Last week, the Financial Times held a theme event titled “The Future of Cars” and Musk participated in an online interview as a guest. When asked which company outside of Tesla impressed him the most in the field of electric vehicles among all the new players, Musk took 10 seconds to think and gave the answer that “I think the company that has made the greatest progress in the field of electric vehicles, apart from Tesla, is not the new carmakers but Volkswagen, which, although not a new carmaker, can be regarded as a new carmaker in the field of electric vehicles because it has done a lot of work in this area.”

Perhaps many people would think that this is just another commercial mutual flattery between Musk and Volkswagen Group CEO Diess, which is nothing new. However, it is undeniable that, looking at Volkswagen’s series of reform actions in the field of intelligent electric vehicles in recent years, as well as Diess, who is already well-known in the electric vehicle industry, it looks more like a new carmaker in the traditional automotive industry.

Actually, before 2020, Volkswagen still impressed me personally as a “Matryoshka” production machine. The “Dieselgate” incident in 2015 undoubtedly lowered my recognition of the Volkswagen brand to freezing point. In terms of electrification, at that time, the Golf and Lavida, which switched from gasoline to electricity, were extremely disappointing, and even the ID.3 launched on the new pure electric MEB platform went through the “software gate” incident. In terms of corporate management, through the reports of foreign media, we saw Volkswagen’s management constantly playing the “palace fighting” drama with unions and supervisory boards.

But all of this has gradually changed with Volkswagen’s reform in electrification in the past two years, and the outside world’s recognition of this company has evolved from the original heavy label of a traditional automotive enterprise to increasingly treating it as a new carmaker.

And all of this could not have happened without one person: Diess.

Reformer: Diess

The Toughest Career Manager

Looking back at Diess’s personal experience, he majored in automotive technology and mechanical engineering at the Technical University of Munich and obtained a PhD in the field of general assembly automation. After joining Bosch in 1989, Diess became the general manager of a Bosch factory in Spain just four years later at the age of 35. After joining BMW in 1996, from initial strategic planning to process consulting, from director of Birmingham’s production plant to director of Oxford’s production plant, from director of BMW motorcycles to member of the BMW board of directors. Finally, after failing to compete for BMW Group CEO, Diess joined the Volkswagen Group in July 2015.

“`

“`

From the very beginning, it seemed that Diess was destined to face challenges during his tenure at Volkswagen. Diess, who had a strong career ambition, could have avoided the “Dieselgate” scandal but his decision to join the company three months earlier resulted in him being implicated. After being promoted to CEO of the Volkswagen Group in 2018, Diess boldly implemented reforms, including aggressive layoffs, extensive changes in senior management, and major adjustments in software and hardware departments. These measures drew the dissatisfaction of the union and supervisory board, and the complex situation almost made Diess lose his CEO position twice.

After a verbal conflict with the supervisory board, Diess had to publicly apologize to Volkswagen’s supervisory board. For any CEO, it was embarrassing to publicly apologize to his own company’s supervisory board, especially for the CEO of one of the largest global corporations. However, all of this did not shake the determined Diess in his ambition to thoroughly reform Volkswagen.

Volkswagen, a company that has been established for more than 80 years, is one of the largest companies in the automotive industry. Volkswagen is like a giant cruise ship carrying 660,000 people, and changing its course is a difficult task. Moreover, Diess faces not only the challenge of this huge organization, but also challenges from various shareholders, such as the Porsche and Piëch families, as well as the union and supervisory board, and senior executives of various brands.

But the man who was rumored to be chosen by Musk as Tesla’s CEO is gradually changing himself and Volkswagen.

Reformation starts from ourselves

At the end of 2020, Diess posted on social media that he also needed to change his management style in Volkswagen’s reform process. He openly stated that Volkswagen’s corporate culture was a critical factor in his reform. When he joined Volkswagen, he intended to change the outdated structure of the company and make it more flexible and modern. In the five years since then, he has made good progress in some areas, but there have also been failures. Diess’s aggressive personality has helped him achieve many positive results in his career, but he still needs to learn from more experienced Volkswagen executives as they are more empathetic to the Volkswagen cultural system.

