Writing by | Zheng Wen

Editor | Zhou Changxian

On May 10th, Li Auto announced its first-quarter 2022 financial results. The two most intuitive data, revenue and net profit, are as follows: The company achieved operating income of CNY 9.56 billion in the first quarter, a year-on-year increase of 167.5%, with vehicle sales revenue of CNY 9.31 billion, up 168.7% year-on-year. The net loss was CNY 10.87 million, a significant year-on-year narrowing.

In the context of the repeated fluctuations in the epidemic and the significant increase in the price of battery raw materials leading to cost increases, objectively speaking, it has not been easy to achieve such results.

However, looking at the performance data alone is superficial and abstract. This article will incorporate Li Auto into the development of the entire industry and interpret some key performance data.

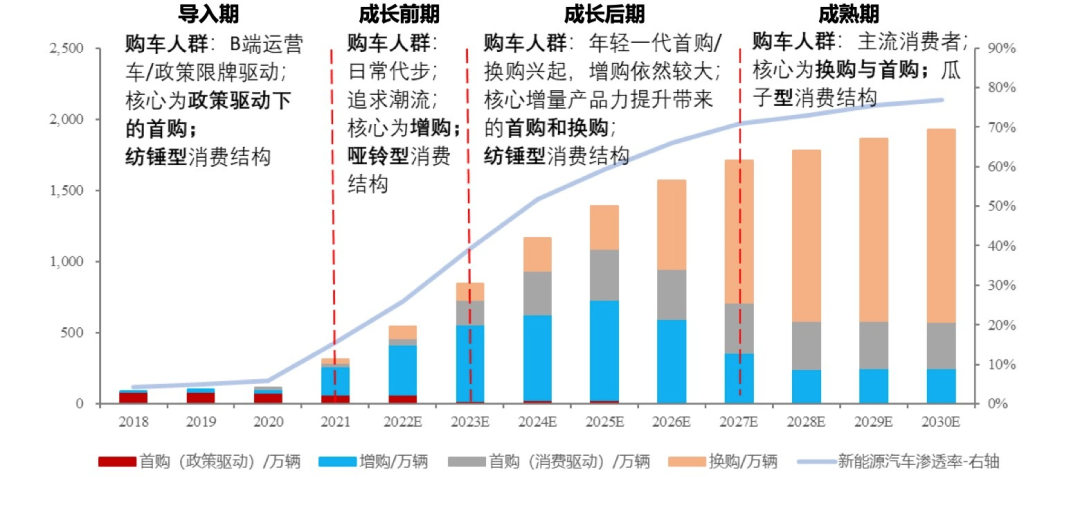

There is a consensus that a penetration rate of 15% for new energy vehicles is an important threshold, which means that the automotive industry has achieved the 0-1 phase of transformation, and the 1-10 phase of rapid development will officially begin.

In 2021, China’s new energy vehicle sales reached 3.521 million units, a year-on-year increase of 157.6%, and the market penetration rate increased significantly from 5.4% in 2020 to 13.4%. The China Association of Automobile Manufacturers predicts that new energy vehicle sales will reach 6 million units in 2022, with a penetration rate of 22%, of which the sales of new energy passenger vehicles will reach 5.5 million units, with a penetration rate of 25%.

In other words, 2022 is the year when the current round of automotive industry transformation takes off.

During the import period of the 0-1 phase in the past, explosive models were born in different segmented markets, helping the new energy market enter a period of rapid development.

In the market below 100,000 yuan, the phenomenal performance of Wuling MINI EV brought the dying micro-car back onto the mainstream stage; in the 100,000-200,000 yuan market, after technological iteration, BYD DM-i made up for its shortcomings and eventually exploded in the most popular market; in the 200,000-300,000 yuan market, Tesla’s Model 3 and Model Y brought it to life; in the market above 300,000 yuan, Li ONE’s accurate grasp of the market demand made it a hit.

Li Auto’s success was unexpected. In 2021, Li ONE achieved a market share of more than 30% in the new energy vehicle market of 300,000-400,000 yuan, pushing this new car-making force far ahead in the most critical time.

In “Xiao Li” (Li Xiang, founder and CEO of Li Auto), Li Auto is the only brand that fights with a single model. In the era of “wolfpack tactics,” its “unique style, eating the world” effect is enough to make competitors jealous.From the perspective of the new forces in the car industry, the overall pace of the “Three Musketeers” is synchronized, as NIO took the lead, XPeng closely followed, and Ideal Auto caught up later, all achieving initial success from 0 to 1. At this stage, their competitiveness is based on “services”, “intelligence”, and “family”, with clearly defined tags.

