Author: Zheng Senhong

Has Tesla Model 3’s biggest rival shown up?

On May 20th, BYD Han Sealion officially started pre-sales, launching a total of 4 models, with pre-sale prices ranging from 212,800 – 289,800 yuan:

-

Standard RWD Elite model for 212,800 yuan, range of 550km.

-

Standard RWD Ultimate model for 225,800 yuan, range of 550km.

-

Long-range RWD model for 262,800 yuan, range of 700km.

-

AWD Performance model for 289,800 yuan, range of 650km.

The release of the Han Sealion is also a new attempt for BYD as compared to their previous models:

-

The largest model for the Han series at 4800mm in length, 1875mm in width, 1460mm in height, and a wheelbase of 2920mm.

-

The most expensive model for the Han series starting at 212,800 yuan, with the AWD Performance model even reaching 289,800 yuan.

-

The model with the highest range for the Han series, with the Standard RWD model having a range of 550km and the Long-range RWD model having a range of 700km.

From the perspective of the Han Sealion equipped with CTB battery integration technology, iTAC intelligent torque allocation function, and the combination of chassis double-wishbone + five-link suspension, Han is targeting Tesla Model 3 in both driving and handling performance.

As the latest model in the BYD Han series, Han Sealion has refreshed the price ceiling of this series. From the pre-sale price, Han Sealion’s status is equivalent to that of the Dynasty Network’s flagship Han.

Unlike BYD’s previous models, the release of Han Sealion is regarded by BYD as the “culmination of the e Platform 3.0 technology”.

Why?

Firstly, technologies such as the eight-in-one electric drive assembly, wide-temperature range and high-efficiency heat pump, and blade battery are all integrated on the e Platform 3.0, which is one of BYD’s core competitiveness for its pure electric vehicle models.

BYD Chairman and President Wang Chuanfu once said that e Platform 3.0 is BYD’s most critical layout in the transformation of new energy vehicles from electrification in the first half to intelligence in the second half, and is the cradle of the next generation of electric vehicles.

Secondly, in terms of the “culmination,” Zhang Zhuo, General Manager of BYD Automotive’s Han Sealion Sales Division, explained the reasons behind the “four firsts”.

(1) The first application of CTB battery body integration technology.

(2) The first application of iTAC intelligent torque control technology.

(3) The first application of RWD / AWD power architecture.(4) The front suspension of the vehicle is equipped with double wishbone, and the rear suspension is equipped with a five-link chassis suspension.

During the half-hour press conference of Haibao, two-thirds of the introduction was dedicated to CTB, highlighting the importance of this technology.

Similar to CTC battery body integration technology, BYD’s CTB optimizes the battery pack structure to achieve “cost reduction and efficiency increase.”

According to Lian Yubo, Executive Vice President of BYD, the CTB technology scheme adopts a body floor integrated battery cover-cell-tray structure. The only difference from the CTP (large battery module) scheme is the integration of the body floor and battery cover into one component.

The CTB structural scheme is similar to that of the The ZERØ Run CTC technology:

-

Vertically, the cabin’s vertical space increased by 10mm, making the Haibao’s body lower and setting a record of 0.219cd in the drag coefficient, which is at the forefront of the same level of models.

-

Horizontally, the position layout of important components such as motors and electric drives has been improved, as evidenced by the fact that everything can be stored in Haibao’s front trunk.

Data shows that the structural adjustments of BYD’s CTB technology have increased the utilization rate of the vehicle’s power battery system volume by 66%, and increased the system’s energy density by 10%.

Due to this structural change, the power battery has become a part of the vehicle’s chassis structure, which has led to a significant improvement in the vehicle’s torsional rigidity.On the one hand, the CTC technology of Leading Ideal (LI) has increased torsional stiffness by 25%, and the Leading Ideal C01, the first vehicle equipped with CTC technology, has a torsional stiffness of 33897N・m/deg.

Thanks to the CTB technology, the torsional stiffness of the BYD Dolphin reaches 40500N・m/deg, which is close to the torsional stiffness of Mercedes-Benz S-Class, BMW 7 Series, and Audi A8.

