The gradually enclosed “smart driving” industry is welcoming a smokeless war.

According to the latest data from “High-Intelligence Automobiles”, from January to March this year, the number of new cars equipped with Advanced Driver Assistance Systems (ADAS) as standard accessories in the Chinese market reached 2.1336 million, an increase of 18.66% compared to the same period last year.

We have found two obvious trends for ADAS in 2022, one is the continuous growth of penetration rate which means more and more cars will support ADAS; the other is the continuous improvement of ADAS functionality which means it will be used in more and more scenarios.

Once these two trends are clear, a new problem arises: who will provide these functions?

Not all car companies have the resources and capabilities to conduct self-research currently. With the increase of quantity demand and the improvement of the ability demand, there is a huge market opportunity for suppliers.

Opportunities have arisen

We can divide automatic/assisted driving suppliers into the following categories.

One of them is traditional Tier-1, which has the advantage of resource integration ability and hardware as the main advantage, such as Bosch, Continental, and Desay SV.

Another type is the company that has long been deeply involved in software algorithms. Automakers can seek software level cooperation through “reverse outsourcing”. For example, Horizon Robotics, Momenta, and so on.

Of course, there are also suppliers such as Huawei ADS, Horizon Robotics, who can directly output a complete set of ADAS/autonomous driving systems for automakers.

Nowadays, some new players have entered this arena, that is, autonomous driving companies that previously focused on L4 level autonomous driving unmanned vehicles.

On May 25th, Pony.ai and Bosch announced a cooperation to jointly promote the large-scale front-loading production and market-oriented application of L2-L3 level autonomous driving for passenger cars.

Pony.ai is a L4-level player, and Bosch is a traditional Tier-1, each has its own difficulties. The former has data closed-loop capability and advanced autonomous driving research and development capabilities, but it lacks engineering capabilities and cannot be landed in a short time. The latter has strong advantages in sensors, domain control, integration, and so on. This cooperation also hopes to rely on Pony.ai’s intelligent driving solution WeRide ONE, to create data-driven intelligent driving software.

On May 18, in the field of autonomous minibuses, Zhongshan Intelligent Navigation also released a vehicle-level autonomous driving solution called DBQ V4, with the clear goal of wanting to get on board and achieve commercialization.

On May 18, in the field of autonomous minibuses, Zhongshan Intelligent Navigation also released a vehicle-level autonomous driving solution called DBQ V4, with the clear goal of wanting to get on board and achieve commercialization.

Going back in time, we will find another player on this path named Momenta. From the beginning, Momenta has always insisted on “walking on two legs” as an autonomous driving company. From a capital perspective, Momenta has also become one of the most popular autonomous driving companies on the market.

In 2021, Momenta completed two rounds of financing with a total amount exceeding $1 billion, and the investment team included top automakers such as SAIC, GM, Mercedes-Benz, and Toyota.

