Recently, Honda’s e:N brand released its first model, the Honda e:NS1, while Toyota’s first all-new architecture electric vehicle, the bZ4X, also began its pre-sale. Interestingly, the two Japanese automakers’ actions were surprisingly consistent, not only in terms of timing but also in naming their products with deliberately complex and difficult names that consumers might have trouble remembering.

Compared to the era of gasoline-powered cars, Japanese brands seem to have lost their voice in the electric age. In the past, when consumers wanted to buy a gasoline-powered car, they often consulted with friends and relatives, and more than half of them recommended a Japanese car brand. However, now very few people think of buying an electric car from a Japanese brand, let alone recommending one to others, except for some diehard fans of certain brands. Today, we will talk about how Japanese brands fell behind.

Past Glory

Before we explore why Japanese brands fell behind in the electric age, let’s take a look at how Japanese automakers rose step by step.

In fact, Japanese cars were not born as “outsiders’ children.” In 1904, under the push of MTA Yashiro Yoshiro, the first Japanese automobile factory “Tokyo Automobile Manufacturing Co., Ltd.” was just established. Among the six major Japanese automakers today, Mazda, the oldest, was established in 1920. At that time, Japanese car companies could only reverse engineer products of European and American car companies. Compared with brands like Ford and GM, there was a big gap in terms of both quality and sales. Even Japanese consumers did not like them, let alone exporting to other countries.

Despite lagging behind at the time, the Japanese automobile industry kept learning and accumulating experience in automobile manufacturing. After World War II, the defeated Japan took the automobile industry as one of the main directions for post-war reconstruction. Thanks to the special relationship between the United States and Japan after the war, Japan also received a lot of technical assistance and military vehicle orders from the United States. These technical assistance and orders gradually helped mature Japan’s automobile industry.

Since the 1960s, the Japanese automotive industry has slowly caught up in terms of technology. However, due to the scarce resources in Japan, the Japanese government encourages local car companies to produce small-displacement, short-wheelbase cars. Therefore, most Japanese brands have produced economical models, including the famous K-Car model.

At that time, the main automotive consumer markets were not very interested in this type of car. The American market was more inclined towards large-displacement cars, while European consumers preferred luxury brands, neither of which were strengths of Japanese car companies. The Japanese automotive industry at this time was waiting for an opportunity to develop.

The real change came with the Oil Crisis of 1973, and the skyrocketing oil prices first devastated American brands that heavily produced large-displacement cars. American car consumers, feeling the increasing car prices, began looking for small-displacement, economical, and affordable cars.

This demand coincided precisely with the characteristics of Japanese car products, and within a few short years, Japanese brands completely dominated the American automotive market. In 1980, Japan exported 1.92 million cars to the United States, accounting for 80% of imported cars and surpassing the US to become the world’s leading car producer, leading America to pass laws limiting Japanese car imports.

After experiencing the devastation of war, Europe faced similar circumstances. Luxury cars produced by traditional European automakers were clearly not suitable for European consumers with empty wallets after the war. Japanese cars met the needs of European consumers for affordable small cars at absolute low prices. Taking the UK as an example, between the 1950s and 1980s, Japan exported a total of 2 million cars to the UK.

The advantage of Japanese cars began to expand in the following years. In the 1990s, the sales of Japanese cars accounted for 40\% of the global total. This gave Japanese car companies confidence, in addition to the loose monetary policy and unprecedented purchasing power of Japanese car consumers. Japanese car brands also began to develop high-performance cars, such as the Nissan GTR and Honda NSX, which became witnesses to the brilliant history of Japanese cars.

The advantage of Japanese cars began to expand in the following years. In the 1990s, the sales of Japanese cars accounted for 40\% of the global total. This gave Japanese car companies confidence, in addition to the loose monetary policy and unprecedented purchasing power of Japanese car consumers. Japanese car brands also began to develop high-performance cars, such as the Nissan GTR and Honda NSX, which became witnesses to the brilliant history of Japanese cars.

The Electric Era

After entering the 21st century, governments around the world have continuously strengthened their emphasis on new energy vehicles due to environmental and energy security reasons. Car companies have gradually divided into two camps in the direction of new energy vehicles. The radical Tesla chose to stick to pure electric vehicles, while Toyota bet on hybrid and hydrogen energy, and neither side gave in to the other.