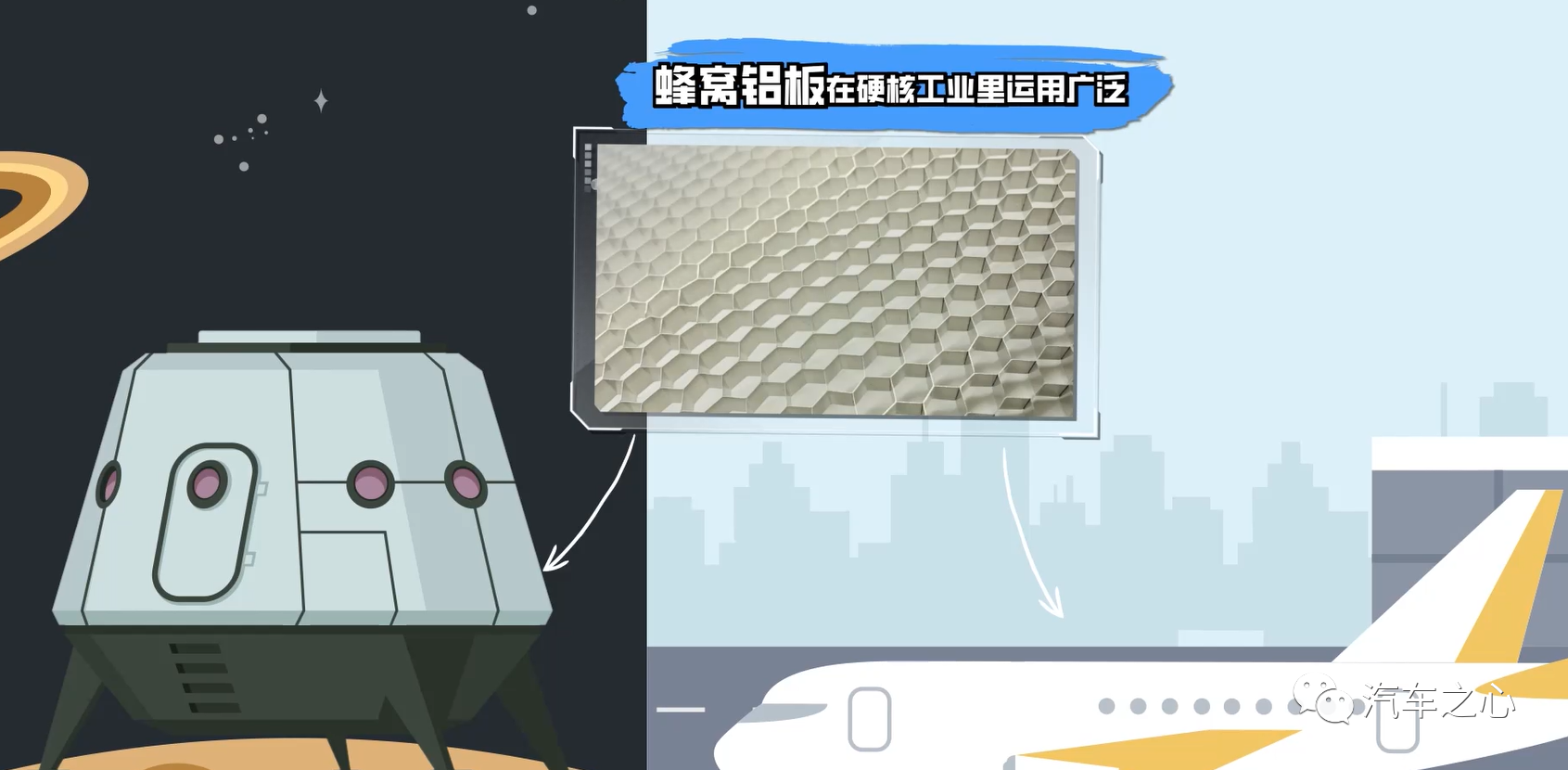

In terms of safety, in addition to the inherent safety and stability of blade batteries, BYD has adopted the concept of honeycomb aluminum structure encapsulation for the first time, which is similar to the hexagonal structure of honeycombs.

BYD demonstrated the safety and stability of the CTB battery pack by crushing the blade battery with a 50-ton loading truck. The battery did not deform, leak or ignite, and core test data remained consistent.

Equipped with the iTAC intelligent torque distribution function, Dolphin also has outstanding features. Technically, iTAC is a miniature of the ESP (vehicle stability control system) in the era of electric vehicles.