We can say that Diess did this to protect himself and avoid conflicts with various management levels. However, as the CEO of Volkswagen, it is rare for him to engage in such self-criticism on his social media. According to Diess, changing his management style is also part of his reform for Volkswagen.

Does Diess’s open attitude make you think a little bit about the person who is busy acquiring Twitter?

“`It is precisely because Volkswagen has a CEO like Diess that it invited competitor CEOs to test-drive its upcoming models, invited them to speak at its high-level management meetings, and exchanged compliments with other leading CEOs in the industry on Twitter. Volkswagen also acknowledges its leading position in the field of intelligent electric vehicles and actively faces the challenge posed by its competitors while transforming itself.

Recently, Volkswagen decided on new competitors in the transformation process. It listed Tesla, BYD, Hyundai, and other groups as core competitors, as well as new forces in the automobile industry such as NIO and XPENG. This undoubtedly demonstrates Diess’s clear understanding of the intelligent electric vehicle market.

So how will Diess change Volkswagen?

Pressing the fast-forward button for Volkswagen

Battery and Charging

Let’s start with the battery, one of the most important aspects of electrification. Last year, Volkswagen held a Power Day that was similar to Tesla Battery Day, showcasing its grand strategy for battery raw materials, production, technology, and energy supplementation.

Volkswagen recognized the importance of batteries in electrification reform and announced plans to build six battery factories in Europe, with a cumulative capacity of 240 GWh. In addition to the two factories in Germany and Sweden, the third factory was recently confirmed to be located in Valencia, Spain. To reduce battery costs, it also focuses on reducing procurement costs from battery raw materials.

Because it does not have its own battery production technology, Volkswagen has invested in mature battery manufacturers such as Northvolt in Sweden and CATL in China. The latter will also undertake the production tasks of some European battery factories of Volkswagen through vertical integration strategy.

In terms of charging experience, Volkswagen is also making a global effort. In the Chinese market, Volkswagen invested in CAMS Charging Technology, and as of May 13 this year, it had built 695 supercharging stations in 93 cities in China. In the North American market, as early as 2016, Volkswagen fully capitalized Electrify America, whose charging stations already support a maximum charging power of 350 kW. In the European market, Volkswagen established a home charging station company, Elli, in 2018.

In terms of supercharging stations, Volkswagen has formed alliances with Enel in Italy, IONITY invested by BMW, Mercedes-Benz, and Ford, IBERDROLA in Spain, and BP in the UK. According to the plan, by 2025, Volkswagen will build 18,000, 17,000 and 10,000 supercharging stations in the European, Chinese, and North American markets, respectively.

Volkswagen’s “soft” spot# The Car Will Become a Software Product

It’s no secret that Diess attaches great importance to software. In January 2019, he published an article titled “The car will become a software product” on social media to awaken the public’s awareness of software. Soon after, he established Volkswagen’s software team, which is now the predecessor of Volkswagen’s independent software company CARIAD. Just less than a month ago, Volkswagen also held the CARIAD China Strategy Conference. However, if we look at this company’s core business globally, we will find that the success or failure of CARIAD will determine Volkswagen’s success or failure in the field of intelligent electric vehicles.

CARIAD’s external propaganda mostly positions itself as a software company, but its three major business segments are by no means as simple as software:

