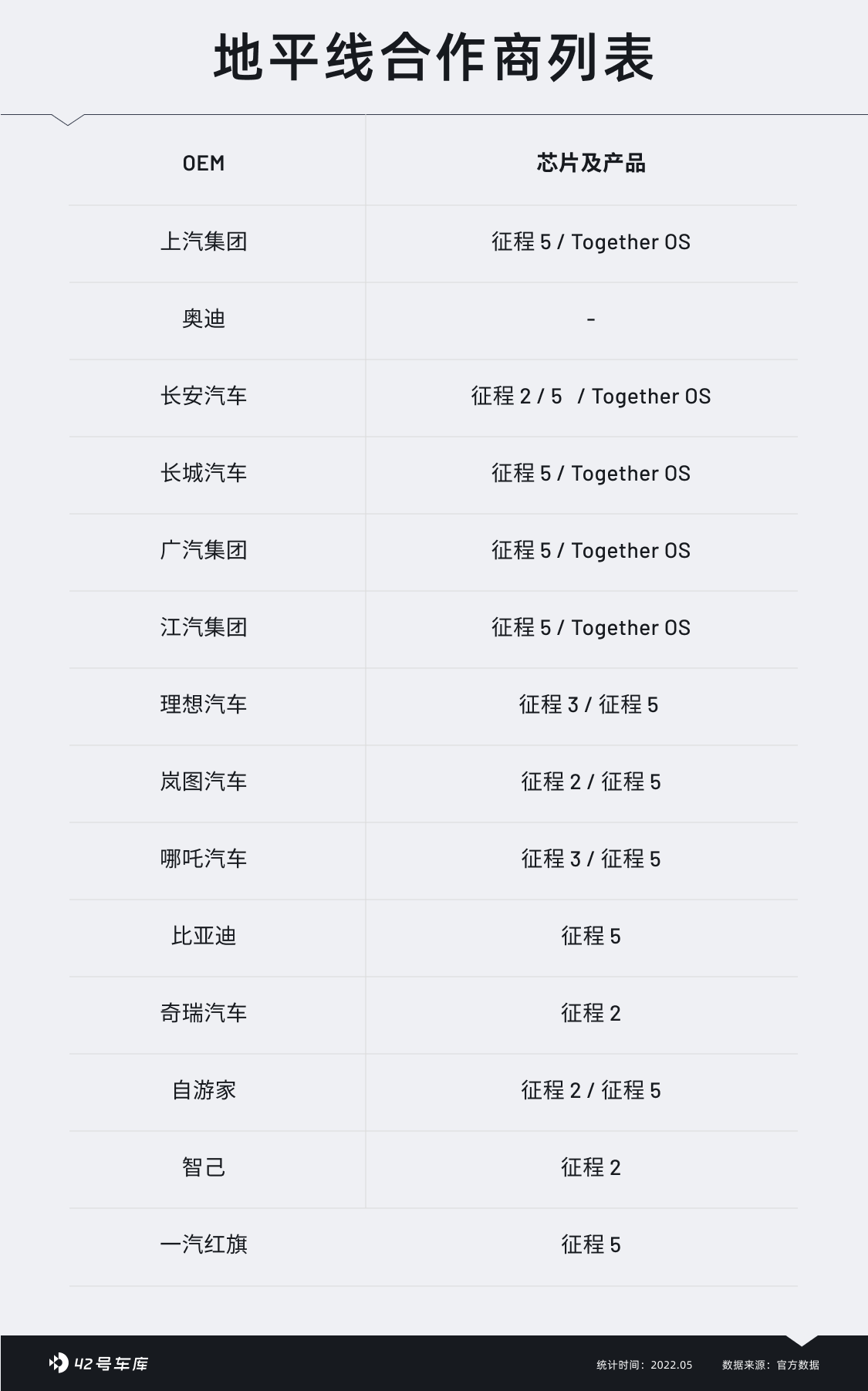

On May 13, Horizon Robotics announced that it had reached a project application cooperation agreement with FAW Hongqi, and FAW Hongqi will adopt multi-Ascend 5 chips to build an intelligent driving domain controller, providing 384-512 TOPS of AI computing power for the new generation of electronic and electrical architecture.

After partnering with BYD and NIO recently, Horizon Robotics’ collaboration with Ascend 5 has become its third official announcement. In fact, this is not all. At the Ascend 5 launch event last year, several automakers had already expressed their intention to partner with Horizon Robotics.

