Editor’s note: “New Energy Pitfall Guide” is a limited-time column launched by Garage 42 for the spring. This series will review the development history of new energy vehicles mainly based on new forces from the marketing and operation end, and analyze and discuss the underlying logic of many strategies and models. We also hope to present the profound changes brought by new forces and new energy to the automotive industry, beyond products and technologies. This section is updated every Wednesday.

Specially invited author Bluehyper, with more than ten years of marketing experience in the automotive industry, has deeply participated in the construction of new power operation system.

For many users, the new energy vehicles closest to them are not fully functional Apps, nor the previously soaring stock prices, but the many exhibition halls in shopping centers around them. These automotive exhibition halls, known as “supermarket stores,” have become a pop culture staple in busy shopping centers. Typically, traditional large-scale 4S stores are located in suburban areas, and storefronts in urban areas that only have sales functions are called “experience centers” or “city exhibition halls.” Experience stores are usually divided into three categories:

-

“Flagship stores” that cover thousands of square meters and bear the brand image;

-

“Supermarket stores” of about 100-200 square meters designed to display and sell cars;

-

“Pop-up stores,” which are short-term rented booths in corridors.

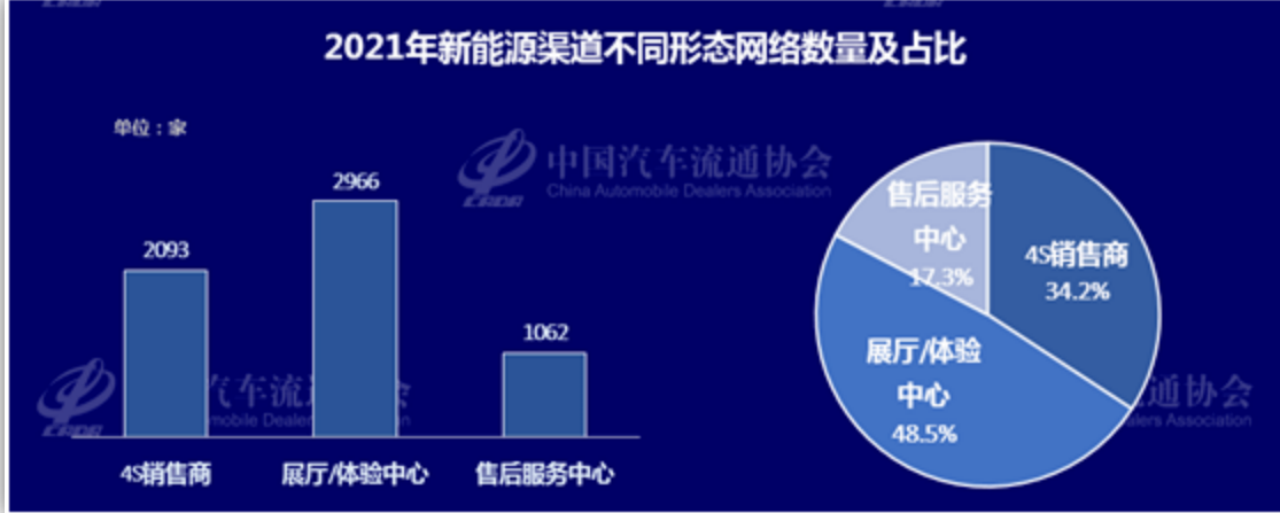

According to data from the China Automobile Dealers Association, there were more than 2,200 new energy vehicle supermarket stores operating in 2021.

Since Tesla opened its first experience store in Beijing in 2013, how and why did auto brands create supermarket stores, how did they develop, and how they evolved have become hot topics today.

The Rise of Supermarket Stores: Separation Occurs While Cost Efficiency Is Prioritized

In 1999, GAC Honda opened the first 4S store in China. 4S refers to Sales, Spare Parts, Service, and Survey, which are integrated into one comprehensive system. Because of the intensive management advantages of 4S stores, coupled with their upscale image, they became the priority choice for consumers in China’s chaotic automotive market at that time.