-

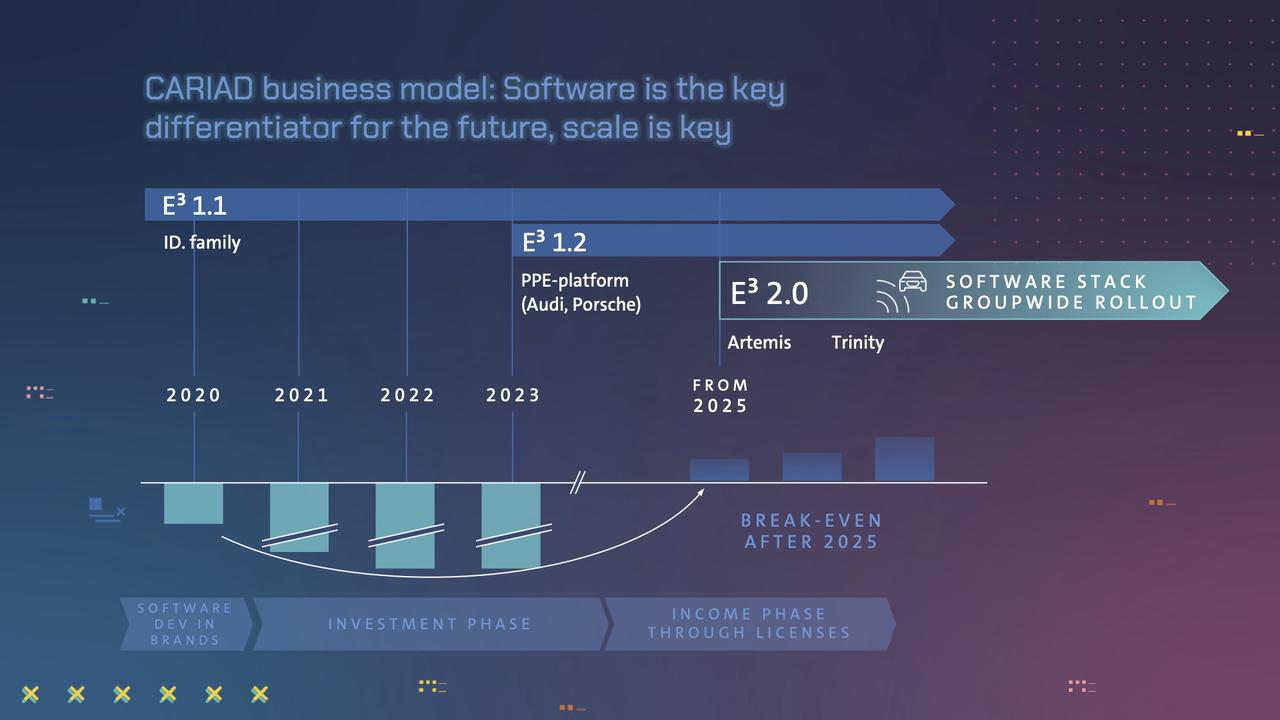

Futureproof Hardware, future-oriented hardware, which can be understood as electronic and electrical architecture. According to Volkswagen’s plan, the architecture version E³ 1.1, currently used on models such as the ID. series born on the MEB platform, will be used on the PPE platform of high-end brands such as Audi and Porsche starting from 2023, using the version E³ 1.2. And starting from 2025, the SSP platform, which has the highest expectations from Volkswagen, will use the version E³ 2.0.

-

Unified Software, standardized software, which is Volkswagen’s own operating system-VW.OS. Volkswagen hopes to create its own operating system, which can provide future in-car systems with rich applications, super expandability, and convenient upgrade capabilities, similar to current smartphones. Volkswagen has partnered with Microsoft’s cloud services to create VW.AC, which not only provides convenient services to users but also forms a large closed loop with all vehicle data generated, thereby enhancing the software service capabilities. Of course, this is also the direction that Diess has always hoped that Volkswagen can move towards.

-

Innovative Applications, innovative applications, including intelligent cockpits, auxiliary driving, electric control, and digital mobility services, etc. Recently, the most noteworthy collaboration is that between CARIAD and Qualcomm, and Volkswagen will use Qualcomm’s Snapdragon Ride platform SoC to create an L4-level autonomous driving. Before this, CARIAD also collaborated with Bosch on the development of L3-level auxiliary driving at the domain controller and software level.Perhaps, we can understand why Diess would rather give up the CEO position of the Volkswagen brand and the chairmanship of the supervisory board of Skoda and Seat, and devote more energy to CARIAD Company, because it determines the future soul of Volkswagen.

Young CARIAD currently has about 4,500 employees, with over 1,000 in the autonomous driving business team. Volkswagen Group has a clear goal for the next phase: to mass-produce L4 level autonomous driving on PPE models by 2025, which will become a powerful product for the Audi brand.

Mobile Travel Services

Volkswagen’s pace of mobile travel is fast and furious. Just last month, Volkswagen released a road test video of its autonomous driving vehicle, which is based on the ID.BUZZ released earlier this year. The perception hardware layer includes one long-range LiDAR, five short-range LiDARs, eleven millimeter-wave radars, and fourteen cameras. Just last week, at the annual conference which just ended, Diess said they will strive to operate an autonomous driving fleet service starting from Hamburg, Germany, in 2025. The partner cooperating with them in developing autonomous driving is ARGO AI, which they invested in two years ago.

