Jia Haonan Posted from the co-driver’s seat temple

Smart cars reference | Official account AI4Auto

The latest Dreamer from Landtu has been launched, starting from RMB 369,900 and the top configuration at RMB 639,900.

Haven’t heard of Landtu?

It is a new brand launched by Dongfeng Motor, a national car brand, which bets on intelligent transformation.

The decades-long self-reliance and high-end dreams of Dongfeng are now embodied in Landtu.

And the new model, Dreamer, has indeed achieved several “firsts”.

First, it’s the world’s first pure electric 7-seater MPV.

It’s also the “fastest MPV in the world”, with a driving orientation like a “small tank”, which is extraordinary for a commercial vehicle.

In terms of market competition, it still has a unique advantage: while other commercial vehicles cannot be granted green plates in China, Dreamer has an extended-range option, along with sportiness, and a spaciousness that exceeds other sport models.

In this regard, Dreamer seems more like a “trick” that Dongfeng has deployed under the siege of new forces.

However, what kind of car can customers get for over 400,000 RMB through purchasing Dreamer?

And has the “intelligent car” that Dongfeng promised when launching Landtu been fully realized in Dreamer?

What can you get with over RMB 400,000 for a Dongfeng car?

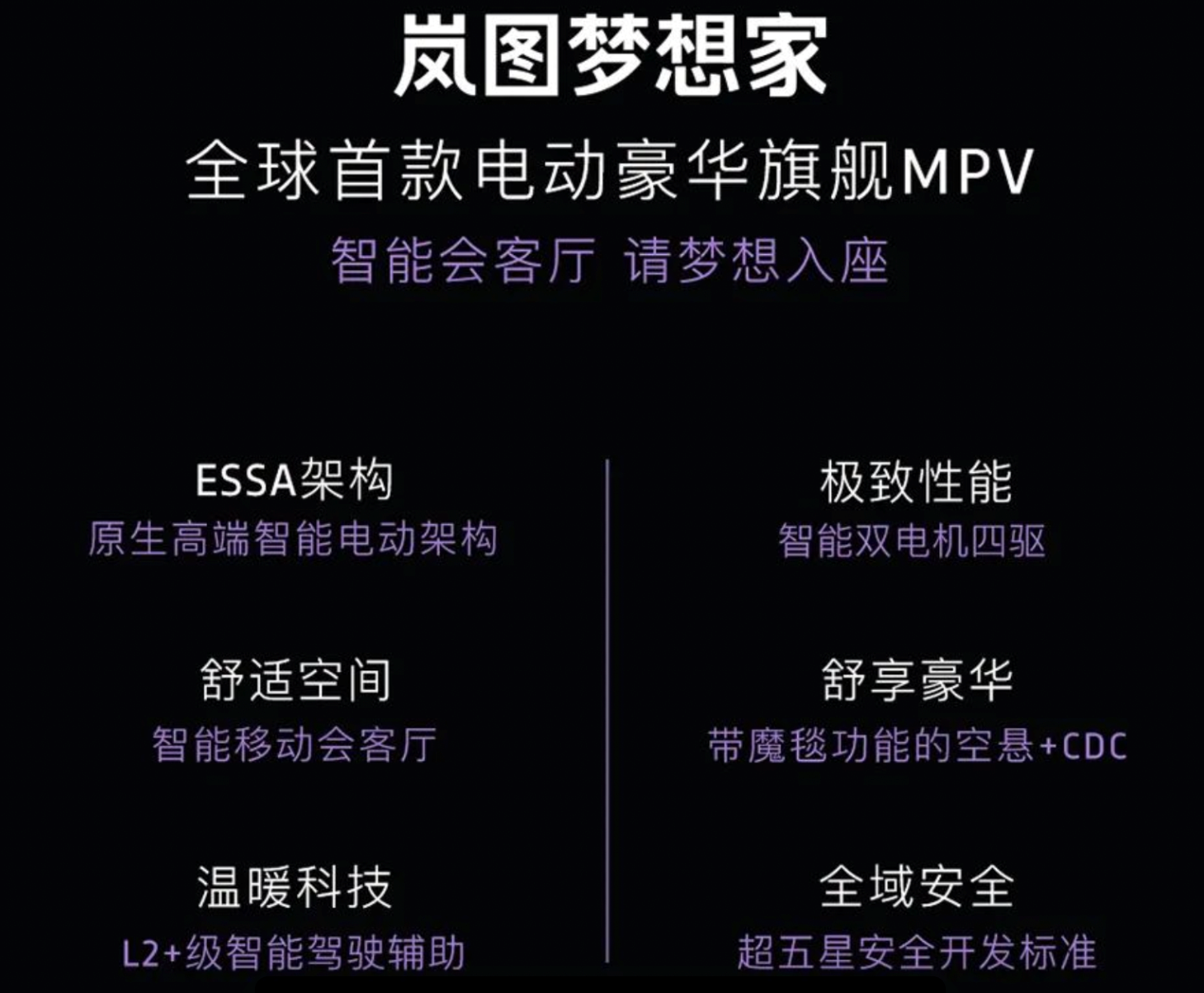

In the official poster, the main selling points are already clear:

So you can understand the official positioning of Dreamer.

The length / width / height of Landtu Dreamer are 5315/1980/1810mm respectively, with a wheelbase of up to 3200mm, which is positioned as a medium-to-large MPV.

At 3.2 meters of wheelbase, it’s 5 centimeters longer than the Mercedes-Benz S-Class and over ten centimeters longer than China’s best-selling MPV, the Buick GL8.

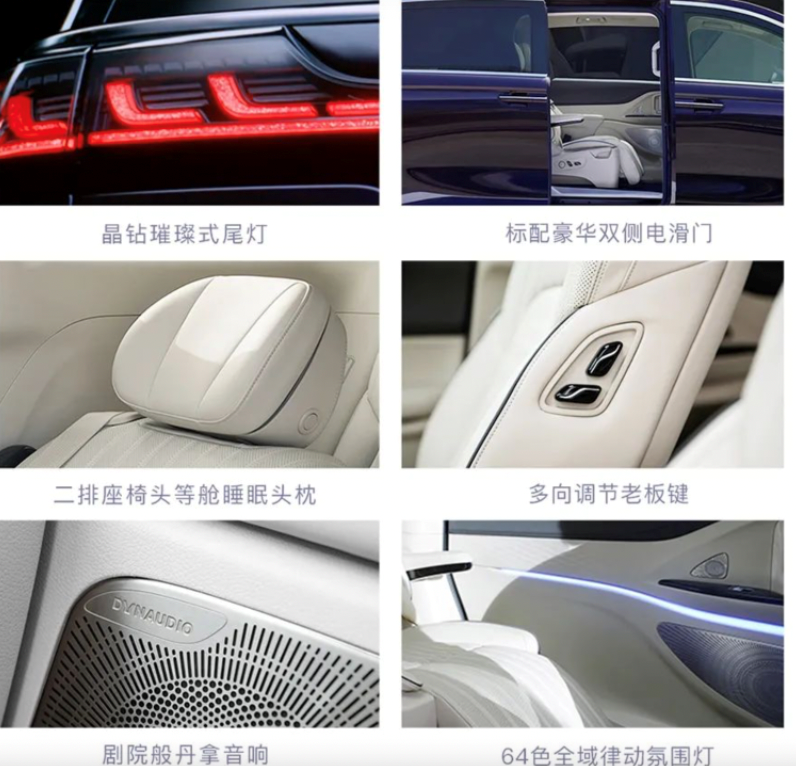

The interior design maximizes the space with all kinds of luxurious configurations:

The entire interior is made of genuine leather, and at least the first two rows of seats all have electric controls, ventilation, massage, heating, and more.

