Author | Wang Lingfang

Editor | Qiu Kaijun

Traditional Tier1 companies are facing challenges – the growth of fuel vehicles is slowing down while electric vehicles are on the rise.

To address this, in 2021, Continental Group spun off its powertrain business group – Vitesco Technologies, which was independently listed with a transaction value of 2.4 billion euros and included in the German SDAX index.

How effective was this “separation of flesh and bones”?

In 2021, Vitesco Technologies’ sales reached 8.3 billion euros, with sales of electrification products reaching 888 million euros, accounting for over 10% of sales.

This is the current situation. Looking at the increase – Vitesco Technologies received 11.2 billion euros in new orders in the 2021 fiscal year, with electrification contributing 5.1 billion euros.

In March of this year, Vitesco Technologies received a 2 billion euro electric drive system order. Vitesco Technologies’ share in electrification is steadily increasing.

Vitesco Technologies China CEO Gregoire Cuny predicts that by 2030, 2/3 of Vitesco Technologies’ sales revenue will come from electrification products.

Faced with the electrification transition, Vitesco Technologies completes internal transformation through organizational structure adjustments and the migration and training of technology and talent.

At the product level, Vitesco Technologies ensures the stability of its Tier1 status by developing cutting-edge products, establishing layouts, and adopting flexible cooperation methods.

Steady increase in electrification share

Vitesco Technologies’ electrification business share is on the rise.

In addition to the above-mentioned 5.1 billion euros in new orders contributed by electrification products in the 2021 fiscal year, in the fourth quarter alone, electric products accounted for over half of the newly-added orders of over 4.8 billion euros, reaching 2.5 billion euros.

