Author: Zhu Yulong

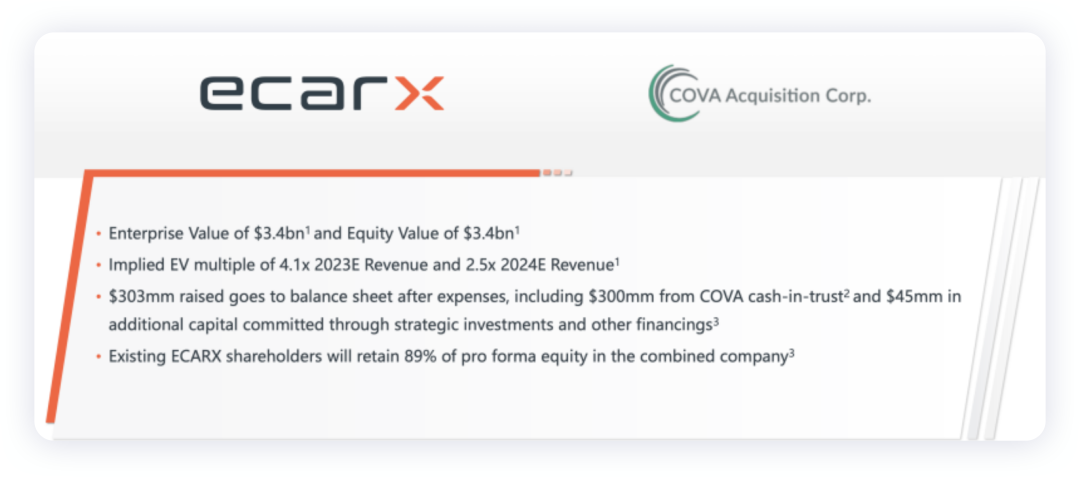

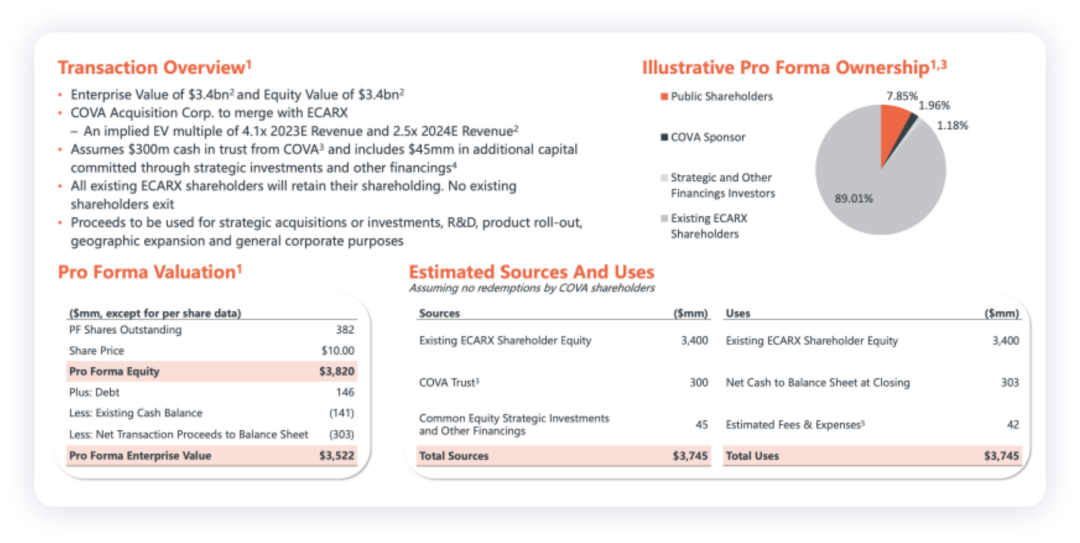

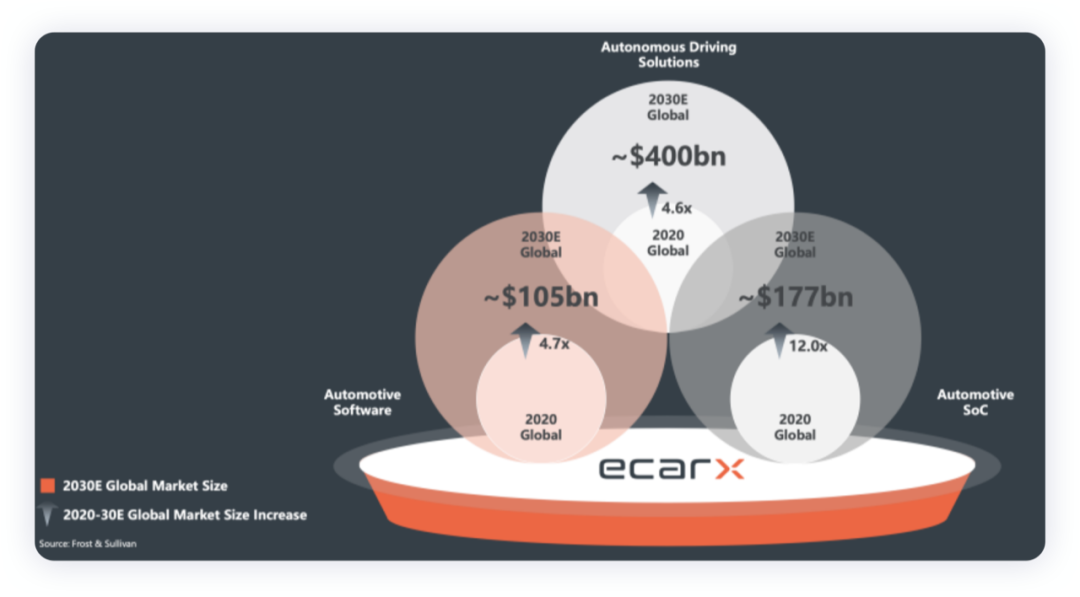

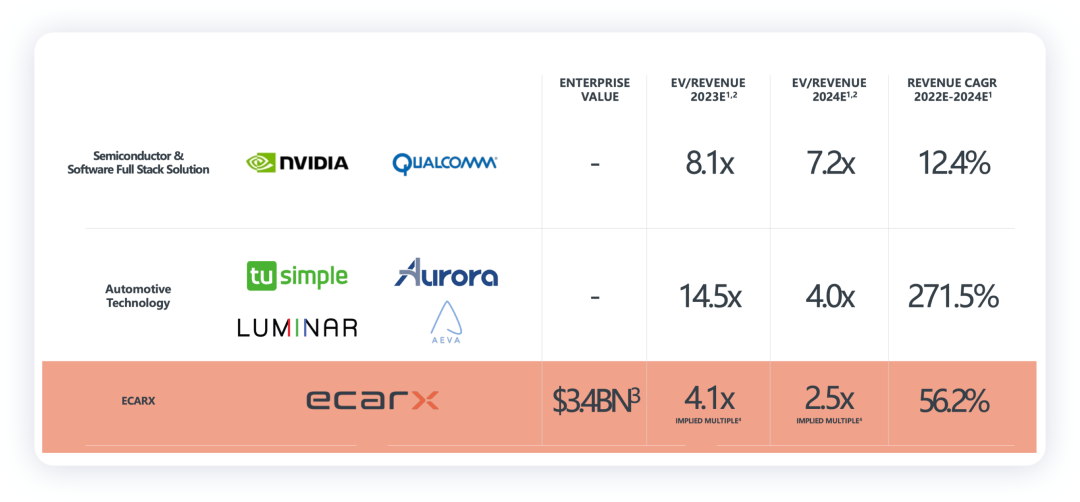

Centered around the system of Geely Automobiles, Yikatong has extended its reach to the intelligent automobile sector and expanded its reach to the American stock market. With the theme of electric automobiles being independent through Polestar, the Geely sector now has a bit of a multi-faceted posture. Yikatong has signed a merger agreement with the American SPAC COVA, and will be listed on the NASDAQ Stock Exchange in the United States (“ECX”). This listing has an estimated value of 3.82 billion US dollars.