As land prices rise, 4S stores begin to focus on suburbs and form clusters. In the era when automobile information was not abundant, the automobile street and industrial park, where 4S stores gathered, also provided convenience for consumers to look at cars. Therefore, for more than 20 years, 4S stores have always been the main sales channel for cars in China.However, with the development of the market, especially the rise of electric cars, the fully functional 4S store model is facing challenges.

On the operational end, the OTA upgrade mode of electric cars and no longer requiring frequent maintenance have made the original one store, one after-sales layout seem excessive. For traditional 4S store after-sales, the frequency of store visits and the amount spent per visit are important assessment indicators, and the easiest way to boost both is to replace oil and filters and to update the system diagnosis.

Secondly, on the consumer end, the increase in per capita car ownership has led to a decrease in demand from first-time buyers, who are no longer in a hurry to make purchases; the abundance of information enables more users to go straight to a specific brand instead of comparing different brands in different locations. Therefore, the previous 4S store layout of being located in remote or clustered areas is no longer suitable for demand, and the transportation and time costs of low-intention users’ visits to the store are too high. In this case, many brands hope to separate the sales and after-sales functions, and the supermarket store model has a basis for its rise.

For most supermarket stores, the most important considerations are cost and efficiency, not brand and image choice. It’s only because the experience stores that each manufacturer opens first will assume the function of “flagship stores”, such as NIO Center at Wangfujing Eastern Plaza, which gives many people this preconceived impression.

The “savings” of supermarket stores are mainly reflected in two aspects.

On the one hand, compared with the thousands of square meters of rent and decoration costs for 4S stores, even one or two hundred square meters, or even tens of square meters, of supermarket stores, though having much higher price per square meter, can save a lot of money overall. For new forces that choose to operate their own stores instead of having dealerships invest in building stores, with fewer car models and less showroom area requirements, the same investment can open more stores. Li Xiang, the CEO of the Ideal Automobile, has candidly stated his company’s data, “Whether an ideal store is available in a city can make a difference of eight times in market share.” The number of stores has a crucial impact on sales in the early stages, while delivery and maintenance centers only need to be located in remote suburbs. After all, the frequency of new car delivery and maintenance is very low for users, and can even be solved through a chauffeur service.On the other hand, in the automobile sales industry, besides obtaining customer information and closing deals, an important process is to invite customers to experience the dealership. With the decrease of the demand-oriented customers, this process becomes more difficult. Compared to inviting customers to 4S dealerships in suburban areas, opening stores in shopping centers within various communities in the city can facilitate more low-intent customers to have a trial experience. If only brand promotion is needed, advertising can achieve that. The core of a supermarket store is to show the products to as many people as possible in a tangible way, providing a close-up experience of the product, which can bring more potential users and shorten the user’s purchase process.

Crazy Expansion, Supermarket Stores Leading the Way

In 2018, with the mass production of the first car model of the new forces, the offline expansion of the new forces started.

First, in late 2017, NIO Center opened in Wangfujing, Beijing. Then, NIO successively opened thousands of square meters of NIO Centers in landmark locations in Shanghai, Hangzhou, Chengdu, and other cities. At that time, as the TOP 2 among the new forces, WM Motor also opened direct flagship stores in Wangfujing, Beijing, Nanjing Road in Shanghai, and Hangzhou. Their actions were viewed as burning money and simple imitation of Tesla.

As of 2019, the new energy market did not experience the expected high growth. The new forces, suffering from various quality issues, consumed their initial customers, and the volume of orders plummeted. NIO’s stock price fell all the way, WM Motor’s listing encountered obstacles, and both XPeng and Li Auto, which were among the “three horses,” encountered huge financing difficulties.

However, the pace of opening stores cannot stop. Everyone is looking for a more cost-effective way, and the real supermarket store is coming.

