Author: Xiao Dong

Editor: Chris

On May 10th, the financial report of the first quarter of Li Auto was officially released.

Affected by the Spring Festival holiday, Li Auto’s Q1 financial report was not as impressive. Li Auto delivered 31,716 vehicles in the first quarter, with a total revenue of RMB 9.56 billion, showing a 10% decrease compared to the previous quarter. However, the Q1 gross profit margin still remained at 22.6%, which is very stable, compared to the Q4 2021 gross profit margin of 22.4%.

In April, due to reasons such as the rise in raw materials and the pandemic, the entire automotive industry was impacted. Li Auto delivered only 4,147 vehicles in April, down 62.2% from the previous month, mainly due to the fact that 80% of Li Auto’s parts suppliers and Li Auto’s Changzhou factory are located in the Yangtze River Delta region, which was severely affected by the pandemic. Li Auto estimates that it will deliver 21,000 to 24,000 vehicles in Q2, and this number may be lowered if the pandemic worsens.

Also affected by the pandemic, the planned flagship Li Auto model, the Li Xiang L9, was postponed from its release in April. Those interested in the Li Xiang L9 can read the two articles before in the Class A channel, which cover the basic information about the Li Xiang L9, and the official pre-sale price is RMB 450,000 to 500,000. It will be officially delivered in Q3 this year, and the Li AD Max intelligent driving system will be standard across the board.

What’s more important is that at this financial report meeting, Li Auto CEO Li Xiang revealed the latest product planning of Li Auto. Let’s take a look together.

Three new products

Li ONE is already an undeniable hot-selling model, with sales of more than 90,000 units in 2021 alone, and over 30% of the market share in the price range of RMB 300,000 to 400,000 in the new energy market. Looking at the global sales of new energy vehicles in Q1 2022, Li ONE ranks sixth among single models.

Obviously, Li ONE has achieved phase victory in its segmented market with its outstanding product concept and market positioning, and L9 has a deeper understanding of the concept of home. At this financial report meeting, Li Auto CEO Li Xiang also revealed the company’s future product planning:

-

First, two different power sources will adopt two different body shapes.

-

We believe that the best form for extended-range vehicles is SUV, and for the level of product we want to make, sedans are not the most efficient, and MPVs are not the most efficient either. SUV is a very good form. In terms of pure electric, we think that the efficiency of making such large SUVs is not high, so on the pure electric side, we have a brand new form. In the next two years, after we release our products, people will find that our pure electric products are different from any other form currently on the market. They are specifically designed for the special form of pure electric.

-

Therefore, for different powertrains, we adopt completely different forms. There will be no competition between the two forms, but they will work together to compete in the 200,000 to 500,000 yuan market.

-

The second level is to adopt different prices.

-

We will have a hot-selling product in each 100,000 yuan price range, including 400,000 to 500,000 yuan. Our starting point is relatively good. Our starting point-Li Xiang ONE is placed in the 300,000 to 400,000 yuan range. We can either step up to the 400,000 to 500,000 yuan range, or step down to the 200,000 to 300,000 yuan price range. We will basically have a heavyweight product in each price range to meet the user demand in that price range.

-

Similarly, there will be both pure electric and extended-range products in the same price range, but the product forms will be different. However, the underlying technologies are more interconnected, such as the platform technology for extended-range, which is shared from product performance to later supply. The same applies to pure electric products. Our autonomous driving, intelligent cockpit, and electronic and electrical architecture will form a more effective module composition for product combinations.

The success of the ideal extended-range model has even driven China’s extended-range market, and more automakers are developing extended-range models. From Li Xiang’s expression, we can basically infer that Ideal will continue to launch extended-range and new pure electric models, and cover the 200,000 to 500,000 yuan price range, with each 100,000 yuan as one interval. That is to say, Ideal needs at least 6 models (3 extended-range + 3 pure electric) to achieve full coverage.

