Author: Zhu Yulong

Let’s take a look at the current situation of power batteries by making some charts over the weekend.

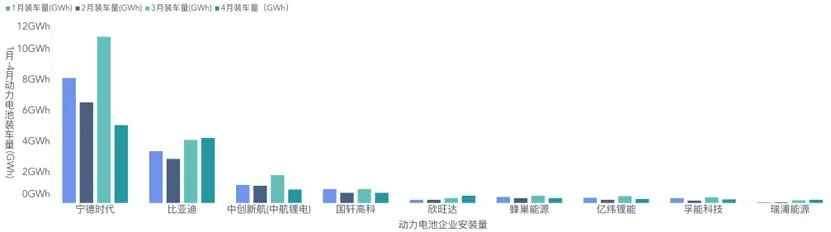

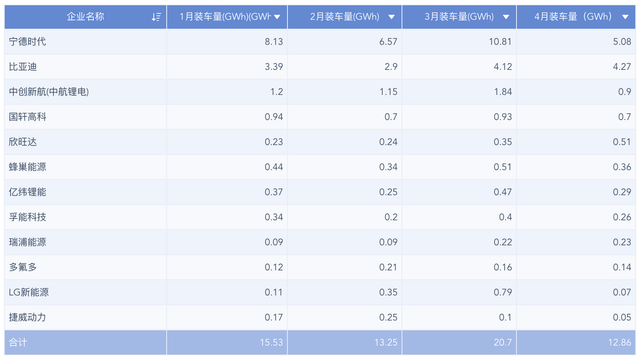

Only 34 power battery companies could be identified in April from installation data. The top 3, 5, and 10 power battery companies had installed volumes of 10.2 GWh, 11.5 GWh, and 12.7 GWh respectively, with a share of 77.2%, 86.4%, and 96.0% of the total installation volume. Currently, it seems that it is difficult for those beyond the top 10 to achieve significant growth without special support. Let’s discuss the supply relationship and next steps.

Supply Relationship of Batteries

- New Energy Vehicle (NEV) Start-ups

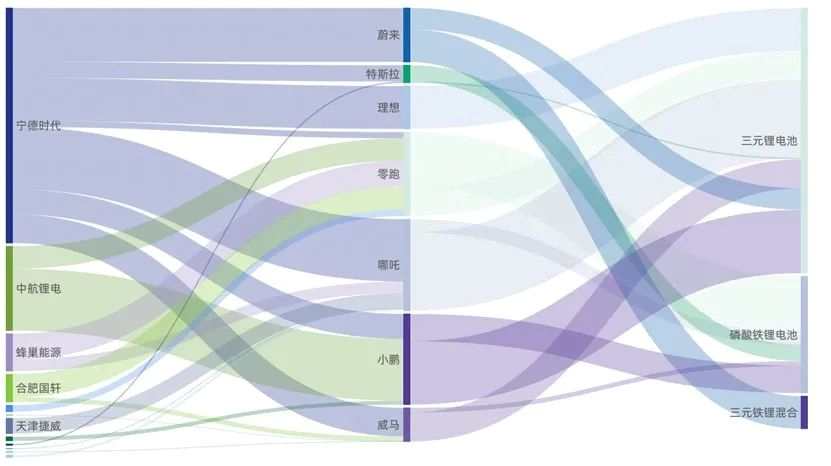

The current structure for NEV start-ups is as follows:

-

Tesla: LG and CATL, mostly comprised of iron-lithium

-

NIO: Exclusive supply by CATL, with 40% being ternary and 60% being a mixture of ternary and iron-lithium

-

Ideal: Exclusive supply by CATL, 100% ternary

-

XPeng: NIKK, CATL, and EVE Energy; supply structure has changed with ternary making up the majority

-

WM Motor: CATL, Taffy, and Gotion

-

NETA: CATL, Funeng Tech, and Tianjin Jiwei Energy

-

Leap: AVIC Lithium Battery, Funeng Tech, RuiPu Energy, CATL and Guoxuan; containing more AVIC Li-battery C01

From the perspective of battery suppliers, CATL covers all the NEV start-ups; AVIC Lithium Battery entered Leap and XPeng, and Funeng Tech entered Leap and NETA.