Since partnering with Changan in 2019 to provide the Ascend 2 chip, more and more OEMs and suppliers have paid attention to this domestic AI chip company, and the release and launch of Ascend 5 has further expanded Horizon Robotics’ influence in the industry.

Clearly, Horizon Robotics has become an indispensable company in the smart driving era.

Statistics show that Horizon Robotics has partnered with dozens of companies in the industry, including OEMs and suppliers.

Today, let’s explore why Horizon Robotics, which didn’t have the same fame as a video game company of the same name, has been able to capture so many customers overnight. What is the background of this company, and what can it bring to its partners?

Originated from Chips

The reason why Horizon Robotics has achieved its current results is not only closely related to its own timely adjustment of strategies but also to the changes in the market environment. Of course, the most important thing is that it has produced suitable products at the right time.

Let’s review the development history of Horizon Robotics and take a look at this company’s success in the face of industry changes, whether by chance or inevitability.

Horizon Robotics was founded in 2015. Its founder, Yu Kai, previously served as the vice president of Baidu Research Institute. When Horizon Robotics was first founded, Yu Kai did not believe that Horizon Robotics would specialize in ADAS chips at the time. In his opinion, robots would become the next intelligent terminal after computers and smartphones.

However, with the development of the industry, it gradually became clear that cars would become the next mobile intelligent terminal, and AI chips and operating systems for cars would become the underlying foundation for this AI intelligent terminal. Horizon Robotics realized that making car-grade AI chips would be the first entry point for realizing the vision of becoming the “Intel of the robot era”.## Translation

Meanwhile, in non-automotive chip fields such as floor-sweeping robots and food delivery robots, Horizon Robotics is also a major supplier.

In short, developing intelligent driving and AIoT in smart homes is just the first field of Horizon Robotics team’s vision for the future. Yu Kai also believes that his team’s strategy is “strategize and adjust in a timely manner”. Only after gaining market position can capabilities radiate to other fields.

In 2019, at the World Artificial Intelligence Conference, Horizon Robotics officially released the Journey 2 chip, which has the following core specifications:

-

Typical computing power: 4 TOPS

-

Typical power consumption: 2 W

-

Number of connectable cameras: 1

-

Chip process: TSMC 28+nm HPC+

This chip supports two functions: DMS driver monitoring and ADAS auxiliary driving visual perception information processing.

In 2020, Horizon Robotics partnered with Changan to provide the Journey 2 chip for the main model UNI-T in the smart cockpit field, realizing DMS and other functions.

Although Horizon Robotics and the auto industry’s first step did not directly enter the ADAS field, this cooperation allowed the Journey 2 chip’s shipments in 2020 to exceed 100,000 units. This also marks Horizon Robotics’ recognition by automakers, and its investment in vehicle-mounted AI chips has paid off.

At the 2020 Beijing Auto Show, Horizon Robotics officially released the Journey 3 chip, which has the following core specifications:

-

Typical computing power: 5 TOPS

-

Typical power consumption: 2.5 W

-

Number of connectable cameras: 6

-

Chip process: 16 nm

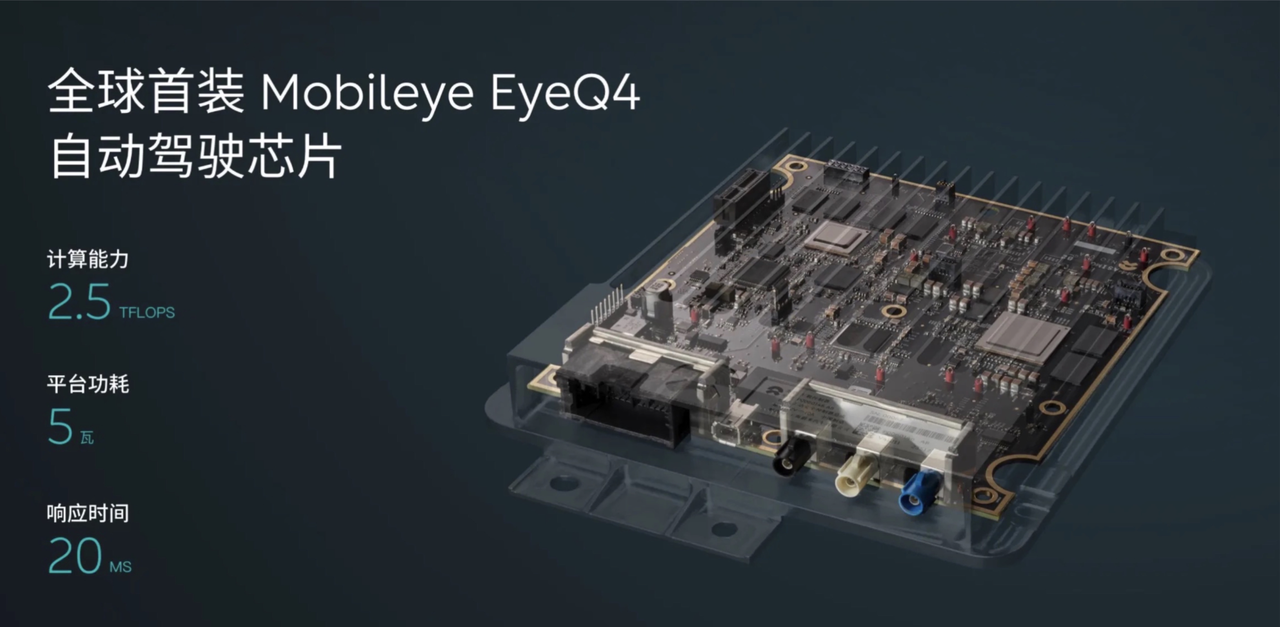

This is a chip that can battle the Mobileye EyeQ4 head-on. After being installed on the 2021 model Ideal ONE, more and more automakers are turning to Horizon Robotics for collaboration.

In July 2021, Horizon Robotics released its third-generation automotive-grade product, Journey 5, which can be regarded as a truly domestically produced high-performance computing chip, with a peak computing power of 128 TOPS and support for up to 16-channel camera perception input. It supports the fusion prediction and planning control of multiple sensors required for advanced autonomous driving.

In July 2021, Horizon Robotics released its third-generation automotive-grade product, Journey 5, which can be regarded as a truly domestically produced high-performance computing chip, with a peak computing power of 128 TOPS and support for up to 16-channel camera perception input. It supports the fusion prediction and planning control of multiple sensors required for advanced autonomous driving.

If Orin seized the “flagship” market segment with its impressive computing performance, the Horizon Journey 5 can fully target the market below Orin, and even be positioned as a “popular” flagship model.

In addition, Horizon’s Matrix 5 computing platform, based on Journey 5, has a single-board computing power of up to 512 TOPS and dual boards can achieve up to 1024 TOPS. This product line can cover L2-L4 level assistance driving scenarios. In the next 1-2 years, it is entirely possible for Horizon to compete with Nvidia’s Xavier SoC using the Matrix 5 computing platform.

The powerful performance of Journey 2, Journey 3, and Journey 5 chips has built Horizon’s strong product matrix. But winning over a large number of automotive companies to place orders based on these three chips is not as simple as it may seem.

Left-hand Market, Right-hand Service

During the launch of the 2021 IDEAL ONE, Li Xiang spoke highly of Horizon Robotics, its partner at the time. Horizon not only provided a 5-TOPS computing power Journey 3 chip to IDEAL, but also sent a team to provide nanny-style services.

By giving up Mobileye and adopting Horizon Robotics, not only did IDEAL become the first domestic tech company to mass-produce ADAS chips, but more importantly, Horizon was beginning to be recognized as one of the new initiative’s top three automakers.

However, the market environment during the period from Horizon’s establishment to mass production of ADAS chips has been continuously changing. To win orders, external environmental conditions are equally important in addition to self-investment.

In 2015, the State Council issued the “Made in China 2025” plan. China subsequently formulated a series of policies to promote the development of intelligent driving and intelligent connected vehicles. Among them, the “Action Plan for the Development of the Connected Vehicle (Intelligent Connected Vehicle) Industry” pointed out that by 2020, the user penetration rate of connected vehicles should reach more than 30%, and the adoption rate of L2 level assistance driving should also reach over 30%.## What is the penetration rate of intelligent driving in the past few years with government support and promotion?

According to the data from “TF Securities”, in 2021, the number of new vehicles with pre-installed ADAS standard equipment and insured in China reached 8.0789 million, with a penetration rate of 30.78%, achieving the established target.