In planning, cost efficiency takes priority. The original flagship store model is discarded, and smaller stores covering more areas becomes the preferred option. An area of 100-200 square meters is sufficient to support exhibition vehicles and office space, with decoration kept as simple as possible for quick online launch. NIO no longer insists on a fully direct-sales route and allows car owners to become franchising partners, jointly participating in store opening. XPeng and WM Motor even give up opening stores and instead set up temporary booths in shopping centers with high traffic.

In site selection, high frequency drives low frequency. XPeng and WM Motor began to focus more on natural customer flow, such as being next to Huawei and Xiaomi stores, both of which had high overlap in product types at the time and competed for store location choices. NIO, through franchising partners, went down to third- and fourth-tier cities, where the city center is more concentrated, and the population coverage is higher.

The turning point happened in the second half of 2020, when China’s new energy market began to surge in sales, capital, and products overall. New forces represented by Tesla, NIO, XPeng, and Li Auto, with the help of more flexible and lower-cost channel development models such as supermarket stores, rapidly expanded the number of stores in first- and second-tier cities.

The success of new forces is constantly pricking the nerves of traditional car manufacturers, and opening superstores is undoubtedly the simplest “imitation game” compared to building a new system. More and more superstores are being opened in the short term, and every commercial center in each city or district is performing a competition between new forces and traditional car manufacturers. In Beijing, the shopping center Blue Harbor adjacent to Chaoyang Park has gathered more than a dozen new energy brands and was once ridiculed as the “Automotive Harbor.” In Shanghai, high-quality commercial real estates such as Xintiandi, Longhua, and Heshenghui are also battlegrounds. In other cities, Wanda, known as the “city center,” has also attracted many automakers’ attention.

The success of new forces is constantly pricking the nerves of traditional car manufacturers, and opening superstores is undoubtedly the simplest “imitation game” compared to building a new system. More and more superstores are being opened in the short term, and every commercial center in each city or district is performing a competition between new forces and traditional car manufacturers. In Beijing, the shopping center Blue Harbor adjacent to Chaoyang Park has gathered more than a dozen new energy brands and was once ridiculed as the “Automotive Harbor.” In Shanghai, high-quality commercial real estates such as Xintiandi, Longhua, and Heshenghui are also battlegrounds. In other cities, Wanda, known as the “city center,” has also attracted many automakers’ attention.

As of 2021, the number of car brands that have opened superstores has exceeded 100, while the growth rate of available shopping centers is not so fast. When there is competition, it will roll up. In first-tier cities, the rental standards for car brand stores in emerging business districts have reached 500-1,000 yuan/㎡/month, and the core business districts are as high as 1,000-3,000 yuan/㎡/month, far higher than traditional businesses such as gold and jewelry and electronics. Even the booth fees in the atrium often exceed 100,000 yuan per month, and the daily rent is also far higher than the price of 100 yuan/㎡/day.

Even if you can afford the rent, you may not be able to get the right location. In limited resources, you often need to wait for vacant shops for a long time. Many brands have to find agents and agencies and pay high intermediary fees to obtain venues, after all, the time for product releases is fixed.

What is unexpected is that Tesla, as a pioneer in separating sales and after-sales and setting up superstores, has started to turn around!

The greater they rise, the harder they fall: the inherent shortcomings of superstores