The second-row seats even come with lumbar and leg support. It is said that the second-row rail is super long, and, when extended to its farthest point, it forms a luxurious, comfortable space for the passengers to have a business meeting.

Equipped with a second-row office desk and charging ports.

In addition, the Dreamer comes with a three-zone intelligent air conditioning system, a Denon audio system, and over 80 noise reduction designs throughout the vehicle…

And if you want the luxury experience, you need a sense of ceremony. The Dreamer is equipped with an air suspension system as standard, with concierge mode that automatically lowers the vehicle during boarding and exiting.

In addition to the 7-seater version starting at 369,900 yuan, the Dreamer also offers a customized ultra-luxury 4-seater version starting at 639,900 yuan.

Driver’s cabin partition, lift television, wooden floor, independent air conditioning, refrigerator, wireless charging, and more…

At this point, you probably think that the Dreamer is just a boss model designed for passengers, but the LanTu surprises you: luxury and performance, they have it all.

Whether it’s a pure electric version or a range-extended version, the Dreamer’s power level far exceeds the comfort level of a household car, and even many self-proclaimed “hot hatch” cars can’t match it.

The pure electric model has a maximum power of 320 kW, peak torque of 620 Nm, and a 0-100 km/h acceleration time of 5.9 seconds; the range-extended model has a maximum power of 290 kW, peak torque of 610 Nm, and a 0-100 km/h acceleration time of 6.9 seconds.

The “hot hatch” representative, the 8th generation Golf GTI, has a 0-100 km/h acceleration time of 7.1 seconds, and it is far smaller and lighter than the Dreamer.

Of course, this level of power comes from the innate advantages of the LanTu’s electric platform, and comparing it to traditional gasoline vehicles is somewhat unfair.

However, electric platforms also have their own pain points: range.

The Dreamer’s pure electric version uses a lithium-ion battery with a base range of 475 km and an 82 kWh battery pack, which is not much.

By adding a 50,000 yuan “battery life extension package,” you can get the long-range version with a full 108kWh battery and a cruising range of 605km on a single charge.

By adding a 50,000 yuan “battery life extension package,” you can get the long-range version with a full 108kWh battery and a cruising range of 605km on a single charge.

It is indeed quite expensive to spend 50,000 yuan for a 130km extension, but there may be improvements after the supply chain is relieved.

The extended range version of the M6 is claimed by the official website to have a range of 1000km, but this figure is mainly achieved by the 1.5T range extender, as the pure electric range is only 82km, and the official fuel consumption is 7.9L/100km.

For 400,000 yuan, the Langtu M6 Dream Edition offers luxury, space, power, and zero mileage anxiety. Do you think it’s worth it?

At the time when the Langtu was founded, it once held high the banner of intelligence. So can this MPV be called an intelligent car?

Of course it’s intelligent, because Dongfeng Motors’ transformation hopes are all on the Langtu, and it’s impossible to use old platforms of oil-to-electric to hoodwink people.

