Author: Deep Alley

“In the eyes of Dyson fans, the strength of the car models launched is defined by the presence of certain figures at the BYD product launch conference.”

The May 16th Lynk & Co brand launch conference clearly adhered to this rather teasing rule. Chairman of BYD, Wang Chuanfu, Executive Vice President and Dean of the Automotive Engineering Research Institute, Lian Yubo, Vice President in charge of Product Planning and the Automotive Technology Research Institute, Yang Dongsheng, and Zhao Changjiang, General Manager of Lynk & Co Sales Division, all attended the event.

After a lofty address, the pre-sale price of the Lynk & Co D9 was finally announced. The Lynk & Co D9 is available in two variants of hybrid and pure electric forms, with the following pre-sale prices for the hybrid models:

- DM-i 945 Luxury: RMB 335,000

- DM-i 1040 Deluxe: RMB 375,000

- DM-i 970 Four-wheel Deluxe: RMB 405,000

- DM-i 970 Four-wheel Flagship: RMB 445,000.

The pre-sale prices of the pure electric models are:

- EV 600+ Honorable: RMB 390,000

- EV 600+ Four-wheel Flagship: RMB 460,000.

As one of the members of the high-end MPV lineup of Chinese brands, the Lynk & Co D9’s popularity is enviable to competitors. Compared to new power companionships aimed at expanding the market, the strategic significance of the Lynk & Co D9 bestowed by Lynk & Co is undoubtedly much weightier.

It is not only the top flagship model launched by BYD that topped the April sales list, but also the “first new energy joint venture automaker” Lynk & Co’s new starting point, expanding the price of the e-platform 3.0 and DM-i super hybrid into the luxury market…

From whichever angle, the Lynk & Co D9 carries high expectations. However, on the high-end journey where time waits for no one, we probably need to first understand the Sino-German cooperation paradigm of the past decade that has returned to the starting line.

Wonderful marriage, still adapting

At the launch event, BYD, who is somewhat nostalgic about Lynk & Co’s past, emphasized repeatedly how to make a resolute transformation for the future. But no matter how much the past is separated, the motives still have to be found in the word “failure.”

-

In May 2010, BYD and Daimler signed a contract to establish Shenzhen BYD Daimler New Technology Co., Ltd. on an equal share basis;

-

In March 2012, the Lynk & Co brand was officially launched;

-

In September 2014, the first mass-produced car, the Lynk & Co 300, was released.- DENZA 400 and 500, which are upgraded for longer range, were successively launched in February 2017 and March 2018.

At that time, DENZA took advantage of the first wave of national policies to incentivize new energy vehicles, and appeared to be very reliable among a backdrop of fraudulent subsidy claims. The market environment was so good that people praised the “wonderful start” and the high-end image became even more established.

However, in the battlefield of new energy, a seemingly favorable situation can quickly flip over if it ignores the development of consumer attitudes, and a wave of life-and-death reversal could lead to the loss of its promising start.

Over the past four years, DENZA has been relying solely on a pure electric mid-sized car, not only missing out on the incremental demand-driven growth stage, but also completely forgotten by the market due to stagnant product strength. At this time, BYD and Mercedes-Benz were both thinking of completing their electrification transformation, and DENZA, caught in the middle, felt like a teenager who had not yet entered society and was facing his parents’ divorce, looking at the already historical Chery eQ, his heart trembling with fear.

Perhaps both sides were unwilling to give up, and the “DENZA X” launched in 2019 clearly had more sincerity injected into it. Its exterior was designed by the Mercedes-Benz design team, while its interior was developed by BYD, which had achieved great success.

When the wonderful start of the strong alliance was played out again, DENZA not only confidently affixed the “Mercedes-Benz Style” plaque, but also boldly appeared on the Mercedes-Benz booth at the Guangzhou Auto Show, showcasing alongside the EQS, as if to tell the world that they were serious this time.

Although the DENZA X is essentially a finished product manufactured by BYD and meticulously decorated by Mercedes-Benz, at least the product level is becoming more mature. Mercedes-Benz not only contributed its brand management, marketing, and sales channels, but even agreed to release the design of the EQXX three years earlier than scheduled, which is enough to show that both parties have the willingness to repair their cooperative relationship in the face of increasingly fierce competition.

