Special Contributor | Zhu Yulong

Editor | Qiu Kaijun

When it comes to the April data of power batteries, we should not just focus on the competition between CATL and BYD.

It is also worth noting that the power battery production volume in April 2022 was 29.0 GWh, a decrease from the peak in March, indicating a significant impact in the following months. Moreover, behind the competition between CATL and BYD, we can see that more and more automotive companies are gaining control over the power battery market and extending their influence upward:

1) The decrease in production volume indicates that the growth rate of new energy vehicles has gradually slowed down in the second quarter. The production volume of ternary batteries, which includes both domestic and foreign demand, was 10.3 GWh and objectively reflects the stability of Chinese power battery supply to Europe; the production volume of lithium iron phosphate batteries was 18.6 GWh, with an installed capacity of 8.9 GWh, indicating that the scheme of replacing lithium iron phosphate batteries for A-level and below vehicle models will be widely promoted under the condition of high battery cost.

2) The installed capacity of ternary batteries was 4.4 GWh, accounting for 32.9% of total installed capacity; the installed capacity of lithium iron phosphate batteries was 8.9 GWh, accounting for 67.0% of total installed capacity, and this proportion has continued to rise. Currently, due to the lower energy density of lithium iron phosphate batteries, the number of vehicles equipped with lithium iron phosphate batteries has exceeded 70%, and this trend will continue for a considerable period of time.

3) In terms of suppliers, CATL had an installed capacity of 5.08 GWh, and BYD had an installed capacity of 4.27 GWh in April, which was the month with the smallest gap between the two companies. This reflects a problem: in the process of continuous battery price reduction, vertically integrated battery assets may not necessarily be wealth, but in the stage where cost needs to be controlled during price fluctuation, the game between automotive companies and battery manufacturers objectively exists. Automotive companies can slow down demand, making it difficult for battery companies to maintain capacity utilization.

4) Personally, I think that during the shortage of power batteries, the seller has indeed gained pricing power over downstream buyers, but when costs do not follow the expected path, buyers can adjust their strategies. Should we promote pure electric vehicles with a range of 500 kilometers or plug-in hybrids? This can be balanced based on financial analysis. The game in 2022 makes automotive companies consider how to combine HEVs (2 kWh), PHEVs (8-10 kWh), EREVs (25-40 kWh), and BEVs (60-90 kWh) under high market penetration. In addition, automotive companies are also constantly moving upstream along the battery supply chain to enhance their control and influence.

Decline in production volume compared to the previous month, the outlook is not optimistic