COVA was established by American Crescent Cove Advisors and invested in the laser radar enterprise Luminar.

In 2016, Geely Holding and Shen Ziyu (serving as CEO) jointly established Yikatong Technology Company. In October 2020, Baidu led the A-round financing with a financing amount of 1.3 billion yuan. Baidu’s purpose was also to form a joint venture with Geely in the future and enter the intelligent automobile manufacturing field. In February 2021, China Guoxin led the A+ round of financing for Yikatong, with a financing amount of 200 million US dollars. The B-round of financing was led by Geely with an amount of 50 million US dollars, and the valuation reached approximately 3.3 billion US dollars.

Product Lineup

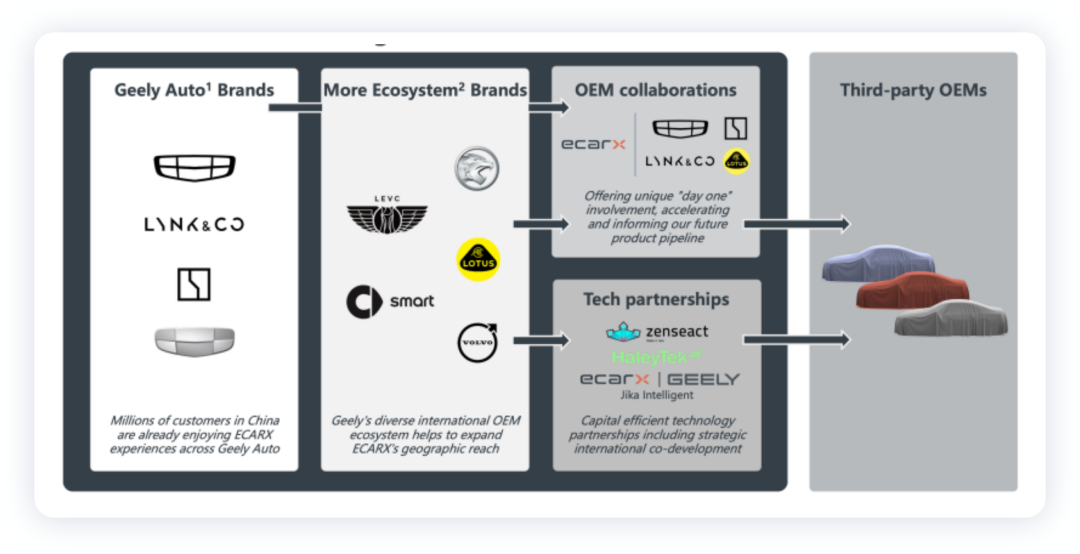

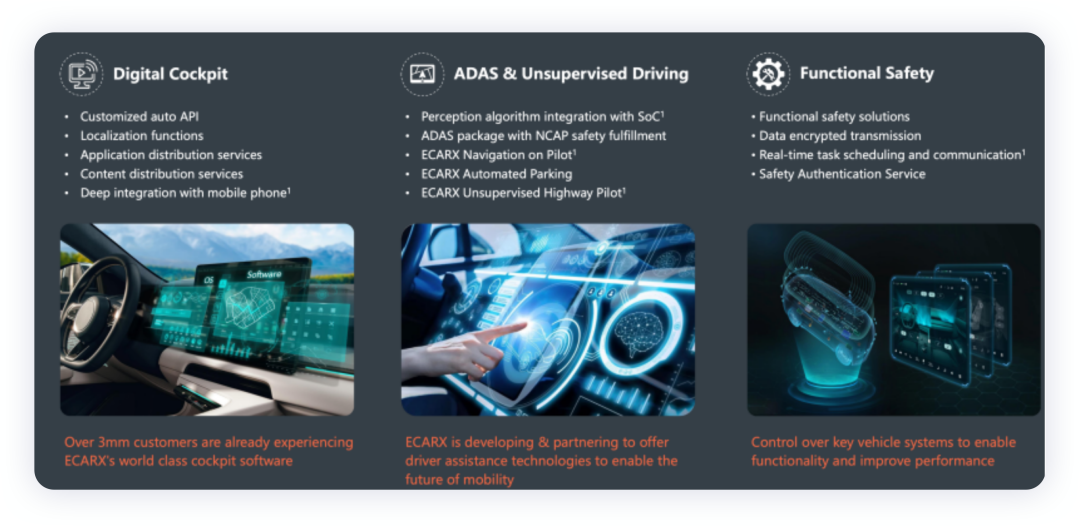

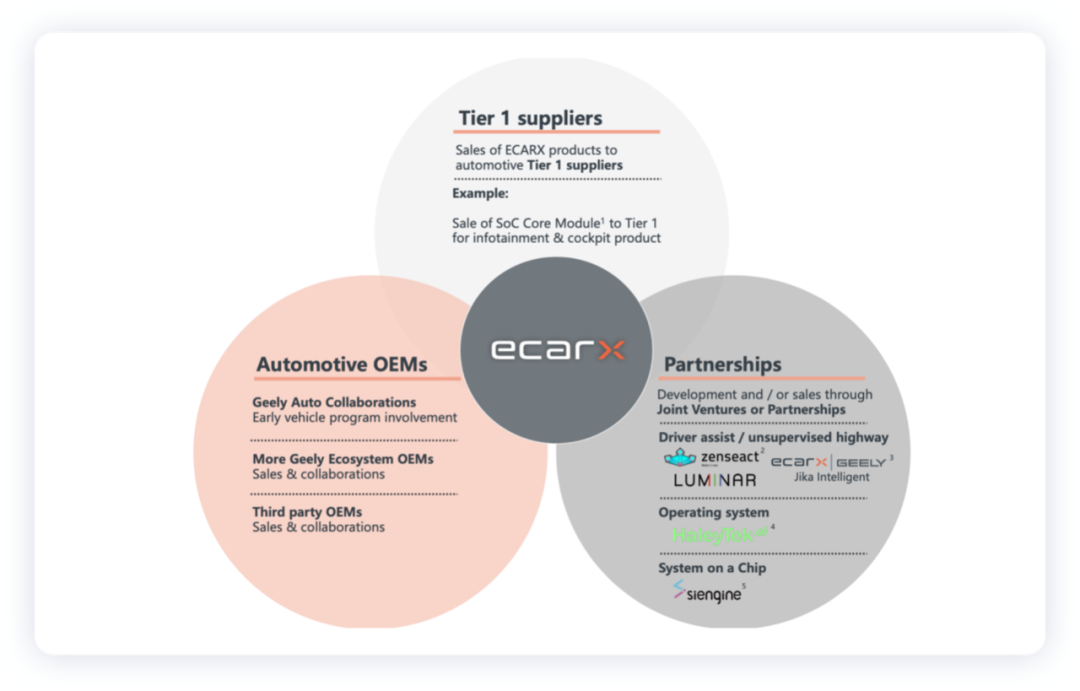

Yikatong’s products include in-car information and entertainment systems, digital intelligent cabins, etc. The customer base is mainly from the Geely Group, one type being Geely Holding’s automobile brands, including Geely, Volvo, Lotus, and Geometry; the other type being Geely Investments’ automobile brands, including Mercedes-Benz, Baojun, and Smart. Currently, the story told in the prospectus has been deployed on 3.2 million vehicles.