After breaking free from the monopoly of cheap cars, high-quality and expensive consumer upgrades gradually became the mainstay of the new energy vehicle market, but this did not change DENZA’s embarrassing fate. After all, no matter how strong the Mercedes-Benz brand is, as long as it does not immediately impress people’s hearts with the shining starlight, the 30,000 to 50,000 yuan price difference will not make car owners easily forget DENZA X’s BYD bottom. Those who really value the Mercedes-Benz brand would rather spend more money to choose the EQC with its own problems, and those who value product strength and cost-effectiveness have no reason not to choose BYD.

For Tencent Motors, the Sino-German joint venture has gone from a boost to a rival, as they struggle not only to surpass ten thousand annual sales but also to balance years of huge losses that wear out the patience of both partners who have injected funds multiple times.

After the latest capital increase on December 24, 2021, the shareholding ratio between the two sides changed from 50-50 to 91-9. Mercedes-Benz, which holds 10% of the shares, has retreated to a “supporting” position and fully devoted itself to EQ’s electrification project.

The leadership has been given to BYD, and Tencent Motors once again returns to the starting line, not as a pioneering new energy brand but as a luxurious one leading BYD to move forward.

Without the entanglement and confusion of mutual adaptation, BYD can also devote more resources and core technology, promoting Tencent Motors to firmly stand in the strategic position of luxury new energy, connecting downwards to the Dynasty and Ocean series, and establishing a good image foundation for the mysterious high-end brand.

“Teng Er Fa”, Firmly High-end

Although the starting price of 335,000 yuan is undoubtedly unaffordable, the record of over 3000 orders within half an hour of the sale has proven consumers’ high recognition of Tencent Motors D9’s product power. As Tencent Motors’ new leader, Zhao Changjiang has dared to declare “having the confidence to be the number one,” let’s take a look at whether Tencent Motors’ high-end ambitions have been fulfilled to what extent.

In terms of design, Tencent Motors D9’s appearance is described as the “Chinese Teng Er Fa.” Although some people may miss the exquisite but introverted Benz’s style, the bold and exaggerated painting style is more suited to the aesthetic preferences of luxury MPV users.

The exclusive π-MOTION design language has undergone a more solid and robust secondary creation of BYD’s design elements. Complemented by 5250/1960/1920 mm in three dimensions, a wheelbase of 3110 mm, Tencent Motors D9 absolutely satisfies the primary pursuit of Chinese people for a grand and unrestrained style.

The front design of DM-i and EV is slightly different.Compared to the appearance, the elements of secondary creation in the interior design have been weakened a lot. The only brand feature inherited is the twin-spoke steering wheel. Most of the rest, such as the embedded 10.25-inch LCD instrument panel, the 15.6-inch suspended central control touch screen, the symmetrical wrap-around cockpit, and the control center that looks like BYD Heart, are all derived from mature designs validated by the market.

For an MPV that serves all passengers in the car, this is understandable. However, this level of differentiation is not commensurate with the higher price, which inevitably creates a sense of contrast for consumers.

However, design is not the fundamental element that DENZA D9 relies on for survival. Compared with the advanced technologies it carries, it is somewhat insignificant.

First, let’s take a look at DENZA D9’s electrification technology:

-

DM-i version is equipped with a plug-in hybrid-exclusive 1.5T Xiaolong engine plus EHS hybrid system. The entry-level battery has a capacity of 11 kWh, and the mid-to-high-end is 40 kWh, with support for 80 kW DC fast charging.

-

DM-i two-wheel drive, NEDC pure electric range of 50/190 km, comprehensive range of 945/1040 km, and a fuel consumption of 5.9-6.2 L/100 km;

-

DM-i four-wheel drive, NEDC pure electric range of 180 km, comprehensive range of 970 km, and a fuel consumption of 6.7 L/100 km;

-

The pure electric version is based on the e-platform 3.0, with a CLTC range of 600+km, a battery capacity of 103 kWh, and optional front-wheel/four-wheel drive;

-

The maximum charging power of the pure electric version is 166 kW. It can charge half the battery (30-80%) in half an hour, and add 150 km of power in 10 minutes.

