Weekly Index

Weekly News

NIO ES7, Changan Blue Cruise SL03 and Other New Cars Land in MIIT

On May 13th, the 356th batch of “Road Motor Vehicle Production Enterprises and Products” was announced by the Ministry of Industry and Information Technology, which includes long-awaited new SUV NIO ES7, Changan Blue Cruise SL03 (formerly codenamed C385), smart elf #1, and a new version of BMW 3 Series.

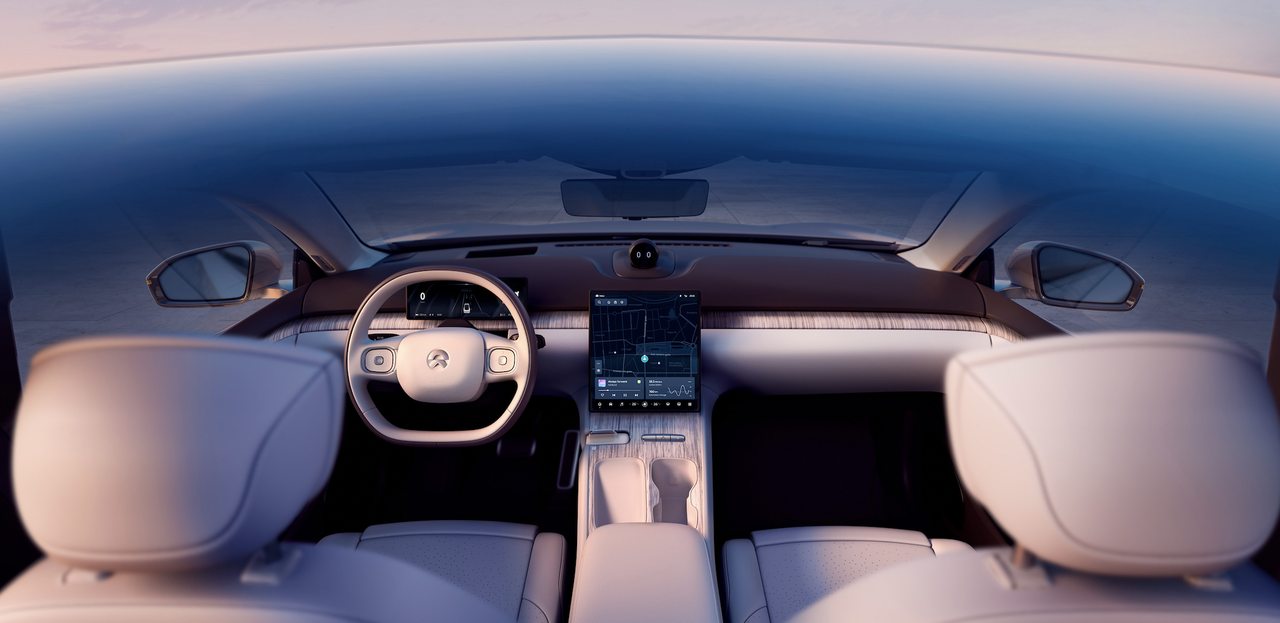

NIO ES7

The dimensions of NIO ES7 are 4,912 x 1,987 x 1,720 mm (LxWxH), with a wheelbase of 2,960 mm. As its name suggests, it is positioned between ES6 and ES8 in NIO’s product lineup.

The overall appearance of NIO ES7 continues the Design for AD concept of ET7, with simplified X-Bar front design and three-dimensional through-type taillights that are identical to ET7. However, the most controversial part is the charging port position of ES7, which is located on the right front fender just like ES6, while ET7 places it at the rear of the car. It’s really inconvenient to fit such a big car into the charging station.

SL03, previously known as Chang’an C385 which has received high attention, has also officially entered the MIIT, and the brand new logo of Chang’an’s new brand, Shenlan, has been announced. Moreover, it can be found from the pictures that the codename of C385 has changed to SL03.

The length, width, and height of SL03 are 4,820 × 1,890 × 1,480 mm, and the wheelbase is 2,900 mm. Currently, both pure electric and range-extender versions have been applied for.

smart FORVISION #1

In addition to bringing the Pro+ and Premium versions of the smart FORVISION #1, this batch of MIIT also exposed the more powerful dual-motor version (or Brabus version) with a total power of 315 kW, including a 115 kW front motor based on the original 200 kW rear motor. It can be said that it is a small racing car.

smart FORVISION #1 uses the full-vehicle visual perception hardware, including front binocular cameras, visual perception of the left and right fenders, and visual perception on the rear wing, which can be expected to have excellent driver assistance capabilities.