In the prospectus for ideal’s secondary listing in Hong Kong in 2021, it revealed the company’s product matrix for the next. Li Xiang also directly revealed during this earnings conference call, “This year, including L9, we will launch 3 products next year, including a new generation of flagship extended-range products, including a new BEV high-voltage platform product, and everyone can see our first 200,000-300,000 yuan midsize car product next year. ” However, it is slightly different from the four models that were announced to be launched in 2023 in the prospectus.

The product planning of Ideal Auto in 2025 still revolves around household users, which also means that priority is given to SUV models rather than sedan models. From the chart, it can be seen that the X-platform (extended range platform) will continue to launch SUV models, and perhaps the first pure electric model will still be an extended range SUV priced at 200,000 to 300,000 RMB. So what kind of product will Ideal bring to us as its first pure electric model?

The product planning of Ideal Auto in 2025 still revolves around household users, which also means that priority is given to SUV models rather than sedan models. From the chart, it can be seen that the X-platform (extended range platform) will continue to launch SUV models, and perhaps the first pure electric model will still be an extended range SUV priced at 200,000 to 300,000 RMB. So what kind of product will Ideal bring to us as its first pure electric model?

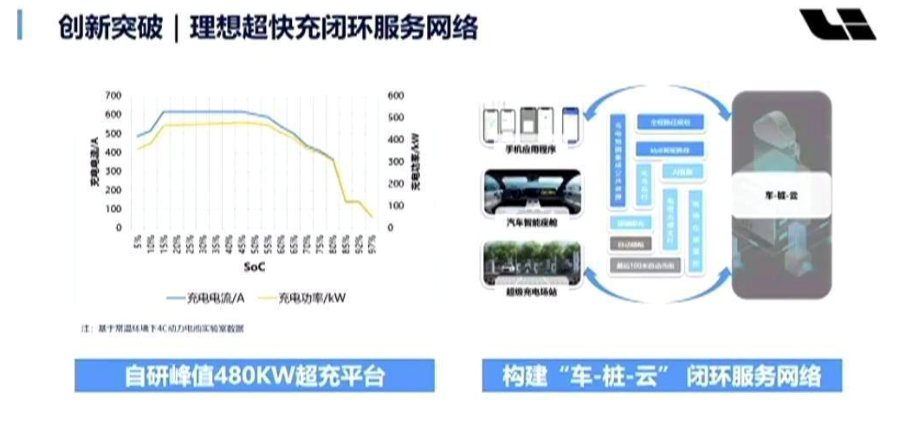

For the pure electric model, based on the previous collected information, it can be basically determined that it will be built on an 800V high-voltage platform with a 4C rate charge and discharge battery support. This also means that the charging speed of Ideal’s pure electric model will be very fast. As for energy supplementation, Ideal has always been committed to reducing customer anxiety about mileage. According to the vice president of Ideal, Sun Guangmin’s disclosure at the 2022 China Electric Vehicle Hundred People Forum, Ideal’s self-developed ultra-fast charging platform can achieve a peak power of 480 kW, and 15% – 50% SoC can maintain such a high charging power, as shown in the chart.

The problem lies in the construction of Ideal’s energy supplementation system.

Currently, the construction of energy supplementation systems for NIO, Tesla, and XPeng has gradually taken shape. NIO’s layout of five verticals and three horizontals for four major high-speed energy supplementation systems is about to be completed. This is a big challenge for Ideal, which entered the market later. NIO will not launch 800V models in the short term. The opening time for Tesla’s supercharging stations in China is still unknown, while it is difficult for XPeng to cover its 480 kW supercharging layout in a short time, and the possibility of opening it to the public is very small. If relying on public basic charging infrastructure construction, it is even more difficult.