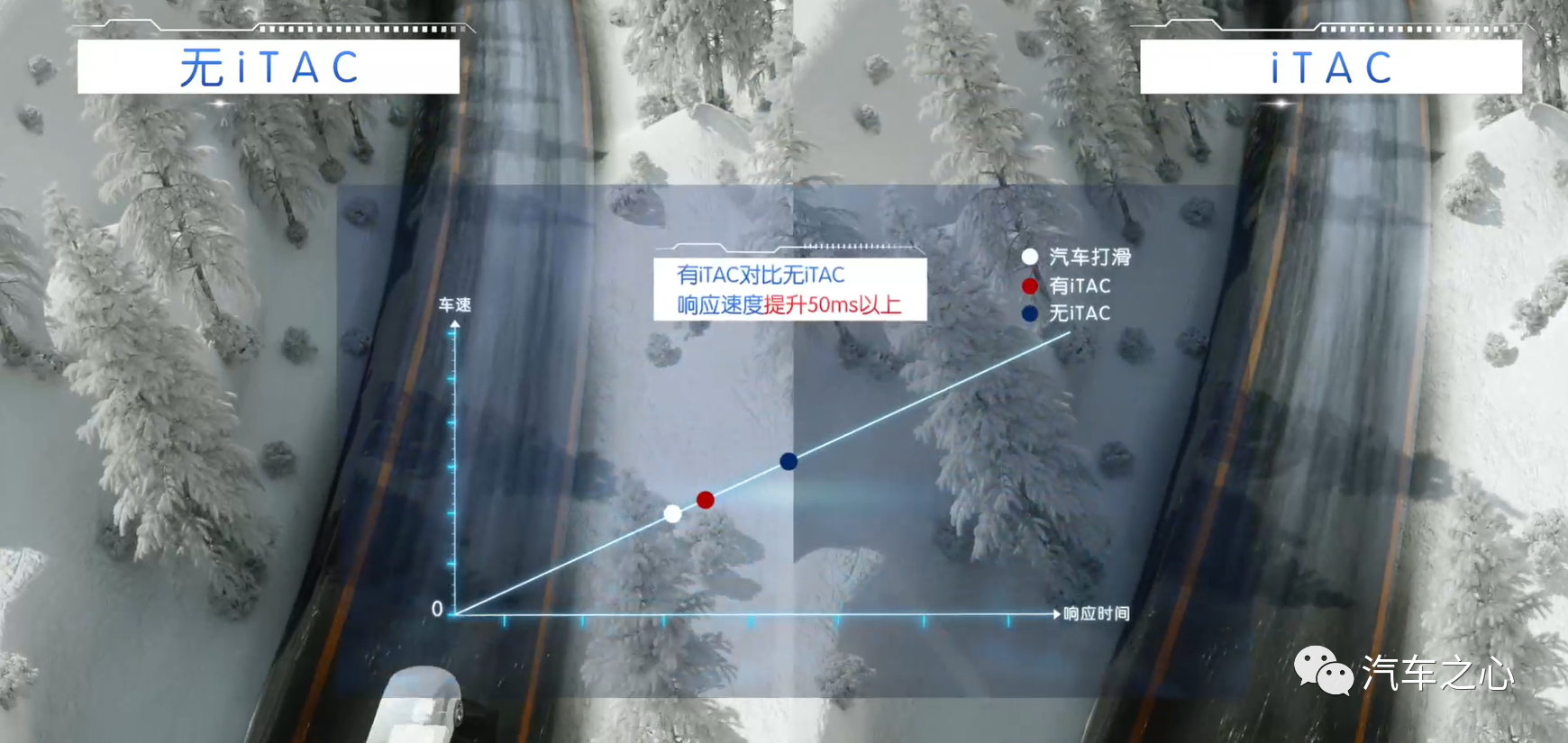

By anticipating the power distribution and adjustment based on the vehicle’s own state and driver’s control demands, iTAC can reduce skidding or prevent it before ESP intervenes.

Compared with ESP which passively receives data from the wheel end, iTAC can monitor the trend of vehicle torque changes from the motor end as early as 50ms in advance, and adjust the front and rear torques before the wheel slips to prevent it from happening.

To sum up, supported by iTAC, Dolphin can bring two benefits: it can fully output power, and it can improve the safety performance and driving comfort of the vehicle.