To better serve mobile travel, Volkswagen will also create its own travel platform. The platform will integrate vehicle calling, rental, sharing, subscription, and hitchhiking functions. Volkswagen is also continuously improving its mobile travel business through investment and acquisition.

Sales Services

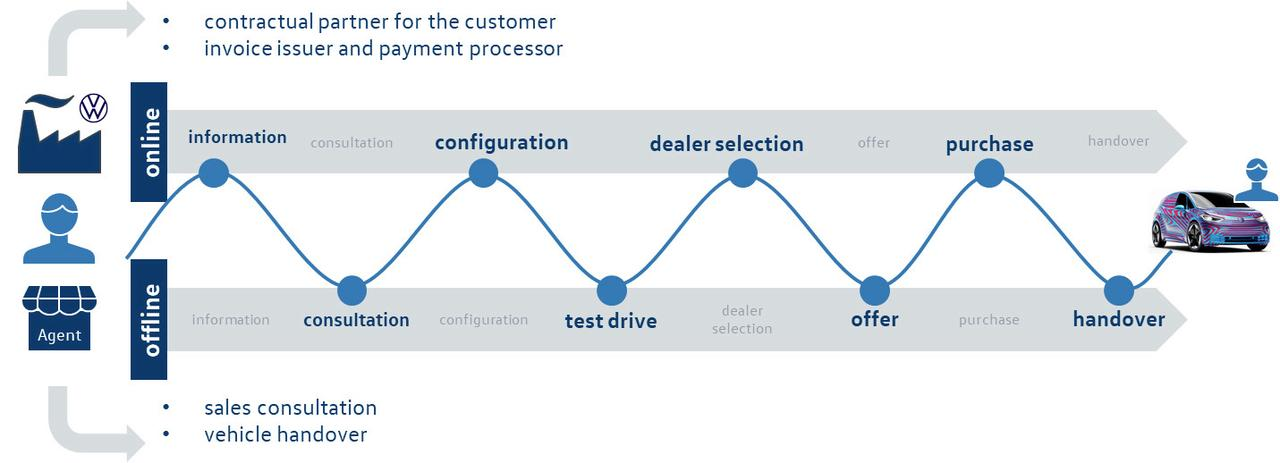

Volkswagen has always used the dealership sales model worldwide. In order to catch up in the era of smart electric vehicles, in May 2020, Volkswagen announced that it would try the agency sales model on ID. series vehicles to improve the customer’s car-buying experience.

Unlike the previous dealership model, in the agency model, the retail store takes on more of the work of product introduction and delivery, and the customer directly enters into a purchase and sale relationship with Volkswagen, which can stabilize vehicle prices to some extent and reduce the inventory pressure of agents. According to data disclosed by Diess at the annual conference, in 2021, Volkswagen sold 93,000 electric vehicles in the Chinese market and built more than 120 special retail stores for selling ID. series models nationwide.The reform in the intelligent electrification field for Volkswagen goes far beyond what has been mentioned. For example, in order to manufacture the new SSP platform models, Volkswagen is building a new factory in Germany that is comparable in size to Tesla’s Berlin Gigafactory; Volkswagen has spent millions of euros to acquire patents from Bosch in areas such as assisted driving; Scout brand has been revived in the US market for the development and production of pure electric pickup trucks and SUV models specifically for the US market; and there have been reports in the media that Volkswagen is considering acquiring Huawei’s autonomous driving department.

All of these show that under the leadership of Diess, Volkswagen has a strong “survival instinct” and is willing to invest whatever it takes to catch up with competitors and achieve progress in this field. It’s like a new force in car making that is willing to spend money to buy time. During the past two years, Volkswagen has established a very clear strategic plan in areas such as batteries, software, platforms, autonomous driving, and production. However, as internet users have commented on Volkswagen, “a giant in strategy, but a weakling in tactics,” time is not abundant for Diess and Volkswagen.

Volkswagen’s homework

Diess is sober-minded, and Volkswagen is rational.