This is also the dilemma faced by Ideal’s pure electric vehicles under the high-voltage platform. Even if high-voltage platform models are launched, the lack of basic infrastructure supporting high-voltage charging has become an obstacle. Ideal stated that it will build 3,000 ultra-fast charging stations by 2025 and plan the layout of ultra-fast charging stations. It will establish a fast charging network of “ten verticals, ten horizontals, and two rings” on high-speed roads, and hope to connect all 36 national high-speed roads by 2025, covering 90% of the total high-speed mileage. It was also mentioned in the earnings conference that Ideal currently has teams planning charging stations, focusing on building ultra-fast charging stations between cities, and the selection of ultra-fast charging station locations within cities will be more cautious.

However, Ideal will face challenges such as power grid pressure, station construction costs, and difficulties for early car owners to experience 480 kW fast charging.In addition, a large number of new car models have also brought considerable production pressure to IDEAL. The maximum daily capacity of the two-shift production line in Changzhou factory is about 500 vehicles, and even with expanded production, the annual production capacity of Changzhou factory has reached 200,000 vehicles, which is not easy. Normally, IDEAL ONE’s monthly sales are stable at around 15,000 units, and this year, together with the production capacity of L9, it has basically reached the production limit of Changzhou factory.

The factory acquired in Beijing is still under renovation, and it will take some time for mass production to begin in 2023. Perhaps the production capacity issue has also affected IDEAL’s new car plans.

Financial Report Data

In this financial report meeting, Li Xiang’s planning for future products was quite unexpected.

Returning to the financial report data for the first quarter of 2022 (in RMB):

- Auto sales revenue was 9.31 billion, down 10.3% month-on-month;

- Total revenue was 9.56 billion, down 10% month-on-month;

- Sales cost was 7.4 billion, down 10.2% month-on-month;

- Gross profit was 2.16 billion, down 9.1% month-on-month;

- Gross profit margin was 22.6%, up from 22.4% in Q4 2021;

- Net loss was 10.9 million, compared to a net profit of 295.5 million in Q4 2021;

- Operating cash flow was 1.83 billion, down 52.2% month-on-month;

