Author: Zhu Yulong

Goldman Sachs has released “Global Batteries: The Greenflation Challenge” and “Green Metals Battery Metals Watch: The End of the Beginning” to elaborate on some viewpoints, which I find very interesting, so I extract some content to share with you.

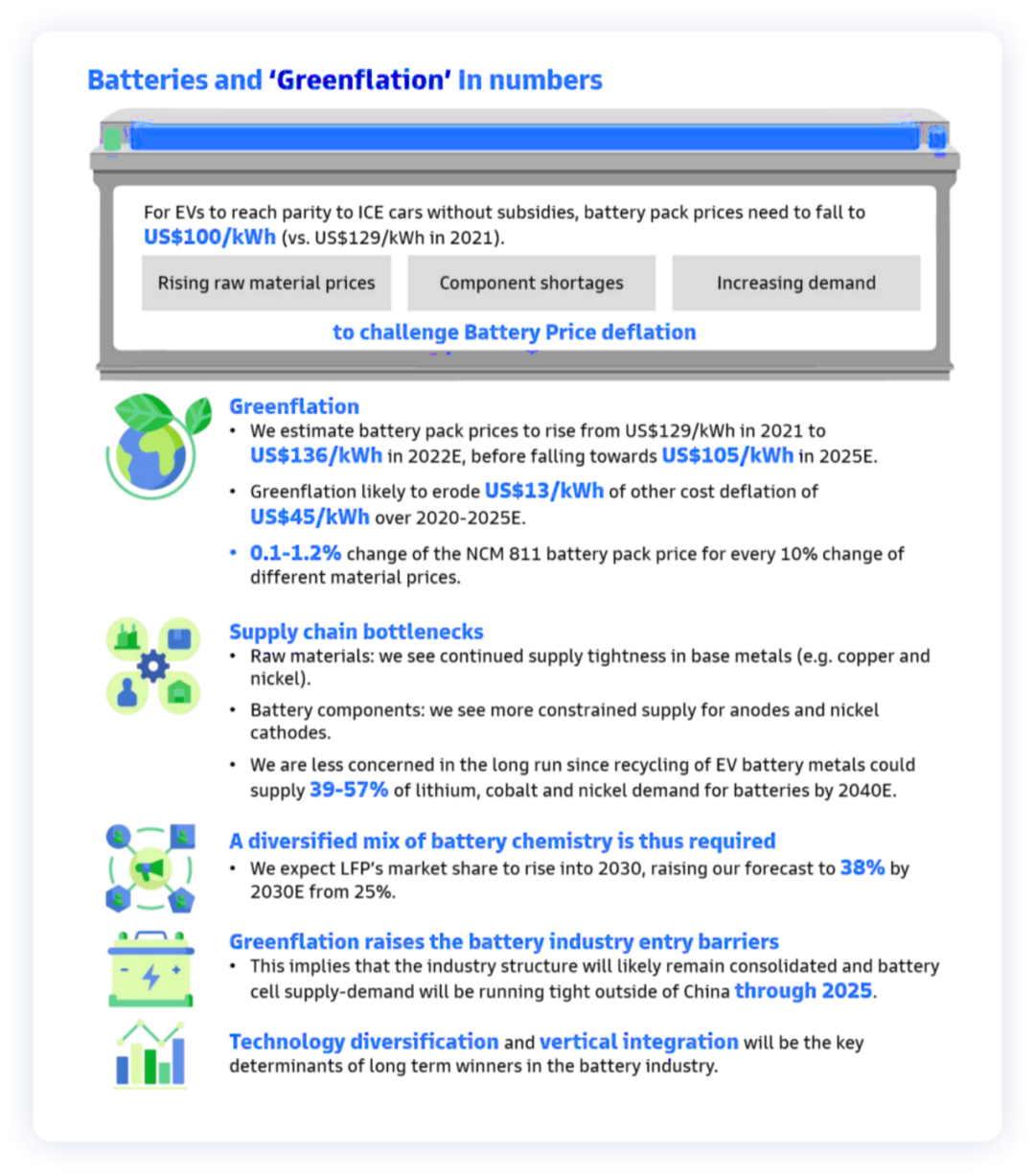

Manufacturing batteries is a complex business that requires protecting various raw materials and managing the supply chain of packs. These top materials will change with the development of chemical systems. Growing demand, parts shortages, and continuously rising raw material prices are challenging the objective rule that battery prices have fallen for 10 years.