Early pure electric vehicle technology was not as mature as it is now, with short battery life and severe battery degradation. Accidents could cause explosions and fires, so pure electric vehicles were frequent headline news at that time.

In contrast, hybrid models were much more reliable, with mature and safer technology and higher consumer acceptance. Japanese brands were also absolute supporters of hybrid technology, with Toyota Hybrid System (THS), Honda i-MMD, and Nissan e-POWER being very representative. I believe friends who paid attention to hybrid models a few years ago should still remember that Japanese hybrid models were almost the best choice for purchasing hybrid vehicles at that time.

Taking Toyota as an example, as of April 2022, Toyota’s global sales of hybrid vehicles had exceeded 20 million units. That is to say, out of every 10 hybrid vehicles on the road, 7 are from Toyota. It can be said that Toyota is one of the absolute leaders in hybrid technology.

Moreover, Toyota’s development of hybrid models is not just to cope with increasingly stringent carbon emission standards. More importantly, in Toyota’s plan, they hope to directly enter the hydrogen energy era from the hybrid era, continuing their patent advantages in internal combustion engines.

According to the report, Toyota holds about a quarter of the global automotive patents, many of which are related to internal combustion engines. History tells us that incumbents usually tend to maintain the status quo and do not want the current rules to change significantly. So until last December, when the Japanese government decided to ban the sale of gasoline cars by 2030, Toyota was still doing its best to promote the advantages of hybrid technology and hydrogen energy to the world.

According to the report, Toyota holds about a quarter of the global automotive patents, many of which are related to internal combustion engines. History tells us that incumbents usually tend to maintain the status quo and do not want the current rules to change significantly. So until last December, when the Japanese government decided to ban the sale of gasoline cars by 2030, Toyota was still doing its best to promote the advantages of hybrid technology and hydrogen energy to the world.

Even Toyota’s President Akio Toyoda, as the chairman of the Japan Automobile Manufacturers Association, has said that electric cars have fewer components and simpler structure compared to gasoline cars. If Japan were to fully shift to electric cars, it would seriously harm Japan’s automotive industry chain and could directly lead to the unemployment of 5.5 million automotive industry workers.

It seems like Mr. Toyoda wants to “use the safety of Japan’s automotive industry chain to attempt to convince the Japanese government to abandon its decision to develop electric cars comprehensively.”

However, how could the Japanese government not understand the interests involved? The comprehensive development of electric cars is also a choice made by the Japanese government under duress. With China, the US, and Europe all heavily investing in electric vehicles, if Japan’s auto industry still hesitates and “sticks to the internal combustion engine route”, it may not even have a chance to enter these markets ten years later.

However, Japanese car companies have already paid the price for their early “nonconformity.” The most obvious example is that while other brands in the Chinese market are discussing “advanced demands” such as intelligence, Japanese brands have not even produced and delivered a single model based on a pure electric platform to meet consumers’ “basic demands.”

Currently, the following Japanese pure electric vehicle models are available on the Chinese market:

-

Toyota: C-HR EV, Yize E engine

-

Honda: Honda e:NS1

-

Nissan: None

-

Lexus: UX EV

## Mazda CX-30 EV and the Lack of Competitiveness of Japanese Electric Vehicles

## Mazda CX-30 EV and the Lack of Competitiveness of Japanese Electric Vehicles

The Mazda CX-30 EV and other models that will suffer humiliation are all derived from the “oil-electric compatible platform.” Even if we ignore the platform and focus solely on the product itself, most of these cars are not competitive with domestic brands in terms of power and pricing, as reflected in their sales figures. In the new energy sales rankings released by the China Passenger Car Association in April 2022, there are no Japanese automakers among the top 50 models.

Therefore, the lack of competitiveness of Japanese electric vehicles is essentially due to the fact that Japanese automakers did not pay enough attention to electric vehicles in the early stages, which led to serious delays in product development compared to European, American, and domestic brands. This is why Japanese brands are reluctantly releasing transitional vehicles, such as the CX-30 EV, that convert from gasoline to electric.