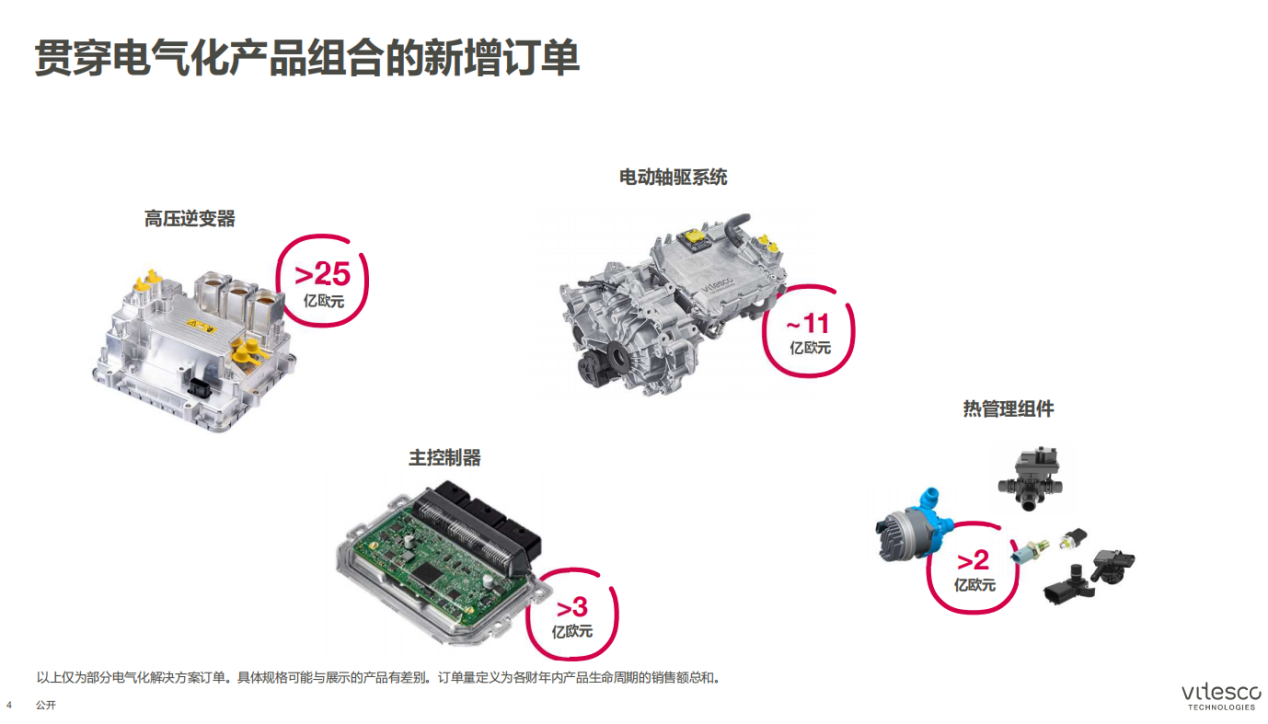

In the past year, Vitesco Technologies has further expanded its electrification business, with high-voltage inverters order exceeding 2.5 billion euros and new orders for electric drive systems exceeding 1.1 billion euros. Overall, Vitesco Technologies’ outstanding orders exceed 51 billion euros, with 33% coming from the electrification field; sales of the New Energy Technology Business Unit increased by as much as 44.6% year on year.

Last year, WePauto signed a high-voltage inverter supply agreement with Great Wall Motors, with a total contract amount of billions of RMB.

Last year, WePauto signed a high-voltage inverter supply agreement with Great Wall Motors, with a total contract amount of billions of RMB.

This year, WePauto’s growth in electrification has accelerated. At the beginning of the year, WePauto announced two orders: one from a top North American car manufacturer for high-voltage inverters with a value exceeding 1 billion Euros, and the other from Hyundai Motors for a three-in-one electric drive with a value up to 2 billion Euros.

Meanwhile, WePauto is gradually reducing non-core product business in traditional combustion engines. According to the plan, the OEM business of the Continental Group will exit around 2025, and non-core parts of the combustion engine business will gradually exit the market. In the long term, WePauto’s electrification products will account for more than 50%, further enhancing the percentage of electrification products.

WePauto’s rapid development is also due to its extensive product layout. For example, Europe has more 48V hybrid products, while China is mainly focused on pure electric vehicles.

WePauto does not neglect any technical route and has layouts in both hybrid and full electric fields. WePauto believes that the development of pure electric direction is a gradual process. Their most important task is to ensure that under the reality of the coexistence of multiple technologies, they are prepared for each technical architecture and have enough product lines to supply different-stage customer needs.

Therefore, they have a complete electrification plan, with core products covering 48V systems, plug-in hybrid and pure electric drives, battery management systems, charging systems, thermal management systems, and power electronics.

In particular, WePauto constantly iterates its core electric drive system. In 2019, WePauto became the world’s first independent supplier to put the three-in-one electric drive system (EMR3) into mass production.

Now, the electric drive system has been iterated to the fourth generation (EMR4). EMR4 is more optimized than EMR3, with a 5% improvement in efficiency, 20% improvement in performance, a 25% reduction in weight, and lower costs. EMR4 is compatible with 400V to 800V and the motor can also be compatible with oil cooling and water cooling.In terms of performance, EMR4 covers a power range of 80 kW to 230 kW through modular design. Automakers can install different versions of the drive system without changing the suspension location or interface, providing different power levels for the vehicle on the new platform.

In the forefront of the industry, WPI values the development trend of Silicon Carbide (SiC) and Gallium Nitride (GaN) semiconductor technology.

In 2020, WPI has signed a strategic cooperation agreement with ROHM, a Japanese company, to develop SiC technology.

WPI believes that SiC and GaN transistors are more efficient and have smaller volumes than silicon transistors. They are also more economical when viewed as part of the system. SiC transistors are particularly advantageous in high-voltage power converters used at 400 volts and 800 volts, making SiC technology an attractive option for automotive applications. The use of SiC technology can help increase the driving range of electric vehicles, thereby significantly improving the overall energy efficiency of electric vehicles.