Five Key Conclusions:

-

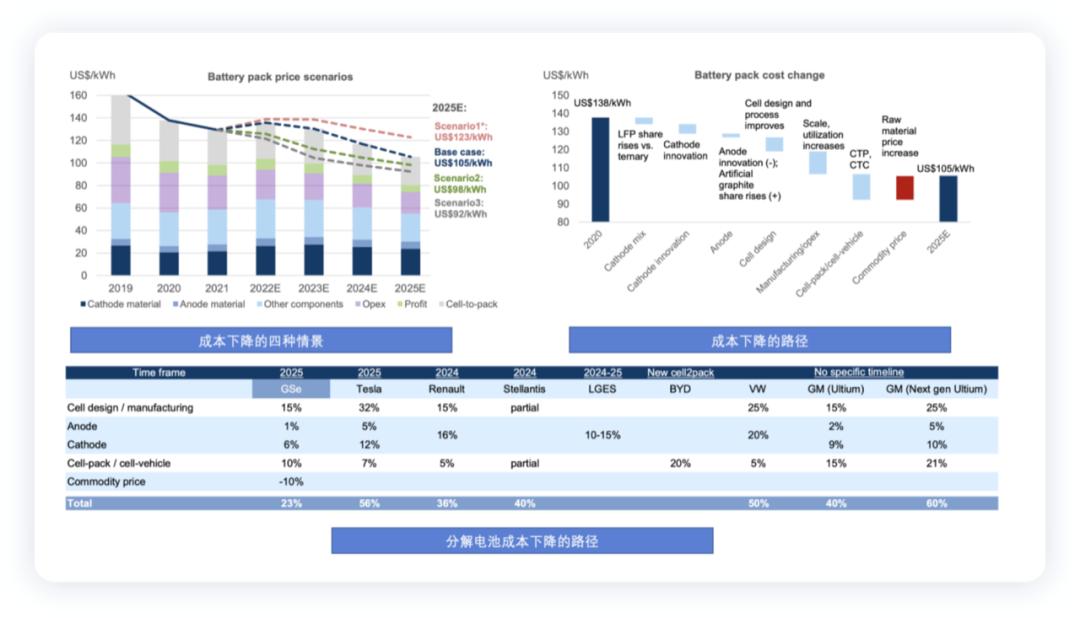

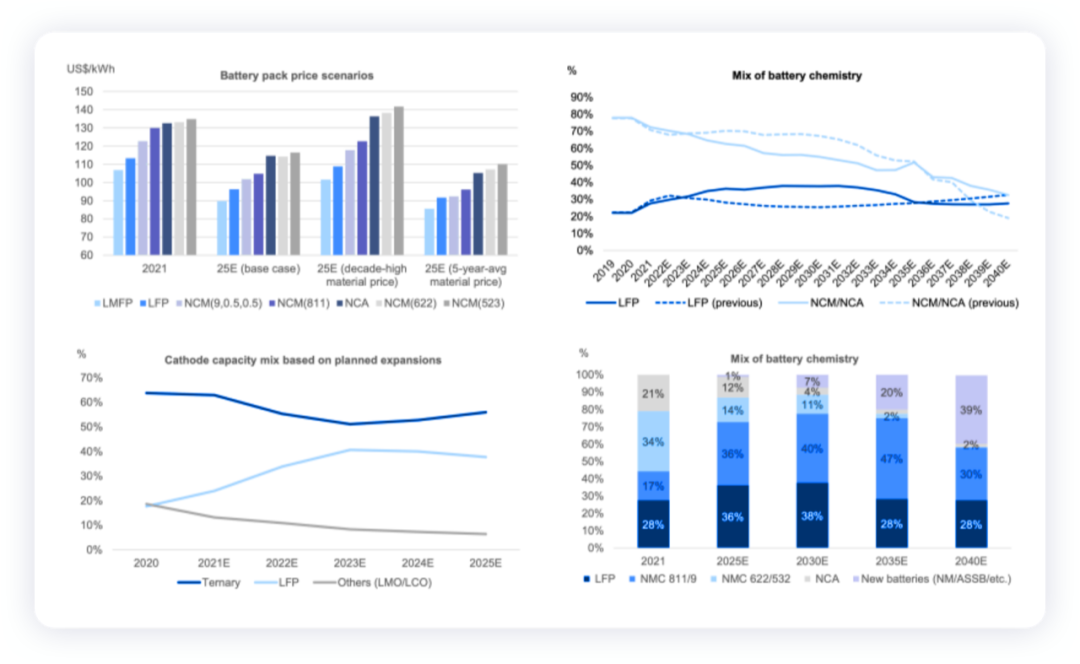

The trend of continuous battery price decline in 2022-23 will change, but compared with battery innovation and rising oil prices, from the perspective of total cost of ownership (TCO) comparison, the cost parity between electric vehicles and internal combustion engines can still be achieved by 2025. The price of battery packs will rise from $129/kWh in 2021 to $136/kWh in 2022 and then drop to $105/kWh in 2025.

-

The supply of metals (such as copper and nickel) used in electric vehicles will continue to be tight, and because the battery pack industry is still in its infancy, geographically concentrated in China, it needs to expand capacity faster, so some battery materials will face bottlenecks.

-

In order to achieve sustainable growth of electric vehicle supply in the face of periodic material shortages, the battery industry will have a more diverse battery chemistry combination (by 2030, LFP market share will increase from 25% to 38%), and recycling metals will play a critical long-term role in retired batteries.

-

Profitability risks in the short term in the power battery industry, as the difficulty of obtaining raw materials increases, the entry threshold for the battery industry also increases. By 2025, the industry structure may continue to consolidate, and demand for batteries outside of China will tighten.

-

Technological diversification and vertical integration will be critical determining factors for the long-term winners in the battery industry.

In fact, the first cost analysis and the second metal and iron-lithium relationship can be further elaborated.

Power Battery Cost Analysis

According to Goldman Sachs’ analysis of the cost model of battery packs, the long-term consensus that battery prices will continue to decline over the next decade due to rising material prices has been greatly challenged. The biggest gap in past predictions is due to global policy convergence, which has led to a tight (supply-demand imbalance) raw material market as a result of the rapid expansion of battery demand.