However, the proud elf on the rear of the car has caused a lot of discussion due to the mismatched name and font, which can be learned from the design of Polestar.

Quick comment:

In fact, the exterior of NIO ES7 has been exposed in various spy photos before it appeared in the MIIT. Compared with the exterior, people may be more interested in the interior and positioning of ES7.The power system of NIO ES7 uses the front and rear motors from ET7, which are dual motors with 180 kW at the front and 300 kW at the rear. The total power is 480 kW, and the maximum torque reaches 850 N·m. The estimated acceleration time to 100 km/h is around 3.9 seconds.

The interior design is expected to be similar to ET7 and ET5 in style. Features such as the 8155 cockpit chip, 23-speaker Dolby panoramic sound system, and air suspension will appear as standard. Therefore, the price is expected to be similar to the performance version of EC6/ES6 plus the cost of optional packages. It is also suitable for users who do not require 6/7 seats in ES8 and prefer the five seats with standard NAD. Competitors will come from the following few.

Next is one of this year’s popular pure electric sedan, the Changan Shenlan SL03. According to official information released earlier, the 190 kW rear-wheel-drive electric version can achieve a comprehensive cruising range of more than 700 km, and the extended-range version can reach more than 1,200 km. The pure electric range is over 200 km and the electricity consumption is 4.5 L/100 km. In addition, there will be a hydrogen fuel cell version, with a comprehensive cruising range of more than 700 km and hydrogen consumption as low as 0.65 kg/100 km, which can be refilled in 3 minutes at the fastest.

The CEO of Changan Shenlan introduced many of the SL03’s highlight features in a previous video, including AR-HUD, a swingable sunflower screen, and interactive light groups.

In terms of ADAS, it may be equipped with 4D millimeter-wave radar, which is said to be capable of achieving L4 level assisted driving. Meanwhile, the test drive of Changan Shenlan SL03 is about to start. At this point, we hope that the epidemic in the country can be resolved sooner, so that these heavyweight new cars can meet us as soon as possible.