According to the latest data from “Gao Gong Intelligent Automobile”, from January to March of this year, the number of new cars in China’s market with pre-installed standard equipment and equipped with ADAS was 2.1336 million, an increase of 18.66% year-on-year. The installation rate of pre-installed ADAS equipment increased by nearly 10 percentage points to 44.84%, maintaining a strong momentum. Among them, the number of new cars with pre-installed ADAS standard equipment from joint venture brands and foreign-owned companies (Tesla) was 1.4167 million, accounting for 66.4%.

The market performance clearly shows that the rate of installation of intelligent driving systems on new energy vehicles is higher.

Behind this phenomenon is a wave of competition triggered by new carmakers led by “TuSimple” in their continuous pursuit of “autonomous driving”, which directly weakens the position of big Tier-1 players such as Bosch and Continental.

Bosch, Continental, and other top players have been under increasingly high pressure. It has been proven that it is no longer possible to make money just by selling hardware. Since Tesla launched the “software-defined car” era with the software upgrade model, it has been constantly threatening traditional car manufacturers and supply chains.

In fact, compared with other Tier-1 players, Bosch’s layout of software development is relatively early. As early as 2012, Bosch began to deploy intelligent cars, and in 2014, it jointly launched China’s first ACC and AEB-assisted driving system with Geely.

In 2015, Bosch’s automotive technology business unit was renamed the Intelligent Transportation Technology Business Unit, adding “intelligent transportation” business. In 2017, Bosch’s assisted driving system business reached its peak, bringing in more than 1 billion euros in revenue in 2017 alone.

However, even with such a large business volume, it can’t withstand the impact of new forces. With Tesla in the front and NIO and XPeng in the back, the play of new forces is too radical.

Take XPeng as an example, the first car model of XPeng, the XPeng G3, still uses Bosch’s MPC2 vision perception solution, which includes optical and processing modules, with both hardware and software provided by Bosch.

But in terms of experience and actual tests, the performance of this solution is average and can hardly be compared with Mobileye EyeQ4. As an entry-level car and considering the R&D capabilities at the time, XPeng may accept the performance of MPC2. However, this solution is difficult to copy to the flagship model P7, which focuses on intelligence.In the era of new car making, Bosch is “ignored”.

Not only is its research and development technology highly rated, but in terms of iteration speed and service attitude, Bosch has no advantages.

New forces not only require performance in assisted driving, but also in software iteration speed. The phenomenon unique to the era of software-defined cars is that the same car, with the same hardware configuration, can have different performances in the same year.

Take another example, Jidu Auto highlights the frequency of software iteration for its first model that has not yet been launched by calling it “weekly update”. This is unimaginable for any Tier-1 supplier.

Service attitude refers to how Tier-1 will execute cooperation with automakers. Will they send an engineering team on-site? Can they provide differentiated services? Do they have the ability, resources, and “mood” to do “after-sales” services, etc.

The same questions can also be applied to the current industry leader, Mobileye.

Compared with solutions such as Bosch MPC2, the EyeQ4, which has the largest installation volume in China, has excellent visual perception quality performance. However, this solution also has two drawbacks. First, it is only a perception solution. Second, its closed system makes new force customers lose patience.

Mobileye introduced EyeQ4 in 2018, and the overall computing performance is nearly ten times stronger than the previous product EyeQ3, while the power consumption only increased by 0.5 W. EyeQ4 can bring better perception effects, but automakers need to self-develop or package decision-making and execution algorithms of another company based on it to complete the entire assisted driving system chain.

The first-generation of NIO’s products, the 668 models, and 2020 LI ONE, all use Mobileye EyeQ4 perception algorithms. The former self-developed the decision-making algorithm and wrote it into the highly open NXP S32V chip, while the perception algorithm of 2020 LI ONE relies on Yihang Intelligence.

In addition, any new force automaker that has cooperated with Mobileye has reflected a fact that the perception algorithm is too closed. Since EyeQ4 is a “black box” algorithm, it is difficult for partner automakers to touch the core algorithm, let alone develop based on the Mobileye algorithm. In communication with automaker R&D personnel, we have also learned that Mobileye’s accumulation in the field of visual perception is really strong, and vehicles using the EyeQ4 solution generally perform well in LCC.The biggest problem is the convenience of cooperation: carmakers often have to send emails for new requirements or feedback, and then wait for a response from Mobileye after evaluation. Considering the demand for updates from new forces in China, such convenience is quite inconvenient. Bosch and Mobileye, with their large projects and limited resources, have become one of the factors that carmakers must consider carefully.