In Diess’s latest Weibo post, he mentioned, “We have had in-depth discussions around various possibilities in establishing a new guidance model for the group. Everyone agrees that a new organizational structure is crucial for us during this key period of transformation from a traditional automaker to a vertically integrated mobility company. In the process of transitioning to NEW AUTO, our competitors will include not only Mercedes-Benz, Toyota, and Stellantis Group, but also Tesla, Foxconn, Apple, LG Electronics, Uber, etc.”

It can be said that Volkswagen has already achieved initial results on the road of reform through the NEW AUTO strategy. At least in the Chinese market, we can see the ID. series models every month in the new energy SUV retail rankings published by China Passenger Car Association. However, Volkswagen, which started later, is not top-notch in areas such as assisted driving, electronic and electrical architecture, battery technology, and intelligent cockpit, and does not have many advantages over new forces in the automobile manufacturing industry in China, let alone highly vertically integrated companies like Tesla and BYD in the field of intelligent electric vehicles.

The software ability that determines the future soul of Volkswagen is one of the urgent homework assignments it needs to complete.Taking OTA, the basic function necessary for smart cars, as an example, Volkswagen has experienced numerous setbacks in this area. From the software scandal of ID.3 in August 2020 to the first large-scale OTA 2.1 version software upgrade of ID series models in March 2021, Volkswagen still requires users to go to the store for the upgrade. Last month, German media reported that Volkswagen needs to install two software packages separately when upgrading the 3.0 version system for ID series models, one of which takes 7.5 hours to install, while the other takes 4.5 hours. Moreover, this upgrade still requires users to go to the store, not because the vehicles cannot be OTA upgraded, but because the OTA upgrade time is too long and may consume the small battery’s power.

Additionally, Volkswagen’s ID series models based on the MEB platform are completely surpassed by various new car-making forces in China in terms of smart cockpits. Not to mention what kind of car computer chip it uses, there are many problems in terms of basic fluency and network stability of the car computer, and the UI and UX performance reveals obvious deficiencies compared with autonomous brands in the same price range.

In terms of assisted driving, Volkswagen has pushed commendable ACC, lane keeping, and light-changing functions to some regions after the system upgrade to version 3.0. However, compared with brands such as Tesla, NIO, XPeng, and Li Auto, which have already pushed the cruising assist function, Volkswagen’s progress in this area is clearly lagging behind, which may explain why there are rumors about Volkswagen’s automatic driving department and Huawei.

Putting aside the development of L4 level autonomous driving in the field of travel services, Volkswagen’s development of assisted driving function is still that of traditional automakers. In the fiercely competitive smart market in China, Huawei is the strongest partner Volkswagen can find, making logical sense as the one that can help the company out of its difficulties in the neighborhood.

For Volkswagen, which is plagued by software problems, it is clear that CARIAD will play a crucial role in the company’s reform. At the 2022 Annual Volkswagen Media Conference held in March, when asked how the Volkswagen Group attracts software and AI talents and how to attract the best software talents to join Volkswagen like Google and Apple, Diess’s answer can be summarized as follows:

-

Volkswagen has a globally dispersed software team, with members located in Wolfsburg, Munich, Shanghai, and the US West Coast, with nearly a thousand people in the Shanghai software team alone;

-

Diess believes that with the current development of AI, good AI and software talent will transfer to the automotive industry because the automotive industry is becoming the focus of AI business, and solving the problem of autonomous driving through AI technology is a major direction.3. In addition to autonomous driving, the intelligent cockpit is also a highly integrated scenario of software and hardware. Cars have already digitized, and the interactive experience in the cockpit is being redefined. At the same time, Volkswagen, which has huge sales, can provide a complete platform for these businesses.

-

The software issue has not yet reached the point where it constraints Volkswagen’s progress. The group will continue to strengthen its software capabilities through acquisitions and other means.

Final words

When I once communicated with a product director of a certain automaker about why a certain product had some very low-level design errors, his answer made me ponder: “You may think it is a personnel issue, but the core is the organizational structure of the company.”

When will Diess transform this giant cruise ship that carries more than 660,000 passengers into a maneuverable, powerful new force ship? There is still a lot of homework for Diess and Volkswagen.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.