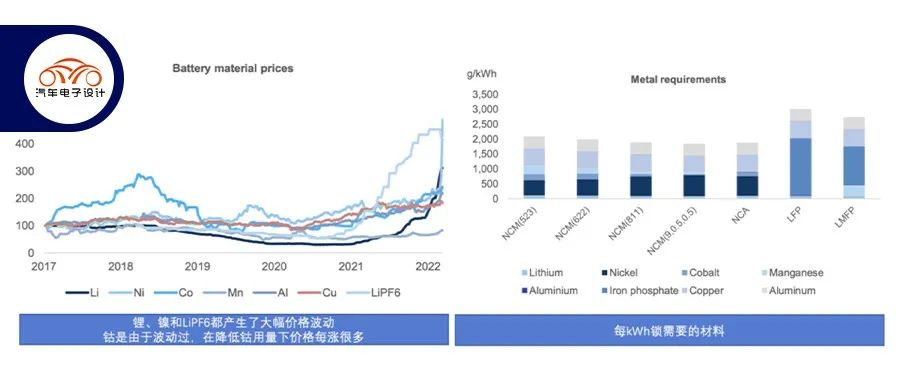

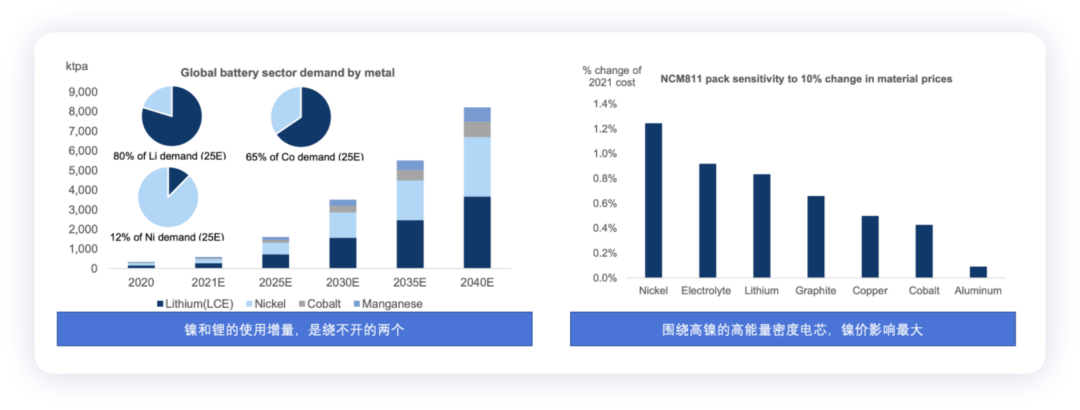

Based on the prospect of global powertrain and the supply of metals for batteries, the demand for major materials (lithium, nickel, cobalt, manganese) in batteries is expected to continue to grow at a compounded annual growth rate of 22%/15% in the next 10-20 years. The expectation of declining battery prices is challenged. Taking the battery of ternary NCM811 as an example, the prices of different materials will cause the pack price of the battery to change by 0.1-1.2%.

The battery is a complex interaction of multiple materials, and its total cost is determined by the total cost of its various materials, which is driven by the different raw material costs and processing profit margins in different links of the supply chain. The battery supply chain starts with the mining of raw materials, including lithium, nickel, cobalt, etc. Material processors transform raw materials into precursor materials for battery components. Component manufacturers further process precursor materials into different types of cathodes (NCM, LFP, etc.), anodes, membranes, electrolytes, and collecting fluids. Battery manufacturers assemble them into batteries, which are then packaged with multiple batteries to achieve the desired energy capacity and installed in vehicles. Other participants in the supply chain usually adopt cost-plus pricing strategies (Korean battery manufacturers’ cost transfer mainly focuses on positive electrode metals), which still largely expose end-users to cost fluctuations.