From the currently announced parameter information, it can be seen that DENZA does not want people to focus too much on what kind of performance experience an MPV can provide. Although BYD has the ability to make DM-i 4WD and dual-motor 4WD achieve good acceleration results, considering this body shape, and the lack of DM-p version, DENZA D9 is estimated to have no interest in being a same-class “performance hegemony”.

In fact, most consumers are not interested in how much power electrification can bring to DENZA D9, and actual reduction in vehicle use costs is the most important. From pure electric range that can cover daily commutes to comprehensive range of over one thousand kilometers, DM-i systems that can be powered by both electricity and gasoline make the vehicle use cost of DENZA D9 comparable to that of conventional sedans.

Different from the centralized procurement and unified operation for government vehicle fleets, private users who value both business and family aspects are more sensitive to this issue.

Now let’s take a look at the performance of intelligence:

-

The brand-new customized DENZA Link super-intelligent interaction system, exclusive UI design, 10 types of scene modes, Qualcomm 7325 chip, all models come with 5G, download speed up to 1Gbps;

-

Seven-screen interconnection throughout the vehicle: 15.6-inch suspended central control screen + embedded 10.25-inch LCD instrument panel + 12-inch W-HUD lift display + two 12.8-inch headrest touch screens with lifting cameras + two 5.5-inch middle row armrest touch screens;

-

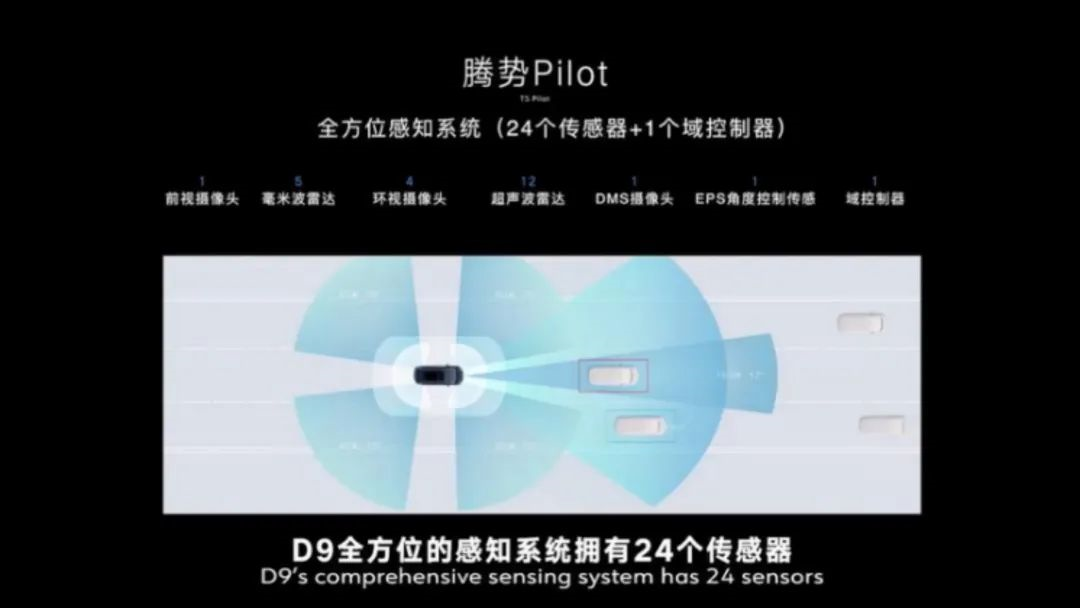

DENZA Pilot Intelligent Driving Assistance System, equipped with 24 sensors + 1 domain controller, with L2+ level driving assistance capability;

-

RPA remote parking system, maximum monitoring distance of 5.5m, minimum detection distance of 3cm;

-

The top-of-the-line model can be upgraded to advanced intelligent driving assistance, achieving the integration of driving and parking functions, such as high-speed navigation assistance driving and memory parking.