As the saying goes, there are no unsuitable products, only unsuitable prices. However, the worst-case scenario is to have extremely low product competitiveness coupled with extremely high prices. At present, due to the fact that Japanese automakers’ main shipments are still gasoline and hybrid vehicles, they are stuck in a situation similar to BBA, where electric vehicles are priced as gasoline vehicles. This means that the oil-to-electric transitional models introduced by Japanese automakers during this period are unlikely to achieve good sales.

However, this situation may change starting this year. Under pressure from Japanese government regulations, Japanese automakers have had to prioritize full electrification. In April of this year, Toyota, Honda, and Nissan have publicized their new electric vehicle models almost simultaneously.

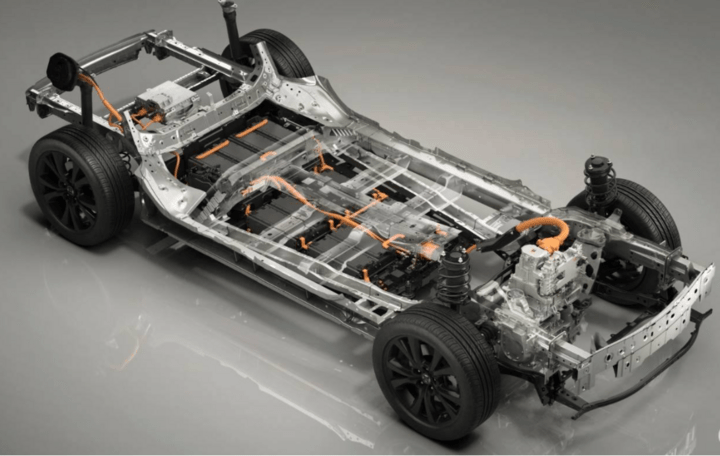

From the information provided on these three models, it can be seen that both Toyota and Nissan have already begun using their pure electric platforms. However, these two products are still in the pre-sale stage, with delivery expected no earlier than this fall. As for Honda, their pure electric platform models have yet to be announced.

Honda’s pure electric architecture, e:N Architecture, has three variations, with e:N Architecture F being the “oil-electric compatible platform” while e:N Architecture W is a pure electric platform. But the platform is still in the car importation stage. The Honda e:NS1 launched this time is based on e:N Architecture F. From its slogan, which claims to be “a front-wheel-drive electric platform,” we can glean some information.Looking at the product strengths of Toyota bZ4X and Nissan Aryia, although they have not completely surpassed their own branded models, they are far superior to their previous models that were converted from gasoline to electricity. Therefore, Toyota and Nissan finally secured tickets to the Chinese electric vehicle market before the cancellation of new energy subsidies in 2023.

Mazda, on the other hand, is not so lucky. Based on the three models of its pure electric platform, Skyactiv EV, it is expected to be launched in 2025.

What is most frightening is not the fact that it will not launch until 2025, but rather the fierce competition in the Chinese electric vehicle market, and the challenge of developing a pure electric platform that can adapt to different layouts and successfully import models is only the first step. Many more challenges lie ahead.

Investment without return of advanced driver assistance

Along with the trend of electric-powered vehicles comes the trend of intelligent, networked, and shared vehicles. The trend of “new four modernizations” in automobiles has become a consensus in the industry. From automakers to parts manufacturers, and even internet companies, they are all gearing up for the “new four modernizations.”

Intelligent driving refers to advanced driver assistance systems, and Japanese automakers have been investing in this area very early on. Toyota, in particular, began researching autonomous driving as early as the 1990s. Not only was it early in terms of time, but Toyota’s investment in the field of autonomous driving is also the largest among traditional automakers, with accumulated spending exceeding billions of US dollars, and cooperation or investment relationships with many well-known autonomous driving star companies.

However, despite the enormous investment, Toyota has not taken a leading position in the advanced driver assistance capabilities of its products; the vast majority of Toyota’s products sold in the Chinese market only have basic L2 advanced driver assistance capabilities.

