annual sales volume of new energy vehicles is expected to continue to grow, and the MoM sales growth rate may further increase.

As an example, BYD’s monthly deliveries have maintained a high-speed growth rate, with more than 110,000 insured cars from May 2 to May 29, an increase of about 10,000 cars compared to the full-month data in April.

In terms of new car reservations, BYD’s new car “Hai Bao” was pre-sold on May 20 with a pre-sale price of CNY 212,800 to CNY 289,800, and received more than 22,000 orders in just 6 hours.

BYD’s high-end brand Tang debuted its new energy MPV Tang D9 on May 16, which is similar to GL8 and has a starting price of CNY 335,000. The current reservation volume is close to 20,000.

In terms of macro policies, the favorable policies after this round of epidemic have begun to be released. Various regions throughout the country have begun large-scale subsidies for consumers to purchase new energy vehicles. Car purchase subsidies ranging from CNY 5,000 to 20,000 will promote consumers to purchase new energy vehicles. Especially in terms of policy effectiveness, the end of 2022 is the deadline, which will inevitably lead to a phenomenon of concentrated car buying in the short term.

Considering various factors and excluding the potential impact of a new round of epidemics, it is expected that from June, the monthly sales expectations of various automakers would be optimistic, and it is not ruled out that some automakers may have an explosive growth similar to BYD.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.