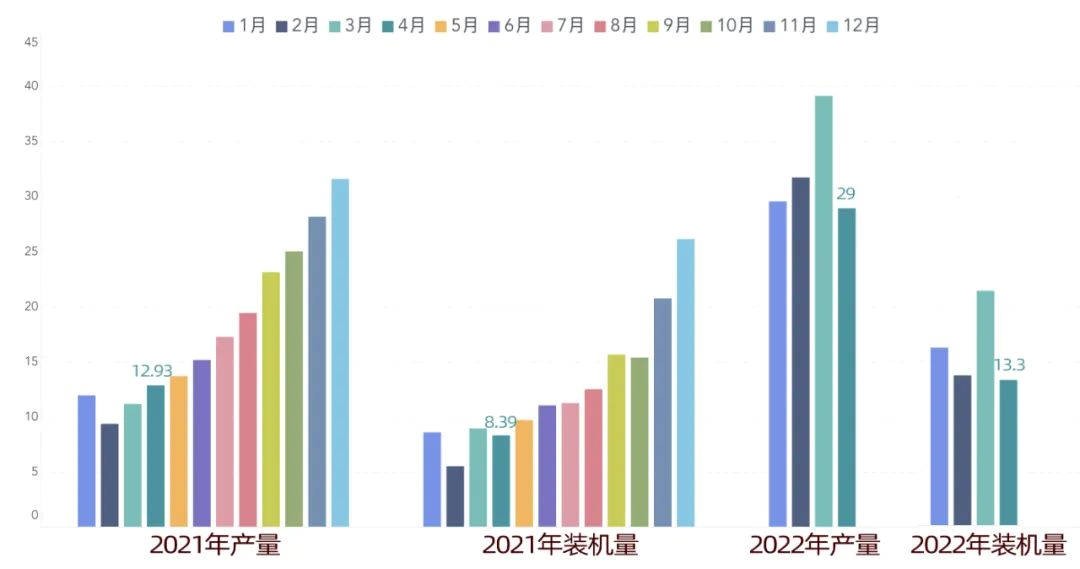

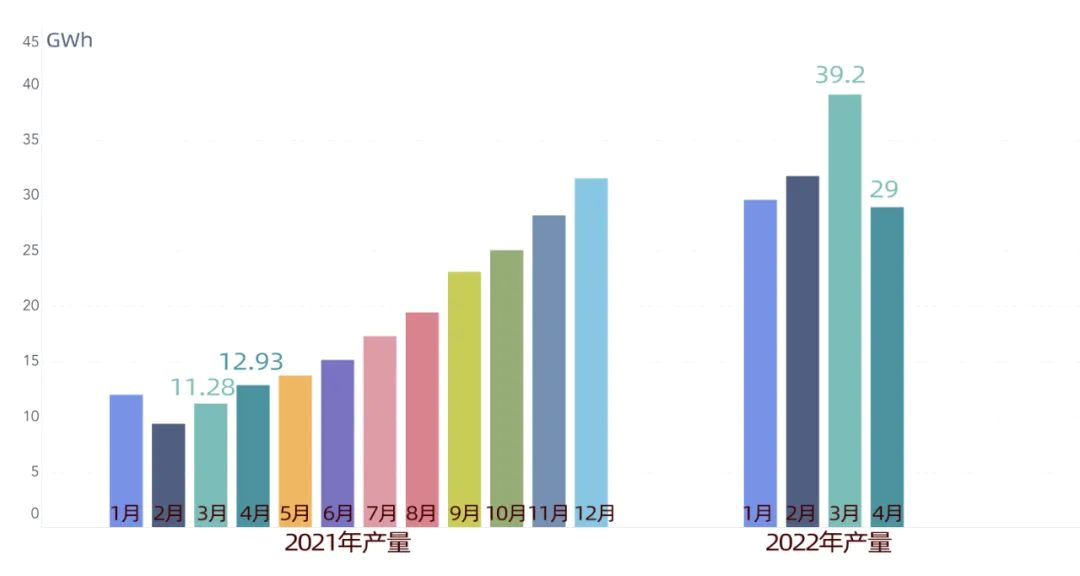

First, let’s review the volume of production and installation data.In April, the production of power batteries totaled 29.0GWh, a year-on-year increase of 124.1% and a month-on-month decrease of 26.1%. Among them, the production of ternary batteries was 10.3GWh, accounting for 35.5% of the total production, with a year-on-year increase of 53.5% and a month-on-month decrease of 33.9%; the production of lithium iron phosphate batteries was 18.6GWh, accounting for 64.3% of the total production, with a year-on-year increase of 200.7% and a month-on-month decrease of 21.0%.

As shown in the figure below, from the trend perspective, there was a period of pause in the trend of power battery expansion after climbing in 2021.

From this data, we can see the instability starting from Q2. Due to a 30% jump in battery pricing in Q2, which was transmitted to the vehicle pricing, a series of price hikes followed. Automakers are adjusting their order backlog and overall sales for the year, and will only be able to truly evaluate consumers’ acceptance of pure electric vehicles in the current economic environment in Q3.

By April 2022, the cumulative production of power batteries reached 129.6GWh, a cumulative year-on-year increase of 183.5%, which still significantly increased the demand for resources. Ternary batteries accounted for 48.3GWh, and lithium iron phosphate batteries accounted for 81.0GWh. China has been striving to explore the market-based approach to power batteries, and China’s power battery costs have previously been the lowest in the world.

After analyzing the production volume and the local installation volume, we can actually see that** many power batteries are actually exported worldwide through whole-vehicle export and battery export**.

According to the situation of lithium carbonate, 5.11 industrial-grade lithium carbonate has a spot price of 42.5-43.5 RMB/ton (including taxes) for single orders, up 1500 RMB from the previous day. This price of 400,000 or more may remain stable for some time.

In terms of shipment volume, the power battery shipment volume in April was 13.3 GWh, an increase of 58.1% year-on-year, but a decrease of 38.0% month-on-month. The shipment volume of ternary batteries was 4.4 GWh, accounting for 32.9% of the total shipment volume, a decrease of 15.6% year-on-year, and a decrease of 46.9% month-on-month. The shipment volume of lithium iron phosphate batteries was 8.9 GWh, accounting for 67.0% of the total shipment volume, an increase of 177.2% year-on-year, but a decrease of 32.6% month-on-month.

In terms of shipment volume, the power battery shipment volume in April was 13.3 GWh, an increase of 58.1% year-on-year, but a decrease of 38.0% month-on-month. The shipment volume of ternary batteries was 4.4 GWh, accounting for 32.9% of the total shipment volume, a decrease of 15.6% year-on-year, and a decrease of 46.9% month-on-month. The shipment volume of lithium iron phosphate batteries was 8.9 GWh, accounting for 67.0% of the total shipment volume, an increase of 177.2% year-on-year, but a decrease of 32.6% month-on-month.

Here, we can see the weak demand for ternary batteries currently, especially under the pandemic. BYD is a unique player in the field, with the amount of lithium iron phosphate batteries continuing to accumulate. By 2022, the cumulative usage of lithium iron phosphate batteries will reach 38.7 GWh, while the cumulative usage of ternary batteries will only be 25.7 GWh.