For this e-platform 3.0 masterpiece of BYD Dolphin, the key words are mainly concentrated on safety, performance, and handling:

-

CTB provides the rear-wheel/four-wheel electric motor layout condition, providing the perfect axis load distribution of 50:50 for Dolphin’s front and rear axles.

-

The coordination of iTAC and chassis suspension enables Dolphin to have the ultimate driving experience.The sea lion’s movement characteristics are obviously comparable to the same level of performance models on the market, in terms of configuration and efficiency.

However, the sea lion does not bring more surprises in the areas of intelligent cockpit and intelligent driving.

From the interior picture and the configuration sheet, it can be found that the sea lion is equipped with a Byton DiLink latest intelligent network system, powered by a Qualcomm 6 series chip (rumored to be Qualcomm 690), and a 15.6-inch adaptive rotating floating pad that supports 5G network.

Some sea lion models are equipped with a HUD heads-up display that supports information such as vehicle speed, speed limit, navigation, LDW, and ACC, which is in line with the mainstream.

In terms of intelligent driving, the sea lion is equipped with 14 auxiliary driving perception hardware:

-

5 cameras

-

3 millimeter wave radars

-

6 ultrasonic radars

The sea lion series is equipped with L2 level auxiliary driving, including ACC adaptive cruise, ICC cruise control, LCC lane centering and other common functions.

As for the news of the sea lion applying for a patent for a laser radar cover on the Internet, it may bring surprises in future revised models.

In 2022, the 200,000-yuan-level pure electric subdivision market welcomed four models: Byton Sea Lion, Changan Deep Blue CL03, Zeros C01, and NETA S.

As the positioning of the models tends to be consistent, the four models are collectively referred to as the “Electric Four Little Dragons” by outsiders.

Now, the four models have gradually entered the market according to their own rhythms:

-

Byton Sea Lion and Zeros C01 have already started pre-sales;

-

Changan Deep Blue CL03 has also released most of the vehicle information through detailed explanations by Deep Blue brand CEO Deng Chenghao;

-

NETA S has also recently announced some configurations.

Comparatively, Byton Sea Lion has absolute competitiveness in the three-electric system, but it bottomed out on intelligentization.

As a “specialized student,” “intelligentization” is not Byton’s strong point.

Although Wang Chuanfu has repeatedly conveyed to the outside world that he will focus on the direction of intelligentization research and development, and frequently cooperate with Baidu, Nvidia, Horizon, Huawei, Suteng Juchuang, Momenta and other companies, it still needs to wait for the launch of Byton’s subsequent high-end models to meet the industry’s expectations for Byton’s rebirth in intelligentization.

But speaking of which, as a “specialized student,” will this really affect the market competitiveness of Sea Lion?

Taking Han EV, a car that overlaps with Sea Lion in price and is similar in intelligence level, as an example, in April this year when the overall auto market was affected by the environment, Byton Han EV sold 5,747 vehicles in a month.If placed in March, Han EV accounted for over 80% of the Han series’ sales with a total sales volume of 87189 units last year, with a score of 10178 units.

In the competition of “Four Dragons of Electric Sedans”, Sea Lion cannot escape the evaluation of “Intelligence” at the bottom to a greater or lesser extent, but on the other hand, with its reliable quality and particularly outstanding “Sport” style, Sea Lion can still open up its own market space.

In the 200,000-300,000 yuan new energy B-class car market, Sea Lion has many competitors, such as Tesla Model 3, which has maintained a monthly delivery volume of 20,000-30,000 units, and XPeng P7, which took less time to surpass 100,000 single bike sales.

In terms of performance and intelligence, Model 3 and P7 still have competitive advantages, and there will not be a significant downward trend in sales due to Sea Lion’s entry.

Therefore, can Sea Lion only seize the market share of Han EV?

In my opinion, Sea Lion’s entry will obviously eat up a part of Han EV’s market share, but this is more like BYD’s intentional act. From the launch of Han DM-i/DM-p this year, whether it is popular or not, the sales volume has proved everything.

Han’s positioning leans towards family use, while Sea Lion highlights sports. In terms of product combination, BYD has penetrated the 200,000-300,000 yuan new energy B-class car market through the dual positioning of family use + sports, EV + DM-i and DM-p.

Therefore, instead of discussing who Sea Lion will eat the cake of, we are more looking forward to which new records BYD can create in this segmented market.

The new energy B-class car market is becoming more and more interesting.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.