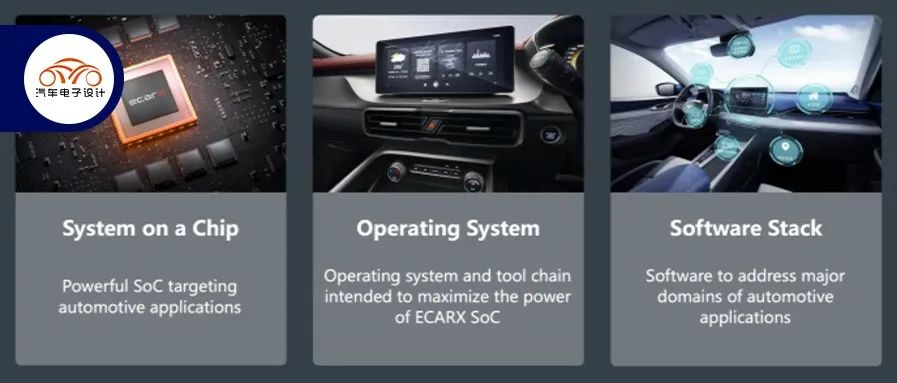

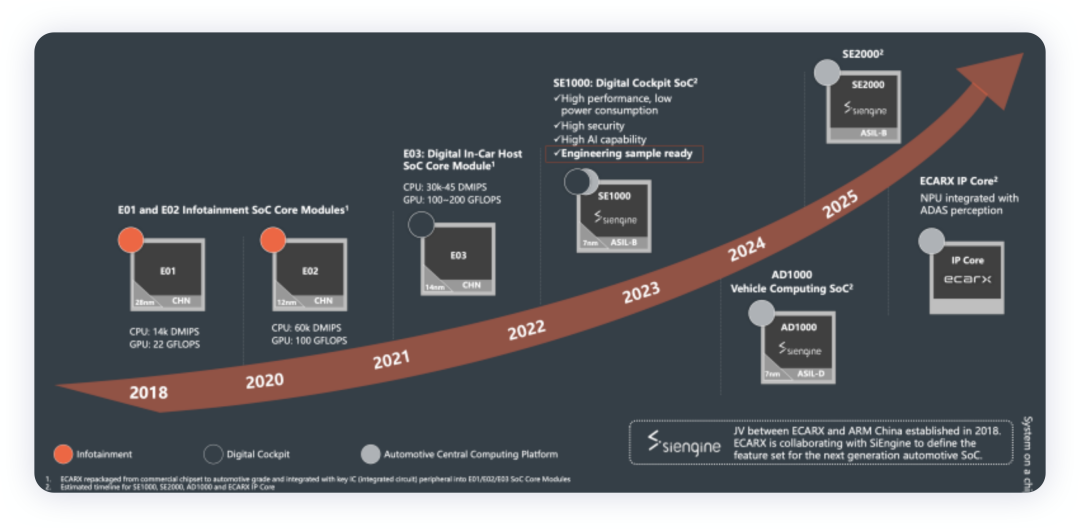

From a product perspective, the initial focus of Yikatong, centered around intelligent automobiles, was mainly on entertainment systems (SOP in 2017), digital cabins (SOP in 2021), and the central control computing platform (SOP in 2024).