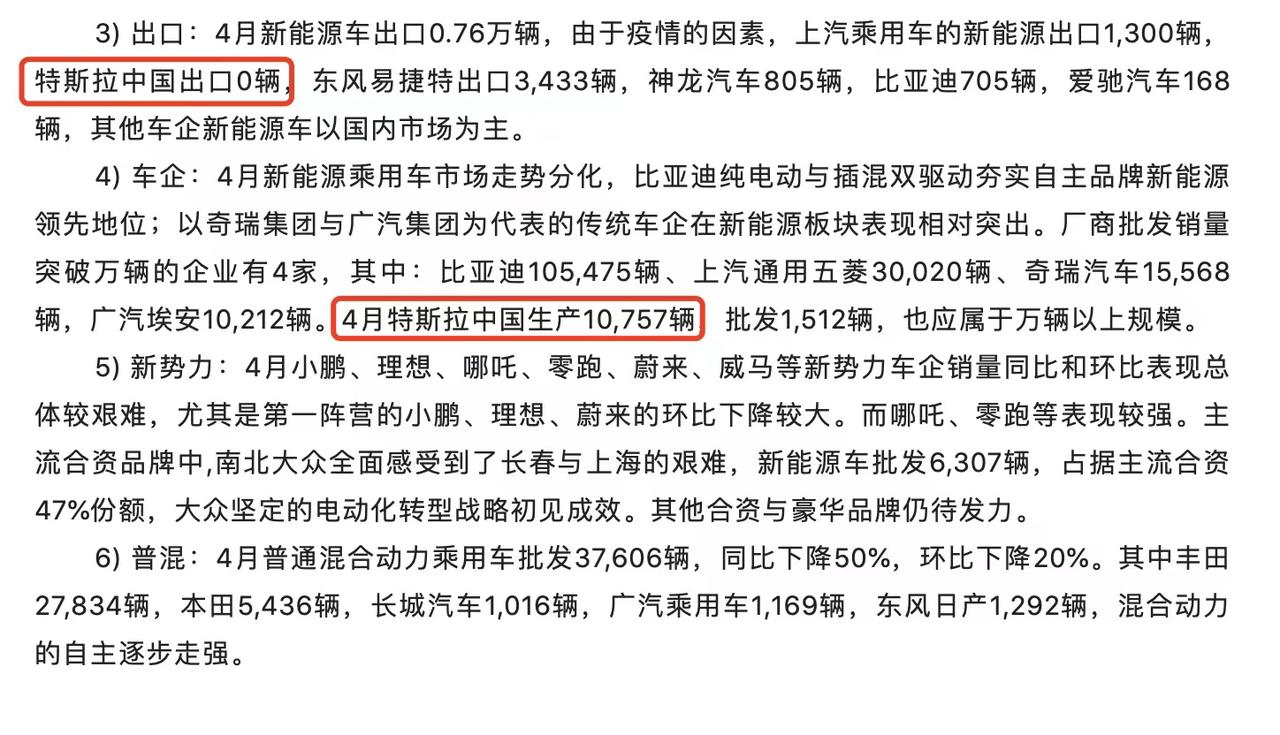

Sales data announced by China Association of Automobile Manufacturers (CAAM) in April

On May 10th, CAAM announced the sales data for April, with BYD ranking first with sales exceeding 100,000 vehicles, and Tesla delivering only 1,512 units due to the severe impact of the epidemic.

In April, affected by the pandemic, the retail sales of passenger cars in domestic market were 1.042 million, a year-on-year decrease of 35.5\% and a month-on-month decrease of 34.0\%. The monthly sales volume hit the lowest point since the epidemic in 2020.

In April, affected by the pandemic, the retail sales of passenger cars in domestic market were 1.042 million, a year-on-year decrease of 35.5\% and a month-on-month decrease of 34.0\%. The monthly sales volume hit the lowest point since the epidemic in 2020.

In April, the wholesale sales of new energy passenger cars were 280,000, a month-on-month decrease of 38.5\%, and the retail sales were 282,000, a month-on-month decrease of 36.5\%.

Comment:

Throughout April, 4 new energy manufacturers exceeded wholesale sales of 10,000 vehicles, including:

-

BYD 105,475 vehicles;

-

SAIC-GM-Wuling 30,020 vehicles;

-

Chery Automobile 15,568 vehicles;

-

GAC Aion 10,212 vehicles.

BYD not only won the new energy sales championship this month, but also became the sales champion of China’s car manufacturers. The layout of factories in many cities and the highly vertical integrated industrial chain helped BYD demonstrate a strong supply capacity during the pandemic.

In April, Tesla China produced 10,757 vehicles, but sold only 1,512 vehicles. The main reason was that Tesla adopts a direct sales model, and new vehicles could not be shipped from the factory due to the pandemic. The logistics suspension also affected the sea transportation at ports. There was almost no Tesla China’s export in April, so the markets such as Europe that need Tesla imported from China will undoubtedly face more severe delivery delays in Q2.

According to the data from China Association of Automobile Manufacturers, due to the slowing production affected by the pandemic, excessive backlog of orders and other factors, the delivery delay of new energy vehicles is quite serious. However, as for the overall new energy market, before the price surge, the orders of the manufacturers are sufficient and more people choose private cars for short-distance travel during the pandemic, which also drives the development of the new energy market.

