Author: Leng Zelin

Editor: Wang Pan

Recently, news broke that the BYD Sea Lion will begin pre-sales on May 20th, and some of its configurations have also been exposed.

This model is BYD’s second pure electric vehicle in the Ocean series, following the Dolphin, which has gained popularity since its launch last year. In the April sedan sales rankings of the China Passenger Car Association, the Dolphin ranked tenth with 11,959 units sold.

The concept car Ocean-X, released during the same period, also received a lot of attention, and the Sea Lion is the production version of the Ocean-X.

The Sea Lion comes in four versions: the standard CLTC model with a range of 550km and a 150kW single motor; the four-wheel performance version with a range of up to 650km and a total power of 390kW from front and rear dual motors; and the longest-range version with a CLTC range of up to 700km.

From the interior and exterior design, BYD has abandoned the heavier design in the Wangchao series and has adopted a more youthful style throughout the Ocean series.

Unlike the relationship between the destroyer 05 and the Qin Plus DM-i, the Sea Lion’s overall design is a style that BYD has never tried before, somewhat similar to the XPeng P7 and the Tesla Model3.

If the logo is covered, most people probably wouldn’t recognize it as a BYD.

In terms of size, the Sea Lion is between the Model 3 and the P7, smaller than the Han EV in the Wangchao series, but with the same wheelbase. The Sea Lion is built on BYD’s e3.0 platform and not the hybrid platform used in the Han EV, so it should have better interior space.

So the question is, is BYD going after Tesla?

It is worth noting that in terms of size, the Sea Lion has “comprehensively” surpassed the Model 3, with some deliberate benchmarking.

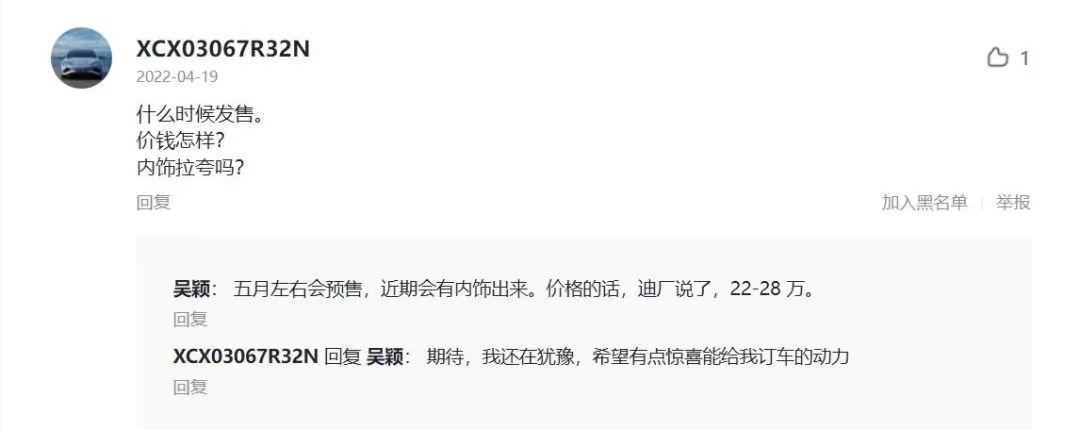

Most of the configurations have been exposed, but the one thing consumers are most concerned about—the price—has yet to be revealed, with only speculation on the internet, with a general consensus of 220,000 to 280,000 yuan.

With a starting price of 280,000 yuan, the Sea Lion has good competitiveness against the Model 3 long-range rear-wheel-drive version.

Photon Motors found that the earliest and most reliable source of this price is from Neoteric Motors, but it is not an official message, and it is very likely that the manufacturer put out the wind to explore the market situation. However, according to the feedback from some car enthusiasts, they hope that the starting price can be lowered to around 200,000 yuan.

On the appearance, the Dolphin is also somewhat similar to the Model 3.

Earlier, a Tesla owner on a social platform thought that “BYD copied Tesla Model 3”, and Tesla CEO and the next major shareholder of Twitter, Elon Musk, “offered” his praise.

Although Musk did not explicitly say, he also showed enough attention to the Dolphin.

Due to its overall size, the curb weight of the Dolphin dual-motor version is up to 2150kg, while the curb weight of the Tesla Model 3 rear-wheel drive version and high-performance version are 1761 and 1836kg respectively. The larger weight means that there is a certain test for range and acceleration.

Therefore, the NCM 60kWh lithium iron phosphate battery carried by the Model 3 rear-wheel drive version has a slightly higher range than the Dolphin’s Blade Battery continuous version of 61.4kWh. The former CLTC is 556km, and the latter CLTC is 550km. The former’s acceleration performance is also about 1.4 seconds faster than the latter.

In fact, BYD currently has two aces, one is a hybrid system, and the other is the Blade Battery. The hybrid system cannot be used on pure electric models, so the Blade Battery needs to support half of the sky.

The BYD Blade Battery can reduce the cost of the entire vehicle battery pack by 30% under the same cruising range, which is definitely a powerful weapon for the current skyrocketing battery costs.

Tesla and BYD have been “ambiguous” since last year. In February, there was news that Tesla had formally placed an order to purchase 204,000 Blade Batteries from CATL per year, with mass production scheduled for March of this year and expected to be listed in the second quarter.

This news has not been confirmed by both parties to the transaction, and there is no news of a new model continuing to be released.

The delivery time of the BYD Dolphin will be as early as July this year. If the Tesla equipped with Blade Battery is officially launched in the second quarter, perhaps Dolphin’s competitors will not be the current two versions of the Model 3, and the competitiveness of the Dolphin needs to be re-examined.

Outside the body, intelligence and vehicle system have always been the shortcoming of traditional car companies such as BYD. It is rumored that the L2 level assisted driving of the BYD Dolphin is comparable to that of the HAN, so what is the level of the assisted driving of the HAN EV?BYD Han EV DiPilot’s performance earned the last place in the assisted driving test of 11 models at Garage No. 42.

Although BYD invited Baidu as its intelligent driving supplier in March this year, its smart capabilities will still take time to catch up with new forces.

Meanwhile, the next two years will be the outbreak stage for 200,000-level models. In addition to P7, Han EV, and Model 3, the recently launched LI ONE C01 has also joined the competition with a starting price of 180,000 yuan, relying on “cost-effectiveness” to enter the market. Its dimensions are 505019021509mm, with a wheelbase of 2930mm, larger than Hebao.

The success of LI ONE C11 gives us a reason to believe in the competitiveness of C01. LI’s car delivery volume exceeded 10,000 units for the first time in March this year and won the championship of new energy vehicle delivery volume in April.

Will the relationship between Model 3, Hebao, and C01 eventually become “praying mantis trying to catch cicadas while a yellow bird waits behind”?

At the same time, NETA S and Ideal’s medium-sized cars are also on the road to market, making the competition in the 200,000-level market particularly lively.

BYD is targeting Tesla, but perhaps it is also a target that more automakers want to surpass.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.