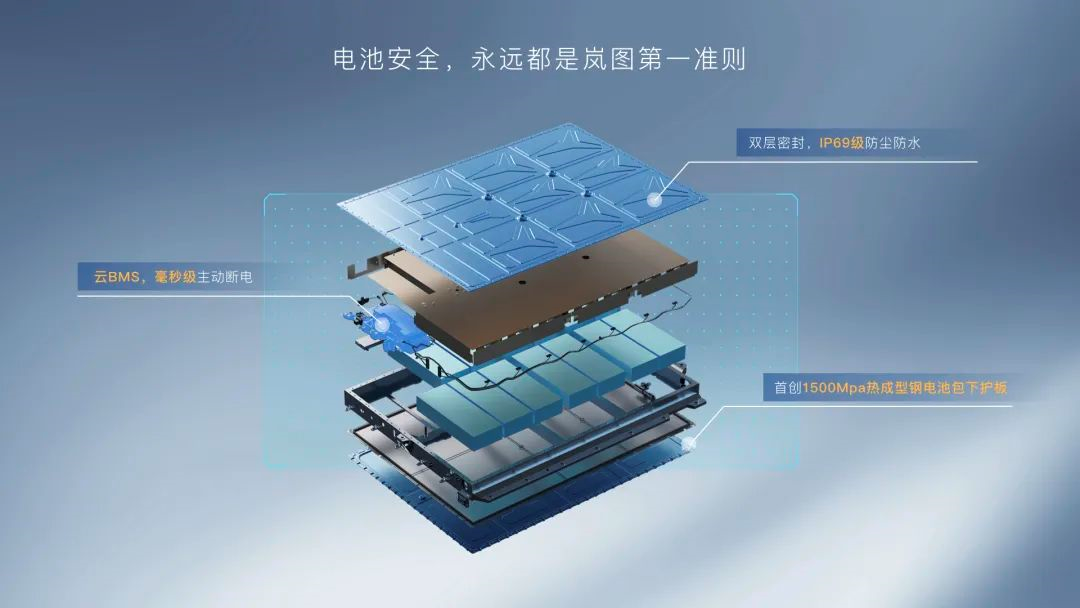

The underlying platform is Dongfeng’s self-developed ESSA architecture. In the simplest terms, ESSA is the “intelligent infrastructure” that Langtu will use on all mass-produced models in the future, which includes battery management technology, intelligent cockpit interaction, vehicle safety configuration, and comprehensive vehicle control system.

But the centralized domain control oriented to intelligence, and the SOA architecture of decoupling hardware and software, which are closely related to automatic driving and intelligent interaction, have not been revealed by Dongfeng any bright spots and details.

However, the dream car has all the relevant functions, but unlike the strong self-developed genes of new forces, the intelligence of the Langtu M6 is “stitched together” from products of different suppliers.

In terms of intelligent driving, the vehicle is equipped with 5 millimeter-wave radars, 7 cameras, 12 ultrasonic radars, and the calculation chip adopts Mobileye EyeQ4. The specific functions of the L2 whole range are all available:

However, this set of L2 whole family package requires an additional 20,000 yuan for optional configuration.

At the launch of the Langtu brand, the autonomous parking function was emphasized by the official as a highlight, which can be parked easily regardless of whether there are lane lines or whether the parking spaces are level:

The system mainly utilizes the four surrounding cameras and ultrasonic radars of the vehicle, and the specific scheme comes from the American manufacturer Texas Instruments.And as for the L2 data input on the road, which includes front-view schemes such as cameras and millimeter-wave radar, it comes from the German supplier, Bosch.

The first car from LvTu, the FREE model, features a night vision system that can identify and alert drivers to obstacles in the dark within a range of 150 meters. This system is also available on the Dreamer, but the scheme is provided by the domestic manufacturer, Horizon.

As for the core intelligent driving algorithm software, it is provided by a domestic autonomous driving startup called ZongMu Technology, and it is exactly the same as the first LvTu FREE, with adaptations made for the MPV model.

You may have noticed by now that the intelligent driving system in the LvTu Dreamer should share sensor data, but each function is actually independently responsible for by modules provided by different suppliers, rather than a centralized architecture on a central computing platform.

In terms of the smart cockpit, the Dreamer model uses the Qualcomm 8155 chip, which is currently the mainstream choice for all smart cockpits.

So what about the system?

In fact, the vehicle operating system is not just a simple UI interface, but rather a “kernel” similar to Android, communicating between the software layer and the vehicle hardware layer to provide support for different functions, including both smart cockpit applications and autonomous driving algorithms.

In fact, the architecture description of LvTu ESSA already includes the connotation of the vehicle operating system, but the company did not separately analyze this important point.