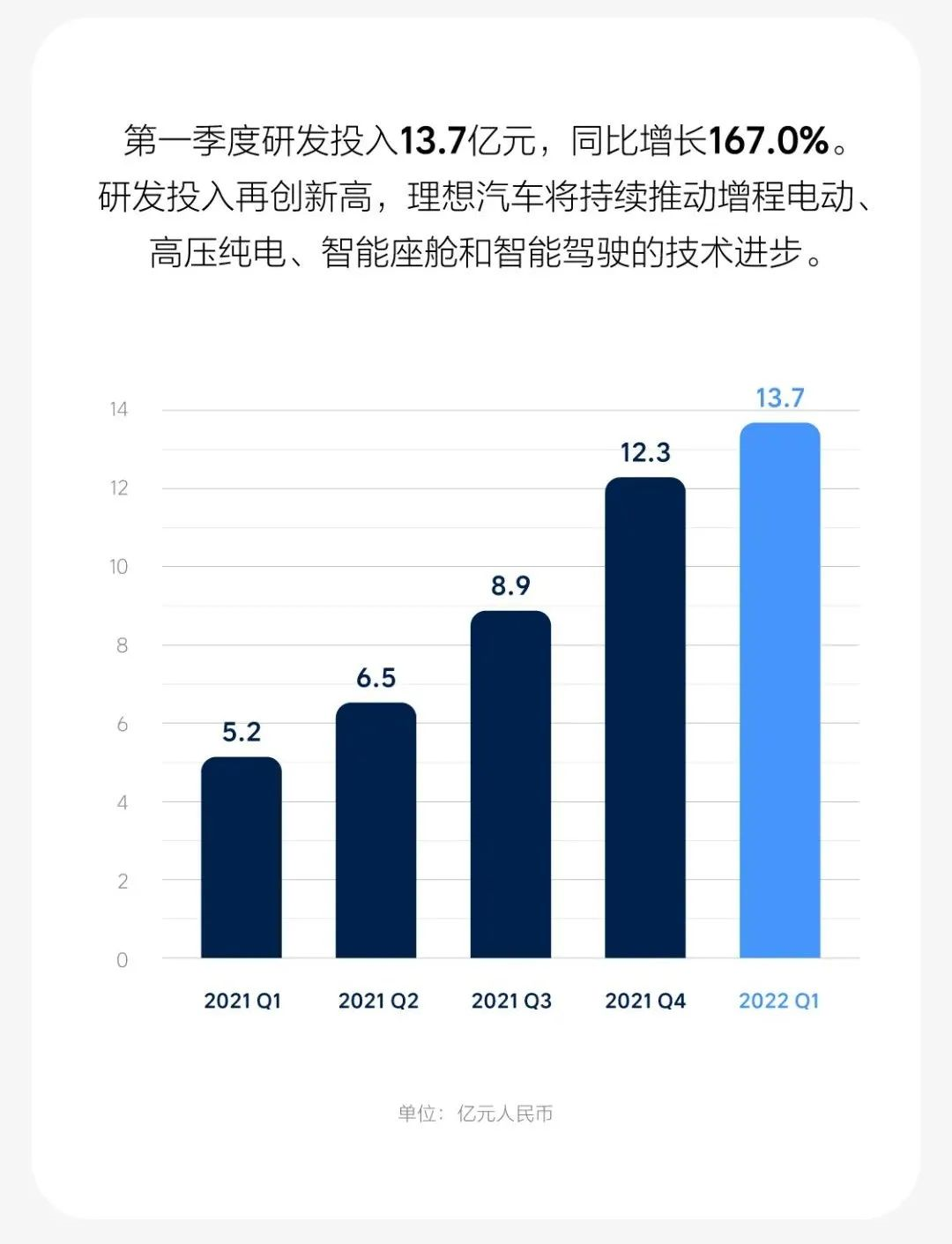

- Research and development expenses were 1.37 billion, up 11.7% month-on-month;

- Selling, general, and administrative expenses were 1.2 billion, up 6.8% month-on-month;

- As of March 31, 2022, cash reserves were 51.19 billion.

From the financial report data, the overall trend is downward. Net profit was 295.5 million in Q4 2021, but it turned into a loss of 10.9 million in Q1 2022. Due to the impact of the Spring Festival holiday, domestic car companies generally performed poorly in the first quarter of this year, and the second quarter is expected to be even worse. The most eye-catching thing about IDEAL in the first quarter was the gross profit margin, which was 22.6%, compared to 22.4% in Q4 2021. This is indeed rare in the current new energy vehicle market.

From the current situation, IDEAL’s gross profit margin will also be stable in the long term. The price of IDEAL ONE was raised by 11,800 yuan from April 1 due to the rise in raw material prices. Fortunately, the price increase has not had a significant impact on IDEAL ONE’s subsequent orders, and IDEAL’s CEO, Shen Yanan, said that the order volume of IDEAL ONE began to gradually recover at the end of April and the beginning of May. At the same time, Shen Yanan also stated that the price increase of IDEAL ONE on April 1 has taken into account all foreseeable cost increases in the future, and “there is currently no need to raise prices”.The three expenditures all increased slightly compared to the previous period. With the launch of several new car models in the future, the subsequent R&D costs for this year are expected to continue to rise. In Q1, there were only 11 Ideal retail stores open across the country, totaling 217. The goal of Ideal is to establish 400 retail stores by the end of this year, which is a big challenge for the next three quarters.

The fierce competition in Q2 has been expected, and with the official delivery of Ideal L9 in Q3, the financial data for Ideal may become more attractive.

In conclusion

Ideal’s financial data for Q1 and Q2 this year may be unsatisfactory, but the upcoming new car plans are even more anticipated. Of course, Ideal still has a lot of problems to solve, such as the layout of the charging network, tight production capacity, and even whether every upcoming car model of Ideal can create differentiated advantages with more and more competitors. For now, I am more concerned about whether Ideal L9 can become a hot-selling car model again.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.