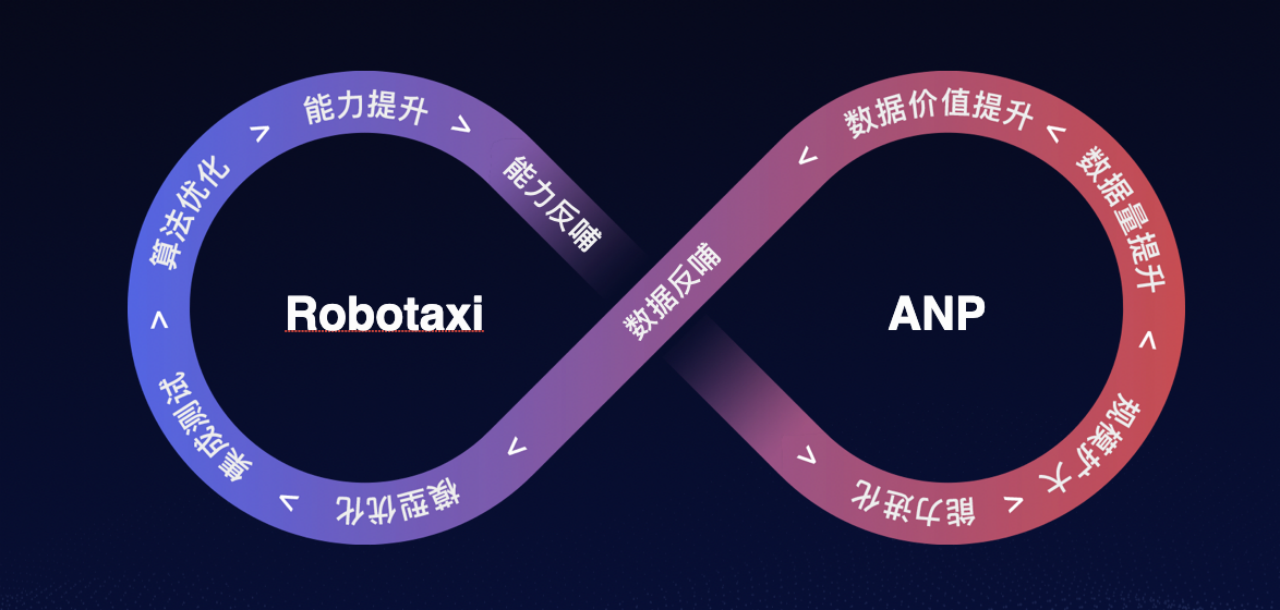

Baidu, the earliest domestic L4-level Robotaxi company to enter this field, actually went “downward” to enter the L2-level assisted driving field before Momenta. As early as 2016, Baidu began research and development of advanced assisted driving functions, and in 2020, Baidu released ANP to the public.

Many people may not know what ANP is. The original name of this system is Apollo Navigation Pilot. This is a vision-based navigation-assisted driving system, similar to Tesla’s NoA. Baidu ANP “went down” from Robotaxi, and the hardware for unmanned vehicles is very rich, but the cost is high and difficult to replicate to civilian cars. Therefore, Baidu has made adjustments to relevant hardware and software algorithms to achieve basic assisted driving functions in a relatively low-cost way.

The first car model to “taste the crab” was the WM W6.

Looking through Baidu’s product and delivery schedule, we found that Baidu has delivered parking products AVP to multiple vehicle manufacturers. In 2021, Baidu Apollo AVP achieved mass production on the WM W6, GAC Aion safety series, and Great Wall Haval Magic Power.

It can be seen that Baidu has put a lot of effort into parking, because they not only deliver automatic parking assistance, but also remote control parking, memory parking, and other functions. However, no matter from the usage scenarios, user needs, or even the “gimmick” aspect, the demand for high-level assisted driving is more vigorous.The data from the “Yiche Research Institute” in Q3 of 2021 further confirms users’ expectations for assisted driving applications: “32% of Chinese users explicitly express their willingness to purchase vehicles with assisted driving functions, 52% of users are still watching and waiting for the technology and industry to mature, and only 16% of users are unwilling to purchase.”

At this time, Baidu ANP was launched, which was relatively suitable in terms of timing.

Against the backdrop of continuously expanding user demand, Baidu has taken the second step, which is to mass-produce and deliver ANP. It is understood that ANP will be first launched on the WM W6 this year. For Baidu, this year is also the first year of delivering the assisted driving system.

Therefore, L4 companies have sharpened their heads and rushed into the L2 passenger car field, mainly for the purpose of landing products. Compared with other L4 companies that have entered the market, Baidu has landed the AVP product and pushed ANP to the forefront. Perhaps for this reason, BYD and Voyah have also chosen Baidu.

To win over OEMs, what does Baidu rely on?

Of course, if you feel that the cooperation between Baidu and WM W6 to land ANP is not typical enough, Baidu also has the following two completed cooperations.