The modern cars mentioned earlier use WPI’s SiC technology platform in the EMR4, but it is a 400V system, which is compatible with Hyundai Motor Group’s B/C grade electric vehicles.

However, advanced SiC technology provides higher efficiency for new 800V motors, and WPI uses 8-layer flat wire hairpin technology to ensure the best copper fill factor, enabling compact motors to deliver higher power density.

It is worth mentioning that WPI has also signed a strategic partnership and invested in GaN Systems, a Canadian-based company. GaN has shown strong penetration ability in RF devices and power devices.

GaN devices are High Electron Mobility Transistors (HEMT), which provide higher electron speed than silicon and SiC devices.

According to a research report by TF Securities, GaN is mainly used for power devices in low-voltage environments, while SiC is mainly used in high-voltage environments. The 600-900V range is the competitive market for both. Compared with SiC, GaN has greater potential in cost and is highly compatible with existing Si semiconductor processes, making it easier to integrate with other semiconductor devices.

It is evident that WPI’s product layout is not only comprehensive but also leading the market.

Focus on the Chinese Market

China is one of the most important markets for WPI.

For example, in the 2021 fiscal year, WPI’s top three countries in terms of sales were China (17.9%), the United States (17.6%), and Germany (16.1%).

As WPI’s largest market, many key products’ release, research, and development are placed in China.EMR4 mentioned earlier is the globally debuted advanced electric drive system platform that Weichai Power showcased in Shanghai in July last year. The platform houses an 800V high-voltage motor with eight-layer flat wire hairpin technology, which will be in mass production in Tianjin by 2023.

As for R&D, Weichai Power’s Tianjin R&D Center was put into use in November last year. The center is responsible for designing and developing “three-electric” systems for pure electric, plug-in hybrid, and 48V mild hybrid vehicles. It covers high-voltage electric drive system, high-voltage electronic control system, high-voltage battery management system, 48V electric auxiliary drive system, and battery system. Additionally, the Tianjin R&D center also has the full capability laboratory for testing and validation of the aforementioned products.

In September last year, Weichai Power’s Changchun Quality Laboratory was officially put into use. With three quality laboratories located in South, North, and Central China in Changchun, Tianjin, and Wuhu respectively, Weichai Power has basically covered the needs of automotive component testing in China.

In terms of mass production, Gu Ruihua introduced some localized products in China, such as the new EMR3 to be mass-produced in Tianjin in 2022, the 48V cold wind belt-driven starter generator, and the electronic water pump to be mass-produced in Wuhu factory. In the future, EMR4 is also expected to be mass-produced in Tianjin.

As for the customer perspective, Weichai Power has announced two Chinese customers, Dongfeng and Great Wall Motors, who are working together on EMR3 and the new generation high-voltage inverter respectively. Moreover, it is collaborating with Chinese new energy vehicles’ companies in developing 800V platform products.

Through a series of deployments last year, Weichai Power attempted to further consolidate and enhance its position and market share in China.