Although DENZA D9 did not boldly adopt a fusion sensing solution based on LiDAR or be equipped with Nvidia’s DRIVE Orin computing platform, considering that the fuel-powered models of the same price cannot even meet the basic L2 level assisted driving function, DENZA D9 may not be amazing, but it can significantly reduce the physical and mental burden of driving a large vehicle.

In contrast, DENZA executives pay more attention to the breakthroughs of DENZA D9 in the intelligent cabin, expanding the responsibilities of the vehicle system from simple audio-visual entertainment to empowering the comfort of all passengers.

Four of the seven screens are dedicated to the VIP sitting on the second row, and the 10 types of scene modes cover specific scenarios such as family travel, business reception, online meetings, and meditation, etc. By creating an all-sensory atmosphere and adding functions, the MPV user’s most valued riding experience is well-arranged.

Compared with the passive pursuit of design, materials, and workmanship, DENZA, who holds the ace of intelligence, is better at injecting thoughtful and considerate elements into new interpretations of luxury. The tall and imposing DENZA D9 is breaking the brand and high-price halos that foreign monks have instilled in consumers.

Why Choose MPV?

The same question can also be asked of Voyah, Zeekr, and WEY Wei. However, individuals’ physical differences and brand development differences give MPV different strategic significance.

Once, a friend in the automotive field told me that the market share of high-end MPVs had already been divided up, and that the market demand for household scenes was inferior to the large-scale and stable commercial travel market. In addition to receiving important guests, the latter also solved such issues as tax deduction, account topping-up, and ceremonial arrangements required by corporate operations. People only recognize traditional vehicle models with strong brands, reputations, and residual value rates. It is difficult for Chinese brands to be recognized as equivalent to foreign brands based solely on cost-effectiveness.

Things are always changing. Despite the fact that the penetration rate of MPVs in China’s passenger car market is hovering around 5%, the decline of Wuling Hongguang, which is often used to “make up the number,” is visibly shrinking. In April of this year, the sales of Wuling Hongguang were surpassed by its price countless times by Buick GL8, followed closely by the relatively small gap of the GAC M8.

Although the epidemic has suppressed consumption by low-income groups, as a product of the upgrading of microvans, the baton of “filling the number MPV” has been passed to pickups and entry-level SUVs, and higher-priced car-like products have become the backbone of the MPV field. The pursuit of comfort, convenience, and functionality has also become the main concern of MPV consumers.

The increasingly younger consumer groups are not satisfied with the constancy of foreign brands, and do not want to endure high and unchanging vehicle costs. Their interest in electrification and intelligentization shows no sign of declining, and greater space, better driving quality, richer configurations, and more balanced riding experiences must be achieved all at once. Making multi-person travel is just a matter of course, while improving quality of life is the fundamental goal.

Faced with a new market opportunity, Horizon Dreamer has taken the lead, while DENZA, backed by BYD’s full set of technical systems, can rely on DM-i in the internet traffic halo and independent and transparent direct sales model to firmly grasp the brand tone and national recognition.

While digesting the needs of BYD and DENZA vehicle owners to upgrade and purchase, the high-end positioning and high profits of the MPV allows DENZA to output and consolidate its luxurious image, which lays a foundation for further coverage of segmented markets such as SUVs, cars, and urban runners.