If ESSA is a completely self-developed intellectual property achievement of Dongfeng Motors, then a stable and mature vehicle operating system is enough to prove that this old carmaker’s intelligent transformation is not unpremeditated, and even surpasses most struggling manufacturers of fuel vehicles.

Dongfeng does not say, it is unclear whether they are unwilling or simply unaware.

Is LvTu, Dongfeng’s All-In bet, thriving?

In 2020, LvTu Cars were officially unveiled, having been established as an H division within Dongfeng in 2018. At the time, Dongfeng Chairman Zhu Yanfeng said:

“We shall run and sprint from the beginning.”

Of course, this sprint is towards the direction of “intelligent electric vehicles”, and at the same time, LvTu also shoulders the duty of Dongfeng Motors to challenge the high-end market.

# Dongfeng’s New Energy Vehicle Brand “Voyah” (岚图)

# Dongfeng’s New Energy Vehicle Brand “Voyah” (岚图)

Dongfeng has been striving to enter the high-end market, and has experienced failures over the past few years. In 2016, Dongfeng launched the self-owned A9 model, which aimed to compete with the Audi A6, but unfortunately ended with a meagre annual sales volume of 300 units within two years. Furthermore, apart from Japanese brands, Dongfeng’s other joint venture brands (including Korean and French) have also rapidly declined in recent years.

Dongfeng urgently needs a self-owned brand that can be widely recognized, and the booming new energy and intelligent revolution provides Dongfeng with the best opportunity.

Therefore, the birth of Voyah is like Zhi-Ji to SAIC and Ji-Ke to Geely.

Against this backdrop, at the inception of Voyah, Dongfeng Group invested 11 billion RMB and recruited Lu Fang, who had product, automotive, and management backgrounds and previously worked in FAW, as Voyah’s CEO and CTO.

So, how has Voyah, the “luxury intelligent electric car,” performed?

The first car, Voyah Free, was launched in June last year and began delivering to customers in the second half of the year.

As of March this year, Voyah Free’s cumulative sales volume was 10,484 units, with an average monthly sales volume of 1,164 units.

This result is considered good for a start-up company, but insufficient to support Dongfeng, the giant in the industry, in its transformation, and far from Voyah’s original expectations and ambitions.

Another trend worth noting is that in the first quarter of this year, Voyah produced 6,044 units, almost double its sales volume of 3,693 units. In other words, Voyah’s production output exceeds its sales by a large margin.

The impact of the domestic epidemic on the production and logistics of the automotive industry in the first quarter was not that severe.

Dongfeng has indeed made strides in the area of intelligent vehicles.

Whether “self-developed” or “stitched together,” Voyah has already launched two models in response to Dongfeng’s urgent transformation needs.

In the traditional automotive industry’s transformation race, Dongfeng Automobile may not be as aggressive as Great Wall or BYD, but compared to century-old brands like Mercedes-Benz and BMW, which are still faking their electric vehicles, Dongfeng is much more sincere in its efforts.

In terms of sales mode, Voyah describes itself as “working for the users,” emulating new start-ups by establishing direct sales stores and providing customer services and benefits that are consistent with those of the new start-ups.

The weaknesses of Voyah’s intelligent functions and services are not easily noticeable.

In addition, many veteran automobile critics believe that Voyah’s mechanical quality and driving experience are much better than those of similar extended-range vehicles.

However, we seem to have discovered one of the reasons why the Beijing Voyah store may not have received great public acclaim.

During our visit to the store, we asked the sales representative what the car’s biggest selling point was, and after thinking for a few seconds, they gave the answer “air suspension”… There is also a difference in the level of service proactivity and enthusiasm compared to neighboring brands such as NIO and Li Auto.

Voyah Motors has received completely opposite reactions from the market compared to professional evaluations, as there are no major flaws in the car, but it still hasn’t achieved commercial success.

What has caused traditional car companies’ transformation products to fall into such a cycle?

-End-

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.