Continued consolidation among power battery manufacturers

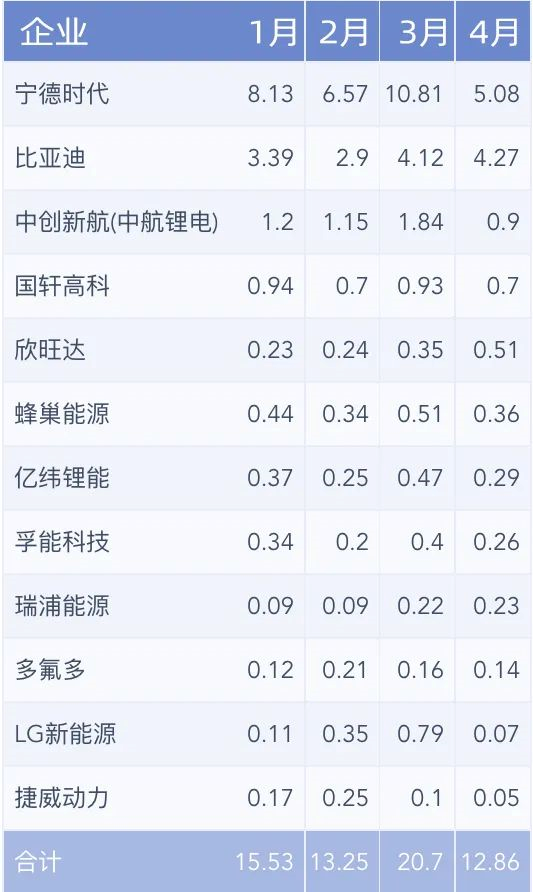

In April, there were only 34 power battery companies left, with the top three, five, and ten companies accounting for 77.2%, 86.4%, and 96.0% of the total shipment volume, respectively.

With the promotion of XPeng and GAC, Zhonghang Innovation performed well in both ternary and lithium iron phosphate batteries in April. CATL’s shipment volume of lithium iron phosphate batteries exceeded ternary batteries and Xinwanda’s shipment volume of ternary batteries reached 0.46 GWh. Several second-tier battery companies performed well as well.

This is the month when the gap between Ningde Times and BYD is the smallest, and BYD’s lithium iron phosphate batteries have even overtaken Ningde Times in terms of installations (Tesla’s demand has stopped due to the pandemic).

This also raises a core question: as the cost of power batteries rises, are the downstream bargaining positions of car companies that can afford power batteries increasing?

The pandemic has presented a challenge to the entire industry, with the current price returning to an era of 1 yuan/Wh. Tesla’s 60 kWh battery cost has exceeded 60,000 yuan again, and whether a 500 km vehicle can be pushed forward depends on the operational capabilities of companies.

Major power battery companies from January to April:

### Translation

### Translation

The battery companies’ capacity planning purposes are now evident – large-scale production planning is not only for future preparation but also requires collaboration with downstream automakers. This strategic relationship is crucial.

From the current battery technology perspective, automakers aim for differentiation. Tesla’s 4680, Volkswagen’s standard battery, and Volvo’s next-generation battery are all examples. Toyota, General Motors, and others are following this path.

Let’s first look at Volkswagen’s power battery strategy – continuously moving forward: from automakers’ vehicle production, module Pack assembly, battery cell production, to upstream main material involvement, the chain is very long. Volkswagen is resolute.

By 2022, any responsible automaker needs to do some work in the battery sector, from mastering the size and specification definition of the battery middle section to cell manufacturing and then to critical material locking – this process is inevitable as he keeps going upstream. It’s particularly important to gain resources globally as many interactive workpieces are available here.

We can see that the battery power on both sides of China and Korea has held sway for the past decade. By negotiating and discussing with downstream automakers, they are working on reliable supply at a reasonable price. During the past ten years, the cost of the automakers’ willingness to delegate all matters to the battery leader has increased.

However, the original tacit agreement mechanism was broken by the current material-induced price increase. Korean power battery companies cannot even control the remote-term prices in 2024-2025, causing automakers to focus strategically on batteries.

The first step is to switch from a single supplier to multiple suppliers in 2023. The second step is to explore the rationality of cell specifications while investigating self-built and multiple suppliers’ collaborative synergy from the original Pack mode. The third step is to secure the ability to develop the next-generation battery via investment or strategic alliances, as well as exploring the manufacturing feasibility of the next-generation battery.

I believe this process is inevitable for automakers with demand above 20GWh, and whoever reaches this point will undoubtedly try it out.

The Power Battery Industry is genuinely long-term observable. Throughout this process, technology and craftsmanship change quickly, with significant fluctuations every 2-3 years. Even technology release with half-year units is overwhelming. The best is yet to come.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.