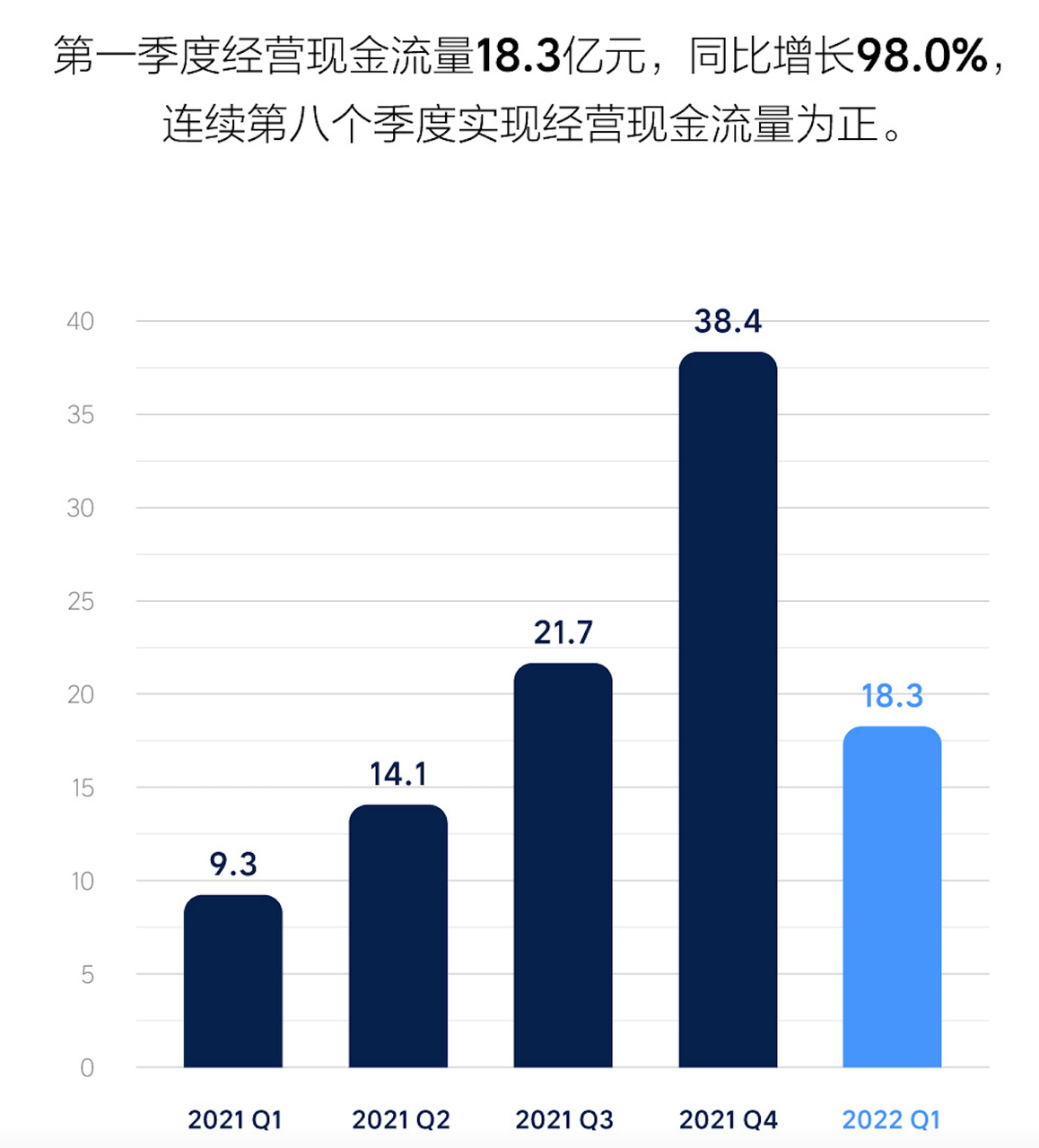

Ideal will release three new cars within two years according to the financial report

On May 10, 2022, Ideal was the first among the top three new forces to release its Q1 2022 financial report.

In Q1 2022, Ideal’s revenue and deliveries were in high agreement. The company delivered a total of 31,716 vehicles, a year-on-year increase of 152.1\%, but a quarter-on-quarter decrease of 10\% compared to Q4 last year. The total revenue was RMB 9.56 billion, a year-on-year increase of 167.5\%, but also a quarter-on-quarter decrease of 10\%.

The Chinese automobile industry experienced various influences including the Spring Festival slack season, subsidy decline, and raw material price increase in Q1. The outbreak that began at the end of the first quarter has brought great challenges to the national automobile industry, leading to increasingly strong market sentiments of risk and uncertainties. Concerns about the delay in the release of L9 and the expectations for the new energy market this year also became the focus of attention in this financial report conference call. Surprisingly, officials revealed during the call that there will be a new car in the 200,000 to 300,000 yuan price range next year.

Fast review:

In the financial data, the most eye-catching is probably the single-vehicle gross profit margin, which remained at a high level of 22.4\% in the first quarter, even showing a slight increase compared to the historical best single-vehicle gross profit level of 22.3\% in 2021Q4. Considering the industry’s rising raw material prices in Q1, it is difficult to maintain the profit margin. The net loss of 10.9 million yuan should be within expectations, as Q1 had three factors that were unfavorable to finance: the Spring Festival, price increases, and the outbreak.

Considering the impact of the current outbreak, IM Motors gave a relatively conservative delivery guide for Q2.

-

It is expected that vehicle deliveries will be between 21,000 and 24,000, an increase of approximately 19.5% to 36.6% compared to 2021Q2;

-

Expected total revenue to be between 6.16 billion yuan and 7.04 billion yuan, an increase of about 22.3% to 39.8% compared to 2021Q2.