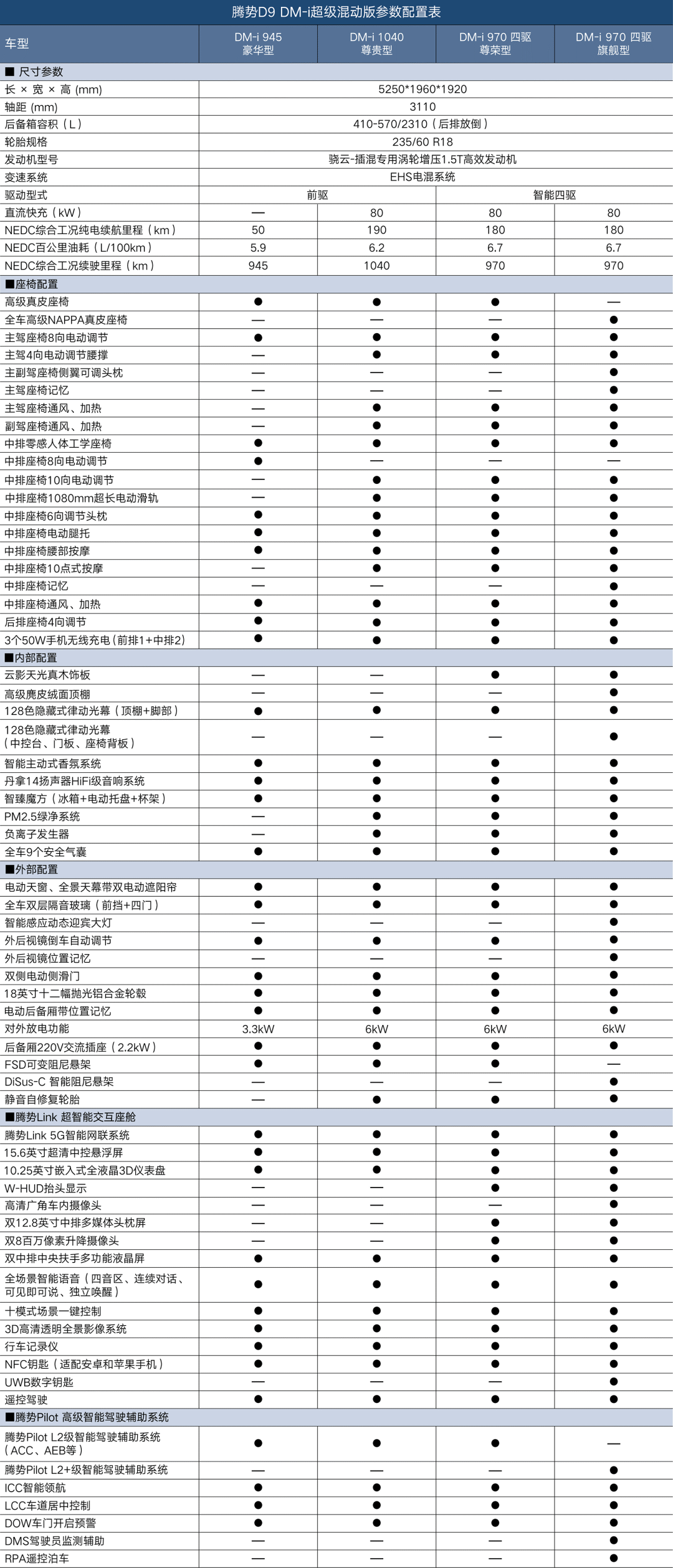

Comprehensive Configuration, Cost-effective.Regarding the configuration, the four D9 DM-i models of Weltmeister have been announced as the first ones:

Judging from the announced pre-sale prices, except for the driving assistance system, other configurations are not much different from the four-wheel drive version, and the intelligent cockpit and seat functions, which are the most important, are close to the fully equipped version. Coupled with good endurance and feeding fuel consumption, as well as the temptation of a six-figure green license plate, it is enough to pose a threat to the mid-to-high-end shares of GL8 ES Landzoon and Toyota Sienna.

The three-power configuration of the lowest version is somewhat stretched, but if compared with the Sienna or GL8 ES Landzoon at the same price, the sincerity of Chinese brands is far beyond the ability of joint ventures, especially considering that there is a player called Li Xiang ONE, who has been threatened by the replacement demand of medium and large MPVs for a long time. Moreover, the Weltmeister D9 is likely to be the most lethal one.

One high-end MPV after another makes people worry about whether they will fall into the trap of homogenization in addition to being dazzled by them. Although “suitable for business and home” is something that every MPV claims, and every MPV is doing well, there are still hopes that this market can produce several unconventional Mavericks rather than being targeted by the GL8, Sienna, and Alphard.

Just like two years ago, Tank 300 triggered an off-road trend. Nowadays, the popularity of camping and recreational vehicles among young people can bring us personal works that are both literary and martial, like Meteeweis and Delica D:5.

Hope this is not just my wishful thinking.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.