“By 2025, our overall product and company strategies will still focus on serving families with children, this is a clear definition,” said Li Xiang, founder and CEO of Ideal Auto. The company’s strategic plan and product roadmap will revolve around this.

If achieving the leap from 0 to 1 is the first indicator in the 1-10 stage, the ability to achieve a self-healing cycle to truly achieve a benign cycle is extremely important. It depends on important indicators such as gross profit margins and net profit margins per vehicle.

Tesla, for instance, leads the industry in gross profit margin and net profit margin per vehicle in the 1-10 stage. According to Tesla’s Q1 earnings report, its gross profit margin reached an astonishing 32.9%.

In the pursuit of high gross profit, Tesla is doing its utmost. It has increased its gross profit margin far above the industry average through cost-cutting and software services. It should be noted that among car manufacturers, few have achieved a gross profit margin of more than 20% in the car sales business. Generally, traditional car companies maintain it between 10% and 15%.

In Q1, Ideal Auto’s gross profit was CNY 2.16 billion, up 250.9% YoY, with a gross profit margin of 22.6%, up 5.3% YoY.

Ideal Auto’s gross profit margin data is second only to Tesla, not only the most eye-catching among the “Three Musketeers” of new car-making forces but also not inferior to the leading independent automakers BYD, Geely, and Great Wall. Their gross profit margin in 2021 was 17.39%, 17.1%, and 16.16%, respectively.

It is worth mentioning that it is precisely because of this high gross profit margin that Ideal Auto achieved its first quarterly profit in Q4 2021, which is only accomplished by Ideal Auto among the “Three Musketeers.”

Another indicator is cash flow. In Q1 2022, Ideal Auto’s free cash flow was CNY 502 million, and its cash reserves reached CNY 51.19 billion at the end of the quarter. Ample cash flow can support the continued development of Ideal Auto for several years.

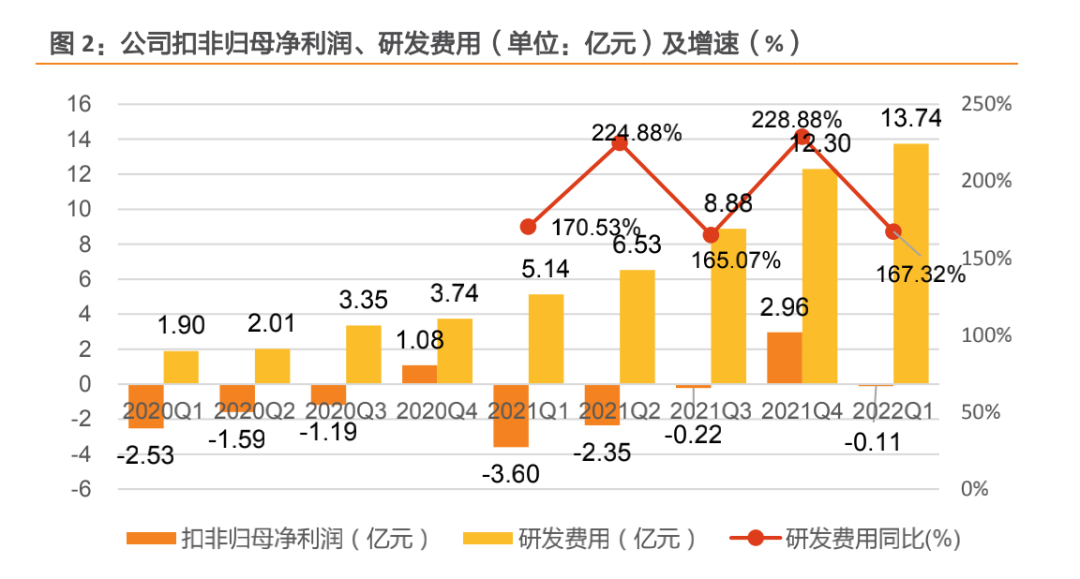

Guodu Securities believes that Tesla is currently in a leading position, and its position is relatively stable. In the next four years, if the momentum continues, perhaps one or two independent brands will run ahead. Is it Ideal Auto? Let’s continue to look at other indicators.In terms of R&D investment, in the first quarter, the R&D expenses of Li Auto were 1.374 billion yuan, an increase of 167.32% YoY, and the R&D expense ratio was 14.37%.

R&D investment is mainly used for the NOA (Navigation on Autopilot) driving assistance system and the technical R&D of pure electric vehicle models developed in-house. It is worth mentioning that the penetration rate of NOA in high-speed driving has reached 61.3%. This indicates that new forces in the automobile industry have made significant contributions to the popularity of intelligent driving systems.