In the Q&A section, the most prominent statement was made by Li Xiang, who revealed, “We will release a hot-selling model in each 100,000-yuan price range, including 200,000 to 500,000 yuan. There will be three new products, including a new generation of extended-range products and BEV high-voltage platform products, including a new product in the 200,000 to 300,000 yuan price range next year.” Accurate positioning combined with product power, a dimensionality-reducing strike will further increase the possibility of the IM Motor’s sales growth.

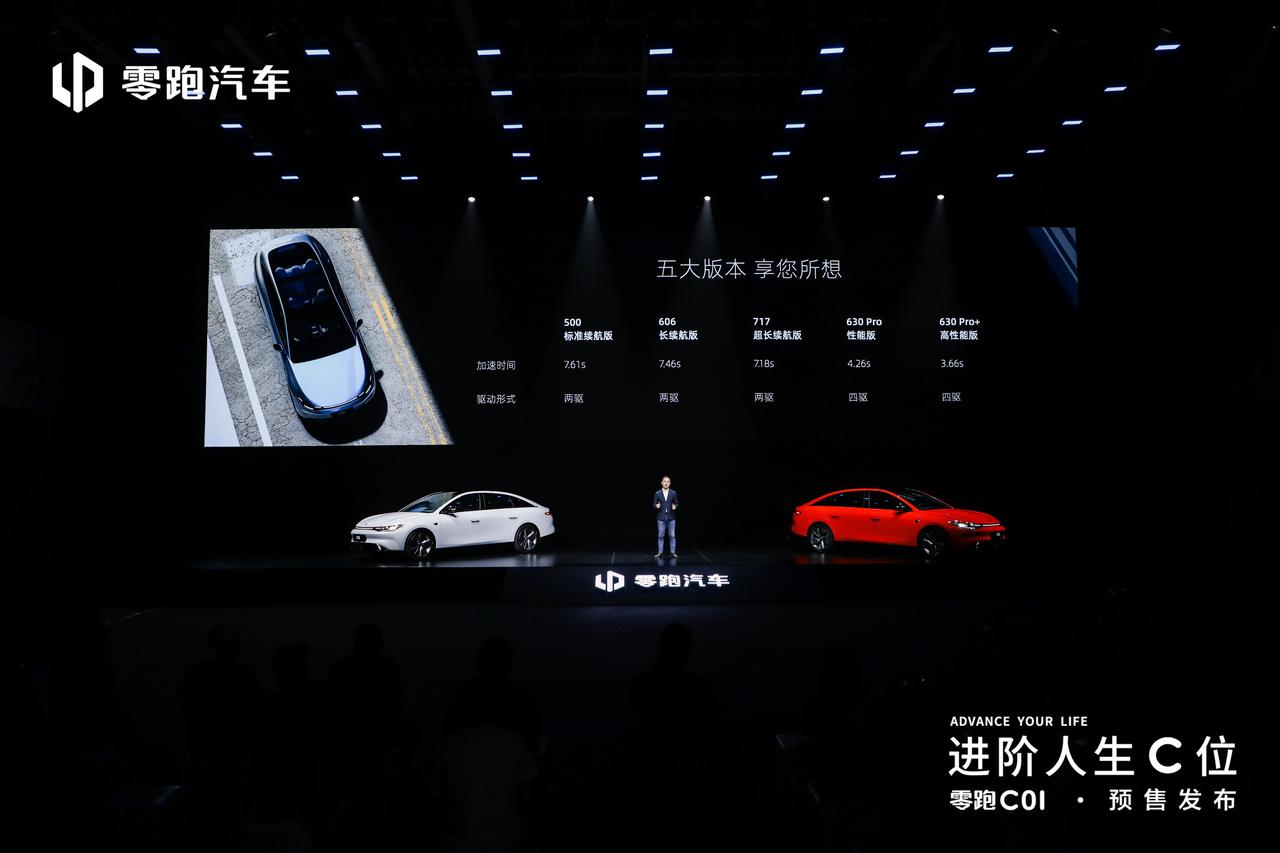

Starting from 180,000 yuan, IM Motors’ Zero Run C01 will be released in Q3.

On May 10th, the Zero Run C01 opened its pre-sale, priced between 180,000 yuan and 270,000 yuan, with 5 configurations available. As the second product of the Zero Run C series, it is equipped with CTC battery pack chassis integration technology, continuing the Zero Run’s high cost-performance strategy.