- Major Domestic Brands

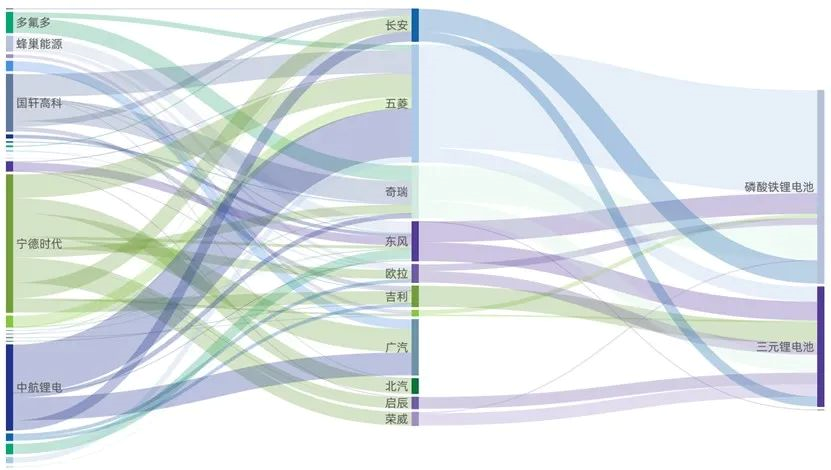

For state-owned enterprises, mainly, they are supplied by CATL. Due to the cost of A00-level batteries, the suppliers are more diverse, as shown in the following chart.

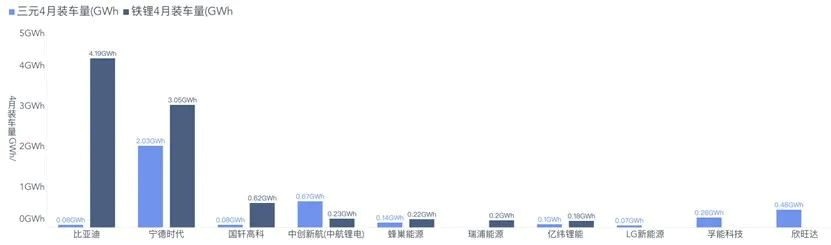

This one shows the smallest gap between CATL and BYD, with the installation volume of iron-lithium batteries exceeding that of CATL. Battery demand still depends heavily on the capacity of NEV start-ups.

The Game

Let’s review this process: from last year to Q1 of this year, the entire battery industry – both major second-tier and first-tier companies – played a game around production capacity, market share, and going public.

Due to exceptional demand in 2021, the battery industry prepared for material shortages, leading to a rise in prices for power batteries, energy-storage batteries, and small-scale power batteries. From the perspective of battery companies’ procurement, prices are on the rise, and inventory is short. Therefore, there was a battle from predicting demand and scheduling battery production to ordering battery materials.

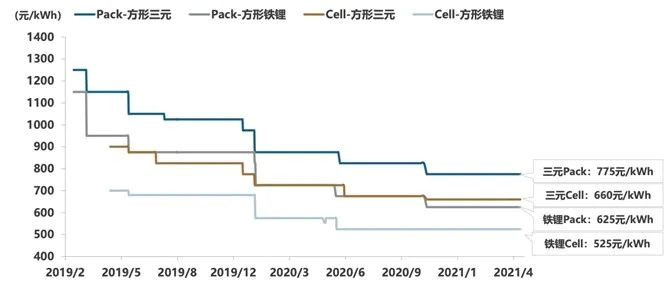

Looking at the raw material side, as the demand for batteries rose at the end of the year and production did not keep up, from December to February it generally caused an imbalance in the lithium supply. Amid this trend, the price of lithium carbonate skyrocketed from CNY 200,000 to CNY 500,000. This caused the price of batteries to rise and ultimately to reach their 2021 low point, climbing up CNY 0.2-0.3 per Wh thereafter. The domestically increased price of lithium carbonate impacted international spodumene settlement prices, leading to an average auction price of $5,000 per ton.

In fact, I believe this wave has different origins among various companies, so their responses are also different:

- First-tier Enterprise 1

To widen the gap, they need to expand their scale effect. Therefore, they must increase production capacity, output, and grab market share. Actually, from a technical perspective, the difference is not so big. The quality rate of later enterprises also increases with production volume. To expand production capacity while maintaining gross margin, they must have absolute control over resources, which is impossible to achieve.

- First-tier Enterprise 2

Under the vertical integration system, they need to support the production of a large number of cars, and purchase the necessary materials. Making money is secondary to supporting the car end’s market share grab.

- Second-tier Enterprise

Nearly all second-tier enterprises must answer their existence value to investors through high growth and project pinpointing. This is a matter of life or death. These companies cannot miss out on participating in competition.

- Other Battery Companies

Companies that do not produce power batteries also need to purchase materials for consumption, tools, and small-scale power. Low-cost lithium iron phosphate provides great opportunities, so they too must make purchases.

Under these circumstances, it somewhat resembles the iron ore-related business. No matter what type of steel you use, you must use iron ore, correct? The production capacity expansion capabilities of Chinese companies bring about an absolute demand for raw materials, leading to an uncontrollable pricing system.Summary: My understanding is that this round of supply relationships will continue to evolve as automakers restructure based on competitive factors. Many companies will seize the opportunity to enter this field, making acquisitions and consolidations as they leverage their financial advantages to lay out a new battle plan for the next 2-3 years. Who’s to say this battle will ever really come to a stop?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.