According to Baidu’s Q1 financial report, Baidu has officially reached a cooperation with Voyah Automotive. Baidu will provide Voyah with intelligent driving, intelligent cockpit, intelligent driving simulation cloud, automotive safety, intelligent maps and other businesses. The cooperation content of BYD mainly revolves around the ANP intelligent driving and human-vehicle co-driving map.

Both of these cooperation agreements point to one business sector-intelligent driving. Although Baidu has laid out the intelligent driving industry early, it hasn’t made much movement in terms of publicity. So, besides having mass-produced products, what other reasons have attracted BYD and Voyah to cooperate?

To find the answer to this question, we need to return to the essential needs of automakers.

Faced with the “internal competition of intelligence” driven by new car-making forces, traditional automakers urgently need suppliers with technical strength and mass production experience to help them obtain competitive advantages in intelligence.In the realm of automotive suppliers, HoloMatic has not yet delivered any mass-produced products to automakers beyond Great Wall. Although Huawei’s ADS system was released last year and shocked the industry, it cannot provide users with a definite delivery time. According to our understanding, Huawei ADS is expected to be delivered as early as Q4 of this year. Even L4 companies like Momenta, who are early adopters of L2 scenarios, lack engineering capabilities. As for Mobileye, through cooperation with Jikua, we have more or less learned that the difficulty of the first intelligent driving field chip is high, and the real ability of EyeQ5 in China has not yet been verified.

Therefore, Baidu seems to be the company that can control costs and has mass production experience. This is exactly what BYD cares most about. BYD has many vehicle models, covering a wide range of people, and urgently needs to quickly improve the intelligence of its vehicles.

There is also a reason for delivery. Baidu ANP has not yet landed, but the AVP delivery rhythm is traceable. Currently, three vehicle manufacturers have adopted AVP, and there has been no delay in Baidu’s delivery.

Car companies have a very high demand for on-time online functionality. Jikua is currently the best example, and its ZAD driver assistance function cannot be launched on time, at least half of which is due to suppliers. The only touchpoint for users is the car manufacturer, so the supplier’s delivery capability directly affects the car manufacturer’s reputation on the user side.

The two reasons behind Baidu’s absence of delay are: first, Baidu can provide customers with a software and hardware integrated solution, and software and hardware are developed in parallel, which can greatly compress mass production time. The second reason is that Baidu has been rolling in the industry for many years and has experience in supply chain management. It can even skip OEM factories and establish direct cooperative relationships with manufacturers. In addition, in order to respond more quickly to OEM demands, Baidu has also established a “date pit” inventory structure, which means that it has stockpiled many “semi-finished products.”

Another very important reason is Baidu’s high-precision map. Currently, advanced level driving assistance cannot be separated from high-precision maps. Among the many suppliers of intelligent driving, only Baidu and Huawei have the qualification for high-precision map surveying and mapping. Compared with others, Baidu’s high-precision map coverage and accuracy are more advanced, and it has already won customers. This may also be one of the reasons why BYD and Voyah ultimately chose Baidu.

Finally, autonomous driving systems have always been based on the performance of mass production. L4 companies can give people a sense of strong research and development capabilities and technological leadership, but users find it difficult to perceive. Conversely, suppliers targeting L2 level driving assistance will be more “steady” and will be faster in terms of landing speed.In the multitude of Level 2 ADAS suppliers, especially those who will deliver products this year, Baidu has yet to showcase its true capabilities to the public, which has added anticipation from both us and the users towards this cross-domain company.

On one hand, numerous Level 4 companies are waiting for Baidu to “set the tone”. On the other hand, users and automakers are also eagerly anticipating the results of Baidu’s years of painstaking research and development. However, opportunities and challenges coexist, and if the product of Apollo Navigation Pilot (ANP) did not meet expectations, the public’s anticipation will be shifted to skepticism.

Therefore, we greatly anticipate reviewing Baidu’s submission of their “answer sheet” for the Apollo project.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.