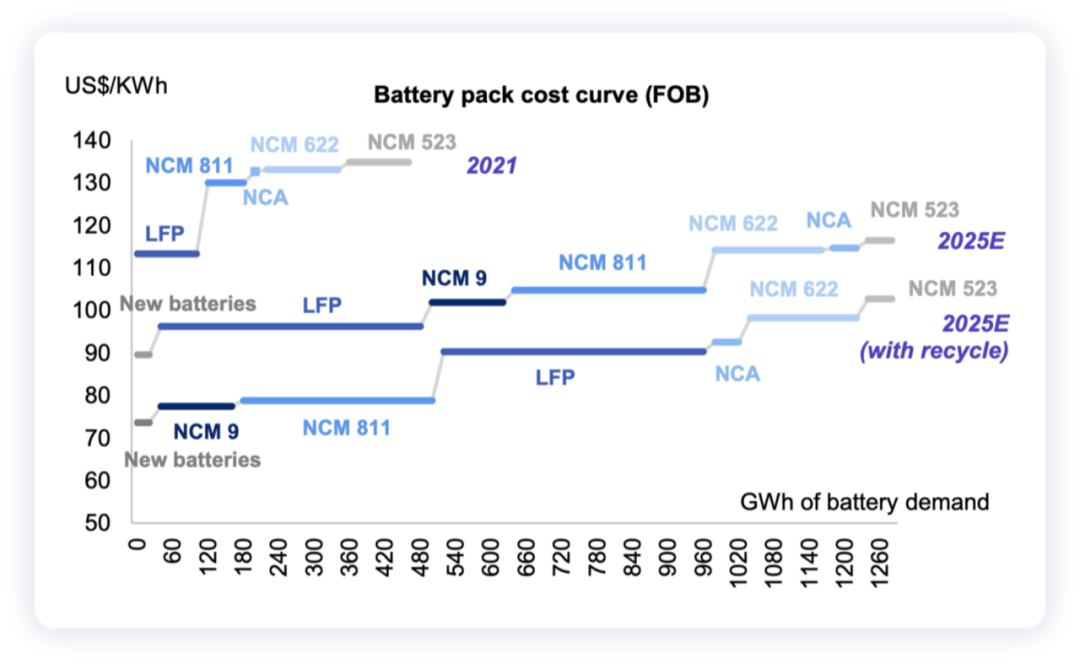

The average battery price is expected to decrease by $32/kWh from 2020-2025 (from $138/kWh to $105/kWh). The price of raw materials may bounce back by $13-45/kWh, and the cost of battery cells mainly comes from positive electrode innovation and changes in cell design, better design (integration from battery to vehicle), and increased capacity utilization that saves operating costs. Carmakers will gradually adopt larger batteries.

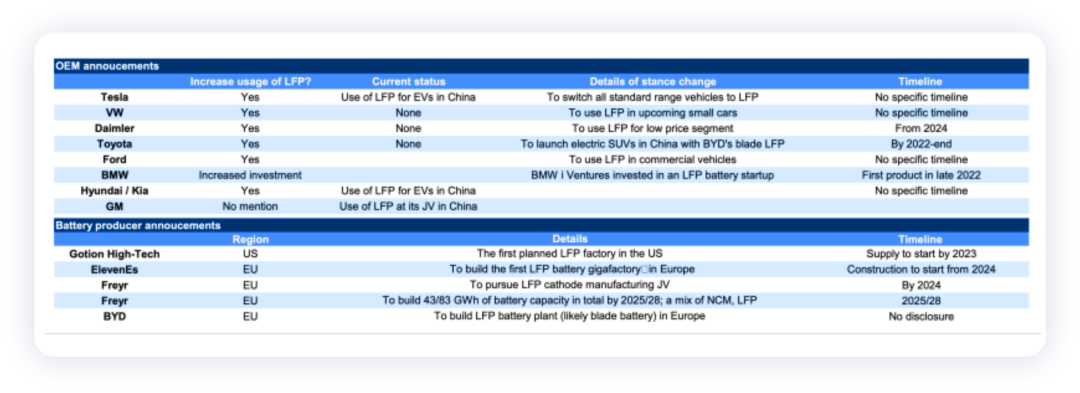

Lithium Iron PhosphateChinese LFP batteries surpassed ternary batteries since September 2021, and the use of LFP outside China is gradually accelerating. The lifting of usage restrictions outside China is expected due to the expiration of relevant patents around 2022-23. Considering the cost advantage of LFP and the material diversification incentives of automakers, it is expected that the market share of LFP will increase from 25% in 2021 to 38% in 2030. LFP batteries are mainly deployed in the field of small to medium-sized electric vehicles due to their lower energy density.

As the battery recycling market advances toward 2030, the market share of LFP will begin to decline after 2030. The cost competitiveness of LFP will decrease due to the lower recycling value relative to NCM, making way for the expansion of NCM811/Ni90 and other new batteries. After standardizing the driving range, LFP batteries were 10-20% cheaper than ternary batteries in 2021. With China gradually canceling subsidies for electric vehicles, the cost advantage of LFP will become more prominent after 2022.

Summary: The article contains many core issues worth exploring, but we will not go into them here. It is worth reading in detail.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.