Meanwhile, these shortcomings of the domestic suppliers mentioned above are nonexistent at Horizon, a local supplier.

First of all, as a start-up company, Horizon has the genes of a “new force” and can respond more quickly to customer needs. Second, with its ideal partnership, Horizon can provide carmakers with a “nanny-style” collaboration, dispatching an engineering team for joint R&D, and providing after-sales service after completion of the project. Moreover, Horizon stated at the Horizon Journey 5 product launch conference that it will firmly avoid closed solutions and software bundling, providing carmakers with perception algorithms and development toolchains to help them better conduct research and development.

At this point, you may think that Horizon is tailor-made for the autonomous driving industry, and that it is perfect compared to foreign large-scale suppliers. In fact, there are still shortcomings.

First of all, Horizon is still positioned as a Tier-2 supplier. Although it is good at developing chips, there is still a domain controller middleware between the chip and the function, which requires high engineering and hardware design and manufacturing capabilities that Horizon is clearly not good at.

Secondly, “nanny-style” collaboration is unsustainable and not replicable. This type of approach is too resource-consuming for a company. As Horizon collaborates with more companies, it will become even more difficult to replicate ideal partnerships.

In addition, although Horizon Journey 5 is a high-performance chip with an AI computing power of 128 TOPS and a frame rate of 1283 FPS, its computing power is lower than that of Nvidia Orin. This makes it difficult for this chip to be used in flagship cars. Even if non-head carmakers, such as Wejo and LI, want to achieve “headline news” in terms of intelligent driving capabilities, investor attention, hype, and the resulting public opinion, they will still choose Nvidia rather than Horizon.

Taking Li Auto as an example, the company’s flagship new car L9 this year uses Nvidia Orin. There are rumors that Li One’s revamped model, which may be renamed Li Auto L7, will use the Horizon Journey 5 for its ADAS chip. If you think it’s because Horizon Journey 5 wasn’t ready when L9 was planned, the fact that later newcomers, such as Jidu Auto, still prefer Nvidia is convincing evidence of this logic.

Apart from chips, what else does Horizon have?As more and more car companies join the collaboration, Horizon Robotics has identified a problem: providing only chips is too limited. There is still a gap between chips and the implementation of features, which is exactly what many car companies lack. Horizon Robotics has chosen to take the initiative and move forward.

Starting in 2021, Horizon Robotics has developed Mono, Pilot, and Halo based on the Journey series of chip products, which cover basic assisted driving, navigation assisted driving, and intelligent cockpit scenarios.

The Mono solution is built on the Journey 2 and Journey 3 chips, and is an assisted driving feature that relies solely on forward vision perception. The recently released Changan UNI-V is equipped with this intelligent driving solution, which includes 1 camera, 5 millimeter-wave radars, and the Journey 2 chip, allowing for lane departure warning, full-speed range adaptive cruise control + lane keeping, turn signal for changing lanes, and more.

In addition to Mono, the product matrix also includes Mono 2, which is suitable for L0-L2, and Mono 3, which is suitable for L2+. Mono 2 is more focused on localization, with enhanced recognition training for fishbone line, cone barrel, and Chinese characteristic traffic lights and road signs. The biggest difference of Mono 3 is that the system supports an 8 million-pixel front single vision scheme, which brings clearer perception images and longer perception distances.

The benefits of a high-pixel camera also include stable perception ability, and the vehicle can maintain high stability of perception even in scenarios like tunnels with complex light changes, improving the system’s continuity of use. In addition, compared to Mono 2, Mono 3 has expanded its recognition ability of ground markers, such as zebra crossings and more.

This kind of perception solution is like paying to win a game. As long as you are willing to spend money, you can have better hardware, and the hardware level determines the height of the ceiling, while the software level is limited by the hardware configuration. In short, there is no problem that cannot be solved by adding money.#### Translation:

By the way, the FOV angle of the 8 million pixels camera for Mono 3, which is a pre-requisite, has been increased from 100° to 120° in order to widen the lateral perception range. The greatest benefit brought by this is the ability to identify cut-in vehicles in adjacent lanes earlier. Mono 3 solution also has the ability of the on-board vision mapbuilding, which can provide cloud map aggregation reference service design. Based on monocular vision, it can be combined with other sensors such as millimeter-wave radar to achieve NOA navigation-assisted driving function.