Organizational Structure Further Optimized

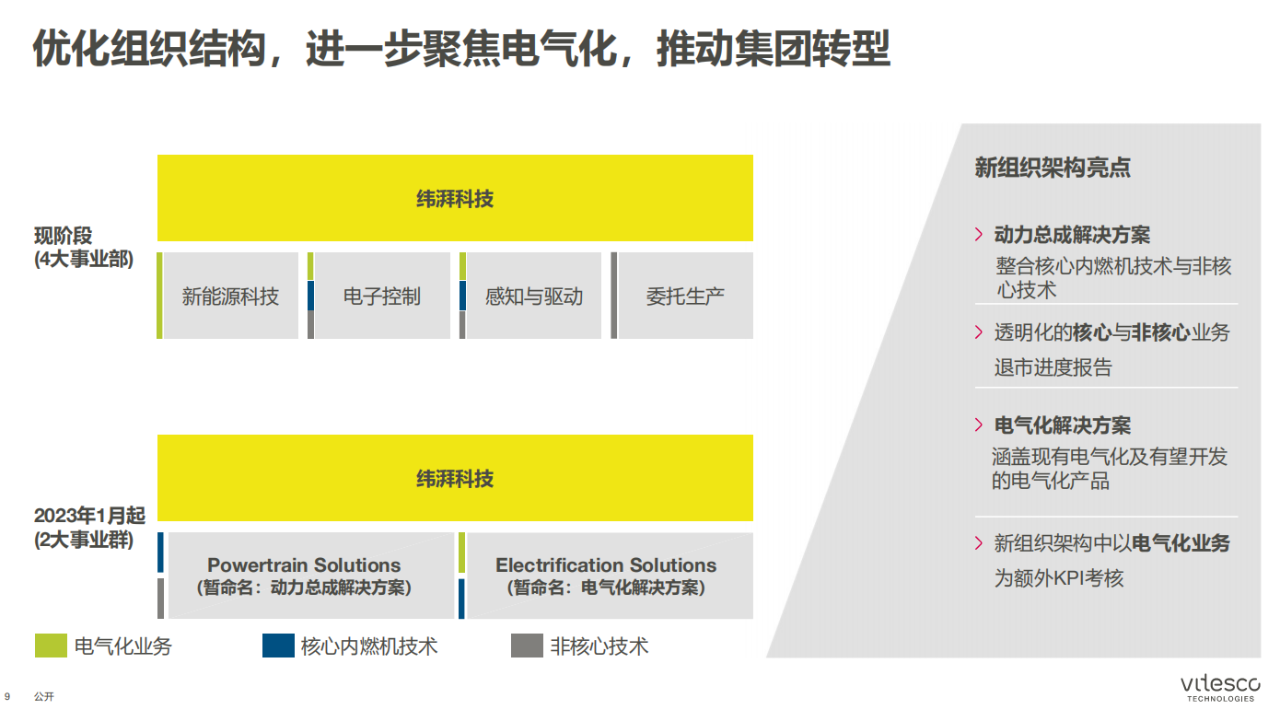

Of course, as a traditional TIER1 enterprise, Weichai Power’s rapid progress in electrification cannot be achieved without its own transformation and optimization. In coordination with the development of electrification, Weichai Power will continue to optimize its organizational structure and improve overall efficiency. Specifically, in the future, Weichai Power will restructure its four business units (electronic control, new energy technology, perception and propulsion, and commission production) into two major business groups: Powertrain Solutions and Electrification Solutions.# Powertrain Solutions and Electrification Solutions

Powertrain Solutions integrates core internal combustion engine technology with non-core technology, with its main mission being to create value. Electrification Solutions mainly focuses on existing and potential electrified products, with its main mission being to drive growth.

In addition to organizational restructuring, 36Kr is also inheriting and transferring traditional advantages in two ways: technology and talent.

36Kr has 7,300 engineers globally, with 5,100 related to software and electronics. Their core strengths, such as electronic control, software integration, and system integration, can be transferred to the field of electric vehicles.

For engineers engaged in traditional fuel-powered vehicle products, 36Kr vigorously promotes upskilling and reskilling projects to help employees quickly adapt to the requirements of new skills and complete job transfers. In addition to training, many employees have also received practical training in electrification projects, transforming knowledge into abilities through practice. Employees who complete the project will serve in electrification projects.

For development in the powertrain field by automakers, 36Kr does not seem to be worried. Gu Ruihua believes that the development trend of key components such as motors tends to be standardized, and 36Kr has a stronger advantage in scale.

36Kr’s cooperation is very flexible. They can help automakers produce components of the electric drive system, or provide a complete set of system solutions.

It can be said that 36Kr has achieved rapid breakthroughs in electrification transformation through early technological accumulation and active transformation. In an era where fuel-powered cars are gradually fading away, 36Kr is sailing on the ship of electrification towards a new “continent” full of hope.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.