– Standard range version (rear-wheel drive, 0-100 km/h in 7.61 seconds) with a range of 500 km

– Standard range version (rear-wheel drive, 0-100 km/h in 7.61 seconds) with a range of 500 km

- Long range version (rear-wheel drive, 0-100 km/h in 7.46 seconds) with a range of 606 km

- Extended range version (rear-wheel drive, 0-100 km/h in 7.18 seconds) with a range of 717 km

- Performance version (four-wheel drive, 0-100 km/h in 4.26 seconds) called 630 Pro

- High-performance version (four-wheel drive, 0-100 km/h in 3.66 seconds) called 630 Pro+

The dimensions of the LI ONE C01 are 5,050 x 1,890 x 1,503 mm (length x width x height) with a wheelbase of 2,930 mm. It competes in the premium electric vehicle market with a price range of around 200,000 RMB, along with the Byd Han, Changan Blue Whale C385 and NIO S. Although the wheelbase is slightly smaller than that of the Mercedes-Benz C260L, the length of the vehicle is already at the level of a medium to large-sized car.

Quick comment:

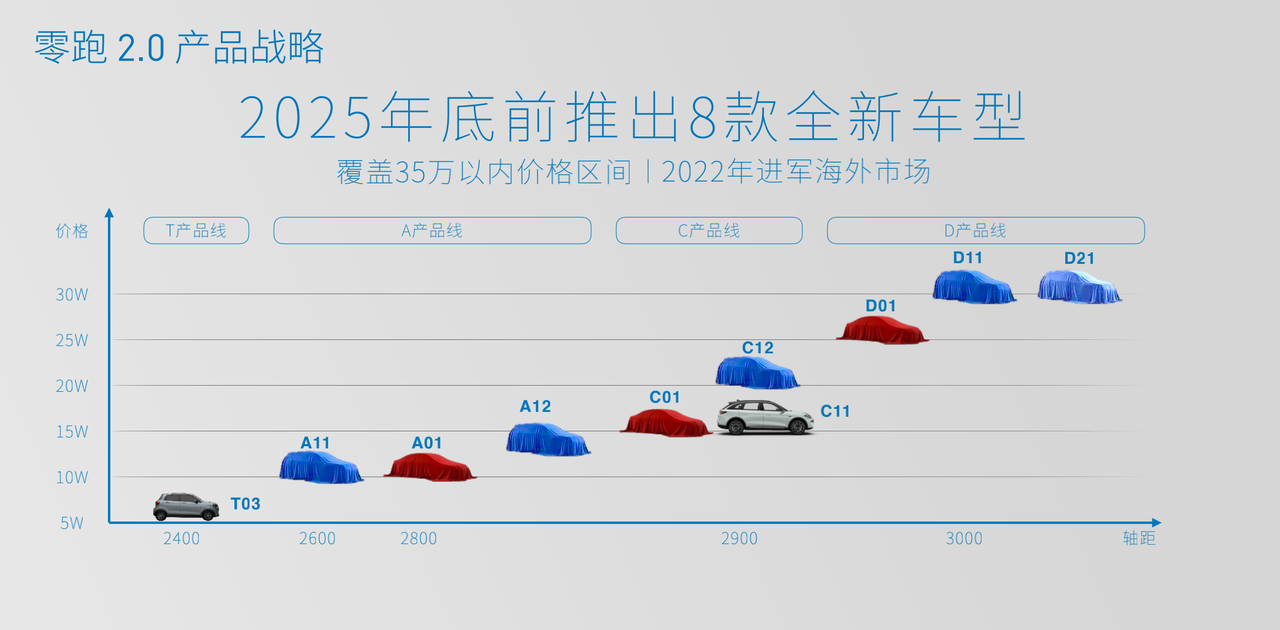

The surprising but not unexpected starting price of the LI ONE C01 at around 180,000 RMB was already announced in LI’s 2.0 strategy last year, and it serves as an entry-level for the C-class market, just like you wouldn’t spend 150,000 RMB on a new Mondeo. As a vehicle that will be delivered in 2022, the mid-to-high-end configuration of the C01 is what really deserves our attention and has the potential for mass sales. It is also due to the existence of 90-degree battery cells that make CTC technology more meaningful on the LI ONE C01.

Looking at the configurations, the starting price of 180,000 RMB for the standard range version 500 has more showmanship than practical use. It is estimated that the 717 extended range version, which costs around 230,000 to 240,000 RMB, will be the product that consumers choose most. Consumers who choose the top-of-the-line model priced at around 270,000 RMB with a 3.66-second acceleration time from 0 to 100 km/h will not be too many, unless they have a strong demand for power. However, for the fully-equipped C01 with good value for money, this kind of power output and comfort configuration cannot be found in any other car at the same price point.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.