Comparing the R&D investments of several other new forces in the automobile industry horizontally, Tesla’s R&D expenses in 2021 were 16.54 billion yuan, an increase of 74% YoY from 9.51 billion yuan in the previous year. During the same period, NIO, XPeng, and Li Auto’s R&D expenses were 4.59 billion yuan, 4.11 billion yuan, and 3.29 billion yuan, respectively.

At first glance, the sum of the R&D expenses of the three new forces in the automobile industry seems to be less than that of Tesla alone. However, objectively speaking, Tesla is larger than “Nio Xia Li”. In fact, in terms of R&D expense ratio, in the first quarter of 2022, Tesla’s R&D expense ratio remained at 4.5%, while “Nio Xia Li” basically maintained at 10% to 20%. From this perspective, Li Auto’s R&D investment is reasonable.

Last spring, Li Xiang stated in an interview with the “100 People of Mobility/AutocarMax” that R&D investment would continue to increase in the next few years. There are two reasons for this. One is that the challenges faced in the future are different, and the other is that there is money after the 2020 IPO. As of December 31, 2021, Li Auto had a total of 11,901 employees, of which R&D personnel accounted for 28.7%.

From the perspective of corporate style, Li Auto has always attached great importance to cost control. Previously, Li Xiang revealed in his circle of friends that Li Auto’s overall control of expenses is extremely strict. The company requires that only the lowest discount tickets be bought for economy class air tickets, and two people of the same sex must share a room in an economy hotel.

It can be foreseen that as Li Auto’s size increases, its R&D investment will also increase accordingly.Ideal L9 will officially end the situation that Ideal Auto relies solely on Ideal ONE. The car will be delivered in the third quarter with a price range of 400,000 to 500,000 yuan, targeting family users. Some of the configuration parameters are as follows: a high-performance computing platform consisting of Qualcomm, Horizon, and Nvidia, an entertainment hardware configuration with HUD+5 15.7-inch screens and 23 speakers, an auxiliary driving system with one LIDAR, five millimeter wave radars, and 12 ultrasonic radars.

Dongwu Securities predicts that Ideal L9 may become the biggest dark horse in 2022.

From 2022 to 2023, it is a big year for Ideal Auto’s product development, which will simultaneously layout extended-range and pure electric product lines, and connect prices from 30,000 to 400,000 yuan, at every 100,000 yuan for a price segment.

Based on the solid foundation of the 30,000 to 400,000 yuan market, Ideal Auto will develop full-size products and mid-range products. Next year, Ideal Auto will launch three new products: a new generation of extended-range flagship models, a new BEV high-voltage platform, and three models of mid-size cars priced between 200,000 to 300,000 yuan.

As the importance of user data increases, the importance of user scale for a car company has also reached an unprecedented height.

According to Ideal Auto’s 2025 strategy, it aims to occupy 20% of the domestic electric vehicle market share and achieve sales of 1.6 million vehicles by 2025. Currently, Ideal Auto has achieved cumulative sales of over 150,000 units with Ideal ONE.

Ideal L9, which is about to be launched, competes with BMW X3, Mercedes-Benz GLC, Audi Q5L and other models in terms of price. The monthly sales volume of these models is around 10,000 units. Considering various factors such as Ideal Auto’s brand awareness and sales outlets, even if L9 becomes a hit, it may be difficult to contribute significantly to Ideal Auto’s sales volume. Therefore, the pressure is on the mid-size car priced between 200,000 to 300,000 yuan.

By the first quarter of 2022, Ideal Auto had a total of 217 retail centers covering 102 cities. As of April 30th, the number has increased to 225 retail centers covering 106 cities. Ideal Auto’s co-founder and president, Shen Yanan, introduced that the plan is to increase the number of retail stores to 400 by the end of the year, and even if there are impacts from the epidemic, they still hope to open as many stores as possible.With the end of the era of solo development of a car model, Ideal Auto will face new challenges. The management approach for producing only one car is different from that for producing multiple cars.

Li Xiang has a clear understanding of this. “Just like the mature and standardized organizational model of supply chain manufacturing, we will cover it. We will also fully engage in App development, internet-related services, and sales in an internet-like way. Moreover, for the development of multiple cars, large-scale software, and the more open L4 autonomous driving system, we also need to acquire the ability to organize complex systems.”

He believes that “keeping everyone working efficiently in the same world is really more difficult than managing large internet companies, which is the biggest challenge we face next.”

In Li Xiang’s view, Huawei has performed the best in managing complex hardware and software systems. “Huawei’s IPD is the most effective in this aspect and is a huge organizational system. We should learn from it.”

If Ideal Auto can successfully overcome the hidden worries in R&D investment, complex system management, and sales scale, what may emerge next is the company’s success.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.