Pilot

Compared with other solutions, Mono is relatively low-cost, but its monocular vision has significant limitations, and greater computing chips and surround vision are essential for achieving higher levels of assisted driving. Therefore, if the automaker is financially strong, Pilot can be directly used.

Based on the Journey 3, Horizon Pilot is designed, and the test vehicle adopted 3 chips with a total computing power of 15 TOPS. The test model was modified based on the Ideal ONE. Pilot integrates 6 cameras, covering a 360° field of view around the vehicle, and can achieve high-speed navigation-assisted driving functions, which is NOA.

At present, there are few technology companies that can land a navigation-assisted driving function, and Horizon is one of them. Unlike other tech companies such as Momenta, Horizon is self-developed from both its hardware and software, from chip to software.

SuperDrive

The above functions are all advanced assisted driving under limited road conditions. In response to more complex situation scenarios, Horizon has a solution for full-domain intelligent functions, which is the SuperDrive vehicle intelligent solution based on Martrix 5.

This solution can meet the full-scene smart vehicle needs of high-speed, urban, parking, and intelligent human-computer interaction. At the same time, with hardware reference design based on Matrix 5, SuperDrive can also be compatible with partner hardware. The SuperDrive urban assisted driving demo will be unveiled this year.

Halo

Horizon can provide full-scenario intelligent driving products from basic assisted driving to navigation-assisted driving, but this company entered our vision by signing a fixed-point cooperation agreement with the main engine factory that focuses on intelligent cockpit.

In 2019, Horizon worked with Changan to create the intelligent cockpit based on Journey 2. Today, the smart interactive solution of Horizon’s cockpit field, Halo, has developed to stage 3.0.

With the 5 TOPS computing power provided by Journey 3 and the ability to connect 6 cameras, Halo 3.0 can provide a set of AI solutions including DMS, face detection, behavior detection, gesture recognition, child behavior detection and multi-mode voice interaction for front and back row users.According to the test vehicle modified by Horizon Robotics, the Changan UNI-K, Halo can provide functions such as always-on without awakening, continuous dialogue, and gesture recognition.

For car companies without self-research abilities, the implementation of these functions is definitely a blessing. Although everyone wants to be self-reliant, there are not many manufacturers with self-research abilities at present, and it is a better choice to adopt supplier solutions. It is more practical to use a stable supplier solution than to use Orin, which cannot provide convincing performance.

However, it should be noted here that although Horizon Robotics develops its own chips and perception algorithms, integrated components are still completed by Tier-1, which is consistent with the positioning of Horizon Robotics’ Tier-2.

The Chinese market has a certain degree of specificity, and the emergence of new forces such as OME and Horizon Robotics has completely changed the Chinese automotive industry. Even large traditional suppliers that used to make money easily have to lower their posture and seek transformation.

In early 2021, Bosch merged four separate business units, powertrain control, body control, intelligent cabin, and autonomous driving, into a brand new business unit-Intelligent Driving and Control. This department has 17,000 employees. Changing the organizational structure is just the first step in Bosch’s transformation. At the same time, Bosch is also increasing its research and development investment. Xu Daquan, executive vice president of Bosch China, once said that in 2021, Bosch’s investment in electrification, automation, and interconnected transportation exceeded 1 billion yuan.

Similarly, Karl Krause, CEO of Continental Group China, once stated that Continental Group will transform from a traditional automotive supplier to a modern mobility technology company. In March 2020, Continental established an autonomous driving and mobility business unit. During last year’s Shanghai Auto Show, Continental and Horizon Robotics reached a cooperation agreement and established a joint venture, which will integrate the advantages of both parties to provide full driver assistance solutions for global car manufacturers.

Chinese car companies especially pursue personalized and customized products. At the same time, suppliers at different levels hope to have software capabilities. To put it bluntly, how can suppliers not be afraid when the car companies have the initiative? The reason why Horizon Robotics can win so many customers is relying on its products and services. It sounds completely the same as the management philosophy of roadside catering shops, but it requires you to have strong research and development capabilities, an open and cooperative attitude, and a better understanding of the needs of local customers, etc. In short, what you need is to actively embrace change and learn to grow with the times.

Under such circumstances, Horizon Robotics, as a supplier, is becoming more and more like a new force car company.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.