According to media reports, Tesla began to close some experience stores in 2021. Among them, four experience stores in Beijing were closed, including the Beijing Dayuechunfengli experience store, which had only been open for half a year. Of course, this statement is not accurate enough. Taking Beijing, Shanghai, Guangzhou, and Shenzhen as examples, in 2021, while Tesla closed nine experience stores, it also opened 11 new experience stores. However, the new experience stores have started to expand to the periphery of the city instead of concentrating in the core business district. At the same time, from 2021 to now, Tesla’s class 4S model central stores in first-tier cities have increased from 21 to 29, an increase of nearly 50%. The proportion of class 4S central stores has further increased.The logic behind Tesla’s location choice is actually quite simple. As a newcomer in the technology industry, Tesla was able to add value to shopping centers in terms of foot traffic and brand image, resulting in lower rent rates from property owners. However, the cost of operating stores with a focus on retail and supermarket sales has risen sharply, and is no longer the most efficient and cost-effective way. With the large-scale closure of suburban 4S stores, rent and operating costs have plummeted. In addition, the significant increase in Chinese Tesla owners has alleviated the need for Tesla to rely on retail and supermarket sales for brand promotion and convenience. Therefore, Tesla has adopted different strategies for different cities, focusing on experience stores and supplementing with central stores in new first-tier cities; focusing on central stores and supplementing with experience stores in second-tier cities; and opening only central stores in third-tier and smaller cities.

The significant increase in costs is due not only to the rapid growth of new car manufacturing and traditional car manufacturers entering the new energy vehicle arena, but also to the fact that shopping center property owners are not very welcoming to car brands.

For car brands, property owners often charge higher unit prices, sometimes several times that of traditional electronics, jewelry, makeup, and luxury brand sectors. The reason behind this is that beyond rent, shopping center property owners also consider lease stability, foot traffic, and revenue when evaluating business operations.

In previous years, many new car makers experienced financial difficulties, and the previous leases became null and void, making it difficult to recover losses. The vacancy period was a significant loss for property owners. To increase profits, shopping centers rely heavily on foot traffic, which is why property owners are sometimes willing to lower rent rates for brands like Starbucks that attract high-frequency customers. However, as low-frequency consumption products, cars are not typically a major draw for foot traffic, and instead play a lesser role in attracting customers. In addition, due to the unique nature of car sales, the sales are often made by regional subsidiaries or dealer groups, and their sales revenue cannot be counted as shopping center revenue.

In addition to the significant increase in costs, automotive supermarkets also have inherent flaws: shopping center foot traffic is mainly from the surrounding community, so the ability to generate new natural foot traffic is low.The development of online shopping platforms, for a long period of time, seriously impacted the operation of shopping centers. However, in recent years, shopping centers have found their way out by creating high-frequency scenes that cannot be replaced by online shopping, such as catering, early childhood education, and movies. However, these formats are all operated around the surrounding 3-5 kilometers of communities, and even the strongest shopping centers can only cover within a radius of about 10 kilometers. Often, a supermarket will cover the surrounding communities’ population within 6-12 months. Unless the speed of product release and iteration can surpass this frequency, it still relies on extensive invitation of customers to come to the store.

The decline in customer acquisition capabilities and the increase in operating costs have directly led to a significant decline in the operational efficiency of supermarkets. In 2021, the annual average sales volume of Tesla sales stores reached 1,405 units, with first-tier cities reaching 1,533 units, new second-tier cities 1,459 units, and even the third-tier cities reaching 1,200 units. With such efficiency, even Tesla is retreating. For many newly opened new energy brands, the cost pressure can be imagined.

Supermarkets Test the Refinement of Operational Ability

At present, in the sales network layout, the greatest pressure does not lie with new forces, but with later traditional automakers who are willing to spend heavily to rent core locations, single-mindedly pursue network density, and even use various means to drive away original tenants to obtain core storefronts. This fishing method is remarkable. In contrast, new forces with rich experience have embarked on the road of refined operation.

In the process of supermarket operation, every aspect requires more refined analysis and management.

First, in planning and site selection, the pursuit should be the coverage of geography and population, from the central area to the east, west, south, and north, especially the coverage of population concentration areas, so that users can reach the storefront within a reasonable distance. At the same time, consider factors such as traffic, such as in a location where traffic is perennially congested or parking is difficult to find, which is unfriendly to non-first-time users.