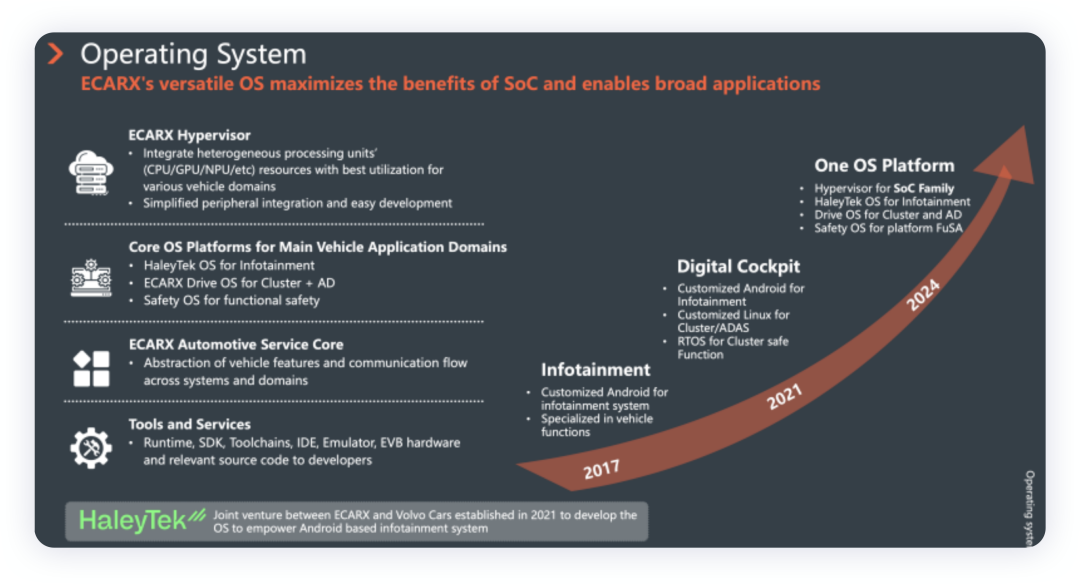

The 2017 entertainment system product features SOC mainly include Mediatek E01 and E02, and the software system is a customized Android system. In 2021, the product uses Qualcomm’s 8155 and Hubei Xinqing’s SE1000, a customized Android system for central control, and Linux and RTOS systems for instrumentation.The next step is to integrate a unified OS platform around the central control platform, covering the cockpit, body, and automatic assisted driving.

In the era of intelligent electric vehicles, car companies must occupy the largest cost item: one is batteries, the other is SOC cockpit and the entire software ecosystem and operating system. Therefore, it seems that ECARX is at least the support point of Geely Group.

The story of SOC chips is really difficult to research and project, and it is not something that ECARX can complete by itself.

- E01 adopts 28nm process, CPU 14k DMIPS, GPU 22FGLOPS.

- E92 12nm process, CPU 60k DMIPS, GPU 100FGLOPS.

- SE1000 is a 7nm product with functional safety ASIL-B. It can be independently financed step by step, which is interesting.

The automotive operating system has become a consensus and requires spending a huge amount of money as the first step to create a customized Android, RTOS, and Linux to work separately around the cockpit and autonomous driving. There is actually a lot of controversy about whether a unified OS platform can be created due to the differences in the needs of the cockpit and autonomous driving.

HaleyTek, developed by Volvo, is based on open and high-ecological Android entertainment system, used to supplement China’s ecosystem outside Google’s Automotive Android. ECARX Drive OS is mainly used in instrumentation and intelligent driving, and Safety OS is developed around functional safety.

This is mainly covered by ECARX’s software because there is a lot of software work in the central integration platform, which not only covers OEM’s needs but also expands the ecosystem, consuming the most engineering resources.

What is Yіkahаtoо

In fact, we can break it down. The SOC itself is still a separate entity, and the operating system is also customized. Yіkahаtoо actually focuses on hardware development around SOC and provides software for operating system modification. Essentially, I am not sure if the entire Gеely Group still needs an OEM software company to develop software around different brands.

Currently, we have not seen Yіkahаtoо enter the SOC market, nor have we seen autonomous driving integrated into it. At present, more are still installed around the software section. Once all the software is installed in one company, can OEM’s requirements for software changes and customization be realized by relying on one company?

My understanding is that Yіkahаtoо will eventually become a software company with software capabilities, based on the rapidly evolving needs of OEMs in the future. That is to say, only with rapid response to brand needs can we run fast, and only with strong binding with OEMs can we fully reduce communication costs. In terms of intelligent software, except for Qualcomm and Nvidia, it is difficult to serve more companies once more is involved.

I think that if we split the automotive parts of the car companies, we can have a certain degree of commonality around the hardware and essential software. However, once the main properties revolve around the operating system and application software, it is difficult to achieve portability between different car companies. The boundary of Yіkahаtoо may be the boundary of Gеely.

Conclusion: This round of intelligent vehicle development will most likely follow the model of Tеslа’s vertical integration at the beginning, trying to survive as companies that can do it. The biggest challenge for software companies that help traditional automakers transform is that the gap between the first and second parties is huge. The biggest problem is that if the iteration speed is slow, it cannot keep up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.