Only a few models from Lexus have advanced driver assistance functions, including LCA lane change assistance (turning signal required), RSA road sign identification assistance, smartphone remote parking, etc. However, NOA navigation-based advanced driver assistance is still absent, and the gap with domestic leading new forces is still significant.

Honda and Nissan are also “early birds who catch the late comers” in assisted driving. Honda invested $2.75 billion in the self-driving startup Cruise. Nissan announced the powerful ProPilot 2.0 assisted driving system as early as 2019. However, there are still no results of their products in the domestic market.

The latest Honda e:NS1 only has basic L2 assisted driving functions and does not even have turn signal for lane change. The domestic version of the Nissan Ariya is still in the blind determination stage, and there is currently no publicity about advanced assisted driving. The previously leading ProPilot 2.0 assisted driving system has also become mediocre in 2022.

Comprehensive lagging behind in intelligent cockpit

If the Japanese brands’ lack of progress in assisted driving functions is only a problem of product landing progress, then in terms of intelligent cockpit, they can be said to be completely lagging behind.

As early as the era of fuel vehicles, Japanese brand’s interior was criticized for its roughness and lack of soft materials covering. Nowadays, the lack of intelligent configuration has become one of the reasons why many consumers give up buying Japanese new energy vehicles.

While domestic brands are constantly competing in the field of intelligent cockpit functions, Japanese brands seem completely indifferent, still moving forward at their own pace. The Toyota Yize E engine currently on the market still uses a very simple interior design, which is inconsistent with its high price of around 200,000 yuan.

The 7-inch central control screen seems like a relic of a previous era in terms of screen quality and software functionality, and only supports basic features such as music, radio, range, and Bluetooth. The interface design is also very cheap.

If you want to achieve more advanced features, you can only connect to Baidu CarLife on your phone, while iPhone users can only choose third-party Carplay converters. On some forums, we can see a large number of third-party modified introductions. If this were ten years ago, consumers could still tolerate such a feature shortage, but now, consumers who can accept it should be an absolute minority.

If you want to achieve more advanced features, you can only connect to Baidu CarLife on your phone, while iPhone users can only choose third-party Carplay converters. On some forums, we can see a large number of third-party modified introductions. If this were ten years ago, consumers could still tolerate such a feature shortage, but now, consumers who can accept it should be an absolute minority.

The reason for this situation may be related to the backwardness of the Japanese Internet industry. Open the most popular search engine in Japan, Yahoo, and the original interface style seems to have returned to the blue ocean era of the Chinese Internet in an instant.

One of the highly popular shopping websites, Rakuten Market, is the same. It can be seen that decades-old interface styles are still retained in popular national websites in Japan. Seeing this, it is not difficult to understand why Japanese car companies are so conservative in terms of intelligent cabins.

Conclusion

After reading the history of the development of the Japanese automobile industry, we can see that the successful takeoff of the Japanese automobile industry is the result of a combination of self-development, external assistance, legal policies, and historical opportunities. Due to the scarcity of local resources in Japan, Japanese brands have long focused on the research and development of small-displacement economic models. With the advantage of cost-effectiveness, they skyrocketed during the fuel crisis in a bit of an accidental way.

However, Japanese brands entering the era of new energy are not so lucky. In the early days, they invested most of their energy in the development of hybrid models and fuel cell technology, which led to some backwardness in pure electric roadmaps. Now forced to turn to pure electric solutions, competitively priced products will not be available until the fall of 2022 at the earliest. Faced with the ending subsidies of the Chinese market, it is obvious that Japanese brands have missed the best time.

In addition to electrification, assisted driving, and intelligent cabins, electric vehicles are still cars. Japanese brands still have significant advantages in supply chain management, manufacturing technology, talent reserves, funds, brand influence, and distribution networks. However, they lost market share and also lost the mind of customers. When it comes to buying electric cars, they even subconsciously exclude Japanese brands.According to the statistics till 2021, the global sales volume of pure electric vehicles reached 6.5 million units, accounting for only 9% of the passenger car sales. As the ban on fuel vehicles becomes increasingly clear, there is still a huge market space for pure electric vehicles, and opportunities for Japanese brands to make a comeback still exist. For China’s electric vehicle industry to maintain its leading edge, it needs to double its efforts.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.