Secondly, for brands with a certain user accumulation, data analysis is very necessary, understand users’ consumption habits through analysis, find supermarkets that match their consumption, such as a model pursuing practical cost performance, but which must squeeze into a luxury brand-centric shopping center, which is unreasonable.

In addition, through the analysis of app and vehicle data, early user gathering places can also be found.

Finally, the choice between “flash store” and “supermarket” is particularly critical.

In specific management, data application is still indispensable, and entry rate, lead retention rate, test drive rate, and conversion rate are all important indicators. If there is no issue with employees, then it is the customer group that is not suitable. Similarly, traditional management methods are not suitable for supermarket stores.

In specific management, data application is still indispensable, and entry rate, lead retention rate, test drive rate, and conversion rate are all important indicators. If there is no issue with employees, then it is the customer group that is not suitable. Similarly, traditional management methods are not suitable for supermarket stores.

Previously, many store managers have jointly reflected on one problem, which is that manufacturers still use the original 4S store entry process to inspect and visit supermarket stores. For example, once someone enters the store, the salesperson needs to approach immediately to inquire, which is essential for 4S stores with fewer customers. After all, many customers come to see the car specifically. However, for supermarket stores with large natural customer flow, many customers just browse around. Such a process will only increase the sense of urgency for customers, and instead shorten their time spent in the store.

If these measures are too difficult to maintain the monthly operating costs of hundreds of thousands, then only the supermarket store model itself will be changed.

Return to rationality and the inevitable evolution of supermarket stores

When cost efficiency is difficult to balance under current conditions, supermarket stores need to look for new outlets.

- Maintain popularity and constantly innovate.

For the problem of fixed customer flow in shopping center communities, new players find it difficult to solve, after all, the product line currently isn’t enough. But for traditional manufacturers, there are innate advantages, even the product lines and sub-brands are abundant, which can be achieved by regularly replacing products, allowing users to experience more products while gaining freshness.

- Transfer territory, experience stores leave supermarkets.

With the reduction of shopping center sites and the increase in rent, many brands choose to enter in more flexible ways, such as opening pop-up stores during peak traffic during festivals or directly setting up long-term booths. Some brands also directly choose to abandon supermarket traffic, and set up experience stores in office buildings or industrial parks. However, this poses higher requirements for the brand’s online customer acquisition capabilities.

- Self-innovation, finding higher-frequency scenarios.

The least compatible aspect of automotive supermarket stores and shopping centers is that cars have always had low-frequency, low-profit margin despite high unit prices. Whereas, shopping centers are often high-margin (luxury cosmetics) or high-frequency (catering, fitness). Therefore, new attempts are needed for the combination of cross-border fields. Driving low-frequency with high-frequency can not only increase customer flow in the store, but also reduce costs through revenue generation.

Here is where Huawei’s innate advantage comes in, while other brands are still in the car+X stage, Huawei is X+car, using existing stores to sell vehicles. Of course, new players are now equipped with a rich boutique mall, which can also create certain sales performance.

When Nio offers coffee in its space, it is easily seen as a means of branding. Similarly, the new contenders WmAuto and XPeng also regard coffee as an important element of the first batch of experience stores. If coffee is only treated as a customer service drink, then coffee itself will only become an object of later procurement for “cost-reduction and efficiency-increase.”Using coffee as a high-frequency element is not a new approach, as Qoros did in 2015. However, Qoros’ products failed to keep up with the times in the end.

If a brand treats coffee as a product and turns its showroom into a slightly competitive coffee shop, it can not only reduce costs by creating revenue but also generate more natural traffic. We look forward to seeing more such cases.

To the point, the rapid rise and challenges faced by supermarkets are a part of the marketing system of new energy and new forces. With the advancement of various brands in product development, the competition at the marketing end will become more intense. We should not only mimic the surface forms of successful pioneers, but also understand their underlying logic, especially changes in users and markets. Otherwise, even if we feel the stones under our feet, we will still find it hard to cross the river.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.